Transcription

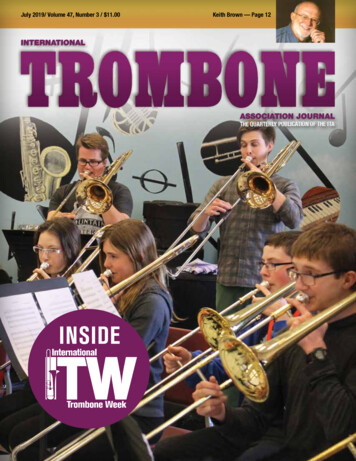

Never Too Young: PersonalFinance for Young LearnersAfter School Program for Elementary School Studentsin Personal Finance and Economics

AuthorsJudy AustinEconomic Education ConsultantCenter for Economic Education & EntrepreneurshipUniversity of DelawareCindy FitzthumSocial Studies TeacherPrinceton High SchoolPrinceton, MNThis material was made possible through funding by the ING DIRECT Kids Foundation.2

The Council for Economic Education expresses its thanks to the many individuals who were involvedwith this project.AcknowledgmentsCouncil for Economic EducationRosanna CastilloManager, Program AdministrationChris CaltabianoVice President, Domestic ProgramsING DIRECTCathy MacFarlaneformer Head of Corporate RelationsBrian MyresHead of SalesBonnie MeszarosAssistant Professor of EconomicsAssociate DirectorCenter for Economic Educationand EntrepreneurshipUniversity of DelawareBoy Scouts of AmericaCentral Minnesota CouncilJane HolmbergScoutReach CoordinatorMohamed MoalimProgram AideDavid TreheyScout ExecutiveKen RebeckAssociate Professor of EconomicsDirector, Center for Economic EducationSt. Cloud State UniversityField Test SitesBel Clare Community CenterSt. Cloud, MNEast Side Boys and Girls ClubSt. Cloud, MNLa Cruz Community CenterSt. Cloud, MNMinistry of Caring’s Homeless ShelterWilmington, DERoosevelt Boys and Girls ClubSt. Cloud, MNSouthside Boys and Girls ClubSt. Cloud, MNStubbs Elementary SchoolWilmington, DEBoy Scouts of AmericaDEL‐MAR‐VA CouncilAtiya ChaseCub Scout Program SpecialistWill NielsenCub Scout Program SpecialistCindy OlsavskyField DirectorDenise PerezScoutReach Coordinator3

IntroductionThe Council for Economic Education (CEE) is the leading organization in the United States thatfocuses on the economic and financial education of students from kindergarten through highschool. For the past 60 years, our mission has been to instill in young people the fourth “R”—areal‐world understanding of economics and personal finance. CEE delivers its core mission ofteaching K–12 students through professional development of teachers, providing educatorswith instruction in content and pedagogy, and developing engaging content in personal financeand economics. The K–5 after‐school program, Never Too Young: Personal Finance for YoungLearners, is a critical program through which CEE delivers this mission.Never Too Young: Personal Finance for Young Learners was developed in response to agrowing interest in teaching students about personal finance through settings outside of thetraditional school day. While there is no lack of material for teaching personal finance, there arefew approaches that take into account the particular features of an after‐school setting—forexample, the broader range in age and ability of students participating in an after‐school group;that the group may meet in a location that is not set up like a standard classroom; moresporadic participant attendance; and, perhaps most importantly, a lack of trained educatorsprepared to teach personal finance in this setting. This program responds to these gaps.The program teaches young students about financial choices, cost‐benefit analysis forpurchases, the role of an entrepreneur, and the economics and finances of their individualcommunities—all with a goal of helping children understand that saving is a good thing for us asindividuals and as a nation. The program has two distinctive features that align with CEE’sdelivery strategy of providing both content and pedagogy: a 12‐lesson manual and a trainingcomponent for service providers.The lessons in the manual focus on topics including scarcity, choice, opportunity cost, decisionmaking, saving, spending, earning income, budgeting, taxes, and entrepreneurship. They aredrawn from a range of sources, including CEE’s financial education series Financial Fitness forLife. All lessons have been modified from their original sources to better align to an after‐schoolsetting. All lessons are hands‐on, keeping the students actively engaged with the content. Onekey feature is ECONObucks, which reward students for participating, being good citizens andcorrectly answering questions. During the lessons and at the conclusion of the program,students are provided with the opportunity to redeem their ECONObucks for prizes.ECONObucks both increase student participation and teach important money skills.The program is designed to be taught by after‐school service providers, with support fromcontent experts. The service providers are connected to seasoned economic educators, whotrain providers on both the content and delivery, and then provide follow‐up support duringinitial implementation to ensure that service providers are comfortable with teaching thelessons.4

Table of ContentsAcknowledgements . 3Introduction . 4Lesson Features . 6ECONObucks . 7Lessons. 9Lesson 1 We Have Wants . 9Lesson 2 Scarcity . 23Lesson 3 Choices, Costs and Benefits . 30Lesson 4 Consumers, Producers and Resources . 36Lesson 5 Entrepreneurs in the Community and Advertising. 47Lesson 6 Entrepreneurship and Problem‐Solving . 62Lesson 7 Entrepreneurship and Market Day . 76Lesson 8 Budgeting . 86Lesson 9 Saving Your Money . 96Lesson 10 Government‐Provided Goods and Services . 104Lesson 11 Market Day—Implementation . 112Lesson 12Market Day—Wrap‐up . 117Word Wall Cards . 122Children’s Literature . 1335

Lesson Features Question of the Day—Each lesson has a question of the day. Each question sets the focusfor a lesson. Questions of the day are introduced in Procedure Step 1 of each lesson; olderstudents are asked to answer the question of the day as a lesson assessment. Word Wall Cards—Vocabulary is a critical part of learning economics and personalfinance. Each lesson introduces three to four concepts. Word Wall Cards are included foreach new vocabulary word. If space is available, these cards can be displayed on a WordWall for the duration of the 12 lessons. Assessments—Each lesson has a short assessment. Because these materials will be usedby a range of students in kindergarten through Grade 5, two assessments are offered—one for younger students and one for older students. Preparation—All 12 lessons require materials preparation. The Materials section lays outspecific instructions on what is needed. A starburst to the left of the lesson title signalsthat additional preparation is required beyond the recommended 30 minutes prep timeper lesson. Market Day—Lesson 11 is the Market Day, in which students sell goods and services theyhave produced to adults, family members, and one another. Preparation is requiredbefore running the Market Day. Some lessons have an additional lesson component at theend called Market Day Preparation. This section lays out for instructors what needs to bedone at various points during the 12 weeks to be ready for Market Day. In addition, anyhandouts related to Market Day are identified with a black border. These include suchthings as a parent letter, a Market Day timeline, and list of business ideas. Age Levels—Lessons are designed for use with students in Grades K–5. To address thisrange of grades, hands‐on activities are included throughout the lessons. These activitieswere carefully selected for this purpose, and where appropriate, suggestions are given onhow to adapt them for use with students of different ages. Lesson Order—Lessons 1–4 focus on economic concepts with particular attention towants, scarcity, and choice. Lessons 5–7 teach about entrepreneurship and includepreparation for Market Day. Personal finance content is taught in Lessons 8–10. The lasttwo lessons focus on setting up and running Market Day, determining if businesses madea profit, and completing reflections on the experience.6

ECONObucksECONObucks are used as incentives throughout the 12 lessons in Never Too Young:Personal Finance for Young Learners to increase participation and motivation. Studentsare rewarded with ECONObucks in a variety of ways for participating, being good citizens,completing work, and answering questions. Students can redeem their ECONObucks forprizes during lessons and at the conclusion of Market Day.Getting Started Start by duplicating multiple sheets of ECONObucks on green paper, if possible, andcutting apart the bills. (See the following page.)Make sure to give each student an envelope, or have the students create wallets forstoring their ECONObucks. Collect the envelopes or wallets at the conclusion of eachlesson to eliminate the chance that students will lose their money.Using ECONObucks To use as an incentive program, simply give ECONObucks to students who areparticipating in activities, being model citizens, correctly answering questions, etc.Students use ECONObucks earned as producers to purchase materials to makeproducts to sell and as consumers to purchase goods and services at Market Day.For students to spend their ECONObucks, set up a table of small toys, candy, pencils,or stickers, and price each item in ECONObucks. Before allowing students to shop,remind them that they will be able to purchase additional items after Market Day.Let students choose if they want to spend their money now or save it. This would bea great time to review opportunity cost. Sales held during the Lessons 1‐10 areoptional. The final sale in Lesson 12 is a critical part of the program.At the end of all 12 lessons, have a final sale giving the students one last opportunityto spend their ECONObucks. An alternative is to conduct an auction usingECONObucks. Prior to bidding, have students count the number of ECONObucksthey have. Another approach is to have students write their names on theECONObucks at the conclusion of the program. Place envelopes by various prizes.Have students place their ECONObucks in the envelopes of prizes they would like towin. Draw an ECONObuck from each envelope and announce the winner.Use ECONObucks to teach simple banking skills. For instance, give students bankingregisters and teach them to track their income and expenses through the lessons.Implement a savings program (with the teacher acting as the bank) and rewardstudents with “interest” for saving.Create new sheets of ECONObucks using different denominations to teach additionalmoney skills.7

8

Lesson 1 – We Have WantsQuestion of the Day: Why do we have to make When shopping at a store, a student may say “I want this” to an adult.However, students may also want lots of other items, too! Students willidentify wants and how they can prioritize their wants to gain the mostsatisfaction. Wants Choice EconomicsStudents will be able to: Identify what a want is. Explain why they have to make choices. Explain why it is necessary to prioritize their wants.60 minutes Visual 1.1 (Question of the Day) – one copy for instructor Visual 1.2 (Song) – one copy per two students Handout 1.1 (Nicholas Has Many Wants) – one copy for instructor Word Wall Cards – wants, choice, economics Colored pencils, crayons, or markers Whiteboard or chalkboard Blank paper – one sheet per student Pencils – one per student1. Display Visual 1.1 (Question of the Day) to the class. Read the questionand tell students that this lesson will help them answer the question.2. Ask students why they can’t have everything they want. (Answers mayvary.)3. Write “Wants” on the board.4. Draw a circle around it and include room to write students’ responsesaround the word.5. Tell students that a want is something desired or wished for like anew bike, a vacation, or a pet. Display the “wants” Word Wall Card.6. Brainstorm five wants and write them on the board as a class.9

7. Distribute a blank piece of paper to each student. Have them fold thepaper into four sections. Have them draw four pictures of wants theycurrently have, one in each box. Ask students to put their names on theback of their papers.8. Discuss the following:a. Can you have all of your wants? (Many will say no.)b. Why not? (Parents won’t buy them, or they do not have enough timeor money.)c. Because you can’t have everything you want, what do you have todo? (Make a choice.)9. Tell students that making a choice means making a decision whenfaced with two or more possibilities. Display the “choice” Word WallCard.10. Explain that because they can’t have everything they want, they mustmake a choice. To help them make a choice they need to prioritize orrank their wants.11. Tell the students that they are going to rank or prioritize their fourwants. Give the students a few minutes to rank their wants 1–4 byplacing a “1” next to the picture of the want they would most like tohave and a “4” next to the item they would want the least.12. Tell the students you are now going to read them a story about savingfor a want. Tell students that saving means setting money aside forfuture use.13. Read Handout 1.1 (Nicholas Has Many Wants).Discuss the following:a. What were some of Nicholas’s wants in the story? (a candy bar,goldfish, a hamster)b. Why was Nicholas sorry he had bought the candy bar? (He ate it,and then it was gone and he was out of money.)c. Why did Dad say Nicholas had to make a decision? (He had lots ofwants, but not a lot of money.)d. What spending choice must Nicholas make? (He must decide if hewants to buy a hamster or a goldfish.)e. Have any of you had to make a decision like Nicholas? (Answersmay vary.)f. What could Nicholas do to save money to achieve his goal of buyinga pet? (Save his allowance; open a lemonade stand.)10

14. Tell the students to look at their want pictures. Explain to them thatover the next few weeks they are going to start learning aboutsomething called economics. Display the “economics” Word WallCard. Tell students that economics is a study of how people satisfytheir wants through choices they make.Closure1. Discuss the following:a. Why do we have to make choices among our wants? (because wecan’t have everything we want)b. Why can’t you have all of your wants? (not enough time, not enoughmoney)c. How do you make a choice among your wants? (Answers may vary.)d. Why is it important to rank your wants? (because it helps you makean informed decision on what you want the most)e. What is economics? (learning how people satisfy their wantsthrough choices they make)2. Display Visual 1.2 (Song) or hand out copies to students.3. Explain to the students that they will be singing a song called “I’ve GotMoney” to the tune of “Are You Sleeping, Brother John.”4. Sing the song and discuss the following:a. What were the wants in the song? (Save to get something later,something big; spend to get something now, something small; or dosome of both.)b. Why was it necessary to make a choice on what to do with themoney? (not enough money to spend and saving all of it)c. Would you spend, save, or do some of both? (Answers will vary.)Assessment1. Older students – Have students write an answer to the Question of theDay.2. Younger students – Read the following story:Nicholas’s sister Anna has one dollar. She goes to the toy store andsees two things she wants to buy. Both cost one dollar each.Then, ask students the following:a. Can Anna have both items? (no)b. Why not? (She does not have enough money.)c. What does Anna have to do? (Make a choice.)d. How can Anna make a good choice? (Rank her wants.)Sources Financial Fitness for Life: Student Storybook K–2, Council forEconomic Education, 2010Financial Fitness for Life: Teacher Guide K–2, Council for EconomicEducation, 201011

Visual 1.112

Visual 1.2 – SongI’ve Got Money LyricsThe following is a song about decisions concerning spending and saving.Tune: Are You Sleeping, Brother JohnI’ve got Money,I’ve got Money,What should I do?What should I do?I must make a choice,I must make a choice,Spend or save,Spend or save.I’ve got Money,I’ve got Money,I could spend,I could spend,Getting something now,Getting something now,Something small,Something small.13

Visual 1.2 (cont.) – SongI’ve got Money,I’ve got Money,I could save,I could save,Getting something later,Getting something later,Something big,Something big.I’ve got Money,I’ve got Money,What should I do?What should I do?Spend a little now,Spend a little now,Save some, too!Save some, too!14

56FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education15

Story 8Nicholas Has Many WantsMom, Dad, Christopher and Nicholas were sitting at the dinner tabletalking about the day and what everyone had done. Nicholas toldDad about going to the grocery store with Mom and Christopher.He mentioned that he had bought a candy bar with some of his birthday money,and he had eaten the candy on the way home.Dad asked, “Well, have you decided what to do with the rest of your money?”Nicholas shook his head. “No, I haven’t,” he said. “I’ve been dreaming about allthe things I want to buy. I want to go to the school carnival. I want to see the newmovie at the theater. I would like to buy some new baseball cards for my collection,but I think I really, really want a hamster.”“Sounds to me like you have a problem, son,” Dad said. “You have a lot ofwants but not a lot of money. You satisfied one of your wants when you bought thatcandy bar, but now you have even more wants.”FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education1657

58FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education17

“Yes, I really wanted that candy bar this morning,” Nicholas said. “But now I’msorry I bought it, because it’s gone, and so is the money!”“And now you want a lot of things,” Dad said. “You want to go places and dothings, you want baseball cards, and you want a hamster. You are really going tohave to make some choices.”Christopher interrupted, “Oh boy! We're going to get a hamster! Yea! Yea!”“Now wait a minute, Christopher,” Nicholas said. “This isn’t your money, and itisn’t your decision. I haven’t made up my mind yet.”Dad asked, “What makes you want a hamster so much? You’ve been talkingabout this for quite a while.”“Brian has a hamster, and he’s always telling me how much fun it is to play withScamper,” said Nicholas.“Is that why you want a hamster—because Brian has one? Do you know anythingabout hamsters?” Dad asked.FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education1859

60FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education19

“Well, I know that Scamper eats out of Brian’s hand,” Nicholas said. “And heplays in his cage, and he has an exercise ball that he runs around in. Brian says thewhole family laughs at him and enjoys watching him. Scamper even stores food inhis cheeks kind of like Christopher does. Only Scamper’s a lot cuter!” Nicholaschuckled as he looked at Christopher, and Christopher scowled back at him.Dad replied, “Nicholas, don’t tease your brother. I know you want a hamster, butbefore you make a decision you need to think about all the things a hamster needs.You will have to take care of the hamster and feed it. You said Scamper has a cageand an exercise ball. What else does a hamster need to have? You should find outmore about hamsters before you make a decision.”Nicholas looked at Mom. “Will you take me to the pet store some time,” heasked, “so I can find out more about hamsters?”“Sure,” Mom said. “Maybe we could go tomorrow afternoon.”FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education2061

The next day as Mom and the boys approached the pet store, Christopher exclaimed, “Oh, look at the picture of the pretty fish. What kind is it? What does thesign say?”“It says S-A-L-E, and that spells sale,” Mom answered, pointing to the letters.“The sign says that goldfish are on sale for a special price. And if you buy one, youget one free.”“You know, Mom, goldfish might be fun,” Nicholas said. “And they wouldn’tcost very much either. Maybe that’s what I’ll get!”“But Nicholas,” Mom said as they entered the store, “you told us last night thatyou wanted a hamster. Now this afternoon you want goldfish. You don’t haveenough money to buy a hamster and goldfish. Are you sure you’re ready to make adecision?"Just then a sales clerk approached them. “Hello. How can I help you?” he asked.“I came here to find out what a hamster costs," Nicholas replied. He hesitatedand then said, "But now I don’t know whether I want a hamster or goldfish. Makingmoney choices is pretty hard. My wants just keep going on and on, but my moneydoesn’t!”Nicholas knew he had to make a decision.62FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education21

FINANCIAL FITNESS FOR LIFE: Student Storybook Grades K-2 Council for Economic Education2263

Lesson 2 – ScarcityQuestion of the Day: What is nStudents will learn about goods and services and why they can’t have allthe goods and services they want. People experience scarcity of goods andservices throughout their daily lives. Through activities, students will learnthat scarcity requires them to make choices. Goods Services ScarcityStudents will be able to: Define a good as an object that satisfies a person’s wants(something that can be touched). Define a service as an action that satisfies a person’s wants(something someone does for you). Define scarcity as not enough to satisfy everyone’s wants. Give examples of scarcity. Explain why scarcity always requires a person to make a choice.60 minutes Visual 2.1 (Question of the Day) – one for the instructorHandout 2.1 (Wheels) – cut apart, enough copies for four wheels perstudent Handout 2.2 (Not Enough Wheels!) – one copy per student Word Wall Cards – goods, services, scarcity Chalkboard or whiteboard An inexpensive item such as a special pen or candy Glue Music source Chairs – one per student1. Display Visual 2.1 (Question of the Day) to the class. Read the questionand tell students that this lesson will help them answer the question.2. The things we want are called goods and services. Display the “goods”and “services” Word Wall Cards. Draw two columns on the board; labelone column “Goods” and the other “Services.”3. Explain to the students that goods are things that we can touch, such asitems in a classroom. Ask several students to give examples of goods.(food, shoes, books, games, etc.) Write the suggestions in the “Goods”column.23

4. Explain to the students that services are things that someone else doesfor you. Ask several students to name some services. Write thesesuggestions in the Services column. (a mechanic fixing your car, Momcleaning your bedroom, Scout leader given instructions, police officerdirecting traffic, etc.)5. Ask students if they can have everything they want. (no) Tell thestudents that the reason they can’t have everything they want is due toscarcity. Display the “scarcity” Word Wall Card.6. Tell students that scarcity means not enough of something to satisfyeveryone’s wants. Tell students there is never enough time to do all thethings they would like to do or money to buy all the things they wouldlike to have. Because of scarcity, people must constantly make choicesabout what to do or how to use their time or money. Ask students whatchoice means. (having to make a decision between two or morepossibilities)7. Ask the students what kinds of things they can think of that might bescarce. (money to buy ice cream when the truck comes through theneighborhood, school computers for everyone who wants to use one, landfor a new playground, trees to make all of our paper products, time toplay soccer and do homework after school, etc.)8. Explain to the students that sometimes there can be a scarcity ofsomething you don’t think is scarce. Hold up the item you brought(something inexpensive such as a special pen or pencil or a candy bar)that students might like to have. Ask students:a.How many of you would like this item? (Most students will want theitem.)b. What is the problem the class faces? (not enough for everyone whowants one)c. What is this problem called? (scarcity)9. Have students give suggestions about how to decide who should get thescarce item. (Possible answers include lottery, a student with the bestparticipation or behavior, a class leader or role model, an auction usingECONObucks, divide it up, take turns with it, etc.) Write the suggestionson the board. Allow students to vote on the allocation method theythink is best, and use the winning method to determine who will get thescarce good.24

10. Distribute to each student glue, a copy of Handout 2.2 (Not EnoughWheels!) and four wheels from Handout 2.1 (Wheels). Explain that thecircles are wheels. Point out that lots of toys and types of transportationhave wheels.11. Discuss the following:a. What is the total number of wheels that would be needed for all ofthe items pictured in Handout 2.2? (20)b. How many wheels do you have? (4)c. What is scarce? (wheels)12. Tell students that because of scarcity, they will have to make choices.Tell students to choose how they would like to use their wheels andthen glue their wheels into place on the activity sheet. Point out thatthey may choose more than one of an item (for example, two scootersor four unicycles).13. When the students have finished gluing, ask if anyone chose the rollerskate. (no) Why not? (can’t use a single roller skate) If you wanted rollerskates, what could you do to solve this problem? (You and a friend couldboth choose to put wheels on skates and then share the pair.)14. Have students tell how they used their wheels and why. (picked favoriteor most useful; perhaps wanted most items possible so chose bicycle ortricycle and unicycle, or two scooters, or four unicycles) After everyonehas had a turn, ask if everyone made the same choice. (no) Why not?(Individuals have different wants.)15. Play musical chairs. At the end of the game, ask:a. Did everyone get a chair? (no)b. Why not? (because chairs kept disappearing; a scarcity of chairs)c. If there is not enough of something for everyone who wants it, whatdo we call this problem? (scarcity)16. Reward the winner(s) with ECONObucks.Closure1.Discuss the following:a. What are goods? (objects that satisfy a person’s wants; somethingthat can be touched)b. What are services? (an action that satisfies a person’s wants;something someone does for you)c. What is scarcity? (not enough of something to satisfy everyone’swants)d. Name things that are scarce. (time, money, food, etc.)25

Assessment1. Older students – Have students write an answer to the Question of theDay.2. Younger students – Read the following story to the students:A 2nd grade class has three field trips planned. They are planning to goto a theme park, a science museum, and the zoo. One day, the principalannounces there are only enough buses for one trip. The students mustnow choose what trip they want to go on.Then, ask students the following:a. What is scarce? (buses)b. How do you think the class might choose? (Answers will vary.)Source Strategies for Teaching Economics, Primary Level (Grades 1–3), JointCouncil on Economic Education, 197726

Visual 2.127

Handout 2.1 – Wheels28

NameHandout 2.2 – Not Enough Wheels!29

Lesson 3 – Choices, Costs, and BenefitsQuestion of the Day: How do I make the best tudents will learn that life is all about choices. Students will explore howpeople make choices by evaluating the opportunity costs of theirdecisions. Making choices is never‐ending and never easy, but necessarybecause our resources are always limited. You must weigh the pros(benefits) and cons (costs) to make the best possible decisions. Benefits Costs Opportunity CostStudents will be able to: Identify choices people make every day. Define costs as things that are unfavorable to a decision maker. Define opportunity cost as the next best thing given up whensomeone makes a choice. Define benefits as things that are favorable to a decision maker. Analyze costs and benefits when making a choice. Identify the opportunity cost of a choice.60 minutes Visual 3.1 (Question of the Day) – one copy for instructorHandout 3.1 (Benefits and Costs Grid) – one copy per groupHandout 3.2 (Opportunity Cost Scenario Cards) – one copy, cutapart and placed in a container Word Wall Cards – benefits, costs, opportunity cost Pencils – one per student White paper – one sheet per student1. Display Visual 3.1 (Question of the Day) to the class. Read the questionand tell students this lesson will help them answer the question.2. Read the following introduction to the students:Decisions, decisions! Everything in life involves making

with instruction in content and pedagogy, and developing engaging content in personal finance and economics. The K–5 after‐school program, Never Too Young: Personal Finance for Young Learners, is a