Transcription

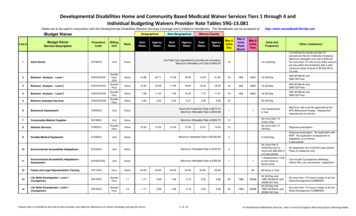

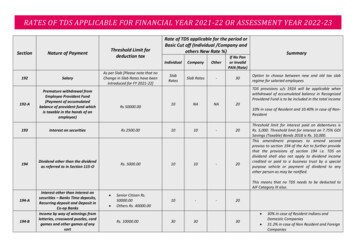

RATES OF TDS APPLICABLE FOR FINANCIAL YEAR 2021-22 OR ASSESSMENT YEAR 2022-23SectionNature of Payment192Salary192-APremature withdrawal fromEmployee Provident Fund(Payment of accumulatedbalance of provident fund whichis taxable in the hands of anemployee)Threshold Limit fordeduction taxAs per Slab [Please note that noChange in Slab Rates have beenintroduced for FY 2021-22]Rate of TDS applicable for the period orBasic Cut off (Individual /Company andothers New Rate %)IndividualCompanyOtherIf No Panor InvalidPAN (Rate)SlabRatesSlab Rates-30SummaryOption to choose between new and old tax slabregime for salaried employeesTDS provisions u/s 192A will be applicable whenwithdrawal of accumulated balance in RecognizedProvidend Fund is to be included in the total incomeRs 50000.0010NANA2010% in case of Resident and 10.40% in case of NonResident193Interest on securitiesRs 2500.001010-20194Dividend other than the dividendas referred to in Section 115-ORs. 5000.001010-20Threshold limit for interest paid on debentures isRs. 5,000. Threshold limit for interest on 7.75% GOISavings (Taxable) Bonds 2018 is Rs. 10,000.This amendment proposes to amend secondproviso to section 194 of the Act to further providethat the provisions of section 194 i.e. TDS ondividend shall also not apply to dividend incomecredited or paid to a business trust by a specialpurpose vehicle or payment of dividend to anyother person as may be notified.This means that no TDS needs to be deducted toAIF Category III also.194-A194-BInterest other than interest onsecurities – Banks Time deposits,Recurring deposit and Deposit inCo-op BanksIncome by way of winnings fromlotteries, crossword puzzles, cardgames and other games of anysort Senior Citizen Rs.50000.00Others Rs. 40000.0010--20 Rs. 10000.00303030 30% in case of Resident Indians andDomestic Companies31.2% in case of Non Resident and ForeignCompanies

194-BBIncome by way of winnings fromhorse racesRs. 10000.00 194-CPayment to Contractors 194-CContract – Transporter notcovered under 44AE194-DInsurance commission194-DAPayment in respect of lifeinsurance policy, the tax shall bededucted on the amount ofincome comprised in insurancepay-out194-EPayment to non-residentsportsmen/ sports association194-EEPayment in respect of depositunder National Savings scheme194-EEPayment on account ofrepurchase of unit by MutualFund or Unit Trust of India194-GCommission on sale of lotterytickets194-HCommission or brokerage Single payment : Rs.30,000Aggregate payment: Rs.100000Single payment : Rs.30,000Aggregate payment: Rs.75000Rs 15000.00Rs. 10000030303012201251020-20 TDS is to be deducted at the rate of 2.0% if thepayee is an AOP or BOI. TDS is not applicable onpayment to Contractor engaged in plying, hiring orleasing of goods carriages, where such contractorowns 10 or less goods carriages during theFinancial Year and furnishes amend definition of“work” to include purchase of raw material fromassociate of the customer. The word Associate shallhave the same relations as stated u/s 40A(2)(b). 10%: If deductee is domestic Company 5%: In any other case55-20Section 194DA is not applicable in case of amountis exempt u/s 10(10D) i.e. the Sum is received at thetime of maturity of policy or Death benefit received.Form 15G/15H can be given wherever applicable.2020-20The rate of TDS shall be increased by applicablesurcharge and Health & Education cess. Rs 2500.0030% in case of Resident Indians andDomestic Companies31.2% in case of Non Resident and ForeignCompanies1010-202020-20Rs 15000.0055-20Rs 15000.0055-20Resident Indians & Domestic Companies –10% Non Resident – 10% Cess Surcharge (IfApplicable)Resident Indians & Domestic Companies – 20%Non Resident – 20% Cess Surcharge (IfApplicable)Threshold Limit of Rs.15,000 on Commission, etc.,on sale of lottery tickets, the 5%, 5.20%, 5% and5.20% will be applicable on resident Indians, NonResident Indians, Domestic Companies, and ForeignCompanies respectively.The Threshold Limit is Rs.15,000 for theCommission or brokerage 5% TDS will be applicable

RENT194-I(a) Plant & MachineryRs. 240000.0022-20194-I(b) Land or building orfurniture or fittingRs. 240000.001010-20194-I194-IATransfer of certain immovableproperty other than agriculturelandRs 50,00,000.0011-20194-IBPayment of Rent by Individualsor HUF not liable for Tax AuditRs. 50,000 per month5--20194-ICPayment of monetaryconsideration under JointDevelopment Agreements-1010-20Fees for professionalor technical services.Ifrecipientisengaged in businessof operation of callCentre194-JFees for professional or technicalservices:Rs 3000022-2010-20If sum is payabletowards fees fortechnicalservices(otherthanprofessional services)In all other casesRs 3000010on resident Indians and Domestic Companiesrespectively. The Threshold Limit of Rs.2,40,000 forRent on Plant & Machinery and LandBuilding, Furniture and Fittings. The 2% TDS in case of Rent on Plant &Machinery for resident Indians andDomestic Companies respectively. The 10% TDS in case of Rent on LandBuilding, Furniture and Fittings forresident Indians and Domestic Companiesrespectively.The Threshold Limit is Rs.50,00,000 for thepayment on transfer of certain immovable propertyother than agricultural land 1% applicable onresident Indians and Domestic Companiesrespectively.The Threshold Limit is Rs.50,000 per month for thePayment of rent by an individual or HUF not liableto tax audit and 5% TDS is applicable on residentIndians.The Threshold Limit of Rs.30,000 on Any sum paidby way of:Cases, Wherein, the payee is engaged in thebusiness of the operation of Call Centreonly, 2% TDS is applicable on residentIndiansandDomesticCompaniesrespectively. Fee for technical services, 2% TDS isapplicable on resident Indians andDomestic Companies respectively. Professional royalty where such royalty isin the nature of consideration for sale,distributionorexhibitionofcinematographic film 10% TDS isapplicable on resident Indians andDomestic Companies respectively. In case of fees for any other professional

194-KPayment of any income inrespect of Units of Mutual fundas per section 10(23D) or Unitsof administrator or from aspecified company194-LATDS on compensationcompulsoryacquisitionimmovable Property194LBA(1)Business trust shall deduct taxwhile distributing, any interestreceived or receivable by it froma SPV or any income receivedfrom renting or leasing or lettingout any real estate asset owneddirectly by it, to its unit holdersforof194LBA(2)Distribution of, any interestreceived or receivable from SPVby Business trust194LBA(3)Distribution of, any incomereceived from renting or leasingor letting out any real estateasset owned directly by re debt fund to NonResident194-LBBInvestment fund paying anincome to a unit holder [other-1010-20Rs. 2,50,000.001010-20-1010-20Interest payment from a SPV and Distribution ofdividend by a Business Trust, to Resident unitholders shall be liable for TDS @ 10%. Whereas, incase of Non-Resident payee, TDS on dividend shallbe @ 10% & that on interest payment shall be @5%.The TDS at the rate of 5.20% is applicable on Nonresident Indians and foreign company in the case ofbusiness trust shall deduct tax while distributingany interest income received or receivable by itfrom a SPV to its unit holders-The TDS at the rate of 31.20% and 41.60%isapplicable on Non-resident Indians and foreigncompany respectively.--services 10% TDS is applicable on residentIndiansandDomesticCompaniesrespectively. In case the payee fails to furnish PAN 20%TDS is applicable on resident Indians andDomestic Companies respectively.Units of Mutual Fund have been specified undersection 10(23D) of Income Tax Act, “specified undertaking” are specified u/s 2 of theUnit Trust of India (Transfer of Undertaking andRepeal) Act, 2002.No tax will be deducted if payment is made inrespect of any award or agreement which has beenexempted from levy of income-tax u/s 96 of theRight to Fair Compensation and Transparency inLand Acquisition, Rehabilitation and ResettlementAct, 2013.55-201010-30The TDS at the rate of 5.20% is applicable on Nonresident Indians and foreign company in the case ofPayment of interest on infrastructure debt fund.The TDS at the rate of 10%, 31.20%, 10%, and41.60% will be applicable on resident Indians, Non-

than income which is exemptunder Section 10(23FBB)]194-LBC194-MResident Indians, Domestic Companies and foreigncompanies respectively.Income in respect of investmentmade in a securitization trust(specified in Explanation ofsection115TCA)Paymentofcommission,brokerage, contractual fee,professional fee to a residentperson by an Individual or a HUFwho are not liable to deduct TDSunder section 194C, 194H, or194J.25Rs.50,00,000.005105--3020The TDS at the rate of 25% , 31.20%, 10%, and41.60% will be applicable on resident Indians, NonResident Indians, Domestic Companies and foreigncompanies respectively.The threshold Limit of Rs.50,00,000 payment ofcommission,brokerage,contractualfee,professional fee to a resident person by anIndividual or a HUF who are not liable to deduct 5%TDS by the resident Indians and DomesticCompanies respectively.2%: In general if cashwithdrawn exceeds Rs.1 crore2%: If assessee has notfurnished return forlast 3 assessmentIf no default is made inyearsandcashfiling of return: Rs 1 crorewithdrawn exceeds Rs.20 lakhs but does notexceed Rs. 1 crore5%: If assessee has notfurnished return forlast 3 assessmentyearsandcashwithdrawn exceeds Rs.1 croreThe Threshold Limit is Rs.5,00,000 for theApplicable for E-Commerce operator for sale ofgoods or provision of service facilitated by itthrough its digital or electronic facility or platform.The TDS at the rate of 1% will be applicable onresident Indians and Domestic Companiesrespectively.If a person defaults infiling of return: 20 lakhs194-N194-O194-QCash withdrawalApplicableforE-Commerceoperator for sale of goods orprovision of service facilitated byit through its digital or electronicfacility or platform.Purchase of goods (applicablew.e.f 01.07.2021)20Rs.5,00,000.0011-20Rs 50,00,000.000.100.10--Budget UpdateA new section 194Q is proposed to be inserted to

195Payment of any other sum to aNon-residentprovide for deduction of TDS by person responsiblefor paying any sum to any resident for purchase ofgoods @ 0.1%.The Threshold Limit is Rs.50,00,000 applicablewhen total sales or gross receipts or turnover fromthe business carried on exceeds Rs. 10 Croresduring the financial year immediately preceding thefinancial year in which the purchase of goods iscarried out. The TDS at the rate of 20.80% is applicableon income from investments made by aNRI. The TDS at the rate of 10.40% is applicableon income from long-term capital gainsunder Section 115E for a NRI The TDS at the rate of 10.40% is applicableon Income from long-term capital gains. The TDS at the rate of 15.60% is applicableon Short-term capital gains under Section111A The TDS at the rate of 20.80% is applicableon any other income from long-termcapital gains The TDS at the rate of 20.80% is applicableon Interest payable on money borrowed inforeign currency The TDS at the rate of 10.40% is applicableon Income from royalty payable by theGovernment or an Indian concern. The TDS at the rate of 10.40% is applicableon Income from royalty other than thatwhich is payable by the Government or anIndian concern. The TDS at the rate of 10.40% is applicableon Income from fees for technical servicespayable by the Government or an Indianconcern.

The TDS at the rate of 31.20% is applicableon Any other source of incomeBudget UpdateRelaxation for senior citizen from filing ITR (Subjectto Tax Deduction under Section 194P) [AY 2021-22]It is proposed to insert a new section 194P to theAct, which proposes to provide relief to the seniorcitizens of the age of 75 years or above from thecompliance of section 139 of the Act which providesfor filing of return of income.194-P206-ABTDS on Senior Citizen above 75YearsTDS on non-filers of ITRA senior citizen of the age of 75 year or above is notrequired to file the return of income, if thefollowing conditions are satisfied – The senior citizen is resident in India andof the age of 75 or more during theprevious year; He has only pension income and may alsohave interest income from the same bank(specified bank – to be notified by the CG)in which he is receiving his pensionincome; He shall be required to furnish adeclaration to the specified bank. Thedeclaration shall be containing suchparticulars, in such form and verified insuch manner, as may be prescribed.The TDS on non-filers of ITR at higher rates Thissection shall not apply where the tax is required tobe deducted under sections 192, 192A, 194B,194BB, 194LBC or 194N of the Act. The ResidentIndian are liable to pay twice the rate specified inthe relevant provision of the Act; or twice the rateor rates in force; or the rate of 5%. It is noteworthy,after considering cess at the rate of 4% and shall beincreased by applicable surcharge.

10 NA NA 20 TDS provisions u/s 192A will be applicable when withdrawal of accumulated balance in Recognized Providend Fund is to be included in the total income 10% in case of Resident and 10.40% in case of Non-Resident 193 Interest on securities Rs 2500.00 10 10 -