Transcription

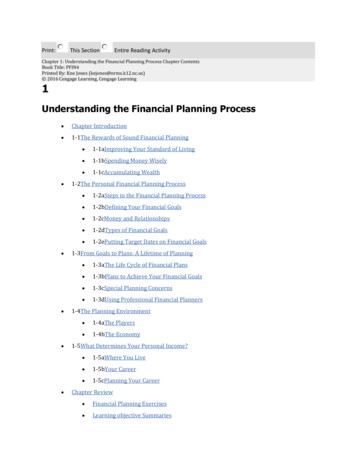

NOTE ONPERSONAL FINANCIAL PLANNINGFrançois Brouard, DBA, FCPA, FCASprott School of Business, Carleton UniversityPersonal Financial Planning (PFP) is a growing field of expertise. Therefore, it may be useful tounderstand the basics as a Chartered Professional Accountant and Tax advisor. This note isprepared to provide basic information about personal financial planning process and components.Table of ContentsDefinition of PFP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Motivations for PFP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Constraints. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Life Cycle and PFP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Process and Areas of PFP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Process - Reflection Phase. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5Process - Situational Analysis Phase. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Process - Planning and Action Phase - Day-to-Day Management. . . . . . . . . . . . . . . . . . . . . . . . . 7Cash management and Budgeting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Assets and Wealth management. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Debt management. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10Risk management. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Process - Planning and Action Phase - Planning Strategies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12Tax planning. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12Education Planning. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13Retirement Planning. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14Life Insurance Planning. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16Succession and Estate Planning. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17Process - Implementation Phase. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18Role of Advisor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18Appendix A - Personal Financial Statements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 May 2, 2018 - François Brouard, DBA, FCPA, FCA1 / 20[Note on Personal Financial Planning]

Definition of PFPPersonal Financial Planning (PFP) is the continuous and integrative process of managingfinancial affairs (assets, liabilities, revenues and expenses) in a personal situation, developingstrategies and taking actions to achieve life goals. A comprehensive planning will consider allaspects of the professional, personal and family situation of an individual, but it is also possibleto focus only on some aspects.Motivations for PFP-set a time to reflect on goals and prioritiesprepare for life cycle events (ex: education, retirement, succession)improve standard of livingmanage cash flows by balancing inflows and outflowsoptimize tax consequencesinvest intelligently and maximize return on investmentsaccumulate wealthavoid surprises and be preparedbe able to assess progressConstraintsVarious general constraints and concepts influence the PFP and the need to get help from anadvisor. Some examples for environmental factors are presented:---economical factors- inflation- interest rate- unemployment ratelegal factors- tax law and regulations- corporate law- family lawtime value of money May 2, 2018 - François Brouard, DBA, FCPA, FCA2 / 20[Note on Personal Financial Planning]

Life Cycle and PFPPersonal situation evolves over time. Over the years, a person will have to focus on variousaspects. Age of a person is an indicator of life cycle. Various other factors may affect andchanges the PFP. Marital status, family formation and the presence of dependants (dependentchildren, disabled children, independent children, dependent adult) will impact the PFP.Different events may occur (foundation of a family, wedding, birth or adoption of a child,divorce and separation, death). Lifelong learning effort and career development throughemployment, business or volunteering will contribute to professional life. Health issues andmoving to another country may also influence the PFP.AgeEarly childhood0-5Education years6-1415-24MaritalStatusSingleRetirement yearsInitialeducationEmployment /BusinessStudent jobEmploymentWeddingDisabledchildrenSeparated ifelonglearningBusiness35-4445-54Pre-retirement nal yearsDependantsVolunteer55-6465 Unemployment May 2, 2018 - François Brouard, DBA, FCPA, FCARetired3 / 20[Note on Personal Financial Planning]

Process and Areas of PFPReflectionIn the reflection phase, the values, objectives, goals and priorities of a person are examined.Situational AnalysisIn the situational analysis phase, the personal situation (document, financial affairs) areevaluated.Planning and ActionIn the planning and action phase, different options and strategies are identified, analyzed andchosen to meet personal objectives within a set of constraints toward helping currentmanagement and preparation for the future. The result is the personal financial plan.ImplementationIn the implementation phase, strategies to control, monitor and revise the plan take place.PhasesReflectionAreasReflections on values, objectives and goalsReflections on prioritiesSituational AnalysisDocument analysisFinancial analysisFinancial Situation (Net worth)Revenues and ExpensesPlanning and ActionDay-to-day managementCash Management and BudgetingAssets and Wealth ManagementDebt ManagementRisk ManagementPlanning strategiesTax PlanningEducation PlanningRetirement PlanningLife Insurance PlanningSuccession and Estate PlanningImplementationControl strategiesMonitoring and revisions May 2, 2018 - François Brouard, DBA, FCPA, FCA4 / 20[Note on Personal Financial Planning]

Process - Reflection PhaseIn the reflection phase, values, objectives and goals are examined and priorities are decided.Reflections on Values, Objectives and GoalsPersonal constraints add to the complexity of the PFP process in thinking about values,objectives and goals.--personal abilities, skills, competencies and attitudesfinancial literacy and tax knowledgefamily situationsocio-cultural factors- ethnicity- religionprevious experiences regarding financial affairspotential of inheritancedreamsneeds, desires, wishesReflections on PrioritiesDeciding on priorities will offer orientations for the PFP process and will need balancingpersonal values to reach personal and financial objectives and goals.-savings vs expensesrisk tolerancelevel of debtstime horizonlifestylequality of lifecost of livingcost of lifeneed of liquidity May 2, 2018 - François Brouard, DBA, FCPA, FCA5 / 20[Note on Personal Financial Planning]

Process - Situational Analysis PhaseIn the situational analysis phase, an assessment of the personal situation is prepared and serve asa foundation for the strategies. By collecting various information, it will be possible to havenecessary foundation about the current situation to establish a diagnosis.Document AnalysisIn the document analysis steps, the objective is to collect all relevant information and to examinevarious documents. The step will be facilitate with proper records management and filing system.---basic information about family memberstax returnsinvestments portfolioemployee benefits bookletspension statementsinsurance policieswillpower of attorney- for personal care- for propertycontracts- employment contract- shareholder agreement- partnership agreement- buy-sell agreementsprivate corporation documents, if applicabletrust agreementslocation of documentsFinancial AnalysisBy preparing a financial analysis, a person present the financial situation, which become thestarting point for the PFP. A personal financial statements (PFS) is an inventory of the financialposition (assets, liabilities, net worth) and an analysis of revenues and expenses (see Appendix Afor examples of content of personal financial statements, including notes). Cash flow statementmay offer a presentation of cash inflows and outflows on a cash basis instead of an accrual basis. May 2, 2018 - François Brouard, DBA, FCPA, FCA6 / 20[Note on Personal Financial Planning]

Process - Planning and Action Phase - Day-to-Day ManagementCash management and BudgetingWith cash management, the step involves management of cash flows (cash inflows andoutflows). With proper treasury management, financial affairs are managed on a daily basis.Examples of activities:- collecting income on a timely basis- paying bills and expenses- paying credit cards- setting up an emergency funds (ex: 10% of gross income or 3-6 months of expenses)Budgeting is a process to plan and to offer a tool to control revenues and expenses andacquisition of assets. Budget will also look at cash flows. By preparing a budget, it offers a guideto compare the reality with plans.Examples of activities:- track revenues and expenditures- track cash inflows and outflows- offer a templateAssets and Wealth managementRegarding assets and wealth management, a number of major decisions occur many times in alifetime. Examples of decisions are housing, transportation and investment.Steps in purchasing assets- look around and shop- evaluate options- make your selection- purchase- financing your purchase- maintain your assets (repairs, renovations)Housing- principal residence- cottage- ownership (rent or buy decision)Transportation- walk- automobile, motorcycle, bicycle- bus, train, airplane- boat, recreational vehicle (RV)- ownership (lease or buy decisions, car sharing option) May 2, 2018 - François Brouard, DBA, FCPA, FCA7 / 20[Note on Personal Financial Planning]

Investments- types of investment- cash and cash equivalencies- deposits in financial institutions- cash in bank accounts- term deposits- Guaranteed Investment Certificate (GIC)- bonds- treasury bills (T-Bills)- Canada savings bonds- provincial savings bonds- municipal bonds- corporate bonds- equities- shares in public corporations- shares in private corporations- common vs preferred shares- interest in a partnership- mutual funds- equity fund- income / bond fund- balanced fund- ethical fund- international fund- dividend fund- commercial paper- bankers’ acceptance- commodities (gold, silver)- deferred income plans- derivatives- options (call, put)- warrants- rights- futures- real estate- principal residence- cottage- rental property- personal use property- household assets- automobile, recreational vehicle (RV), boat, kayak, canoe- art work (painting, sculpture)- tax shelters- flow-through shares- income trusts- limited partnership May 2, 2018 - François Brouard, DBA, FCPA, FCA8 / 20[Note on Personal Financial Planning]

----investment style- active vs passivedifferent tax treatment of investment income- interest- dividend- capital gainsfactors- risk vs return trade-off- long term vs short term perspective- pleasure of investment- management requirements effortdiversification- between types of investment- between different countries- risk tolerancevaluation issuestypes of investment risk- business risk- market risk- marketability risk- liquidity risk- reinvestment risk- default risk- interest rate risk- inflation rate risk- political risk- exchange rates risk- term risk May 2, 2018 - François Brouard, DBA, FCPA, FCA9 / 20[Note on Personal Financial Planning]

Debt managementFor debt management, the challenge is to use debt as an advantage and to avoid falling in thecredit trap and financial difficulties.----types of liabilities- loans- line of credit- credit card- consumer loan single purpose loan- student loan- mortgages- home mortgage- second mortgagefinancial difficulties- risk of insolvency- refinancing and debt consolidation- proposal (consumer, commercial)- bankruptcyfinancing issues- loans for investment and interest deductibility- credit ratings- debt capacityexamples of strategies- refinance- reduce debt- leases- eliminate in priority debt with highest interest rate (ex: credit card)- replace debt with non-deductible interest by other with deductible interest- reimburse faster mortgage and loan May 2, 2018 - François Brouard, DBA, FCPA, FCA10 / 20[Note on Personal Financial Planning]

Risk managementRisk management is a process to handle risks by using various strategies and techniques. Allrisks are not equal.-----process of risk management- identifying the risks and threats- setting risk management objectives- evaluating the risks- selecting strategies on how to handle risks- risk control- risk avoidance- risk reduction- risk financing- risk transfer- risk sharing- risk retention- implementation- monitoring the riskstypes of risk- death- health (medical, critical illness, disability)- property and casualty (home, automobile)structure of insurance- group vs individual- governmental vs privatetype of insurance- life- temporary: term- permanent: whole, universal- health (medical: drug, dental, vision)- governmental coverage- extended health coverage- disability- property and casualty (home, automobile)- liability (personal, professional)- long-term careissues about insurance- representation of facts with a declaration / statement of facts- coverage and exclusions- designation of beneficiaries(irrevocable, revocable) May 2, 2018 - François Brouard, DBA, FCPA, FCA11 / 20[Note on Personal Financial Planning]

Process - Planning and Action Phase - Planning StrategiesTax planningTax planning are strategies and techniques to optimize present value of after-tax individual andfamily net worth.----tax planning strategies- apply the known legislation- reduce tax payable- defer tax- shifting income / deductions / credits- over time- between types- between entities- between jurisdictions- income splitting / income sprinkling- between spouses- with children- with other family members- choice of transactions- choice of business structuretax rates- effective- marginalcharitable giving (during life time and upon death)- gift of money- gift of property- gift of publicly trades shares- gift of ecologically sensitive land- gift of remainder interests in property- gift of life insurance and annuitiestax consequences on- various types of income- disposition of asset- wealth- various ownership structure May 2, 2018 - François Brouard, DBA, FCPA, FCA12 / 20[Note on Personal Financial Planning]

Education PlanningEducation planning are strategies and techniques to accumulate funds to pay for education costsof family members (own and/or dependents), especially at post-secondary institutions.Related tax issues- Registered Education Savings Plan (RESP)- Canada Education Savings Grant (CESG)- Canada Learning Bond (CLB)- Registered Retirement Savings Plan (RRSP)- lifelong learning exception- regular withdrawal- use of trusts for education of children and grandchildrenSources of funding- Registered Education Savings Plan (RESP)- Registered Retirement Savings Plan (RRSP) (lifelong learning exception)- Tax-free savings account (TFSA)- use of personal funds- disposition of assets- government assistance (loans and- scholarship- tax credits- loans- parents’ contributionsEducation timingFunding period (x years)NowEducation period - Needs of funds (y years)start of trainingend of trainingSteps in education planning- determine time horizon- choose education program- estimate the funding period- estimate the education period (number of months / years) to finance- estimate the cost of education- tuition and school related expenses- living expenses- estimate the necessary funding (per month, semester, year)- evaluate the sources of funding available May 2, 2018 - François Brouard, DBA, FCPA, FCA13 / 20[Note on Personal Financial Planning]

Retirement PlanningRetirement planning are strategies and techniques for accumulation of wealth and for withdrawalduring pre-retirement and retirement years.Sources of retirement income and funds- governments programs- Canada Pension Plan / Québec Pension Plan (CPP/QPP)- Old Age Security (OAS) and Guaranteed Income Supplement (GIS)- Canada Child Benefit (CCB)- employment insurance (EI)- workers’ compensation programs- income assistance programs- deferred pensions plans- Registered Pension Plan (RPP)- defined benefit plan- defined contribution plan- Registered Retirement Savings Plan (RRSP)- Registered Retirement Income Fund (RRIF)- Deferred profit sharing plan (DPSP)- supplemental pension arrangements- supplemental retirement plans- retirement compensation arrangement (RCA)- retiring allowance- selling assets- estate freeze- other- Life income funds (LIF)- Lock-in retirement income funds (LRIF)- annuitiesFactors to consider for retirement- inflation- life expectancy- income tax- rate of return- lock-in funds May 2, 2018 - François Brouard, DBA, FCPA, FCA14 / 20[Note on Personal Financial Planning]

Retirement timingFunding period (x years)NowRetirement period (y years)Retirement dateDeathSteps in retirement planning- set goals- desired retirement vision- desired retirement date- desired quality of life- determine time horizon (funding period and retirement period)- estimate rate of return- estimate risk tolerance- estimate income at retirement- estimate spending requirements- estimate difference and needs of funding- financing of needs for retirementFactors during retirement period- layer different sources of funding (income and disposition of assets)- structure income in order to preserve tax credits and government benefits- create efficient cash flowCalculations (see Note on PFP Retirement Planning Analysis)A) Excess Discretionary Cash Flow during Funding PeriodB1) Retirement GoalB2) Retirement Cash Flow May 2, 2018 - François Brouard, DBA, FCPA, FCA15 / 20[Note on Personal Financial Planning]

Life Insurance PlanningFactors to consider for life insurance- age- gender- health (medical history and current health)- habits (smoking, drinking, drugs)- pre-existing conditions- family’s medical history- physical condition (weight, height)- occupation and profession- lifestyles choices and hobbies (ex: mountain climbing, skydiving)- marital status and number of children- amount needed (existing policy and new policy)- level of incomeLife insurance timingFunding periodNeeds of funds periodFunds for Parent 2 and childrenNowDeath Parent1Funding periodFunds for childrenDeath Parent2Needs of funds periodFunds for childrenNowDeath both ParentsSteps regarding life insurance planning- determine time horizon- develop scenarios- funding following death of one parent (spouse and/or children)- funding following death of both parent- estimate life insurance needsLife Insurance Needs Analysis (see Note on PFP Life Insurance Needs Analysis)A) Cash Required at DeathB) Cash Required after Death (Long-Term)C) Annual Living ExpensesD) Actual Annual Income to Cover Living ExpensesE) Additional Insurance Needed May 2, 2018 - François Brouard, DBA, FCPA, FCA16 / 20[Note on Personal Financial Planning]

Succession and Estate PlanningSuccession and Estate Planning are strategies and techniques for distribution of wealth and forwithdrawal before and after death.-------steps in succession and estate planning- set objectives and goals- identify and evaluate issues- estimate value of estate net worth- identify and select heirs (who, how, how much, when)- select executor- monitor plansteps following death- collect documents (will, death certificate, funeral arrangement)- transmit information (notice to various stakeholders and requests)- identification of assets and liabilities- payment of liabilities- disposition of assets- cash available- manage estate- distribution of cash and assets from estateneed to revise key documents- will (importance of will)- power of attorney- for personal care- for propertyuse of trusts in estate planning- control- beneficiaries- estate freezetypes of trusts- testamentary trust- inter vivos trustRegistered Disability Savings Plan (RDSP)- Canada Disability Savings Grant (CDSG)- Canada Disability Savings Bond (CDSB)death benefitslife insurancetaxation upon deathtiming of distributiontransfer of a business- use of capital gains exemptionimpact of shareholders’ agreementcontrol issuesprobate will May 2, 2018 - François Brouard, DBA, FCPA, FCA17 / 20[Note on Personal Financial Planning]

Process - Implementation PhaseControl strategiesControl strategies are strategies and techniques for controlling the management of financialaffairs and evaluate achievements of goals. The budget may offer some guidelines on thefinancial affairs.Monitoring and revisionsMonitoring and revisions are strategies and techniques for monitoring and revising the personalfinancial planning to take into account changes in personal situation and goals.--examples of events bringing a need for revisions- marriage, separation, divorce- birth of a child- death in the family- health issues (illness, loss of mental capacity)- advancement of children to post-secondary institutions- sabbatical leave (return to school, extended vacation, personal project)- change in professional activities (unemployment, new job, new career, retirement)- purchase / sale of a business / family business- emigration / immigration- financial difficulties- reception of an inheritance- major tax legislation changespossible solutions- increasing revenues- reducing expenses- selling assets- purchasing assets- paying liabilities- obtaining financing- changing the timeframe- modifying goalsRole of Advisor-understand the needs and preferences of clientassess and document client situationlist and examine feasibility of optionsmake recommendations specific to a clientimplement your strategiesmonitoring and revising the plan May 2, 2018 - François Brouard, DBA, FCPA, FCA18 / 20[Note on Personal Financial Planning]

Appendix A - Personal Financial StatementsBalance SheetAssetsLiabilitiesCurrent AssetsCashTerm deposits and GICCurrent LiabilitiesCredit cardsAccounts payableLine of creditBank loansLoansCapital AssetsReal estateAutomobilesPersonal assetsNon-registered investmentsRegistered deferred plansInvestment in private corporationsInvestment in partnershipsLife insuranceLong-term debtsMortgageTax liabilitiesOther debtsNet worthIncome StatementRevenuesExpensesIncome from EmploymentIncome from a BusinessIncome from PropertyPension incomeCapital gainOther thingInsurancePurchase of assetsEducationRecreationVacationSavings and investmentTaxesFun moneyExcess (Deficiency) of Revenues over Expenses May 2, 2018 - François Brouard, DBA, FCPA, FCA19 / 20[Note on Personal Financial Planning]

Notes on Personal Financial Statement-------Personal family situationSignificant accounting policiesBank accounts (checking, savings)Term deposits and GICInvestments- Investments in partnerships- Investments in private corporations- Stocks optionsMarketable securities- Bonds- Equities- Mutual fundsRegistered deferred plans- TFSA - Tax Free Savings Account- RPP - Registered Pension Plan- RRSP - Registered Retirement Savings Plan- RRIF - Registered Retirement Income Fund- RESP - Registered Education Savings Plan- RDSP - Registered Disability Savings Plan- DPSP - Deferred profit sharing planReal estate- Principal residence- Cottage- Rental propertyPersonal assets- Household assets- Other personal property (automobile, boat)- Listed personal property (paintings, jewelry)Life insuranceCurrent debt- Credit card- Bank loans- Line of creditReal estate mortgagesTax liabilityInsurance policiesCommitmentsContingenciesSubsequent events May 2, 2018 - François Brouard, DBA, FCPA, FCA20 / 20[Note on Personal Financial Planning]

PERSONAL FINANCIAL PLANNING François Brouard, DBA, FCPA, FCA Sprott School of Business, Carleton University . Life Cycle and PFP Personal situation evolves over time. Over the years, a person will have to focus on various aspects. Age of a person is an indicator of life cycle. Various other factors may affect and