Transcription

Se v e nthn th E d itio nENGINEERINGECONOMYbla76302 fm i-xx.indd i1/14/11 8:28 PM

bla76302 fm i-xx.indd ii1/14/11 8:28 PM

Se v e n th E d itio nENGINEERINGECONOMYLeland Blank, P. E.Texas A & M UniversityAmerican University of Sharjah, United Arab EmiratesAnthony Tarquin, P. E.University of Texas at El PasoTMbla76302 fm i-xx.indd iii1/14/11 8:28 PM

TMENGINEERING ECONOMY: SEVENTH EDITIONPublished by McGraw-Hill, a business unit of The McGraw-Hill Companies, Inc., 1221 Avenue of the Americas, NewYork, NY 10020. Copyright 2012 by The McGraw-Hill Companies, Inc. All rights reserved. Previous editions 2005, 2002, and 1998. No part of this publication may be reproduced or distributed in any form or by any means, orstored in a database or retrieval system, without the prior written consent of The McGraw-Hill Companies, Inc.,including, but not limited to, in any network or other electronic storage or transmission, or broadcast for distancelearning.Some ancillaries, including electronic and print components, may not be available to customers outside the UnitedStates.This book is printed on recycled, acid-free paper containing 10% postconsumer waste.1 2 3 4 5 6 7 8 9 0 QDB/QDB 1 0 9 8 7 6 5 4 3 2 1ISBN 978-0-07-337630-1MHID 0-07-337630-2Vice President & Editor-in-Chief: Marty LangeVice President EDP/Central Publishing Services: Kimberly Meriwether DavidGlobal Publisher: Raghothaman SrinivasanSponsoring Editor: Peter E. MassarSenior Marketing Manager: Curt ReynoldsDevelopment Editor: Lorraine K. BuczekSenior Project Manager: Jane MohrDesign Coordinator: Brenda A. RolwesCover Designer: Studio Montage, St. Louis, MissouriCover Image: Brand X Pictures/PunchStock RFBuyer: Kara KudronowiczMedia Project Manager: Balaji SundararamanCompositor: MPS Limited, a Macmillan CompanyTypeface: 10/12 TimesPrinter: Quad/Graphics-DubuqueAll credits appearing on page or at the end of the book are considered to be an extension of the copyright page.Library of Congress Cataloging-in-Publication DataBlank, Leland T.Engineering economy / Leland Blank, Anthony Tarquin. — 7th ed.p. cm.Includes bibliographical references and index.ISBN-13: 978-0-07-337630-1 (alk. paper)ISBN-10: 0-07-337630-21. Engineering economy. I. Tarquin, Anthony J. II. Title.TA177.4.B58 2012658.15—dc222010052297www.mhhe.combla76302 fm i-xx.indd iv1/14/11 8:28 PM

This book is dedicated to Dr. Frank W. Sheppard, Jr. His lifelongcommitment to education, fair financial practices, internationaloutreach, and family values has been an inspiration to many—oneperson at a time.bla76302 fm i-xx.indd v1/14/11 8:28 PM

M C GRAW-HILL DIGITAL OFFERINGSMcGraw-Hill Create Craft your teaching resources to match the way you teach! With McGraw-Hill Create , www.mcgrawhillcreate.com, you can easily rearrange chapters, combine material from other contentsources, and quickly upload content you have written like your course syllabus or teaching notes.Find the content you need in Create by searching through thousands of leading McGraw-Hilltextbooks. Arrange your book to fit your teaching style. Create even allows you to personalizeyour book’s appearance by selecting the cover and adding your name, school, and course information. Order a Create book and you’ll receive a complimentary print review copy in 3–5 business days or a complimentary electronic review copy (eComp) via email in minutes. Go to www.mcgrawhillcreate.com today and register to experience how McGraw-Hill Create empowersyou to teach your students your way.McGraw-Hill Higher Education and Blackboard HaveTeamed UpBlackboard, the Web-based course-management system, has partnered with McGraw-Hill to better allow students and faculty to use online materials and activities to complement face-to-faceteaching. Blackboard features exciting social learning and teaching tools that foster more logical,visually impactful and active learning opportunities for students. You’ll transform your closeddoor classrooms into communities where students remain connected to their educational experience 24 hours a day.This partnership allows you and your students access to McGraw-Hill’s Create right fromwithin your Blackboard course – all with one single sign-on. McGraw-Hill and Blackboard cannow offer you easy access to industry leading technology and content, whether your campushosts it, or we do. Be sure to ask your local McGraw-Hill representative for details.Electronic Textbook OptionsThis text is offered through CourseSmart for both instructors and students. CourseSmart is anonline resource where students can purchase the complete text online at almost half the cost of atraditional text. Purchasing the eTextbook allows students to take advantage of CourseSmart’sweb tools for learning, which include full text search, notes and highlighting, and email tools forsharing notes between classmates. To learn more about CourseSmart options, contact your salesrepresentative or visit www.CourseSmart.com.bla76302 fm i-xx.indd vi1/14/11 8:28 PM

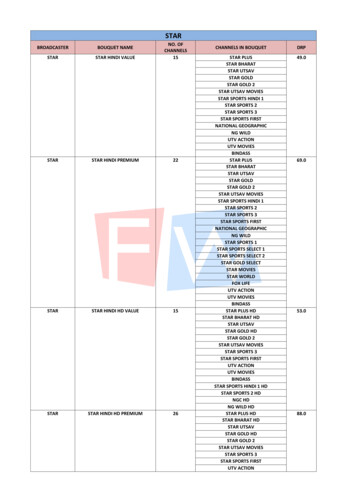

CONTENTSPreface to Seventh EditionLEARNINGSTAGE 1Chapter 1xiiiTHE FUNDAMENTALSFoundations of Engineering Economy1.11.21.31.41.51.61.71.81.91.10Chapter 2Factors: How Time and Interest Affect MoneyPE2.12.22.32.42.52.62.7Chapter 3Calculations for Uniform Series That Are ShiftedCalculations Involving Uniform Series and Randomly Placed Single AmountsCalculations for Shifted GradientsChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Preserving Land for Public UseNominal and Effective Interest RatesPE4.14.24.34.44.5bla76302 fm i-xx.indd viiProgressive Example—The Cement Factory CaseSingle-Amount Factors (F P and P F )Uniform Series Present Worth Factor and Capital Recovery Factor (P A and A P)Sinking Fund Factor and Uniform Series Compound Amount Factor (A F and F A)Factor Values for Untabulated i or n ValuesArithmetic Gradient Factors (P G and A G)Geometric Gradient Series FactorsDetermining i or n for Known Cash Flow ValuesChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Time Marches On; So Does the Interest RateCombining Factors and Spreadsheet Functions3.13.23.3Chapter 4Engineering Economics: Description andRole in Decision MakingPerforming an Engineering Economy StudyProfessional Ethics and Economic DecisionsInterest Rate and Rate of ReturnTerminology and SymbolsCash Flows: Estimation and DiagrammingEconomic EquivalenceSimple and Compound InterestMinimum Attractive Rate of ReturnIntroduction to Spreadsheet UseChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Renewable Energy Sources for Electricity GenerationCase Study—Refrigerator ShellsProgressive Example—The Credit Card Offer CaseNominal and Effective Interest Rate StatementsEffective Annual Interest RatesEffective Interest Rates for Any Time PeriodEquivalence Relations: Payment Period and Compounding PeriodEquivalence Relations: Single Amounts with PP 6469707273768086869293949596991051061071/14/11 8:28 PM

viiiContents4.64.74.84.9LEARNINGSTAGE 2Chapter 5Present Worth ion of a Rate of Return ValueRate of Return Calculation Using a PW or AW RelationSpecial Considerations When Using the ROR MethodMultiple Rate of Return ValuesTechniques to Remove Multiple Rates of ReturnRate of Return of a Bond InvestmentChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Developing and Selling an Innovative Idea173175179180184190193193198200Rate of Return Analysis: Multiple Alternatives2028.18.28.38.48.58.6bla76302 fm i-xx.indd viiiAdvantages and Uses of Annual Worth AnalysisCalculation of Capital Recovery and AW ValuesEvaluating Alternatives by Annual Worth AnalysisAW of a Permanent InvestmentLife-Cycle Cost AnalysisChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—The Changing Scene of an Annual Worth AnalysisRate of Return Analysis: One Project7.17.27.37.47.57.6Chapter 8Progressive Example—Water for Semiconductor Manufacturing CaseFormulating AlternativesPresent Worth Analysis of Equal-Life AlternativesPresent Worth Analysis of Different-Life AlternativesFuture Worth AnalysisCapitalized Cost AnalysisChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Comparing Social Security BenefitsAnnual Worth Analysis6.16.26.36.46.5Chapter 7109112114116117118122124BASIC ANALYSIS TOOLSPEChapter 6Equivalence Relations: Series with PP CPEquivalence Relations: Single Amounts and Series with PP CPEffective Interest Rate for Continuous CompoundingInterest Rates That Vary over TimeChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Is Owning a Home a Net Gain or Net Loss over Time?Why Incremental Analysis Is NecessaryCalculation of Incremental Cash Flows for ROR AnalysisInterpretation of Rate of Return on the Extra InvestmentRate of Return Evaluation Using PW: Incremental and BreakevenRate of Return Evaluation Using AWIncremental ROR Analysis of Multiple Alternatives2032032062072132141/14/11 8:28 PM

Contents8.7Chapter 9Benefit/Cost Analysis and Public Sector EconomicsPE9.19.29.39.49.59.6Progressive Example—Water Treatment Facility #3 CasePublic Sector ProjectsBenefit/Cost Analysis of a Single ProjectAlternative Selection Using Incremental B/C AnalysisIncremental B/C Analysis of Multiple, Mutually Exclusive AlternativesService Sector Projects and Cost-Effectiveness AnalysisEthical Considerations in the Public SectorChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Comparing B/C Analysis and CEA of Traffic Accident ReductionLEARNINGSTAGE 2EPILOGUE: SELECTING THE BASIC ANALYSIS TOOLLEARNINGSTAGE 3MAKING BETTER DECISIONSChapter 10Project Financing and Noneconomic Attributes10.110.210.310.410.510.610.7Chapter 11MARR Relative to the Cost of CapitalDebt-Equity Mix and Weighted Average Cost of CapitalDetermination of the Cost of Debt CapitalDetermination of the Cost of Equity Capital and the MARREffect of Debt-Equity Mix on Investment RiskMultiple Attribute Analysis: Identification and Importance of Each AttributeEvaluation Measure for Multiple AttributesChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Which Is Better—Debt or Equity Financing?Replacement and Retention DecisionsPE11.111.211.311.411.511.6bla76302 fm i-xx.indd ixAll-in-One Spreadsheet Analysis (Optional)Chapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—ROR Analysis with Estimated Lives That VaryCase Study—How a New Engineering Graduate Can Help His FatherProgressive Example—Keep or Replace the Kiln CaseBasics of a Replacement StudyEconomic Service LifePerforming a Replacement StudyAdditional Considerations in a Replacement StudyReplacement Study over a Specified Study PeriodReplacement ValueChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Will the Correct ESL Please 22932942963023063073123123133193211/14/11 8:28 PM

xContentsChapter 12Independent Projects with Budget Limitation12.112.212.312.412.5Chapter 13Breakeven and Payback Analysis13.113.213.313.4LEARNINGSTAGE 4Chapter 14Effects of InflationUnderstanding How Cost Estimation Is AccomplishedUnit MethodCost IndexesCost-Estimating Relationships: Cost-Capacity EquationsCost-Estimating Relationships: Factor MethodTraditional Indirect Cost Rates and AllocationActivity-Based Costing (ABC) for Indirect CostsMaking Estimates and Maintaining Ethical PracticesChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Indirect Cost Analysis of Medical Equipment Manufacturing CostsCase Study—Deceptive Acts Can Get You in TroubleDepreciation Methods16.116.216.316.416.5bla76302 fm i-xx.indd xUnderstanding the Impact of InflationPresent Worth Calculations Adjusted for InflationFuture Worth Calculations Adjusted for InflationCapital Recovery Calculations Adjusted for InflationChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Inflation versus Stock and Bond InvestmentsCost Estimation and Indirect Cost Allocation15.115.215.315.415.515.615.715.8Chapter 16Breakeven Analysis for a Single ProjectBreakeven Analysis Between Two AlternativesPayback AnalysisMore Breakeven and Payback Analysis on SpreadsheetsChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Water Treatment Plant Process 355361363ROUNDING OUT THE STUDY14.114.214.314.4Chapter 15An Overview of Capital Rationing among ProjectsCapital Rationing Using PW Analysis of Equal-Life ProjectsCapital Rationing Using PW Analysis of Unequal-Life ProjectsCapital Budgeting Problem Formulation Using Linear ProgrammingAdditional Project Ranking MeasuresChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsDepreciation TerminologyStraight Line (SL) DepreciationDeclining Balance (DB) and Double Declining Balance (DDB) DepreciationModified Accelerated Cost Recovery System (MACRS)Determining the MACRS Recovery 53974014034044044104114124144154184194224261/14/11 8:28 PM

Contents16.6Depletion MethodsChapter SummaryAppendix16A.1 Sum-of-Years-Digits (SYD) and Unit-of-Production (UOP) Depreciation16A.2 Switching between Depreciation Methods16A.3 Determination of MACRS RatesProblemsAdditional Problems and FE Exam Review QuestionsAppendix ProblemsChapter 17After-Tax Economic r 18Sensitivity Analysis and Staged Decisions18.118.218.318.418.518.6Chapter 19Interpretation of Certainty, Risk, and UncertaintyElements Important to Decision Making under RiskRandom SamplesExpected Value and Standard DeviationMonte Carlo Sampling and Simulation AnalysisChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Using Simulation and Three-Estimate Sensitivity AnalysisUsing Spreadsheets and Microsoft Excel A.1A.2A.3A.4A.5A.6bla76302 fm i-xx.indd xiDetermining Sensitivity to Parameter VariationSensitivity Analysis Using Three EstimatesEstimate Variability and the Expected ValueExpected Value Computations for AlternativesStaged Evaluation of Alternatives Using a Decision TreeReal Options in Engineering EconomicsChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—Sensitivity to the Economic EnvironmentCase Study—Sensitivity Analysis of Public Sector Projects—Water Supply PlansMore on Variation and Decision Making under Risk19.119.219.319.419.5Appendix AIncome Tax Terminology and Basic RelationsCalculation of Cash Flow after TaxesEffect on Taxes of Different Depreciation Methods and Recovery PeriodsDepreciation Recapture and Capital Gains (Losses)After-Tax EvaluationAfter-Tax Replacement StudyAfter-Tax Value-Added AnalysisAfter-Tax Analysis for International ProjectsValue-Added TaxChapter SummaryProblemsAdditional Problems and FE Exam Review QuestionsCase Study—After-Tax Analysis for Business ExpansionIntroduction to Using ExcelOrganization (Layout) of the SpreadsheetExcel Functions Important to Engineering EconomyGoal Seek—A Tool for Breakeven and Sensitivity AnalysisSolver—An Optimizing Tool for Capital Budgeting, Breakeven, and Sensitivity AnalysisError 75495505585595601/14/11 8:28 PM

xiiContentsAppendix BBasics of Accounting Reports and Business RatiosB.1B.2B.3561561562563Appendix CCode of Ethics for Engineers566Appendix DAlternate Methods for Equivalence Calculations569D.1D.2Appendix EReference MaterialsFactor TablesPhoto CreditsIndexUsing Programmable CalculatorsUsing the Summation of a Geometric SeriesGlossary of Concepts and TermsE.1E.2bla76302 fm i-xx.indd xiiThe Balance SheetIncome Statement and Cost of Goods Sold StatementBusiness RatiosImportant Concepts and GuidelinesSymbols and Terms5695705735735765795816106111/14/11 8:28 PM

PREFACE TO SEVENTH EDITIONThis edition includes the time-tested approach and topics of previous editions and introduces significantly new print and electronic features useful to learning about and successfully applying the exciting field of engineering economics. Money makes a huge difference in the life of a corporation, anindividual, and a government. Learning to understand, analyze, and manage the money side of anyproject is vital to its success. To be professionally successful, every engineer must be able to deal withthe time value of money, economic facts, inflation, cost estimation, tax considerations, as well asspreadsheet and calculator use. This book is a great help to the learner and the instructor in accomplishing these goals by using easy-to-understand language, simple graphics, and online features.What's New and What's BestThis seventh edition is full of new information and features. Plus the supporting online materialsare new and updated to enhance the teaching and learning experience.New topics: Ethics and the economics of engineering Service sector projects and their evaluation Real options development and analysis Value-added taxes and how they work Multiple rates of return and ways to eliminate them using spreadsheets No tabulated factors needed for equivalence computations (Appendix D)New features in print and online: Totally new design to highlight important terms, concepts, and decision guidelines Progressive examples that continue throughout a chapter Downloadable online presentations featuring voice-over slides and animation Vital concepts and guidelines identified in margins; brief descriptions available (Appendix E) Fresh spreadsheet displays with on-image comments and function details Case studies (21 of them) ranging in topics from ethics to energy to simulationRetained features: Many end-of-chapter problems (over 90% are new or revised) Easy-to-read language to enhance understanding in a variety of course environments Fundamentals of Engineering (FE) Exam review questions that double as additional orreview problems for quizzes and tests Hand and spreadsheet solutions presented for many examples Flexible chapter ordering after fundamental topics are understood Complete solutions manual available online (with access approval for instructors)How to Use This TextThis textbook is best suited for a one-semester or one-quarter undergraduate course. Studentsshould be at the sophomore level or above with a basic understanding of engineering conceptsand terminology. A course in calculus is not necessary; however, knowledge of the concepts inadvanced mathematics and elementary probability will make the topics more meaningful.Practitioners and professional engineers who need a refresher in economic analysis and costestimation will find this book very useful as a reference document as well as a learning medium.Chapter Organization and Coverage OptionsThe textbook contains 19 chapters arranged into four learning stages, as indicated in the flowcharton the next page, and five appendices. Each chapter starts with a statement of purpose and a specific learning outcome (ABET style) for each section. Chapters include a summary, numerousbla76302 fm i-xx.indd xiii1/14/11 8:28 PM

xivPreface to Seventh EditionCHAPTERS IN EACH LEARNING STAGEComposition by levelChapter 1Foundations ofEngineering EconomyChapter 2Factors: How Time andInterest Affect MoneyLearningStage 1:TheFundamentalsChapter 3Combining Factors andSpreadsheet FunctionsChapter 4Nominal and EffectiveInterest RatesLearningStage 2:BasicAnalysisToolsChapter 5Present WorthAnalysisChapter 6Annual WorthAnalysisChapter 7Rate of ReturnAnalysis:One ProjectChapter 8Rate of ReturnAnalysis: MultipleAlternativesChapter 9Benefit/Cost Analysisand Public SectorEconomicsLearning Stage 2 EpilogueSelecting the BasicAnalysis ToolLearningStage 3:MakingBetterDecisionsLearningStage 4:RoundingOut theStudyChapter 10Project Financing andNoneconomic AttributesChapter 14Effects ofInflationChapter 11Replacement andRetention DecisionsChapter 15Cost Estimation andIndirect Cost AllocationChapter 12Independent Projectswith Budget LimitationChapter 13Breakeven andPayback AnalysisChapter 16DepreciationMethodsChapter 18Sensitivity Analysisand Staged DecisionsChapter 17After-Tax EconomicAnalysisChapter 19More on Variationand Decision Makingunder Riskend-of-chapter problems (essay and numerical), multiple-choice problems useful for course review and FE Exam preparation, and a case study.The appendices are important elements of learning for this text:Appendix AAppendix BAppendix CAppendix DAppendix ESpreadsheet layout and functions (Excel is featured)Accounting reports and business ratiosCode of Ethics for Engineers (from NSPE)Equivalence computations using calculators and geometric series; no tablesConcepts, guidelines, terms, and symbols for engineering economicsThere is considerable flexibility in the sequencing of topics and chapters once the first sixchapters are covered, as shown in the progression graphic on the next page. If the course is designed to emphasize sensitivity and risk analysis, Chapters 18 and 19 can be covered immediatelybla76302 fm i-xx.indd xiv1/14/11 8:28 PM

Chapter Organization and Coverage OptionsxvCHAPTER AND TOPIC PROGRESSION OPTIONSTopics may be introduced at the point indicated or any point thereafter(Alternative entry points are indicated by)Numerical progressionthrough chaptersInflationCostEstimationTaxes andDepreciationSensitivity, StagedDecisions, and Risk1. Foundations2. Factors3. More Factors4. Effective i5. Present Worth6. Annual Worth7. Rate of Return8. More ROR9. Benefit/Cost10. Financing andNoneconomic Attributes11. Replacement12. Capital Budgeting13. Breakeven andPayback14. Inflation15. Estimation16. Depreciation17. After-Tax18. Sensitivity, DecisionTrees, and Real Options19. Risk and Simulationafter Learning Stage 2 (Chapter 9) is completed. If depreciation and tax emphasis are vitallyimportant to the goals of the course, Chapters 16 and 17 can be covered once Chapter 6 (annualworth) is completed. The progression graphic can help in the design of the course content andtopic ordering.bla76302 fm i-xx.indd xv1/14/11 8:28 PM

SAMPLE OF RESOURCES FORLEARNING OUTCOMESL E A R N I N GEach chapter begins with a purpose, listof topics, and learning outcomes(ABET style) for each correspondingsection. This behavioral-basedapproach sensitizes the reader to whatis ahead, leading to improvedunderstanding and learning.O U T C O M E SPurpose: Use multiple factors and spreadsheet functions to find equivalent amounts for cash flows that have nonstandard placement.SECTIONTOPICLEARNING OUTCOME3.1Shifted series Determine the P, F or A values of a seriesstarting at a time other than period 1.3.2Shifted series and single cashflows Determine the P, F, or A values of a shifted seriesand randomly placed single cash flows.3.3Shifted gradients Make equivalence calculations for shiftedarithmetic or geometric gradient series thatincrease or decrease in size of cash flows.CONCEPTS AND GUIDELINESTime value of moneyIt is a well-known fact that money makes money. The time value of money explains the changein the amount of money over time for funds that are owned (invested) or owed (borrowed).This is the most important concept in engineering economy.IN-CHAPTER EXAMPLESTo highlight the fundamental buildingblocks of the course, a checkmark and titlein the margin call attention to particularlyimportant concepts and decision-makingguidelines. Appendix E includes a briefdescription of each fundamental concept.EXAMPLE 4.6Numerous in-chapter examplesthroughout the book reinforce thebasic concepts and makeunderstanding easier. Whereappropriate, the example is solvedusing separately marked hand andspreadsheet solutions.A dot-com company plans to place money in a new venture capital fund that currently returns18% per year, compounded daily. What effective rate is this (a) yearly and (b) semiannually?Solution(a) Use Equation [4.7], with r 0.18 and m 365.0.18 365 1 19.716%Effective i% per year 1 ——365(b) Here r 0.09 per 6 months and m 182 days.0.09 182 1 9.415%Effective i% per 6 months 1 ——182()()PROGRESSIVE EXAMPLESPEWater for Semiconductor Manufacturing Case: The worldwide contribution ofsemiconductor sales is about 250 billionper year, or about 10% of the world’sGDP (gross domestic product). This industry produces the microchips used in manyof the communication, entertainment,transportation, and computing deviceswe use every day. Depending upon thetype and size of fabrication plant (fab),the need for ultrapure water (UPW) tomanufacture these tiny integrated circuitsis high, ranging from 500 to 2000 gpm(gallons per minute). Ultrapure water isobtained by special processes that commonly include reverse osmosis deionizingresin bed technologies. Potable waterobtained from purifying seawater orbrackish groundwater may cost from 2 to 3 per 1000 gallons, but to obtainUPW on-site for semiconductor manufacturing may cost an additional 1 to 3 per1000 gallons.A fab costs upward of 2.5 billion toconstruct, with approximately 1% of thistotal, or 25 million, required to providethe ultrapure water needed, includingthe necessary wastewater and recyclingequipment.A newcomer to the industry, AngularEnterprises, has estimated the cost profiles for two options to supply its anticipated fab with water. It is fortunate toSeveral chapters include a progressiveexample—a more detailed problem statementintroduced at the beginning of the chapter andexpanded upon throughout the chapter inspecially marked examples. This approachillustrates different techniques and someincreasingly complex aspects of a real-worldproblem.have the option of desalinated seawateror purified groundwater sources in thelocation chosen for its new fab. The initial cost estimates for the UPW system aregiven below.SourceEquipment firstcost, MSeawater(S) 20Groundwater(G) 22 0.5 0.3Salvage value, % offirst cost510Cost of UPW, per1000 gallons45AOC, M per yearAngular has made some initial estimatesfor the UPW system.Life of UPW equipment 10 yearsUPW needs1500 gpmOperating time16 hours perday for 250 daysper yearbla76302 ch04 094-126.indd 106PW analysis of equal-life alternatives(Section 5.2)PW analysis of different-life alternatives (Section 5.3)Capitalized cost analysis (Section 5.5)Problems 5.20 and 5.34bla76302 fm i-xx.indd xvibla76302 ch05 127-149.indd 12912/22/10 8:24 PMThis case is used in the following topics(Sections) and problems of this chapter:1/14/11 8:28 PM12/22/10 11:06 PM

INSTRUCTORS AND STUDENTSxviiContentsONLINE PRESENTATIONSbla76302 ch08 202-227.indd 212An icon in the margin indicates theavailability of an animated voice-over slidepresentation that summarizes the material inthe section and provides a brief example forlearners who need a review or prefer videobased materials. Presentations are keyed tothe sections of the text.3.1 Calculations for Uniform Series That Are ShiftedWhen a uniform series begins at a time other than at the end of period 1, it is called a shiftedseries. In this case several methods can be used to find the equivalent present worth P. Forexample, P of the uniform series shown in Figure 3–1 could be determined by any of thefollowing methods: Use the P F factor to find the present worth of each disbursement at year 0 and add them. Use the F P factor to find the future worth of each disbursement in year 13, add them, andthen find the present worth of the total, using P F(P F,i,13). Use the F A factor to find the future amount F A(F A,i,10), and then compute the presentworth, using P F(P F,i,13). Use the P A factor to compute the “present worth” P3 A(P A,i,10) (which will be locatedin year 3, not year 0), and then find the present worth in year 0 by using the (P F,i,3) factor.MARRFilter 1 ROR 25%Filter 2 ROR 23%MARRBreakeven ROR 17%EXAMPLE 13.8BreakevenChris and her father just purchasedsmall office building for 160,000 that is in need of a lotIncrementala ROR17%of repairs, but is located in a prime commercial area of the city. The estimated costs each yearfor repairs, insurance, etc. are 18,000 the first year, increasing by 1000 per year thereafter.At an 8–6expected 8% per year return, use spreadsheet analysis to determine the payback periodFigureif versusthe buildingis (a)forincremental2 years andsold for 290,000PWi graph andPWkeptversusi graph,Example8.4. sometime beyond year 2 or (b) keptfor 3 years and sold for 370,000 sometime beyond 3 years.SPREADSHEETSSolution12/11/10 6:52 PMFigure 13–11 shows the annual costs (column B) and the sales prices if the building is kept 2or 3 years (columns C and E, respectively). The NPV function is applied (columns D and F) todetermine when the PW changes sign from plus to minus. These results bracket the paybackperiod for each retentionperiod 7–12and sales price. When PW 0, the 8% return is exceeded.FigureSpreadsheetof 4ROICGoalSeek, isExample7.6.(a) The 8% return paybackperiod isapplicationbetween 3 andyears method(column usingD). If thebuildingsoldafter exactly 3 years for 290,000, the payback period was not exceeded; but after 4 yearsit is exceeded.(b) At a sales price of 370,000, the 8% return payback period is between 5 and 6 years (column F). If the building is sold after 4 or 5 years, the payback is not exceeded; however, asale after 6 years is beyond the 8%-return payback period.bla76302 ch07 172-201.indd 18912/11/10 4:32 PMIf kept 2 years andsold, payback isbetween 3 and 4If kept 3 years andsold, payback isbetween 5 and 6 NPV(8%, B 4:B7) B 3 PV(8%,A7,,290000)The text integrates spreadsheets to showhow easy they are to use in solving

Seventh EditionSeventh Edition bla76302_fm_i-xx.indd i 1/14/11 8:28 PM. bla76302_fm_i-xx.indd ii 1/14/11 8:28 PM. . Library of Congress Cataloging-in-Publication Data Blank, Leland T. Engineering economy / Leland Blank, Anthony Tarquin. — 7th ed. . 7.5 Techniques to Remove Multiple Rates of Return 184 7.6 Rate of Return of a Bond .