Transcription

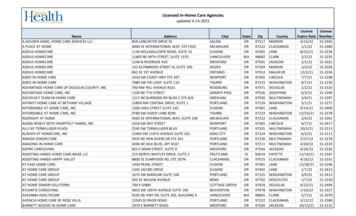

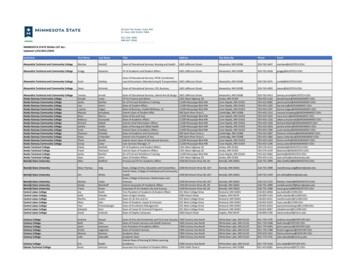

Course 3031323334353637383940UPDATED:Becker Prime - CoursesField of ntingTitleAccounting for Goodwill and Acquisition Related ExpensesAccounting for Income Taxes (ASC 740): Overview and Special IssuesAdvanced Derivative and Hedge Accounting ConceptsBankruptcy: How to Effectively Address Financial Reporting Issues and Bankruptcy CodeBankruptcy: How to Effectively Address Financial Reporting Issues and Bankruptcy CodeBusiness Combinations and Consolidations, Part 2 (ASC 805 & 810)Debt – Accounting and Financial Reporting RisksInspecting the Annual Report, Part 1Inspecting the Annual Report, Part 2Introduction to Derivatives and Hedge AccountingLiquidation Basis of Accounting (ASC 205-30)Managing the Company’s Cash and CreditMastering Accounting for Income Taxes (ASC 740)Meeting SEC Disclosure Requirements: Management's Discussion & Analysis of financialMeeting SEC Disclosure Requirements: Management's Discussion & Analysis of financialMeeting SEC Disclosure Requirements: Management's Discussion & Analysis of financialNonmonetary TransactionsOther Comprehensive Basis of Accounting (OCBOA)Revenue Recognition - Clarifications to the Standard (ASC 606)SEC Initial Public Offering RequirementsSEC Reporting Requirements, Part 1SEC Reporting Requirements, Part 2SEC Reporting Requirements, Part 3Accounting & Auditing Update – Q1 2020Accounting and Auditing Update – Q3 2019Business Combinations and Consolidations, Part 1 (ASC 805 & 810)Construction Industry - Advanced TopicsConstruction Industry - Overall LandscapeDeep Dive into Financial InstrumentsEquity (ASC 505)Financial reporting challenges - Q1 2020 with coronavirus (COVID-19) impactFinancial Reporting Framework for Small- and Medium-Sized EntitiesLeases – ASC 842The Coronavirus (COVID-19) Impact: What Every CPA Should KnowXBRL: Today's Language of Business ReportingCracking the Codification: U.S. GAAP Research Made EasyFinancial Instruments: Derivatives and HedgingForeign Currency Accounting (ASC 830)Foundations of Business Combinations and Noncontrolling InterestsInsights on the Business and Accounting Impact of the Coronavirus (COVID-19)CPE .02.02.02.51.51.52.03.01.0Course cBasic3/23/2021Expiration 05/31/2105/31/2105/31/21

UPDATED:Becker Prime - CoursesCourse 5Field of ingAccountingAccountingTitleNon-GAAP Financial MeasuresPrivate Company Financial ReportingSEC Quarterly Update Q1 2020 - with coronavirus (COVID-19) implicationsSegment Reporting (ASC 280)Standard CostingAccounting for stock options & other stock-based compensation (ASC 718)Activity-Based Costing to Manage CapacityFinancial Instruments—Credit Losses (ASU 2016-13)Implications from the Adoption of the New Leasing StandardIntroduction to Financing an Entity Using Equity InstrumentsRevenue Recognition: ASC 606 Analysis for the Life Sciences IndustryRevenue, capitalization, and expense recognition for software companiesSustainability Accounting and Integrated ReportingAccounting and Auditing Hot Topics – June 2019Accounting and Auditing Update - Q2 2020Accounting Changes and Error Corrections (ASC 250)Auditing InventoryBusiness Combinations and GoodwillComprehensive IncomeEarnings per Share (ASC 260)Forecasting for the Start-Up BusinessGross-to-Net Revenue Adjustments for the Pharmaceutical IndustryImpairment of Tangibles, Intangibles, and Goodwill (effective for SEC filers)Implementing Revenue Recognition – Lessons LearnedInventory: Techniques to Manage, Account for, and asicCourse LevelExpiration 1/21Meeting SEC Disclosure Requirements: Compensation Discussion and Analysis1.0Basic07/31/21PCAOB Inspection FindingsRevenue Recognition: ASC 606 Analysis for the Technology IndustryRevenue Recognition—DisclosuresThe Covid-19 Impact on LeasesWhat Is Integrated Reporting?Accounting for Stock-Based CompensationBuilding a Persuasive CaseConsolidation of VIEs, Part 1 (ASC 810)Consolidation of VIEs, Part 2 (ASC 810)GAAP financial statements (ASC 205-235)SEC Quarterly Update - Q2 2020Annual Accounting UpdateAnnual Accounting 108/31/2108/31/2109/30/2109/30/21CPE Credit

UPDATED:Becker Prime - CoursesCourse #8081828384858687888990919293949596Field of counting (Governmental)Accounting (Governmental)Accounting (Governmental)Accounting (Governmental)Accounting (Governmental)Accounting (Governmental)TitleBusiness Restructuring: Part 1Business Restructuring: Part 1Business Restructuring: Part 2Business Restructuring: Part 2Financial Instruments—Recognition and Measurement (ASU 2016-01)Financial Reporting and Accounting Update 2020 - Q2Financial Reporting and Accounting Update 2020 - Q2Financial Reporting Challenges for 2020 - Q2Financial Reporting Challenges for 2020 - Q2Impairment of Tangibles, Intangibles, and GoodwillImpairment of Tangibles, Intangibles, and GoodwillIntroduction to BookkeepingNot-for-Profit Entities: Financial Statement Presentation (ASU 2016-14)Opening a New Chapter: Fresh-Start Accounting and Subsequent EventsPreparing the Statement of Cash FlowsAICPA Valuation and Consulting StandardsAsset Retirement and Environmental Obligations (ASC .51.53.02.02.5Course asicExpiration 09/30/2109/30/2109/30/2110/31/2110/31/21Evaluating the Quality of Earnings1.0Intermediate11/30/21FASB’s Disclosure Framework ProjectIntroduction to Financial Reporting QualityPension accounting & reporting requirements (ASC 715 & 712)Quality Control Standards, Part 1Quality Control Standards, Part 2Quality Control Standards, Part 3Quality Control Standards, Part 4Quality Control Standards, Part 5Standard CostingTransfers and Servicing of Financial Assets (ASC 860)Mergers and Acquisitions Due DiligenceSpecial Purpose Acquisition Companies (SPACs)2021 SEC Update2021 Accounting UpdateIntroduction to BookkeepingGASB Other Postemployment Benefits (OPEB)2019 Not-For-Profit Accounting & Auditing UpdateGASB Statement 87: Leases2020 GASB Update2020 Not-For-Profit Accounting & Auditing UpdateGASB Conceptual Framework: 6/30/2106/30/2106/30/21CPE Credit

UPDATED:Becker Prime - CoursesCourse #119120121122123124125126127128129130131Field of StudyAccounting (Governmental)Accounting (Governmental)Accounting (Governmental)Accounting (Governmental)Accounting (Governmental)Accounting ditingTitleFederal Government Contracting—An IntroductionAccounting for Revenues in Government (Emphasis on Non-Exchange Transactions)Federal Appropriation Principles-An OverviewIntermediate Governmental AccountingGASB 84: Fiduciary Activities2021 GASB updateAccountants’ Responsibilities Regarding Fraud, Part 1AICPA Control Risk Assessment RequirementsAICPA Engagement Quality Control Review (EQCR)AICPA Risk Assessment RequirementsAnalytical Procedures Used by AuditorsAsset Misappropriation SchemesAuditing Prepaid 1.51.5Course on 03/31/21Common Issues in Auditing Student Financial Assistance2.0Overview03/31/21Corruption, Part 1Corruption, Part 2Healthcare Industry, Part 1—Overview and UpdateIntroduction to Audit SamplingManaging Professional Liability Risk in Nonattest ServicesAccountants' Responsibilities Regarding Fraud, Part 2Audit Sampling, Part 1: Introduction to Basic Sampling Concepts and TermsAudit Sampling, Part 2: Attribute Sampling for Tests of Controls and Selecting aFraud in Not-for-ProfitsNavigating System and Organization Control (SOC) ReportsProfessional Skepticism for Public AccountantsRequired Auditor CommunicationsUpcoming Peer Review, Part 1Audit Sampling, Part 3: Substantive Audit Sampling – An IntroductionAuditing Accounts ReceivableAuditing Fair ValueComparing the Audit Standards – AICPA vs. PCAOB vs. International StandardsFraud Investigation, Part 2Going Concern UncertaintyHealthcare Industry, Part 2 - Understanding Health Care Financial StatementsThe 2017 PCAOB Auditor's ReportThe New AICPA Auditor’s ReportUpcoming Peer Review, Part 2A Guide Through Common Audit DeficienciesAudit Risk Assessment: The Do's and Don'ts, Part 5/31/2105/31/2106/30/2106/30/21CPE Credit

UPDATED:Becker Prime - CoursesCourse #158159160161162163164165166Field of t Risk Assessment: The Do's and Don'ts, Part 2Audit Sampling, Part 4: Classical Variables Sampling (CVS) TechniquesFundamental IT Auditing ConceptsHow to Properly Prepare Audit Documentation and Workpapers, Part 2Professional Judgment in AuditReporting on Subject Matters Other Than Historical Financial StatementsAnnual Update For Employee Benefit PlansAuditing Property, Plant & EquipmentDrafting Audit Reports Under SAS No. 134 and PCAOB3/23/2021CPE CreditCourse cExpiration 2107/31/2107/31/2107/31/21Employee Benefits, Part 3—Defined Benefit Pension Plans2.5Intermediate07/31/21AuditingFinancial Statement Fraud2.5Intermediate07/31/21169AuditingFraud Investigation, Part gAuditingAuditingAuditingAuditingAudit and Attestation UpdateAuditing Cash and Cash EquivalentsAuditing Current LiabilitiesAuditing Employee Benefit Plans – Part 1Auditing Long Term LiabilitiesCompilations and Reviews – Avoiding Peer Review Deficiencies (Updated for SSARS 176AuditingFraud Investigation, Part ingAuditingGroup Audit (AU-C 600)How to Assess Internal Controls and Safeguard AssetsPreparing Compilations and Reviews: 2018-2019, Part 1Preparing Compilations and Reviews: 2018-2019, Part 8/31/2108/31/21181AuditingRequired Communications in an Audit2.0Basic08/31/21182AuditingAudit Quality: How to Prevent Audit Failure2.0Update09/30/21183Auditi

20.05.2010 · Becker Prime - Courses 119 Accounting (Governmental) Federal Government Contracting—An Introduction 2.0 Basic 08/31/21 120 Accounting (Governmental) Accounting for Revenues in Government (Emphasis on Non-Exchange Transactions) 3.0 Intermediate 09/30/21