Transcription

M U M B AISILICON VALLEYBANGA LORESINGA P OREMUMBA I BK CNE W DE L HIMUNICHE-Commercein IndiaLegal, Tax and Regulatory AnalysisJuly 2015 Copyright 2015 Nishith Desai Associateswww.nishithdesai.com

E-Commerce in IndiaLegal, Tax and Regulatory AnalysisAbout NDANishith Desai Associates (NDA) is a research based international law firm with offices in Mumbai, Bangalore,Silicon Valley, Singapore, New Delhi & Munich. We specialize in strategic legal, regulatory and tax advice coupledwith industry expertise in an integrated manner. We focus on niche areas in which we provide significant valueand are invariably involved in select highly complex, innovative transactions. Our key clients include marqueerepeat Fortune 500 clientele.Our practice areas include International Tax, International Tax Litigation, Litigation & Dispute Resolution, FundFormation, Fund Investments, Corporate & Securities Law, Mergers & Acquisitions, Competition Law, JVs &Restructuring, Capital Markets, Employment and HR, Intellectual Property, International Commercial Law andPrivate Client. Our specialized industry niches include funds, financial services, IT and telecom, pharma andhealthcare, media and entertainment, real estate and infrastructure & education.Nishith Desai Associates has been ranked as the Most Innovative Indian Law Firm (2014 & 2015) at the InnovativeLawyers Asia-Pacific Awards by the Financial Times - RSG Consulting. Nishith Desai Associates has been awardedfor “Best Dispute Management lawyer”, “Best Use of Innovation and Technology in a law firm”, “Best DisputeManagement Firm”, and “M&A Deal of the year” by IDEX Legal 2015 in association with three legal charities; IDIA,iProbono and Thomson Reuters Foundation. Nishith Desai Associates has been recognized as a RecommendedTax Firm in India by World Tax 2015 (International Tax Review’s directory). IBLJ (India Business Law Journal) hasawarded Nishith Desai Associates for Private equity & venture capital, structured finance & securitization, TMTand Taxation in (2014/2015). IFLR1000 has ranked Nishith Desai Associates in Tier 1 for Private Equity (2014).Chambers and Partners ranked us as # 1 for Tax and Technology-Media-Telecom (2014/2015). Legal 500 ranked usin # 1 for Investment Funds, Tax and Technology-Media-Telecom (TMT) practices (2011/2012/2013/2014). IDEXLegal has recognized Nishith Desai as the Managing Partner of the Year (2014).Legal Era, a prestigious Legal Media Group has recognized Nishith Desai Associates as the Best Tax Law Firm ofthe Year (2013). Chambers & Partners has ranked us as # 1 for Tax, TMT and Private Equity (2013). For the thirdconsecutive year.International Financial Law Review (a Euromoney publication) has recognized us as the Indian “Firm of theYear” (2012) for our Technology - Media - Telecom (TMT) practice. We have been named an Asian-Mena Counsel‘In-House Community Firm of the Year’ in India for Life Sciences practice (2012) and also for InternationalArbitration (2011). We have received honorable mentions in Asian Mena Counsel Magazine for AlternativeInvestment Funds, Antitrust/Competition, Corporate and M&A, TMT and being Most Responsive Domestic Firm(2012).We have been ranked as the best performing Indian law firm of the year by the RSG India Consulting in its clientsatisfaction report (2011). Chambers & Partners has ranked us # 1 for Tax, TMT and Real Estate – FDI (2011). We’vereceived honorable mentions in Asian Mena Counsel Magazine for Alternative Investment Funds, InternationalArbitration, Real Estate and Taxation for the year 2010.We have been adjudged the winner of the Indian Law Firm of the Year 2010 for TMT by IFLR. We have won theprestigious “Asian-Counsel’s Socially Responsible Deals of the Year 2009” by Pacific Business Press.In addition to being Asian-Counsel Firm of the Year 2009 for the practice areas of Private Equity and Taxation inIndia. Indian Business Law Journal listed our Tax, PE & VC and Technology-Media-Telecom (TMT) practices in theIndia Law Firm Awards 2009. Legal 500 (Asia-Pacific) has also ranked us #1 in these practices for 2009-2010. Wehave been ranked the highest for ‘Quality’ in the Financial Times – RSG Consulting ranking of Indian law firmsin 2009. The Tax Directors Handbook, 2009 lauded us for our constant and innovative out-of-the-box ideas. Otherpast recognitions include being named the Indian Law Firm of the Year 2000 and Asian Law Firm of the Year (ProBono) 2001 by the International Financial Law Review, a Euromoney publication.In an Asia survey by International Tax Review (September 2003), we were voted as a top-ranking law firm andrecognized for our cross-border structuring work. Nishith Desai Associates 2015

Provided upon request onlyOur research oriented approach has also led to the team members being recognized and felicitated for thoughtleadership. NDAites have won the global competition for dissertations at the International Bar Association for 5years. Nishith Desai, Founder of Nishith Desai Associates, has been voted ‘External Counsel of the Year 2009’ byAsian Counsel and Pacific Business Press and the ‘Most in Demand Practitioners’ by Chambers Asia 2009. He hasalso been ranked No. 28 in a global Top 50 “Gold List” by Tax Business, a UK-based journal for the internationaltax community. He is listed in the Lex Witness ‘Hall of fame: Top 50’ individuals who have helped shape the legallandscape of modern India. He is also the recipient of Prof. Yunus ‘Social Business Pioneer of India’ – 2010 award.We believe strongly in constant knowledge expansion and have developed dynamic Knowledge Management(‘KM’) and Continuing Education (‘CE’) programs, conducted both in-house and for select invitees. KM andCE programs cover key events, global and national trends as they unfold and examine case studies, debate andanalyze emerging legal, regulatory and tax issues, serving as an effective forum for cross pollination of ideas.Our trust-based, non-hierarchical, democratically managed organization that leverages research and knowledgeto deliver premium services, high value, and a unique employer proposition has now been developed into a globalcase study and published by John Wiley & Sons, USA in a feature titled ‘Management by Trust in a DemocraticEnterprise: A Law Firm Shapes Organizational Behavior to Create Competitive Advantage’ in the September 2009issue of Global Business and Organizational Excellence (GBOE).Please see the last page of this paper for the most recent research papers by our experts.DisclaimerThis report is a copyright of Nishith Desai Associates. No reader should act on the basis of any statementcontained herein without seeking professional advice. The authors and the firm expressly disclaim all and anyliability to any person who has read this report, or otherwise, in respect of anything, and of consequences ofanything done, or omitted to be done by any such person in reliance upon the contents of this report.ContactFor any help or assistance please email us on ndaconnect@nishithdesai.com orvisit us at www.nishithdesai.com Nishith Desai Associates 2015

E-Commerce in IndiaLegal, Tax and Regulatory AnalysisContents1. INTRODUCTION 01I.What is E-commerce 012. SNAPSHOT OF E-COMMERCE INDUSTRY IN INDIAI.04Penetration of E-commerce Model – An Industry wise Analysis043. INVESTMENTS IN THE E-COMMERCE SPACE IN INDIA06I. What Constitutes E-commerce under the FDI Policy06II. FDI Restrictions in E-commerce 06III. Recent Developments 074. LEGAL VALIDITY OF ELECTRONIC TRANSACTIONS08I. Formation of an E-Contract 08II. Validity of Online Contracts 08III. Whether Standard-form Online Contracts are Unconscionable095. SECURITY ISSUES IN E-COMMERCE 11I.II.III.IV.Authentication and Identification 11Privacy 11Data Protection 12Security of Systems 126. PAYMENT MECHANISMS FOR E-COMMERCEI.II.III.IV.14What is a Payment System 14Players Involved In Electronic Payment Systems14Payment Instruments 15Card not Present Transactions 167. CONSUMER PROTECTION ISSUES 178. INTELLECTUAL PROPERTY ISSUES 18I. Is there a Protectable Intellectual Property?II. Common Issues with Respect to IP in E-CommerceIII. Enforcing IP - Liability for Infringement of IP1818209. CONTENT REGULATION 21I. Obscenity Issues 21II. Defamation 2210. INTERMEDIARY LIABILITY 23I. Who is an Intermediary? 23II. Is an Intermediary Liable for Third Party Actions?23III. Exemption from liability vis-à-vis copyright and patent laws2411. JURISDICTION ISSUES 26I. IT Act 26II. Indian Penal Code, 1869 (“IPC”) 26III. International Jurisprudence 2612. TAXATION OF E-COMMERCE TRANSACTIONS28I. Direct Taxes 28II. Indirect Taxes 3213. CONCLUSION 34 Nishith Desai Associates 2015

E-Commerce in IndiaLegal, Tax and Regulatory Analysis1. IntroductionToday e-commerce has become an integral part ofeveryday life. Accessibility to e-commerce platformsis not a privilege but rather a necessity for mostpeople, particularly in the urban areas. There arealternative e-commerce platforms available (insteadof the traditional physical platforms) for almostevery aspect of our lives, starting from purchasing ofeveryday household items to online brokage. Mailorder or catalogue shopping has been in existencein the United States since 1980. This was thepredecessor of online commerce, which started inIndia post 2000.1Today the number of internet users in the world isclose to 3 billion.2 Out of this, India has a total of259.14 Million internet and broadband subscribers.3This penetration of internet coupled with theincreasing confidence of the internet users topurchase online, has led to an enormous growth inthe e-commerce space, with an increasing numberof customers registering on e-commerce websitesand purchasing products through the use of mobilephones.4 It is not surprising, therefore, that India isin a prime position for the growth and developmentof the e-commerce sector. In particular, e-commercepresents one of the greatest opportunities in theretail sector since it provides a dramatic change frombrick and mortar establishments to virtual shopswhich could operate for a fraction of the cost.5According to a report provided by Forrester Research,social networks play an important role in drivingconsumers online and getting them to engage withbrands. This would gain specific significance in lightof facts such as India being ranked as Facebook’ssecond largest audience after the US.6 However,it should be kept in mind that there still exists aform of ‘digital divide’ in India where the benefitsof internet have not fully percolated to non-urbanareas. In this scenario, mobile connections wouldplay a very important role. India has close to 914.92Million wireless subscribers.7 Mobile phones havebeen and will be a key tool in helping users connectsin a market where overall internet penetration maybe low.The Indian Government has approved projectsfor providing broadband connectivity to the localand village level government bodies (i.e. the GramPanchayats). The Government’s plan is to enablebroadband connectivity at the rural levels.8 This isfurther likely to boost e-commerce in India.I. What is E-commerceThough there exists no standard definition for theterm e-commerce9, it is generally used in the sense ofdenoting a method of conducting business throughelectronic means rather than through conventionalphysical means. Such electronic means include‘click & buy’ methods using computers as well as‘m-commerce’ which make use of various mobiledevices or smart phones. This term takes intoaccount not just the act of purchasing goods and /or availing services through an online platform butalso all other activities which are associated with anytransaction such as: Delivery, Payment facilitation, Supply chain and service management.E-commerce has defied the traditional structure ofbusinesses trading with consumers bringing to thefore various business models which has empoweredconsumers.Some of the common business models which arefacilitated by e-commerce are as follows:1.Cited from “Going back to brick and mortar”, Venkatesh Ganesh available at nd-life/article3836141.ece (last visited on January 22, 2015)2.Cited from “Internet Usage Statistics - The Internet Big Picture - World Internet Users and Population Stats” available at http://www.internetworldstats.com/stats.htm (last visited on January 22, 2015)3.Cited from “The Indian Telecom Services Performance Indicators (April – June 2014)” available at uments/Indicator%20Reports%20-%20Jun-14.pdf (last visited on January 22, ce-market/ (last visited on January 22, 2015).5.‘Trends In India’s e-Commerce Market’: Report provided by Forrestor Research for ASSOCAM’s 2nd National Conference on e-Commerce op-15-countries-based-on-number-of-facebook-users/ (last visited on January 22, 2015)7.Cited from “The Indian Telecom Services Performance Indicators (April – June 2014)” available at uments/Indicator%20Reports%20-%20Jun-14.pdf (last visited on January 22, th-five-year-plan (last visited on January 22, 2015)9.In Chapter III, we have discussed how the FDI Policy categorises e-commerce activities. However this categorization is relevant from the point ofview of foreign investments which we have dealt with in Chapter III. Nishith Desai Associates 20151

IntroductionProvided upon request only B2B: E-commerce has enabled various businessesto build new relationships with other businessesfor efficiently managing several of their businessfunctions. B2B e-commerce could comprise ofvarious models, which may include distributionservices, procurement services, digital / onlinemarket place like services etc. IndiaMART.comis one such B2B online market place whichprovides a platform for businesses to find othercompetitive suppliers. On the other hand Aribaprovides procurement services by providingaccess to digital electronic market.Traditional B2C modelManufacturerOnline B2C modelRetailerMost sellers of products or services in the physicalmedium have begun providing their goods/ serviceson the internet as well and it is by virtue of thismodel that e-tailing has become very popular withinternet users where a near virtual shop is createdwith images of products sold. This not only providescost benefits to the sellers as brick and mortar type ofinvestments are considerably reduced, but the selleris also able to provide benefits to the consumers interms of discounts and free additions (such as freedelivery) C2C: Traditionally consumers have haddealings with other consumers, but only fewof those activities were in a commercial sense.E-commerce has made it possible to bringtogether strangers and providing a platform forthem to trade on. For example, portals such aseBay and quikr enables consumers to transactwith other consumers. C2B: This relatively new model of commerceand is a reverse of the traditional commercemodels; here consumers (i.e. individuals) provideservices/ goods to businesses and create value forthe business. This type of transaction can be seenin internet forums where consumers provideproduct development ideas or in online platformswhere consumers provide product reviews whichare then used for advertisement purposes. B2B2C: A variant of the B2C model whereinthere is an additional intermediary business toassist the first business transact with the endconsumer. This model is poised to do much better2 B2C: Direct dealings between businesses andconsumers have always existed; however with theemergence of e-commerce such transactions havegained further momentum. In a traditional B2Cmodel, the distribution channel typically startswith manufacturer and goes through a distributor/ wholesaler to retailer, who interacts with theend customer. However, in an online modelone finds the manufacturer or the intermediarydirectly trading with the consumer.Manufacturer/Retailerin a web based commerce with the reduced costsof having an intermediary. For instance, Flipkart,one the most successful e-commerce portalsprovides a platform for consumers to purchase awide variety of goods such as, electronic goods,apparels, books and music CDs. In fact the growthof this model is evident from the surge in thenumber of e-commerce players adopting thismodel in recent times – fashionandyou, Jabongto name a few. Further, apart from businessesproviding intermediary services such as thatof Flipkart a lot of online platforms tie up withpayment gateway facilitators who provide aplatform for the processing of payments.Though at the outset, the prospect of conductingbusiness through e-commerce may seemuncomplicated and economical, there are a varietyof legal factors that an e-commerce businessmust seriously consider and keep in mind beforecommencing and while carrying out its activities.The importance of dealing with these complex legalissues have already been highlighted starting fromthe court ruling in the year 2001 in the “Napster.com” case wherein the United States Ninth CircuitCourt of Appeals held that music filesharingsystem known as “Napster” committed repeatedinfringements of copyright law as millions of usersuploaded and downloaded copyright protected soundrecordings. Closer home, the Delhi High Court heldin the ‘Myspace’ order that social networking sitessuch as Myspace may be held liable for copyrightinfringement caused due to infringing materialposted on such if the intermediaries had control overthe material posted, had the opportunity to exercise Nishith Desai Associates 2015

E-Commerce in IndiaLegal, Tax and Regulatory Analysisdue diligence in preventing infringement and derivedprofits out of such infringing activities. Further,privacy and data protection issues have assumedgreat significance with the Indian Governmentnotifying specific rules for data protection.In this paper we shall discuss some of the importantlegal issues relating to e-commerce in India. Nishith Desai Associates 20153

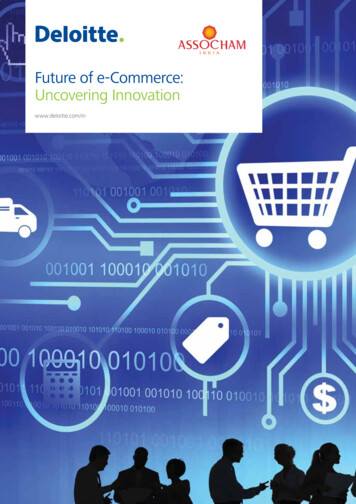

Provided upon request only2. Snapshot of E-Commerce Industry in IndiaA report by the Internet and Mobile Association ofIndia has revealed that India’s e-commerce marketexpected to grow by 37% to reach USD 20 Billion by2015.10According to a report provided by Forrester11Research, e-commerce revenues in India will increaseby more than five times by 2016, jumping from USD1.6 billion in 2012 to USD 8.8 billion in 2016.Figure 1 forecast: India Online Retail Revenues (B2C & C2C), 2012 & 2016US 8.8billionUS 1.6billion20122016Source: Forrester Research Online Retail Forecast, 2011 To 2016 (Asia Pacific)78361According to report provided by Forrester12Research, shoppers in metropolitan India are drivinge-commerce: these consumers primarily avail ofe-commerce service in the areas of travel, consumerelectronics and online books.Source: Forrester Research, Inc.(approximately 71 % and e-tailing taking the secondspot with a small share of 16%.I. Penetration of E-commerceModel – An Industry wiseAnalysisIn fact e-commerce has radically changed the travelindustry to the extent that making travel plans is justa click away as is evident from the increasing numberof users of IRCTC i.e. the website for booking ticketsfor Indian Railways. Even though the surge in the useof e-commerce was primarily with respect to bookingtickets online, now, even related activities such ashotel accommodation and car rental are also catchingon.The growth of the e-commerce industry over the lastfew years is definitely undisputable, at the same timeit is important to understand that success storiesof e-commerce as a model have been observed incertain specific industries. According to recent newsreports13, the travel industry accounts for nearlythree-fourths of the commerce that takes place onlineThe fact that only a small market share is attributableto the e-tailing industry does not defy the growinginfluence that online shopping has on people. Inrecent times, e-tail businesses are adopting varioustechnologies to create a near virtual world toovercome the biggest hurdle that e-tailing faces,namely, the direct connection that the customer has10. next-year-rep.html (last visited onJanuary 22, 2015)11. ‘Trends In India’s e-Commerce Market’: Report provided by Forrestor Research for ASSOCAM’s 2nd National Conference on e-Commerce 2012.12. ‘Trends In India’s e-Commerce Market’: Report provided by Forrestor Research for ASSOCAM’s 2nd National Conference on e-Commerce 2012.13. next-year-rep.html (last visited onJanuary 22, 2015)4 Nishith Desai Associates 2015

E-Commerce in IndiaLegal, Tax and Regulatory Analysiswith the goods.14 In the initial years e-tailing seemedmore popular for purchase of computer products andit still does contribute to a majority of e-tailing, butlifestyle shopping seems to be the new found trendfor internet users. These businesses have capitalizedon the convenience factor that online trading offersto customers and this has been the success mantranot just for Flipkart but host of other websites.Financial services have also seen a sizeable growth inthe use of e-commerce model. This sector which didnot have much of share in the e-commerce industryin 2008 is now pretty much on par with e-tailbusinesses in its share of the e-commerce industry.14. Cited from Using tech to make e-tail as real as retail, Pragya Singh, DNA, September 26, 2012 and available at http://www.dnaindia.com/analysis/column using-tech-to-make-e-tail-as-real-as-retail 1745323 (last visited on January 22, 2015) Nishith Desai Associates 20155

Provided upon request only3. Investments in the E-Commerce Space in IndiaForeign direct investment (“FDI”) in India isregulated under the Foreign Exchange ManagementAct 1999 (“FEMA”). The Department of IndustrialPolicy and Promotion (“DIPP”), Ministry ofCommerce and Industry, Government of India makespolicy pronouncements on FDI through Press Notesand Press Releases which are notified by the ReserveBank of India (“RBI”) as amendments to ForeignExchange Management (Transfer or Issue of Securityby Persons Resident Outside India) Regulations, 2000.The consolidated FDI policy issued by the DIPP (“FDIPolicy”) lays down two entry routes for investment:i. Automatic Route where foreign investments donot require prior approval of the government andii. Government / Approval Route where priorapproval of the Government of India throughForeign Investment Promotion Board (“FIPB”) isrequired.I. What Constitutes E-commerceunder the FDI PolicyThe FDI Policy states as follows:“E-commerce activities refer to the activity of buyingand selling by a company through the e-commerceplatform”This definition makes it clear that any buy / saletransactions would be covered. This definition doesnot seem to cover other forms of transactions whichcould take place on e-commerce platforms such asinformation sharing and advance bookings (withoutpayments being made).II. FDI Restrictions in E-commerceThe current regulatory status with respect to foreigninvestments in the e-commerce space is as follows; 100% FDI is allowed under the automatic route(i.e. no FIPB approval is required) in companiesengaged in B2B e-commerce.15 No FDI is allowed in companies which engagein single brand retail trading by means ofe-commerce.16 No FDI is allowed in companies which engagein multi brand retail trading by means ofe-commerce.17These restrictions are related to sale of goods and notservices.There have been various liberalizations in FDI insingle brand retail and multi brand retail and itwas thought that FDI in e-commerce would alsobe liberalized. However, there continues to berestrictions in this space.These express restrictions on FDI in B2C businesseshas led to development of market place models,where the online platform acts as a trading platformrather than a trader. In this case the online platform’sclients are various sellers who own the inventoryof goods and advertise their goods on the onlineplatform. The ultimate sale of the goods is completedbetween the third party seller and the end consumer.There are other innovative models which are beingadopted to bring in investments into companiesengaged in e-commerce or companies which directlyor indirectly collaborate with e-commerce businessessuch as Investing into companies engaged in wholesaletrading (where 100% FDI is allowed under theautomatic route subject to certain conditions 18)which owns inventory and maintains the onlineB2B platform.15. Para 6.2.16.2.1 of the Consolidated FDI Policy 201416. Para 6.2.16.3 of the Consolidated FDI Policy 201417. Para 6.2.16.4 of the Consolidated FDI Policy 201418. Under Para 6.2.16.1.2 of the FDI Policy 2014, some of the pertinent conditions to be fulfilled for investing into a wholesale trading company are (i)wholesale trade to group companies should not exceed 25% of the total turnover of the venture (ii) a wholesale trader cannot open retail shops to sellto the consumer directly, (iii) full records indicating all the details of the sales (such as name of entity, kind of entity, registration/ license/ permit etc,number and amount of sale) to be maintained on a daily basis.6 Nishith Desai Associates 2015

E-Commerce in IndiaLegal, Tax and Regulatory Analysis Investing into companies providing technologyservices (where 100% FDI is allowed under theautomatic route) which provides technologyrelated services on an arms length basis toe-commerce platforms. In February 2014, Kunal Bahl-led Snapdealamassed 133 million funding led by eBay,Kalaari Capital, Nexus Venture Partners,Bessemer Venture Partners, Intel Capital andSaama Capital.While considering any such models, it is importantto be in compliance with the FDI Policy. Mukesh Bansal-led Myntra secured 50 million(about Rs.300 crore) investment led by PremjiInvest along with existing investors AccelPartners and Tiger Global.III. Recent DevelopmentsSome of the major investments that have beenwitnessed recently are as follows:19 Flipkart, raised 1 billion from Tiger GlobalManagement and Naspers. Singapore’s sovereignwealth fund, GIC, along with existing investorsAccel Partners, DST Global, ICONIQ Capital,Morgan Stanley Investment Management andSofina, also participated in this latest financinground. The financial service arm of the Japanesetelecommunication and internet corporation,SoftBank Internet and Media, Inc. committed 627 million funding in New Delhi-based onlinemarketplace, Snapdeal. Following the investment,SoftBank became the biggest stakeholder in thecompany. Grocery etailer Bigbasket snapped up 33 millionfrom Helion Ventures, Ascent Capital, ZodiusCapital and Lionrock Capital in September 2014. Fashion e-commerce major Jabong secured 27.5million (Rs 173 crore) from British developmentfinance institution CDC in a deal in February2014. Furniture etailer Urbanladder closed 21million (approx Rs.120 crore) Series B fundingfrom Steadview Capital along with the existinginvestors, SAIF Partners and Kalaari Capital, inJanuary 2014.19. ments/ (last visited on January 22, 2015) Nishith Desai Associates 20157

Provided upon request only4. Legal Validity of Electronic TransactionsIn this chapter, we discuss various legal issuesrelating to the formation and validity electronictransactions such as online contracts andenforcement issues.I. Formation of an E-ContractSome of the most common forms of e-contracts areclick wrap, browse wrap and shrink-wrap contracts.A browse wrap agreement is intended to be bindingon the contracting party by the mere use (or browse)of the website.Shrink wrap agreements though not directly relevantto e-commerce platforms are relevant in the contextof e-commerce mostly because of the kind of goodsassociated with shrink-wrap agreements. In case ofa shrink-wrap agreement the contracting party canread the terms and conditions only after opening thebox within which the product (commonly a license)is packed.In each of these contracts, the terms and conditionsof the contract are made available to the contractingparty in a form that is significantly different from theusual paper contracts. In case of a click wrap contract,the contracting party’s affirmative acceptance istaken by means of checking on an ‘I accept” tab.Also, there is typically a scroll box that allows thecontracting party to view the terms and conditions.An example of how a click wrap contract would lookis given below.consideration. What needs to be examined is howthese requirements of the Indian Contract Act wouldbe fulfilled in relation to e-contracts. In this context itis important to note that the Information TechnologyAct, 2000 (“IT Act”) provides fortification for thevalidity of e-contracts.Some of the important requirements of a validcontract under the Indian Contract Act are as follows:II. Validity of Online Contractsi. The contract should be entered into with the freeconsent of the contracting parties;Existence of a valid contract forms the crux of anytransaction including an e-commerce transaction. InIndia, e-contracts like all other contracts are governedby the basic principles governing contracts in India,i.e. the Indian Contract Act, 1872 (“Indian ContractAct”) which inter alia mandate certain pre-requisitesfor a valid contract such as free consent and lawfulii. There should be lawful consideration for t

E-Commerce in India Nishith Desai Associates (NDA) is a research based international law firm with offices in Mumbai, Bangalore, Silicon Valley, Singapore, New Delhi & Munich. We specialize in strategic legal, regulatory and tax advice coupled with industry expertise in an integrate