Transcription

2021Annual ReportDecember 31, 20211832 AM Canadian Dividend LP1832 AM Canadian Growth LP1832 AM Global Completion LP1832 AM International Equity LP1832 AM Tactical Asset Allocation LP1832 AM Global Low Volatility Equity LP1832 AM Total Return Bond LP1832 AM U.S. Dividend Growers LP1832 AM U.S. Low Volatility Equity LP

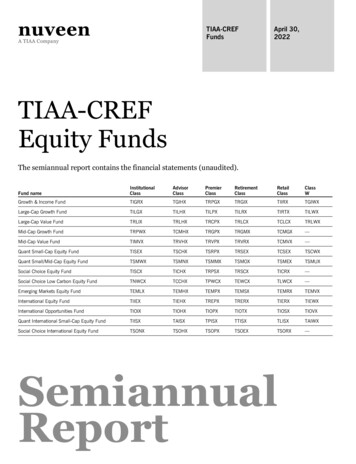

Tableof ContentsFinancial Statements1591316192431341832 AM Canadian Dividend LP1832 AM Canadian Growth LP1832 AM Global Completion LP1832 AM International Equity LP1832 AM Tactical Asset Allocation LP1832 AM Global Low Volatility Equity LP(formerly Scotia Global Low Volatility Equity LP)1832 AM Total Return Bond LP (formerly ScotiaTotal Return Bond LP)1832 AM U.S. Dividend Growers LP (formerlyScotia U.S. Dividend Growers LP)1832 AM U.S. Low Volatility Equity LP (formerlyScotia U.S. Low Volatility Equity LP)37Notes to the Financial Statements46Management’s Responsibility forFinancial Reporting47Independent Auditor’s Report

1832 AM Canadian Dividend LPSTATEMENTS OF FINANCIAL POSITIONSTATEMENTS OF CHANGES IN NET ASSETSATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITSAs at(in dollars)ASSETSCurrent assetsFinancial assets at fair value through profit or loss (note 2)Non-derivative financial assetsDerivativesCashAccrued investment income and otherTotal assetsLIABILITIESCurrent liabilitiesFinancial liabilities at fair value through profit or loss(note 2)DerivativesPayable for securities purchasedRedemptions payableAccrued expensesTotal liabilitiesNet assets attributable to holders of redeemableunitsDecember 31,2021December 0343,049,028306,945,839343,049,028306,945,839For the periods ended December 31 (note 1),(in dollars)NET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS PER SERIESSeries INET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS PER UNITSeries I15.57NET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS, BEGINNING OF PERIODSeries IREDEEMABLE UNIT TRANSACTIONSProceeds from issueSeries IPayments on redemptionSeries IINCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLE TOHOLDERS OF REDEEMABLE UNITS FROM OPERATIONSPER SERIESSeries IINCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLE TOHOLDERS OF REDEEMABLE UNITS FROM OPERATIONSPER UNIT†Series IWEIGHTED AVERAGE NUMBER OF UNITS PER SERIESSeries 0(71,765,900)(289,622,210)(53,750,300) (276,555,110)INCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLETO HOLDERS OF REDEEMABLE UNITSSeries I11.74NET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS, END OF PERIODSeries IFor the periods ended December 31 (note 1),20212020306,945,839INCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLETO HOLDERS OF REDEEMABLE UNITS FROMOPERATIONSSeries ISTATEMENTS OF COMPREHENSIVE INCOME(in dollars except average units)INCOMENet gain (loss) on financial assets and liabilities at fair valuethrough profit or lossDividendsInterest for distribution purposesNet realized gain (loss) on non-derivative financial assetsChange in unrealized gain (loss) on non-derivative financialassetsNet realized gain (loss) on derivativesChange in unrealized gain (loss) on derivativesNet gain (loss) on financial assets and liabilities at fairvalue through profit or lossSecurities lending (note 11)Net realized and unrealized foreign currency translation gain(loss)Total income (loss), netEXPENSESFixed administration fees (note 6)Independent Review Committee feesInterest expenseForeign withholding taxes/tax reclaimsHarmonized Sales Tax/Goods and Services TaxTransaction costsTotal expensesIncrease (decrease) in net assets attributable to holdersof redeemable units from ,8392020STATEMENTS OF CASH FLOWS9,156,971342,15530,844,075For the periods ended December 31 (note 22,639(15,360,868)10,744(in dollars)(5,533)(31,659)90,602,132 (0.39)22,786,36443,038,9692021CASH FLOWS FROM OPERATING ACTIVITIESIncrease (decrease) in net assets attributable to holders ofredeemable units89,853,489Adjustments for:Net realized (gain) loss on non-derivative financial assets(30,844,075)Change in unrealized (gain) loss on non-derivative financialassets(49,781,140)Change in unrealized (gain) loss on derivatives697,843Unrealized foreign currency translation (gain) loss(15,490)Other non-cash transactions(28,566)Purchases of non-derivative financial assets and liabilities(164,198,439)Proceeds from sale of non-derivative financial assets andliabilities237,248,278Accrued investment income and other(158,316)Accrued expenses and other 4(522)–(253,797,371)509,276,398414,184–Net cash provided by (used in) operating activitiesCASH FLOWS FROM FINANCING ACTIVITIESProceeds from issue of redeemable unitsAmounts paid on redemption of redeemable ,067,100(290,922,210)Net cash provided by (used in) financing activitiesUnrealized foreign currency translation gain (loss)Net increase (decrease) in cashCash (bank overdraft), beginning of period(53,950,300) 10,700,814CASH (BANK OVERDRAFT), END OF 95,90414,104,969Interest paid(1)Interest received, net of withholding taxes(1)Dividends received, net of withholding taxes(1)(1)Classified as operating items.The increase (decrease) in net assets attributable to holders of redeemable units fromoperations per unit is calculated by dividing the increase (decrease) in net assetsattributable to holders of redeemable units from operations per series by the weightedaverage number of units per series.The accompanying notes are an integral part of these financial statements.12020

1832 AM Canadian Dividend LP (continued)SCHEDULE OF INVESTMENT PORTFOLIOAs at December 31, 2021Number ofSharesIssuerEQUITIES – 91.2%Communication Services – 11.9%Activision Blizzard Inc.BCE Inc.Netflix Inc.Rogers Communications Inc., Class BShaw Communications Inc., Class BTELUS ageCost ( 832CarryingValue ( )IssuerEQUITIES (cont'd)Health Care – 7.0%Medtronic PLCNovartis AGStryker 66,100131,10018,600Information Technology – 3.4%Microsoft CorporationSalesforce.com Inc.Texas Instruments 2,900Materials – 8.9%Agnico-Eagle Mines LimitedAir Products and Chemicals Inc.Barrick Gold CorporationCCL Industries Inc., Class BKinross Gold CorporationNutrien 111,9007,700187,40099,700700,50037,70038,614,946 38,473,787Financials – 26.0%Bank of Nova Scotia, TheBrookfield Asset Management Inc., Class ABrookfield Asset Management Reinsurance Partners Ltd.Fairfax Financial Holdings LimitedIndustrial Alliance Insurance and Financial Services Inc.Manulife Financial CorporationPower Corporation of CanadaRoyal Bank of CanadaThomson Reuters CorporationToronto-Dominion Bank, 544,159,9733,869,1192,281,0375,456,2698,418,018 11,606,42518,351,795 19,090,432Energy – 11.2%ARC Resources Ltd.Enerflex Ltd.Parkland Fuel CorporationPrairieSky Royalty Ltd.TransCanada CorporationCarryingValue ( )15,937,025 19,192,71015,462,205 15,366,369Consumer Staples – 5.6%Empire Company Limited, Class AGeorge Weston LimitedSaputo Inc.AverageCost ( )24,618,429 23,962,209Industrials – 5.6%ABB Ltd.Canadian National Railway CompanyCanadian Pacific Railway LimitedSNC-Lavalin Group Inc.Toromont Industries Ltd.35,089,498 40,932,579Consumer Discretionary – 4.5%Amazon.com Inc.NIKE Inc., Class BRestaurant Brands International Inc.Number 141,6703,584,51629,690,936 30,476,154Real Estate – 1.9%Granite Real Estate Investment Utilities – 5.2%Northland Power Inc.4,482,287470,200 16,423,876 17,844,090TOTAL EQUITIES271,571,324 312,686,978Transaction Costs(236,954)TOTAL INVESTMENT PORTFOLIO–271,334,370 312,686,978Unrealized Gain (Loss) on Derivatives – (0.1%)OTHER ASSETS, LESS LIABILITIES – 8.9%64,482,309 89,070,4036,671,820(339,878)30,701,928NET ASSETS – 100.0%343,049,028SCHEDULE OF DERIVATIVE INSTRUMENTSUNREALIZED GAIN ON CURRENCY FORWARD CONTRACTSCounterpartyCredit RatingSettlement DateCurrency To BeReceivedToronto-Dominion Bank, TheRoyal Bank of CanadaRoyal Bank of CanadaA-1 A-1 A-1 Jan. 14, 2022Feb. 28, 2022Mar. 11, 2022Canadian dollarCanadian dollarCanadian dollarContractualAmount ( )640,590140,2883,068,940Currency To BeDeliveredUS dollarSwiss francUS dollarContractualAmount ( )ContractPrice ( )MarketPrice ( )UnrealizedGain ( .7908,2311,36131,85041,442UNREALIZED LOSS ON CURRENCY FORWARD CONTRACTSCounterpartyCredit RatingSettlement DateCurrency To BeReceivedState Street Bank & Trust CompanyBank of MontrealToronto-Dominion Bank, TheState Street Bank & Trust CompanyToronto-Dominion Bank, TheToronto-Dominion Bank, TheA-1 A-1A-1 A-1 A-1 A-1 Jan. 14, 2022Feb. 18, 2022Feb. 18, 2022Feb. 28, 2022Feb. 28, 2022Jan. 14, 2022Canadian dollarCanadian dollarCanadian dollarCanadian dollarCanadian dollarUS dollarContractualAmount ( 000Currency To BeDeliveredUS dollarUS dollarUS dollarSwiss francSwiss francCanadian dollarContractualAmount ( )ContractPrice ( )MarketPrice ( )UnrealizedLoss ( 832)(3,469)(381,320)2

1832 AM Canadian Dividend LP (continued)FUND SPECIFIC NOTESFor the periods indicated in note 1The Fund (note 1)As at December 31, 2021, if the Canadian dollar fluctuated by 10% inrelation to all other foreign currencies, with all other variables heldconstant, net assets attributable to holders of redeemable units of theFund would have decreased or increased by 2,473,414 orapproximately 0.7% of net assets (December 31, 2020 – 2,328,881 orapproximately 0.8%). In practice, actual results may differ from thissensitivity analysis and the difference could be material.The Fund’s investment objective is to provide income and long-termcapital growth by investing primarily in equity securities of Canadianbusiness that pay dividend or distribution. The Fund can invest up to49% of its assets in foreign securities.The Fund may also invest a portion of its assets in funds managed bythe Manager and/or by third party investment managers (the“Underlying Funds”). In addition to the risks described below, theFund could be exposed to indirect risk to the extent that theUnderlying Funds held financial instruments that were subject to thebelow risks.Price riskAs at December 31, 2021, approximately 91.2% (December 31, 2020 –97.9%) of the Fund’s net assets were directly exposed to price risk. Ifprices of these instruments had fluctuated by 10%, with all othervariables held constant, net assets attributable to holders ofredeemable units of the Fund would have decreased or increased byapproximately 31,268,698 (December 31, 2020 – 30,053,618). Inpractice, actual results may differ from this sensitivity analysis and thedifference could be material.Risks associated with financial instruments (note 4)Interest rate riskBelow is a summary of the Fund’s direct exposure to interest rate riskby the remaining term to maturity of the Fund’s portfolio, net of shortpositions, if applicable, excluding Underlying Funds, preferred shares,cash and overdrafts, as applicable.Interest rate exposureLess than 1 year1-3 years3-5 years5-10 years 10 yearsDecember 31, 2021( )December 31, 2020( redit riskBelow is a summary of the credit ratings of bonds and debentures,money market instruments and preferred shares held by the Fund, asapplicable.December 31, 2021Credit ratingsAs at December 31, 2021, had the prevailing interest rates fluctuatedby 0.25%, assuming a parallel shift in the yield curve and all othervariables held constant, net assets attributable to holders ofredeemable units of the Fund would have decreased or increased by nil(December 31, 2020 – 64,713 or approximately 0.0%). In practice,actual results may differ from this sensitivity analysis and thedifference could be material.UnratedPercentageof totalcredit ratedinstruments(%)––100.01.4–100.01.4Below is a summary of the Fund’s concentration risk by carrying valueas a percentage of net assets.Communication ServicesConsumer DiscretionaryConsumer StaplesCorporate BondsEnergyFinancialsHealth CareIndustrialsInformation TechnologyMaterialsReal EstateUtilitiesUnrealized Gain (Loss) on DerivativesDecember 31, 2021CurrencyUS dollarSwiss francNet currencyexposure ( )Percentage ofnet assets 1367.2Gross currencyexposure ( )Currencycontracts ( )Net currencyexposure ( )Percentage ofnet assets ,373,027)23,288,8127.5December 31, 2020CurrencyUS dollarSwiss francEuroPercentage ofnet assets(%)Concentration riskBelow is a summary of the Fund’s direct exposure to currency risk.Amounts shown are based on the carrying value of monetary and nonmonetary assets and liabilities of the Fund net of currency contractsand short positions, as applicable.Currencycontracts ( )Percentage ofnet assets(%)–Currency riskGross currencyexposure ( )December 31, 2020Percentageof totalcredit ratedinstruments(%)3December 31, 2021December 31, 92.07.51.411.935.04.47.66.45.71.65.80.1

1832 AM Canadian Dividend LP (continued)FUND SPECIFIC NOTESFor the periods indicated in note 1December 31, 2020Fair Value Classification (note 2)Financial assets – bytypeBelow is a summary of the classification of the Fund’s financialinstruments within the fair value hierarchy.Level 1( )Level 2( )Level 3( )Total( )297,392,85015,294,128–312,686,978December 31, 2021EquitiesUnrealized gain on currencyforward �312,728,420Unrealized loss on currencyforward contracts–297,392,850–14,954,250–Level 3( )Total( 5–305,243,645Unrealized loss on currencyforward rency forwardcontractsOptions contracts – OTCSwap contracts – Master nettingoffset( )Collateralpledged( 0(15,120)––Net Amount( )Comparison of net asset value per unit and net assets per unit(note 2)As at December 31, 2021 and December 31, 2020, there were nosignificant differences between the net asset value per unit and the netassets per unit for any series of the Fund.Below is a summary of the offsetting of financial assets and liabilitiesand collateral amounts that would occur if future events, such asbankruptcy or termination of contracts, were to arise. No amountswere offset in the financial statements.December 31, 2021Gross amountof assets( )Master nettingoffset( )Collateralreceived( )Net Amount( 442(8,231)–33,211December 31, 2021Currency forwardcontractsOptions contracts – OTCSwap contracts – OTC(15,120)––305,228,525Offsetting of financial assets and liabilities (note 2)Gross amountFinancial liabilities – by of liabilitiestype( )373,085––The Fund did not hold any interest in Underlying Funds as atDecember 31, 2021 or December 31, 2020.(15,120)During the periods ended December 31, 2021 and December 31, 2020,there were no significant transfers between Level 1 and Level 2.Currency forwardcontractsOptions contracts – OTCSwap contracts – OTCNet Amount( )Interest in Underlying Funds (note 2)Transfers between levelsFinancial assets – bytypeCollateralreceived( )December 31, 2020312,347,100Level 2( )Master nettingoffset( )Gross amountFinancial liabilities – by of liabilitiestype( )(381,320)Level 1( )December 31, 2020EquitiesBonds and debenturesUnrealized gain on currencyforward contracts(381,320)Currency forwardcontractsOptions contracts – OTCSwap contracts – OTCGross amountof assets( )Master nettingoffset( )Collateralpledged( )Net Amount( 81,320(8,231)–373,0894

1832 AM Canadian Growth LPSTATEMENTS OF FINANCIAL POSITIONSTATEMENTS OF CHANGES IN NET ASSETSATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITSAs atDecember 31,2021(in dollars)ASSETSCurrent assetsFinancial assets at fair value through profit or loss (note 2)Non-derivative financial assetsCashAccrued investment income and otherTotal assetsDecember 31,2020(in nt liabilitiesRedemptions payableAccrued expenses–43283,400–Total 011649,897,158Net assets attributable to holders of redeemableunitsNET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS PER SERIESSeries IFor the periods ended December 31 (note 1),NET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS PER UNITSeries I16.11NET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS, BEGINNING OF PERIODSeries IINCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLETO HOLDERS OF REDEEMABLE UNITS FROMOPERATIONSSeries IINCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLETO HOLDERS OF REDEEMABLE UNITSSeries 902EXPENSESFixed administration fees (note 6)Independent Review Committee feesInterest expenseForeign withholding taxes/tax reclaimsHarmonized Sales Tax/Goods and Services TaxTransaction 356–201,71819,15593,261Total expenses593,967500,924Increase (decrease) in net assets attributable to holdersof redeemable units from operations175,659,25348,129,978INCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLE TOHOLDERS OF REDEEMABLE UNITS FROM OPERATIONSPER SERIESSeries I175,659,25348,129,978Net gain (loss) on financial assets and liabilities at fairvalue through profit or lossSecurities lending (note 11)Net realized and unrealized foreign currency translation gain(loss)Total income (loss), netINCREASE (DECREASE) IN NET ASSETS ATTRIBUTABLE TOHOLDERS OF REDEEMABLE UNITS FROM OPERATIONSPER UNIT†Series IWEIGHTED AVERAGE NUMBER OF UNITS PER SERIESSeries (78,032,200)(32,186,300)(15,480,400) 209,790,394NET ASSETS ATTRIBUTABLE TO HOLDERS OFREDEEMABLE UNITS, END OF PERIODSeries IFor the periods ended December 31 (note 1),INCOMENet gain (loss) on financial assets and liabilities at fair valuethrough profit or lossDividendsInterest for distribution purposesNet realized gain (loss) on non-derivative financial assetsChange in unrealized gain (loss) on non-derivative financialassets2020649,897,158REDEEMABLE UNIT TRANSACTIONSProceeds from issueSeries IPayments on redemptionSeries ISTATEMENTS OF COMPREHENSIVE INCOME(in dollars except average ATEMENTS OF CASH FLOWS3.441.2151,105,34339,720,484For the periods ended December 31 (note 1),(in dollars)2021CASH FLOWS FROM OPERATING ACTIVITIESIncrease (decrease) in net assets attributable to holders ofredeemable units175,659,253Adjustments for:Net realized (gain) loss on non-derivative financial assets(6,323,765)Change in unrealized (gain) loss on non-derivative financialassets(158,292,585)Unrealized foreign currency translation (gain) loss(34,897)Other non-cash transactions(1,588,785)Purchases of non-derivative financial assets and liabilities(80,421,993)Proceeds from sale of non-derivative financial assets andliabilities87,357,413Accrued investment income and other(107,787)Accrued expenses and other (241,623)(243,552,553)22,352,684(257,004)–Net cash provided by (used in) operating activitiesCASH FLOWS FROM FINANCING ACTIVITIESProceeds from issue of redeemable unitsAmounts paid on redemption of redeemable 242,480,994(31,902,900)Net cash provided by (used in) financing activitiesUnrealized foreign currency translation gain (loss)Net increase (decrease) in cashCash (bank overdraft), beginning of 19,0919,767,483–94,1307,336,608CASH (BANK OVERDRAFT), END OF PERIODInterest paid(1)Interest received, net of withholding taxes(1)Dividends received, net of withholding taxes(1)(1)Classified as operating items.The increase (decrease) in net assets attributable to holders of redeemable units fromoperations per unit is calculated by dividing the increase (decrease) in net assetsattributable to holders of redeemable units from operations per series by the weightedaverage number of units per series.The accompanying notes are an integral part of these financial statements.52020

1832 AM Canadian Growth LP (continued)SCHEDULE OF INVESTMENT PORTFOLIOAs at December 31, 2021IssuerEQUITIES – 98.9%Communication Services – 7.8%Alphabet Inc., Class CMeta Platforms, Inc.Number ofSharesAverageCost ( )CarryingValue ( 12032,411,796 62,806,992Consumer Discretionary – 7.6%Amazon.com Inc.Dollarama Inc.Magna International Inc.NIKE Inc., Class BRestaurant Brands International 695,970,07614,972,7199,194,02951,220,219 61,696,547Consumer Staples – 7.6%Alimentation Couche-Tard Inc., Class ACostco Wholesale CorporationMetro Inc., Class ASaputo ,968,12046,563,401 61,258,275Energy – 4.0%Parkland Fuel CorporationSuncor Energy 18,61434,239,800 32,308,239Financials – 23.2%Brookfield Asset Management Inc., Class AIntact Financial CorporationNational Bank of CanadaRoyal Bank of CanadaToronto-Dominion Bank, ,067,67738,110,19537,720,22333,494,952135,836,735 187,862,342Health Care – 5.6%Danaher CorporationEdwards Lifesciences 2814,194,63526,426,073 45,760,063Industrials – 18.3%Canadian National Railway CompanyCanadian Pacific Railway LimitedTFI International Inc.Toromont Industries Ltd.Waste Connections 5,250,20116,112,17627,653,39229,783,824110,943,757 148,461,892Information Technology – 17.5%CGI Group Inc., Class AConstellation Software Inc.Descartes Systems Group Inc., TheKinaxis Inc.MasterCard Inc., Class AMicrosoft 1,377,22639,834,92193,354,510 141,785,084Materials – 6.2%CCL Industries Inc., Class BSherwin-Williams Company, 82,69932,132,825 50,502,521Utilities – 1.1%Fortis Inc.TOTAL EQUITIESTransaction CostsTOTAL INVESTMENT PORTFOLIOOTHER ASSETS, LESS LIABILITIES - 1.1%NET ASSETS – 100.0%147,4507,454,6058,998,874570,583,721 801,440,829(212,813)–570,370,908 801,440,8298,635,182810,076,0116

1832 AM Canadian Growth LP (continued)FUND SPECIFIC NOTESFor the periods indicated in note 1The Fund (note 1)Credit riskThe Fund’s investment objective is to provide long-term capital growth.It invests primarily in a broad range of Canadian equity securities. TheFund can invest up to 49% of its assets in foreign securities.The Fund did not have significant direct exposure to bonds anddebentures, money market instruments or preferred shares as atDecember 31, 2021 or December 31, 2020.The Fund may also invest a portion of its assets in funds managed bythe Manager and/or by third party investment managers (the“Underlying Funds”). In addition to the risks described below, theFund could be exposed to indirect risk to the extent that theUnderlying Funds held financial instruments that were subject to thebelow risks.Concentration riskBelow is a summary of the Fund’s concentration risk by carrying valueas a percentage of net assets.December 31, 2021December 31, 3.25.220.518.25.51.2Communication ServicesConsumer DiscretionaryConsumer StaplesEnergyFinancialsHealth CareIndustrialsInformation TechnologyMaterialsUtilitiesRisks associated with financial instruments (note 4)Interest rate riskThe majority of the Fund’s financial instruments were non-interestbearing as at December 31, 2021 and December 31, 2020. Accordingly,the Fund did not have significant direct interest rate risk exposure dueto fluctuations in the prevailing levels of market interest rates.Fair Value Classification (note 2)Currency riskBelow is a summary of the classification of the Fund’s financialinstruments within the fair value hierarchy.Below is a summary of the Fund’s direct exposure to currency risk.Amounts shown are based on the carrying value of monetary and nonmonetary assets and liabilities of the Fund net of currency contractsand short positions, as applicable.December 31, 2021EquitiesLevel 1( )Level 2( )Level 3( )Total( 440,829December 31, 2021CurrencyUS dollarGross currencyexposure ( )Currencycontracts ( )Net currencyexposure ( )Percentage ofnet assets 051,19930.7CurrencyGross currencyexposure ( )Currencycontracts ( )Net currencyexposure ( )Percentage ofnet assets (%)US 84,098,37328.3Level 1( )December 31, 2020EquitiesDecember 31, 2020Level 2( )Level 3( )Total( 5,579,601241,623642,171,114Transfers between levelsDuring the periods ended December 31, 2021 and December 31, 2020,there were no significant transfers between Level 1 and Level 2.Reconciliation of Level 3 financial instrumentsAs at December 31, 2021, if the Canadian dollar fluctuated by 10% inrelation to all other foreign currencies, with all other variables heldconstant, net assets attributable to holders of redeemable units of theFund would have decreased or increased by 24,905,120 orapproximately 3.1% of net assets (December 31, 2020 – 18,409,837 orapproximately 2.8%). In practice, actual results may differ from thissensitivity analysis and the difference could be material.Below is a summary of the movement in the Fund’s Level 3 financialinstruments.Beginning of periodPurchasesSales/Return of CapitalTransfers into Level 3Transfers out of Level 3Net realized gains (losses)Net change in unrealized gain (loss)*Price riskAs at December 31, 2021, approximately 98.9% (December 31, 2020 –98.8%) of the Fund’s net assets were directly exposed to price risk. Ifprices of these instruments had fluctuated by 10%, with all othervariables held constant, net assets attributable to holders ofredeemable units of the Fund would have decreased or increased byapproximately 80,144,083 (December 31, 2020 – 64,217,111). Inpractice, actual results may differ from this sensitivity analysis and thedifference could be material.End of periodDecember 31, 2021( )December 31, 2020( –––––241,623* Net change in unrealized gain (loss) for Level 3 financial instruments held as atDecember 31, 2021 and December 31, 2020 was nil and nil, respectively.Level 3 valuation techniquesBelow is a summary of the valuation techniques and the significantunobservable inputs used in the fair value measurement of Level 37

1832 AM Canadian Growth LP (continued)FUND SPECIFIC NOTESFor the periods indicated in note 1financial instruments. The significant unobservable inputs used in thevaluation of Level 3 financial instruments can vary considerably overtime depending on company specific factors and economic or marketconditions. Below also illustrates the potential impact on the Fund ifthe significant unobservable inputs used in the valuation techniqueshad increased or decreased by 5%, or in the case of Underlying Funds,5% (PY : 10%), with all other variables held constant. Certainsignificant unobservable inputs used in the valuation techniques arenot reasonably expected to shift and are indicated below as “n/a”.Securities where the reasonable possible shift in the significantunobservable inputs did not result in a material impact on the Fundare indicated below as nil. As at December 31, 2021, the Fu

Scotia U.S. Low Volatility Equity LP) 37 Notes to the Financial Statements 46 Management's Responsibility for Financial Reporting 47 Independent Auditor's Report . 1832 AM Canadian Dividend LP STATEMENTS OF FINANCIAL POSITION As at (in dollars) December 31, 2021 December 31, 2020 ASSETS Current assets Financial assets at fair value through profit or loss (note 2) Non-derivative financial .