Transcription

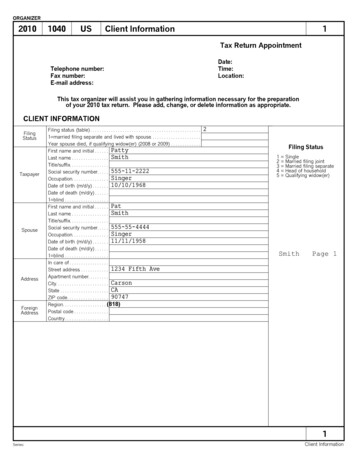

Client Tax OrganizerPlease complete this Organizer before your appointment. Prior year clients should use the proforma Organizer provided.1. Personal InformationNameSoc. Sec. No.Date of BirthOccupationWork PhoneTaxpayerSpouseStreet AddressCityStateZIPHome PhoneEmail AddressTaxpayerSpouseMarital StatusBlindYesNoYesNoMarriedDisabledPres. Campaign FundYesYesNoNoYesYesNoNoSingleWidow(er), Date of Spouse's DeathWill file jointlyYesNo2. Dependents (Children & Others)Name(First, Last)RelationshipSocialSecurityNumberDate With Disabled TimeStudentIncomePINYouPlease provide for your appointment- Last year's tax return (new clients only)- Name and address label (from government booklet or card)- All statements (W-2s, 1098s, 1099s, etc)Please answer the following questions to determine maximum deductions1. Are you self-employed or do youreceive hobby income?Yes*No2. Did you receive income fromraising animals or crops?Yes*No3. Did you receive rent from realestate or other property?Yes*No9. Were there any births, deaths,marriages, divorces or adoptionsin your immediate family?YesNo10. Did you give a gift of more than 15,000to one or more people?YesNo11. Did you have any debts cancelled, forgiven,or refinanced?YesNoYesNoYesNo14. Did you pay interest on a student loan foryourself, your spouse, or your dependentduring the year?YesNo15. Did you pay expenses for yourself, yourspouse, or your dependent to attendclasses beyond high school?YesNo4. Did you receive income fromgravel, timber, minerals, oil, gas,copyrights, patents?Yes*No5. Did you withdraw or writechecks from a mutual fund?12. Did you go through bankruptcyproceedings?YesNo13. (a) If you paid rent, how much did you pay?6. Do you have a foreign bankaccount, trust, or business?YesNo7. Do you provide a home for orhelp support anyone not listedin Section 2 above?YesNo8. Did you receive any correspondencefrom the IRS or State Departmentof Taxation?YesNoCTORG01 01-21-22* Contact us for further instructions(b) Was heat included?

16. Did you have healthcare coverage (healthinsurance) for you, your spouse anddependents during this tax season? If yes,include Forms 1095-A, 1095-B, and 1095-C.17. Did you and/or your spouse receive anyadvance child tax credit payments?If yes, enter the amount and include IRSLetter(s) 6419.18. Did you have any children under the age of19 or 19 to 23 year old students withunearned income of more than 1100?YesNoYesNoYesNo20. Did you install any energy property to yourresidence such as solar water heaters,generators or fuel cells or energy efficientimprovements such as exterior doors orwindows, insulation, heat pumps, furnaces,central air conditioners or water heaters ?21. Did you own 50,000 or more in foreignfinancial assets?YesNoYesNoYesNo22. Have you or your spouse been a victim of identity theft and givenan identity theft protection PIN by the IRS? If yes, enter the sixdigit identity protection PIN number.3. Wage, Salary IncomeAttach W-2s:Employer19. Did you and/or your spouse receive the thirdeconomic impact payment?If so enter the payment amount andinclude Notice(s) 1444-C.TaxpayerTaxpayerSpouseSpouse7. Property SoldAttach 1099-S and closing statementsPropertyDate AcquiredCost & Imp.Personal Residence*Vacation HomeLandOther4. Interest IncomeAttach 1099-INT, Form 1097-BTC & broker statementsPayerAmount* Provide information on improvements, prior sales of home,and cost of a new residence. Also see Section 17(Job-Related Moving).8. I.R.A. (Individual Retirement Acct.)Contributions for tax year incomeU forAmountTax ExemptTaxpayerSpouseAmounts withdrawn. Attach 1099-R & 5498PlanReason forTrusteeWithdrawal5. Dividend IncomeReinvested?YesYesYesYesFrom Mutual Funds & Stocks - Attach eNoNoNoNo9. Pension, Annuity IncomeAttach 1099-RPayer*Reason forWithdrawalReinvested?YesYesYesYes6. Partnership, Trust, Estate IncomeList payers of partnership, limited partnership, S-corporation, trust,or estate income - Attach K-1* Provide statements from employer or insurancecompany with information on cost of orcontributions to plan.Did you receive:Social Security BenefitsRailroad RetirementCTORG02 01-21-22NoNoNoNoAttach SSA 1099, RRB 1099TaxpayerYesYesSpouseNoNoYesYesNoNo

10. Investments SoldStocks, Bonds, Mutual Funds, Gold, Silver, Partnership interest - Attach 1099-B & confirmation slipsInvestment11. Other IncomeList All Other Income (including non-taxable)Alimony ReceivedChild SupportScholarship (Grants)Unemployment Compensation (repaid)Prizes, Bonuses, AwardsGambling, Lottery (expenses)Unreported TipsDirector / Executor's FeeCommissionsJury DutyWorker's CompensationDisability IncomeVeteran's PensionPayments from Prior Installment SaleState Income Tax RefundEconomic Impact Payment 1 (First Stimulus Payment)Economic Impact Payment 2 (Second Stimulus Payment)OtherOther12. Medical/Dental ExpensesMedical Insurance Premiums(paid by you)Prescription DrugsInsulinGlasses, ContactsHearing Aids, BatteriesBracesMedical Equipment, SuppliesNursing CareMedical TherapyHospitalDoctor/Dental/OrthodontistMileage (no. of miles)Date Acquired/Sold////CostSale Price14. Interest ExpenseMortgage interest paid (attach 1098)Interest paid to individual for yourhome (include amortization schedule)Paid to:NameAddressSocial Security No.Investment InterestPremiums paid or accrued for qualifiedmortgage insurance15. Casualty/Theft LossFor property damaged by storm, water, fire, accident, or stolen.Location of PropertyDescription of PropertyOtherFederally DeclaredDisaster LossesAmount of DamageInsurance ReimbursementRepair CostsFederal Grants Received16. Charitable ContributionsOtherChurchUnited WayScoutsTelethonsUniversity, Public TV/RadioHeart, Lung, Cancer, etc.Wildlife FundSalvation Army, GoodwillOther13. Taxes PaidNon-CashReal Property Tax (attach bills)Personal Property TaxOtherCTORG03 01-21-22Volunteer (no. of miles)@ .14 0.00

17. Child & Other Dependent Care ExpensesName of Care ProviderAddressSoc. Sec. No. orEmployer IDAmountPaidAlso complete this section if you receive dependent care benefits from your employer.18. Job-Related Moving ExpensesU if you are a member of the Armed Forces on active dutyand moving due to a permanent change of station due toa military order.Date of moveMove Household GoodsLodging During MoveTravel to New Home (no. of miles)19. Employment Related Expenses That You Paid(Not self-employed)U if Armed Forces reservist, a qualified performing artist,a fee-basis state or local government official, or an individualwith a disability claiming impairment-related work expenses.Dues - Union, ProfessionalBooks, Subscriptions, SuppliesLicensesTools, Equipment, Safety EquipmentUniforms (include cleaning)Sales Expense, GiftsTuition, Books (work related)EntertainmentOffice in home:In Square a) Total homeb) OfficeFeetc) StorageRentInsuranceUtilitiesMaintenance20. Investment-Related Expenses State use onlyTax Preparation FeeSafe Deposit Box RentalMutual Fund FeeInvestment CounselorOther21. Business MileageDo you have written records?YesNoDid you sell or trade in a car usedfor business?YesNoIf yes, attach a copy of purchase agreementMake/Year VehicleDate purchasedTotal miles (personal & business)Business miles (not to and from work)From first to second jobEducation (one way, work to school)Job SeekingOther BusinessRound Trip commuting distanceGas, Oil, LubricationBatteries, Tires, etc.RepairsWashInsuranceInterestLease paymentsGarage Rent22. Business TravelIf you are not reimbursed for exact amount, give total expenses.Airfare, Train, etc.LodgingMeals (no. of days)Taxi, Car RentalOtherReimbursement Received23. COVID-19Were you, your spouse, or a dependentdiagnosed with COVID-19?Did you experience adverse financialconsequences as a result of you, your spouse,or other member of your household beingquarantined, furloughed or laid off, experienceda reduction of work hours, or unable to work dueto a lack of childcare?CTORG04 01-21-22YesNoYesNo

24. Estimated Tax PaidDue DateDate Paid25. Other DeductionsFederalStateAlimony Paid toSocial Security No. Student Interest PaidHealth Savings Account Contributions Archer Medical Savings Acct. Contributions 27. Questions, Comments, & Other Information26. Education ExpensesStudent's NameType of ExpenseAmountResidence:TownVillageCityCountySchool District28. Direct Deposit of Refund / or Savings Bond PurchasesWould you like to have your refund(s) directly deposited into your account?(The IRS will allow you to deposit your federal tax refund into up to threedifferent accounts. If so, please provide the following information.)YesNoACCOUNT 1Owner of accountType of accountTaxpayerCheckingTreasury DirectTraditional SavingsArcher MSA SavingsTraditional IRACoverdell Education SavingsSpouseRoth IRAHSA SavingsJointSEP IRAName of financial institutionFinancial Institution Routing Transit Number (if known)Your account numberACCOUNT 2Owner of accountType of accountTaxpayerCheckingTreasury DirectTraditional SavingsArcher MSA SavingsName of financial institutionFinancial Institution Routing Transit Number (if known)Your account numberCTORG05 01-21-22Traditional IRACoverdell Education SavingsSpouseRoth IRAHSA SavingsJointSEP IRA

ACCOUNT 3Owner of accountType of accountTaxpayerCheckingTreasury DirectTraditional SavingsArcher MSA SavingsTraditional IRACoverdell Education SavingsSpouseRoth IRAHSA SavingsJointSEP IRAName of financial institutionFinancial Institution Routing Transit Number (if known)Your account numberWould you like to purchase Series I Savings bonds with a portion of your refund? If so, please answer the following:Amount used for bond purchases for yourself (and spouse if filing jointly).Amount used to buy bonds for someone else (or yourself only or spouse only if filing jointly).Owner's nameCo-owner or Beneficiary'sname if applicableX if name is fora beneficiaryBond purchase AmountTo the best of my knowledge the information enclosed in this client tax organizer is correct and includes allincome, deductions, and other information necessary for the preparation of this year's income tax returns forwhich I have adequate records.TaxpayerCTORG06 01-21-22DateSpouseDate

16. Did you have healthcare coverage (health insurance) for you, your spouse and dependents during this tax season? If yes, include Forms 1095-A, 1095-B, and 1095-C.