Transcription

Barramundi LimitedANNUAL MEETINGOF SHAREHOLDERS3 November 2017

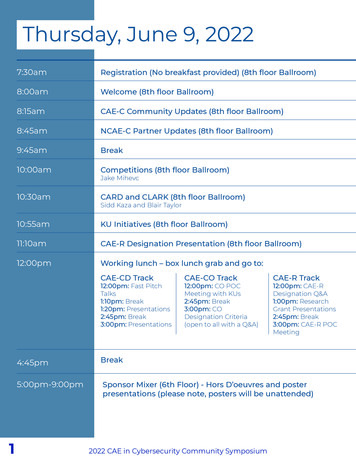

Agenda Preliminary matters (Annual Report, minutes& class financial advice) Chair’s Overview Manager’s Review Q&A Annual Meeting Resolutions

Board of DirectorsAlistair RyanCarmel FisherAndy CoupeCarol CampbellInvestment TeamManuel GreenlandSnr Portfolio ManagerTerry TolichSnr Investment AnalystDelano GallagherInvestment Analyst

Chair’s OverviewPresentation of Annual Result

Barramundi’s Investment ObjectivesAbsolute ReturnsAchieve a high real rate of return, comprising bothincome and capital growth within acceptable riskparametersDiversified PortfolioAccess to a diversified portfolio of Australianquality, growth stocks single tax-efficient vehicle

2017 OverviewNet profitDividend 2.7m 5.40cps(2016: 5.4m)(2016: 5.52cps)Total shareholderDividend returnreturn*NAV per share 0.64(2016: 0.67)Adjusted NAVreturn* 6.2% 8.7% 2.7%(2016: 0.4%)(2016: 8.2%)(2016: 6.2%)*These metrics are Non-GAAP measures calculated in accordance with the methodology described in the Barramundi Non-GAAPFinancial Information Policy which is available on the Barramundi website.

Use of Shareholder FundsYear ended 30 June 2017105100 3 million95-897 39590858075OpeningNAVNetProfitsDividends PaidDividends ReinvestedBuybacksClosingNAV

Portfolio Performance12 months3 years(annualised)5 years (annualised)GrossPerformanceReturn* 6.0% 9.9% 10.0%BenchmarkIndex 14.7% 10.2% 8.3%For the year ended30 June S&P/ASX Small Ords Industrial Gross Index until 30 September 2015 & S&P/ASX 200 Index (hedged 70% toNZD) from 1 October 2015*This metric is a Non-GAAP measure and calculated in accordance with the methodology described in the Barramundi Non-GAAPFinancial Information Policy which is available on the Barramundi website.

Warrants Warrant exercise date: 24 November Final date for trading warrants: 22November Warrant exercise price is 0.58

2017/2018 First Four Months30 June – 31 October 2017Total shareholder return* 0.3%NAV per share 0.69Gross performancereturn* 11.2%Benchmark Index 7.0%Net profit 10.0m S&P/ASX Small Ords Industrial Gross Index until 30 September 2015 & S&P/ASX 200 Index (hedged 70% toNZD) from 1 October 2015*These metrics are Non-GAAP measures calculated in accordance with the methodology described in the Barramundi Non-GAAPFinancial Information Policy which is available on the Barramundi website.

Manager’s ReviewManuel GreenlandSenior Portfolio Manager

Underperformed vs. ASX200

Core Holdings Continue to Grow ProfitablyBarramundi company annual earnings growth 2014 to CarSales.comResMedDomino'sTech One

Super Sensitive Share PricesVocusDomino'sAPN %-60%RevisionShare Performance

What went especially wellCSL 25%ResMed 23%NAB 25%

What went against usVocus-50%Aconex-40%Domino’s-22%

100 invested after the GFC 450400350NZD30025020015010050AustraliaEuropeNew ZealandUSUS technology

The RBA has rung the bell Commodity prices Retail sales Jobs

Changing logisticsWhat does Wisetech do?Why do we like Wisetech? software for freight forwardersmanages compliancereduces staff costsimproves customer efficienciespresence in strategic globaltrade locations it makes its customers more profitableleading technologyevery customer enhances thesolutiontheir knowledge is hard to replicatethe sales opportunity is hugepositive customer feedbackE-commerce is increasing . but so is regulation

Stronger safer vehiclesWhat does ARB do? 4x4 vehicle upgrades high tech suspension systems innovative storage solutions wide range of accessories advice, service, socialWhy do we like ARB? it enjoys a niche dominance great long-term track record growing opportunity locallyand globally

Future of advertisingTraditional mediaaudiences arefalling, especiallyamong the youth and onlineadvertising isgrowing fast but so are onlinead blockers.Out of HomeMedia Solution

Multitude of Opportunity Ahead

General Questionsfrom Shareholders(not relating to resolutions)

Annual Meeting2017 resolutions

2017 Annual Meeting Resolutions Introduce and propose Discussion, questions Enter your vote on voting paper andlodge your voting paper at end ofresolutions

Matters of Business Annual Report Resolutions:– Re-elect Andy Coupe– Auditor’s remuneration

Proxy Re-electAndy 2,3813,102,97614,253,32580,038Fix auditor’s10,947,968remunerationProxy votes to date: 14.3 million

Resolution 1Re-election of Andy CoupeTo re-elect Andy Coupe as a director ofBarramundi Limited

Resolution 2Auditor’s RemunerationTo authorise the Board of Directors to fix theremuneration of the auditor for the ensuingyear

Conclusion Complete and sign voting paper Voting papers in the voting boxes If you need a voting paper please seeComputershare Results to NZX

THANK YOU

Vocus Domino's APN Outdoor Revision Share Performance. What went especially well CSL 25% NAB 25% ResMed 23%. What went against us Vocus-50% Aconex -40% Domino's -22%. 100 invested after the GFC -50 100 150 200 250 300 350 400 450 Australia Europe New Zealand US US technology NZD.