Transcription

www.pwc.comLeases2016

This publication has been prepared for general informational purposes, and does not constituteprofessional advice on facts and circumstances specific to any person or entity. You should not act uponthe information contained in this publication without obtaining specific professional advice. Norepresentation or warranty (express or implied) is given as to the accuracy or completeness of theinformation contained in this publication. The information contained in this publication was not intended orwritten to be used, and cannot be used, for purposes of avoiding penalties or sanctions imposed by anygovernment or other regulatory body. PricewaterhouseCoopers LLP, its members, employees, and agentsshall not be responsible for any loss sustained by any person or entity that relies on the informationcontained in this publication. The content of this publication is based on information available as of March31, 2016. Accordingly, certain aspects of this publication may be superseded as new guidance orinterpretations emerge. Financial statement preparers and other users of this publication are thereforecautioned to stay abreast of and carefully evaluate subsequent authoritative and interpretative guidance.Portions of various FASB documents included in this work are copyrighted by the Financial AccountingFoundation, 401 Merritt 7, Norwalk, CT 06856, and are reproduced with permission.

PwC guide libraryOther titles in the PwC accounting and financial reporting guide series:Bankruptcies and liquidations (2014)Business combinations and noncontrolling interests, global edition (2014),second editionConsolidation and equity method of accounting (2015)Derivative instruments and hedging activities (2013), second editionFair value measurements, global edition (2015)Financial statement presentation (2014), second editionFinancing transactions: debt, equity and the instruments in between (2014),second editionForeign currency (2014)IFRS and US GAAP: similarities and differences (2015)Income taxes (2013), second editionRevenue from contracts with customers, global edition (2014)Stock-based compensation (2013), second editionTransfers and servicing of financial assets (2013)Utilities and power companies (2013)Variable interest entities (2013), second editionPwCi

AcknowledgmentsThe Leases guide represents the efforts and ideas of many individuals within PwC.The following PwC people contributed to the contents or served as technical reviewersof this publication:Takashi AnrakuJohn BishopRoberta ChmielnikJustin FrenzelAshima JainMarc JerusalemNora JoyceRalph MartinoChuck MelkoLauren MurphyBrian NessJeff NormantJonathan RhineChad SoaresBill StaffieriSuzanne StephaniValerie WiemaniiPwC

PrefacePwC is pleased to offer the first edition of our Leases guide. In February 2016, theFASB issued its standard on leases, ASC 842, which will replace today’s leasesguidance in 2019.The chapters in this guide discuss both lessee and lessor accounting by topic. Forexample, LG 3 discusses lease classification for both lessees and lessors. The first fourchapters provide an introduction and guidance on determining whether anarrangement is (or contains) a lease and how to classify and account for lease andnonlease components. This guide also discusses the modification, remeasurement,and termination of a lease, sale and leaseback transactions, leveraged leasetransactions, as well as other topics. Finally, this guide contains chapters on thepresentation and disclosure requirements, as well as the effective date and transition.Locating guidance on particular topicsGuidance on particular topics can be located as follows:Table of contents—The table of contents provides a detailed listing of the varioussections in each chapter. The titles of each section are intentionally descriptive toenable users to easily find a particular topic.Table of questions—The table of questions includes a listing of questions and PwCresponses in numerical order, by chapter.Table of examples—The table of examples includes a listing of examples innumerical order, by chapter.The guide also includes a detailed index of key topics.References to US GAAPDefinitions, full paragraphs, and excerpts from the Financial Accounting StandardsBoard’s Accounting Standards Codification are clearly designated, either withinquotes in the regular text or enclosed within a shaded box. In some instances,guidance was cited with minor editorial modification to flow in the context of the PwCGuide. The remaining text is PwC’s original content.References to other chapters and sections in this guideWhere relevant, the discussion includes general and specific references to otherchapters of the guide that provide additional information. References to anotherchapter or particular section within a chapter are indicated by the abbreviation “LG”followed by the specific section number (e.g., LG 2.3.2 refers to section 2.3.2 inchapter 2 of this guide).PwCiii

PrefaceReferences to other PwC guidanceThis guide focuses on the accounting and financial reporting considerations for leases.It supplements information provided by the authoritative accounting literature andother PwC guidance. This guide provides general and specific references to chapters inother PwC guides to assist users in finding other relevant information. References toother guides are indicated by the applicable guide abbreviation followed by thespecific section number. The other PwC guides referred to in this guide, includingtheir abbreviations are:Business combinations and noncontrolling interests (BCG)Derivative instruments and hedging activities (DH)Fair value measurements (FV)Financial statement presentation (FSP)Financing transactions: debt, equity and the instruments in between (FG)Income taxes (TX)Stock-based compensation (SC)Transfers and servicing of financial assets (TS)Variable interest entities (VE)All references to the guides are to the latest editions noted in the PwC guide library. Inaddition, PwC’s Accounting and reporting manual (the ARM) provides informationabout various accounting matters in US GAAP.Copies of the other PwC guides may be obtained through CFOdirect, PwC’scomprehensive online resource for financial executives (www.cfodirect.com), asubscription to Inform, PwC’s online accounting and financial reporting reference tool(www.pwcinform.com), or by contacting a PwC representative.Guidance dateAs the environment continues to change, so will the content in this guide. This guideconsiders existing guidance as of March 31, 2016. Future editions will be released tokeep pace with significant developments.Certain events, such as the issuance of a new pronouncement by the FASB, aconsensus (and ensuing endorsement by the FASB) of the Emerging Issues TaskForce, or new SEC rules or guidance, may necessitate an update or supplement to theguide. Updates or supplements that may be in the form of other PwC communicationscan be found on CFOdirect (www.cfodirect.com) or Inform (www.pwcinform.com).ivPwC

PrefaceOther informationThe appendices to this guide include guidance on professional literature, a listing oftechnical references and abbreviations, and definitions of key terms.*****This guide has been prepared to support you in applying the leases accountingguidance. It should be used in combination with a thorough analysis of the relevantfacts and circumstances, review of the authoritative accounting literature, andappropriate professional and technical advice.We hope you find the information and insights in this guide useful. We will continueto share with you additional perspectives and interpretations as they develop.Paul KeppleUS Chief Accountant2016PwCv

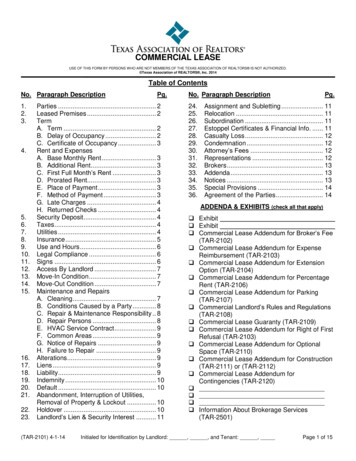

Table of contentsChapter 1: Introduction1.1Background .1-21.2High-level overview .1-41.2.1Definition and scope .1-51.2.2Lessee classification .1-61.2.3Lessor classification .1-61.3Comparison of ASC 842 and ASC 840 .1-61.4Disclosures.1-111.5Transition and effective date .1-111.6Implementation guidance .1-12Chapter 2: Scope2.1Chapter overview .2-22.2Exceptions to applying lease accounting .2-22.2.1Short-term lease exception for lessees .2-32.3Definition of a lease .2-32.3.1Use of an identified asset .2-52.3.1.1Explicitly identified asset.2-52.3.1.2Implicitly identified asset .2-52.3.1.3Physically distinct .2-62.3.1.4Substantive substitution rights .2-72.3.2Right to control the use of an identified asset over theperiod of use .2-112.3.2.1The right to obtain substantially all of the economic benefits .2-122.3.2.2Right to direct the use of the identified asset .2-142.3.2.3Examples – the right to control the use of an identified asset .2-182.4Separating lease and nonlease components .2-212.4.1Identifying lease and nonlease components .2-222.4.2Lessor allocation of consideration to lease andnonlease components .2-23Lessee allocation of consideration to lease andnonlease components .2-242.4.3.1Practical expedient for lessees .2-252.4.4Allocation of variable consideration .2-252.4.4.1Allocating variable consideration for lessors .2-252.4.3viPwC

Table of contents2.4.4.2Allocating variable consideration for lessees .2-332.5Components within a lease .2-342.5.1Portfolio exception .2-362.5.2Reallocation of consideration .2-362.6Reassessment of whether a contract contains a lease .2-37Chapter 3: Lease classification3.1Chapter overview .3-23.2Overview of lease classification .3-23.2.1Lease commencement .3-53.2.2Lease components .3-63.3Lease classification criteria .3-63.3.1Transfer of ownership .3-93.3.2Option to purchase the underlying asset is reasonablycertain of exercise .3-103.3.2.1Purchase option prices .3-103.3.3Lease term is for the major part of the remainingeconomic life of the asset.3-103.3.3.1Determining the term of the lease .3-113.3.3.2Determining the estimated economic life .3-133.3.3.3Determining the estimated economic life of a lease componentwith multiple underlying assets .3-15Present value of the lease payments amounts tosubstantially all of the fair value of the underlying asset .3-153.3.4.1Fixed lease payments .3-173.3.4.2Lease incentives .3-183.3.4.3Variable lease payments .3-193.3.4.4Residual value guarantees .3-243.3.4.5Fair value of the underlying asset .3-263.3.4.6Discount rate.3-283.3.4.7Collectibility (lessors) .3-293.3.5Underlying asset is of a specialized nature .3-313.4Application of the “reasonably certain” threshold .3-313.5Lessee classification examples.3-323.5.1Finance leases .3-333.5.2Operating lease .3-373.6Lessor classification examples.3-443.6.1Sales-type lease .3-443.3.4PwCvii

Table of contents3.6.2Operating lease .3-49Chapter 4: Accounting for leasesviii4.1Chapter overview .4-24.2Initial recognition and measurement – lessee .4-24.2.1Measuring the lease liability .4-24.2.2Measuring the right-of-use asset .4-34.2.2.1Payments made at or before the commencement date, less leaseincentives received.4-34.2.2.2Initial direct costs .4-34.2.2.3Examples – measuring the right-of-use asset .4-44.3Initial recognition and measurement – lessor .4-154.3.1Sales-type lease .4-154.3.1.1Selling profit / selling loss .4-164.3.1.2Initial direct costs .4-174.3.1.3When collectibility is not probable at the commencement datefor a sales-type lease .4-174.3.1.4Examples – lessor accounting for sales-type leases.4-194.3.2Direct financing lease .4-244.3.2.1Initial measurement of net investment in the lease .4-244.3.3Operating lease .4-254.3.3.1When collectibility is not probable at the commencement datefor an operating lease .4-254.3.3.2Examples – lessor accounting for operating leases .4-264.4Subsequent recognition and measurement – lessee .4-274.4.1Finance leases . 4-284.4.1.1Finance lease with a purchase option .4-294.4.2Operating leases .4-314.5Subsequent recognition and measurement – lessor .4-334.5.1Lessor sales-type leases and direct financing lease .4-344.5.2Lessor operating leases .4-354.6Impairment – lessee .4-374.6.1Finance leases .4-374.6.2Operating lease .4-374.7Impairment – lessor . 4-384.7.1Sales-type and direct financing leases . 4-384.7.2Operating leases . 4-38PwC

Table of contentsChapter 5: Modification, remeasurement, and termination of a lease5.1Chapter overview .5-25.2Accounting for a lease modification – lessee .5-25.2.1Lessee accounting for a lease modification .5-35.2.1.1Separate new lease .5-35.2.1.2Modified lease .5-55.3Accounting for lease remeasurement – lessee .5-55.3.1Lease remeasurement for a change in lease paymentsor the probability of exercising an option .5-75.3.2Remeasurement of lease liability.5-95.3.3Right-of-use asset adjustment .5-105.3.4Lease expense subsequent to remeasurement .5-105.3.4.1Finance lease upon remeasurement.5-105.3.4.2Operating lease upon remeasurement .5-105.3.5Illustrative examples of lease remeasurement .5-115.4Lessee reassessment of short-term lease exception .5-245.5Accounting for a lease termination – lessee.5-255.5.1Accounting for a partial lease termination .5-255.5.2Purchase of a leased asset during the lease term .5-265.6Accounting for a lease modification – lessor .5-265.6.1Separate new lease .5-275.6.2Modified lease .5-275.6.2.1Direct financing lease prior to the modification .5-275.6.2.2Operating lease prior to the modification .5-345.6.2.3Sales-type lease prior to the modification .5-395.7Accounting for a lease termination – lessor . 5-40Chapter 6: Sale and leaseback transactions6.1Chapter overview .6-26.2Sale and leaseback transactions .6-26.2.1Sale and leaseback-sublease transactions.6-36.3Determining whether a sale has occurred .6-36.3.1Existence of a contract .6-36.3.2Indicators that control of an asset has been obtained .6-46.3.2.1Seller-lessee has a present right to payment (or buyer-lessorhas a present obligation to make payment) .6-5Buyer-lessor has legal title.6-56.3.2.2PwCix

Table of contents6.3.2.3Buyer-lessor has physical possession .6-56.3.2.4Buyer-lessor has the significant risks and rewards of ownership .6-56.3.2.5Buyer-lessor has accepted the asset .6-66.3.2.6Impact of a prospective lessee obtaining control of an underlyingasset prior to lease commencement .6-66.3.3Lessee involvement in construction of leased asset .6-76.3.3.1Construction costs incurred by a lessee .6-116.3.4Impact of lease classification on qualification as a sale .6-116.3.5Repurchase rights and obligations in a sale andleaseback transaction .6-12Seller-lessee has a repurchase option or the transaction is subjectto a forward .6-126.3.5.2Buyer-lessor has a put option .6-136.4When the transaction qualifies as a sale .6-146.4.1Accounting by the seller-lessee .6-156.4.2Accounting by the buyer-lessor .6-166.4.3Costs in a sale and leaseback transaction .6-166.4.4Accounting for sale and leaseback transactions enteredinto at off-market terms .6-176.4.4.1Seller-lessee accounting for a transaction with off-market terms .6-186.4.4.2Buyer-lessor accounting for a transaction with off-market terms .6-216.5Transaction is not accounted for as a sale (failed saleand leaseback).6-22Accounting for a failed sale and leaseback by aseller-lessee.6-236.5.1.1Allocation of the leaseback payments by a seller-lessee .6-236.5.1.2Accounting by a seller-lessee when the buyer-lessor obtainscontrol of the asset after lease commencement .6-24Accounting by the seller-lessee when the leaseback is for aportion of the asset .6-29Accounting for a failed sale and leaseback by abuyer-lessor .6-31Accounting by the buyer-lessor when it obtains control ofthe asset .6-316.3.5.16.5.16.5.1.36.5.26.5.2.1Chapter 7: Leveraged leasesx7.1Chapter overview .7-27.2Definition and characteristics of a leveraged lease .7-27.2.1Classification criteria for leveraged leases.7-27.2.2Economic rationale for leveraged leases.7-3PwC

Table of contents7.2.3Financial statement presentation of leveraged leasesand income recognition .7-37.3Changes to a leveraged lease arrangement .7-47.3.1Changes to the fundamental characteristics of aleveraged lease .7-47.3.1.1Requirement for a long-term creditor.7-57.3.1.2Requirement for substantial leverage .7-57.3.1.3Requirement for nonrecourse debt .7-57.3.2Modifications to a leveraged lease .7-67.3.2.1Replacing the lessee .7-67.3.2.2Discontinuing the use of leveraged lease accounting .7-67.3.3Changes in the underlying assumptions .7-77.4Leveraged leases acquired in a business combination .7-8Chapter 8: Other topics8.1Chapter overview .8-28.2Subleases .8-28.2.1Accounting by the intermediate lessor .8-38.2.1.1Accounting for the arrangement when the intermediate lessoris not relieved of its primary obligation under the head lease.8-3Intermediate lessor is relieved of its primary obligation underthe head lease.8-58.2.2Accounting by the head lessor .8-58.3Sale of leased assets .8-68.4Sale of lease receivables and residual assets .8-68.4.1Accounting for the sale of a lease receivable .8-68.4.2Accounting for the sale of an unguaranteed residualasset in a direct financing or a sales-type lease .8-7Accounting for the purchase of an interest in theresidual value of a leased asset .8-78.4.3.1Purchase of an unguaranteed residual asset .8-78.4.3.2Purchase of guaranteed residual asset .8-88.5Sales of equipment with guaranteed minimum resaleamount .8-8Sales of equipment with guaranteed minimum resaleamount accounted for as an operating lease .8-9Evaluating a guaranteed minimum resale agreement todetermine whether it contains an embedded derivative .8-108.6Business combinations .8-108.6.1Acquiree in a business combination is a lessee .8-118.2.1.28.4.38.5.18.5.2PwCxi

Table of contents8.6.2Acquiree in a business combination is a lessor .8-11Chapter 9: Presentation and disclosure9.1Chapter overview .9-29.2Lessees .9-29.2.1Balance sheet presentation .9-29.2.1.1Right-of-use asset .9-29.2.1.2Lease liability .9-39.2.2Statement of comprehensive income .9-39.2.2.1Finance lease .9-39.2.2.2Operating lease .9-39.2.3Statement of cash flows .9-49.2.3.1Finance lease .9-49.2.3.2Operating lease .9-49.2.4Qualitative disclosure .9-49.2.5Quantitative disclosure .9-59.3Lessors .9-79.3.1Balance sheet presentation .9-79.3.1.1Sales-type and direct financing leases .9-79.3.1.2Operating lease .9-79.3.2Statement of comprehensive income .9-79.3.2.1Sales-type and direct financing leases .9-89.3.2.2Operating lease .9-89.3.2.3Subleases .9-89.3.3Statement of cash flows .9-89.3.4Disclosure .9-89.3.4.1Sales-type and direct financing leases .9-99.3.4.2Operating leases.9-109.4Sale and leaseback transactions .9-119.5Leveraged leases .9-119.6Related party leases.9-119.7Transition disclosures .9-11Chapter 10: Effective date and transitionxii10.1Chapter overview .10-210.2Effective date .10-210.3Transition .10-3PwC

Table of contents10.3.1Lessee transition .10-310.3.1.1Operating leases.10-310.3.1.2Capital leases .10-410.3.1.3Build-to-suit leases .10-510.3.2Lessor transition .10-510.3.2.1Operating leases.10-510.3.2.2Finance leases .10-610.3.2.3Leveraged leases .10-610.3.3Practical expedients .

This guide focuses on the accounting and financial reporting considerations for leases. It supplements information provided by the authoritative accounting literature and other PwC guidance. This guide provides general and specific references to chapters in other PwC guides to assist users in finding other relevant information. References to