Transcription

Management levelexamination blueprintIncorporating Management Case StudyExamination, E2, P2 and F2 Objective TestsObjective tests from January 2021 to January 2022Case study examinations in May, August, November2021 and February 2022

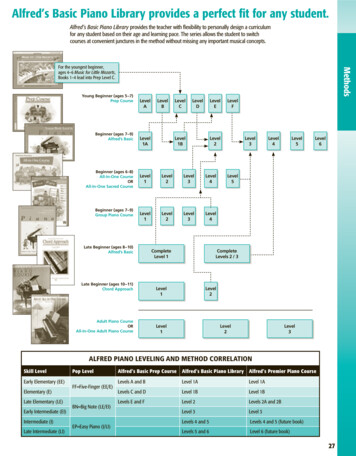

IntroductionBlueprints for the futureIn a rapidly digitising ecosystem the competenciesexpected from finance professionals are radicallydifferent. CIMA has been at the forefront of equippingfinance professionals with the aptitude and theattitude that drive businesses forward. And with the2019 CIMA Professional Qualification, we seek to givelearners the skill set and the mindset to be resilientand ready for the future.Passing each of the three levels of the CIMAProfessional Qualification is the litmus test againstwhich employers evaluate a candidate’s capabilities todrive organisational success.For the first time, CIMA is releasing blueprints for itsProfessional Qualification Examination. The blueprintswill demystify the examination — giving greater clarityon examinable topics; assessment approach, designand weightings; and learner expectations. Theblueprints won’t just aid learners taking theexamination, but will also orientate learning partnersand employers about the judging parameters and thecapabilities of finance professionals for tomorrow.The purpose — setting expectationsThe examination blueprints give learners the clearestexpression of what is expected of them in the CIMAProfessional Qualification Examinations. It tells learnerswhat to prepare for and how to prepare for the CaseStudy Examinations and the Objective Tests. Workingin tandem with the syllabus document, it aids thelearner in anticipating the type of questions to expectin the examination.1Along with explaining the Examinations’ key features, itlists the competencies, skills and knowledge necessaryto pass the Case Study Examination and ObjectiveTests; apprises educators about the knowledge andskills needed to pass the examination; alignsemployers with the capabilities of the candidates; and,above all helps us keep the examinations current,relevant and up to date with the latest standards.As our most comprehensive statement to date onCIMA Professional Qualification Examinations, one ofthe core purposes of the blueprints is to assist learnersin getting into the mindset the examination demands.Improving employability — now andin the futureThe purpose behind the updated 2019 CIMA ProfessionalQualification is to ensure the relevance of the financeprofessional. In a business environment where digitisationis reshaping and reimagining more and more roles, weare looking to build capabilities, enhance competencies,drive the employability and add to the confidence of aCIMA qualified finance professional.For learners at the Management level, the blueprint willintroduce them to the skills they will need to translatelong-term decisions into medium-term plans. In thesame way that a finance professional working at thislevel, learners will be shown how to use technologyand data to manage organisational and individualperformance, allocate resources and prepare financialstatements to show performance, among otherresponsibilities.The ‘I Can’ statements, which reflect the competenciesof a learner at the end of a Case Study Examinationand the representative task statements that emergefrom the successful completion of Objective Tests,correspond directly with what employers are lookingfor and businesses need to transform and thrive.

Arriving at the blueprintAs automation and digital platforms take over and reshapesome of the core finance functions, we wanted tounderstand the future of the profession. We set outon a year-long research — consulting with financeprofessionals across the world to learn what the futureof finance looks like and, more importantly, whatbusinesses need to thrive.In a digitally disrupted business environment, it’s evenmore important that finance professionals shift their focusfrom foundational and intermediate proficiency level,to applying a higher-level expertise. The 2019 CIMAProfessional Qualification is a result of these researchfindings and has been designed to drive employabilityand continued growth.The CIMA Professional Qualification is made up of threelevels — Operational, Management and Strategic. Eachlevel imparts the knowledge and business acumenthat’s expected from a finance professional working at anentry level, managerial level or at a senior leadership level.At the end of each level, learners have to take a CaseStudy Examination — a business simulation of real-lifejob tasks that someone at that level is expected toperform. In addition, the purpose of the Case StudyExamination is to assess the candidate’s proficiency inthose specific skills that are less likely to be automated.The Case Study Examination blueprints articulate thebusiness simulation through the core activities andassessment outcomes. The Objective Test blueprintsstate the job tasks through the representative taskstatements. As a result, learners are clear about thebasis for each type of assessment.Management level examination blueprint 2

Getting the skill sets and the mindsetthat matterThe fundamentals and the skills acquired througheach subject will be tested in the Objective Tests.Questions can be asked across the whole breadth ofthe Syllabus and the tests are weighted based onremembering, understanding and application withsome analysis and evaluation in highly structuredscenarios. Learners must pass the Objective Tests tomove on to the Case Study Examination.While the Objective Tests check that learners have thebest knowledge and skill set to tackle a situation,what’s equally important is having the right attitudeand mindset to affect and influence decisions, actionsand behaviours. The Case Study Examination giveslearners ample opportunities to demonstrate thesetraits and an awareness and understanding of theirsimulated organisation and the ecosystem in which itoperates. To be successful in the examination — andby extension in the real world of work — a learner isalso required to demonstrate qualities andcompetencies such as leadership, professionaljudgement and ethical awareness.The Case Study Examination —demonstrating the aptitude andthe attitudeThe Case Study Examination tests the knowledge, skillsand techniques from the three pillars within onesimulated scenario and is taken at the end of eachlevel of the CIMA Professional Qualification. Candidatesare given a fictional Case Study before the examinationand are expected to give solutions to the situationsand challenges presented within the examination —based on the knowledge and skills acquired from thethree subjects. The Case Study mimics their role in areal-work scenario, at each level of the qualification.The Management level Case Study Examinationsimulates the role of a finance manager. Learners whocomplete this level are awarded the Advanced Diplomain Management Accounting.3Driving employability through simulationCase Study materials are provided well in advance ofthe actual examination so that learners can immersethemselves into its context. The pre-seen materialsprovide an opportunity for learners to consider theirprevious studies in the context of the workplace andexplore the links between the individual subjects aspart of their research and preparation for the CaseStudy Examination. The Case Study Examinationpresents challenges and situations that a financeprofessional will encounter and employers haveidentified as critical at that level.The Management level Case Study Examination assessesthe learner on five core activities that are the most frequent,important and critical to the work of the finance manager.These include evaluating opportunities to add value,implementing senior management decisions, managingperformance and costs to aid value creation, measuringperformance and managing internal and externalstakeholders. Successfully completing these activities isdirectly reflected in the ‘I Can’ statements that showcasethe competencies acquired by a successful learner.The CIMA Professional Qualification ExaminationBlueprints are pointers to the direction the future offinance will take. With the needs of the employer andof a digitising business landscape at its core, the 2019CIMA Professional Qualification seeks to build capabilities,future-proof skills, improve employability and createfinance professionals who will be navigators ofdisruption. It is yet another step from CIMA to help andpartner you in leading the transformation — go beyondlimits, beyond insights and beyond expectations.

Contents5.Outline6.Effective dates and examinable standards24. Acquiring the knowledge, skills and techniquesrequired for the finance manager role —Management level Objective Testsw Examination period coveredw Test purposew International Accounting Standards andExposure Draftsw Understanding the blueprint7.Developing the exam blueprints8.Management level examination — An overvieww The CIMA Professional Qualificationw CIMA’s approach to assessmentw Management Case Study Examinationw Management level Objective Tests11. Assessing skillsw Skill levels and verbs14. Simulating the role of the finance manager —The Management Case Study Examinationw Examination purposew Objective Tests blueprintsw E2: Managing Performancew P2: Advanced Management Accountingw F2: Advanced Financial Reportingw Examination approachw Structure and formatw Item typesw Reference materialsw Marking, grading and feedbackw Candidate experience49. Glossary50. Appendix — International accounting standardsw The simulationw Simulating the role of the finance functionw Finance manager — simulating the rolew Finance manager — simulating the jobtasksw F inance manager — mindset of the CIMAfinance professionalw Understanding the blueprintw Management Case Study Examination blueprintw Examination approachw Structure and formatw Item typesw Reference materialsw Marking, grading and feedbackw Candidate experienceManagementStrategic level examination blueprint 4

OutlineThis is the examination blueprint for the Managementlevel of the CIMA Professional Qualification. It will setout in detail what is examinable in the Case StudyExamination and the Objective Tests for the periodstated on the cover of this document. It also providesinformation about the format, structure and weightingsof the assessments. It complements the syllabusdocument and provides details specifically related tothe different type of assessments and is our mostcomprehensive statement to date on CIMA’sexaminations.The purpose of the examination blueprint is to:w Explain the key features of the examination.w Describe how the examination was developed inconsultation with employers.w Document the competencies, skills and knowledgenecessary to pass the Case Study Examination.w Assist learners in preparing for the examination.w Apprise educators about the knowledge and skillslearners will need to pass the examination.w Apprise employers of what passing learners can do.w Guide the development of examination tasksand questions.5This blueprint sets out the examinable content andassessment structure for the Management level CaseStudy Examination and Objective Tests for:w E2: Managing Performancew P2: Advanced Management Accountingw F2: Advanced Financial AccountingYou can find the blueprints for the Operational andManagement level at cimaglobal.com/examblueprints.For more information on the operational andadministrative aspects of the examination pleaserefer to cimaglobal.com.

Effective dates andexaminable standardsThe blueprint is based on the 2019 CIMA ProfessionalQualification Syllabus and was examined for the firsttime in November 2019 with the Objective Tests and inFebruary 2020 with the Case Study Examinations.Examination period coveredObjective tests from January 2021 to January 2022Case study examinations in May, August,November 2021 and February 2022This is the second release of the examination blueprintfor the 2019 Professional Qualification Syllabus. Anyupdates to the blueprint document in futurepublications will be detailed here.Version numberDate first publishedSummary of changes131 January 2019N/A1.130 August 2019Page 28 — E2 deleted duplicate section 3. How tomanage relationships.Page 44 — F2 corrected section 1.c to ‘TheInternational integrated reporting framework’.Page 47 — P2 delete bullet point ‘Learning Curve’.Other minor weblink updates.231 July 2020Cover - updated examinable period datesPg 21, 47, 48 - minor text and web link changesAppendix - update mapping for IFRS 15, and IAS 38International Accounting Standardsand Exposure DraftsThe examination will be set in accordance withrelevant International Accounting Standards andInternational Financial Reporting Standards. This alsoapplies to the material relating to Financial ReportingExposure Drafts.For Case Study Examinations, where individualstandards will not normally be directly assessedand where marking can accommodate a variety ofapproaches, learners may refer to new standards beforethe effective date where early adoption is permitted.As a general rule, CIMA will examine such standardsfrom the effective date. Details of specific standardsthat are examinable for the period covered by thisblueprint document will be clearly stated in theObjective Tests blueprints below.Management level examination blueprint 6

Developing theexam blueprintsWith new technology and digital platforms playing agreater role in the way businesses and their financefunction operate, we wanted to identify the futuredirection of the finance function. The year-long researchspanning 150 countries featuring over 5,500 financeprofessionals in 200 organisations opened up insightsinto the future of finance and more crucially anunderstanding of the future needs of businesses andemployers globally. The 2019 CIMA ProfessionalQualification is rooted in this research and its findings.The updated syllabus sets out the body of knowledge,skills and techniques that employers andorganisations value and need.By collaborating with learning partners, test designexperts and psychometricians, we translated the syllabuscontent into core activities, assessment outcomes andrepresentative task statements. Based on this, weproduced the draft blueprints that provides a clearerdirection on the approach to be taken in examinations.We discussed the draft with learning providers and keystakeholders and as a final step surveyed CIMAmembers worldwide to validate the draft and to informthe final decisions about the blueprints and examinationdesign such as weightings.7These extensive discussions and multiple layers ofconsultations ensured that what is included andemphasised are indeed the knowledge, skills andtechniques that are most in-demand with employers.At the heart of it, both the syllabus and the blueprintswork together to drive employability andorganisational performance.The blueprints will be reviewed and updated on anannual basis to ensure CIMA’s Examinations remainfocussed on the skills that organisations most value intheir finance professionals.You can get the PDF with the full details of the research,here: Accounting in extraordinary times: the futureof finance

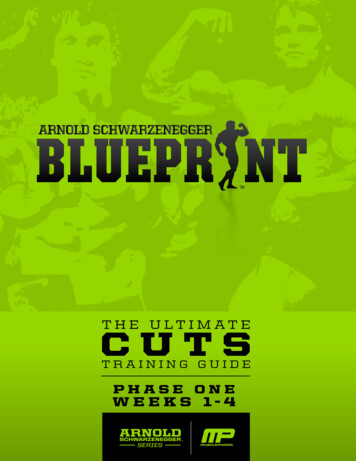

Management levelexamination — an overviewThe CIMA Professional QualificationOur overriding objective in designing the CIMAProfessional Qualification is to enhance theemployability of learners and members by creating alearning system that enables them to acquire skills,competencies and the mindset that are in high demandwith employers. This is more important than ever,keeping in mind the increasing pace of change andtraditional roles being redefined by technology anddigital advances.The CIMA Professional Qualification is divided intothree levels — Operational, Management and Strategic.Each of these levels consists of three pillars of domainknowledge — Enterprise, Performance and Financial.Passing each level of the qualification confirms acandidate’s capabilities to perform the tasks at thatlevel in the workplace to the highest standards. Whencombined with the required practical experience, theCIMA Professional Qualification ensures that membersare ready to support and lead their organisations,through the challenging environment of continuouschange. The syllabus, assessments and practicalexperience requirements ensure members are not onlycompetent in the essential accounting, finance andbusiness-related skills, but also in the skills required tolead the finance function in a digital age.The Management level focuses on the role of thefinance manager and focuses on translating long-termdecisions into medium-term plans. Candidates will beable to use data and relevant technology to manageorganisational and individual performance, allocateresources to implement decisions; monitor and reportimplementation of decisions; as well as prepare andinterpret financial statements to show performance.Management level examination blueprint 8

AWARD: Membership of the Chartered Institute of ManagementAccountants (ACMA/FCMA) and the CGMA designationAssessment of practical experience requirements (PER)StrategiclevelManagementlevelStrategic Case Study alStrategyAWARD: CIMA Advanced Diploma in Management Accounting (CIMA Adv Dip MA)E2P2F2ManagingPerformanceAdvanced ManagementAccountingAdvanced FinancialReportingOperationallevelAWARD: CIMA Diploma in Management Accounting (CIMA Dip MA)Operational Case Study ExamE1P1F1Managing Financein a Digital ise pillarCertificatelevelFinancial pillarAWARD: CIMA Certificate in Business Accounting (CIMA Cert BA)BA1BA2BA3Fundamentals ofBusiness EconomicsFundamentals ofManagement AccountingFundamentals ofFinancial AccountingBA49Performance pillarFundamentals of Ethics,Corporate Governance and Business LawPractical experience / lifelong learningManagement Case Study Exam

CIMA’s approach to assessmentManagement level Objective TestsEach level of the CIMA Professional Qualificationculminates in a Case Study Examination, which integratesthe knowledge, skills and techniques from across thethree pillars into one synoptic capstone examination. TheCase Study Examination is a role simulation. It requirescandidates to perform authentic work-based activitiespresented during the course of the examination,drawing together learning from each of the threesubjects to provide solutions to the issues andchallenges asked. Case Study material is provided inadvance, so that learners can immerse themselves inthe fictional organisation and industry for thesimulation and can analyse the organisation’s currentposition prior to the examination.Three Objective Tests underpin the Management CaseStudy Examination, one for each of the professionalqualification subjects. The Case Study Examinationcan only be attempted after all Objective Tests for thelevel have been completed successfully or exemptionshave been given.The Case Study Examination, at each level, simulatesthe job role linked to the level and focusses on the coreactivities which employers expect competentindividuals in those roles to perform.Objective Tests for each of the individual subjectsensure the acquisition of the breadth of knowledge,skills and techniques which provide the foundation forapproaching the Case Study Examination.Management Case Study ExaminationWithin each level, learners are free to study and takeObjective Tests in any order they wish. CIMA’ssuggested order of study is to begin with theEnterprise pillar subject, then move to the Performancepillar subject and then to the Financial pillar subject.The qualification has been designed so that, at eachlevel, the Enterprise pillar gives the broad context inwhich the Performance and Finance pillars operate.The Performance pillar provides the context of whatManagement Accountants do within an organisationand the Finance pillar considers the reporting and theimplications of this activity. It is for these reasons thatthis order is suggested.For example, CIMA would recommend studentsstudying the Management Level to start with E2, thenmove to P2 and then to F2 before sitting theManagement Case Study examination.At the Management level, the role simulated is that of afinance manager. The capstone Case StudyExamination provides a simulated context allowingcandidates to demonstrate that they have acquired therequired knowledge, skills, techniques and the mindsetrequired for that role.The Advanced Diploma in Management Accounting isawarded at the completion of the Management CaseStudy Examination.Management level examination blueprint 10

Assessing skillsCIMA has adopted a skill framework for theassessments based on the revised Bloom’s Taxonomyof Education Objectives. Bloom’s Taxonomy classifiesa continuum of skills that learners are expected toknow and demonstrate.Footnote:Bloom’s taxonomyRevised taxonomy see Anderson, L.W. (Ed.), Krathwohl, D.R. (Ed.), Airasian, P.W., Cruikshank, K.A., Mayer, R.E., Pintrich,P.R., Raths, J., & Wittrock, M.C. (2001). A taxonomy for learning, teaching and assessing: A revision of Bloom’sTaxonomy of Educational Objectives (Complete Edition). New York: Longman. For original taxonomy see Bloom, B.S.(Ed.), Engelhart, M.D., Furst, E.J., Hill, W.H., & Krathwohl, D.R. (1956). Taxonomy of educational objectives: Theclassification of educational goals. Handbook 1: Cognitive domain. New York: David McKay.11

Skill levels and verbsThe following table details the verbs included in theblueprints for both Objective Tests and Case StudySkill levelExaminations and maps these to the four skill levelsthat will be used for the purposes of assessment:Verbs usedDefinitionLevel 5EvaluationThe examination orassessment of problemsand use of judgement todraw ctCounsel, inform or notifyEvaluate or estimate the nature, ability or quality ofAppraise or assess the value ofPropose a course of actionAssess and evaluate in order, to change if necessaryChoose an option or course of action afterconsideration of the alternativesLevel 4AnalysisThe examination and studyof the interrelationships ofseparate areas in order toidentify causes and findevidence to support inferencesAlignAnalyseCommunicateCompare roduceArrange in an orderly wayExamine in detail the structure ofShare or exchange informationShow the similarities and/or differences betweenApplicationThe use or demonstrationof knowledge, concepts inePerformPrepareReconcileRecordPut to practical useAscertain or reckon mathematicallyOrganise and carry outProve with certainty or exhibit by practical meansAscertain or establish exactly by research or calculationCarry out, accomplish, or fulfilMake or get ready for useMake or prove consistent/compatibleKeep a permanent account of facts, eventsor transactionsApply a technique or conceptLevel 3UseLevel1/2Remembering andunderstandingThe perception andcomprehension of thesignificance of an areausing knowledge strateListRecogniseStateOutlineUnderstandGrow and expand a conceptExamine in detail by argumentInspect thoroughlyObserve and check the progress ofPlace in order of priority or sequence for actionCreate or bring into existenceGive the exact meaning ofCommunicate the key features ofHighlight the differences betweenMake clear or intelligible/state the meaning orpurpose ofRecognise, establish or select after considerationUse an example to describe or explain somethingMake a list ofIdentify/recallExpress, fully or clearly, the details/facts ofGive a summary ofComprehend ideas, concepts and techniquesManagement level examination blueprint 12

Simulating the role of a financemanager — the ManagementCase Study ExaminationExamination purposeThe simulationThe CIMA Case Study Examinations are capstoneexaminations designed to demonstrate mastery ofpreviously acquired knowledge, skills and techniquesand the drawing together of these to provide solutionsto unstructured problems. By their position and designthey are synoptic.The simulation is made up of three broad parts:w The role of financew The role simulatedw The job tasks simulatedEach synoptic assessment combines the contentcovered in the three pillar subjects at the level into asingle assessment. Its aim is the “undoing” of the pillarand subject divisions of the syllabus and the applicationof knowledge, skills and techniques together with themindset of a CIMA finance professional. It challengeslearners to provide solutions to the type of problemsthat they would encounter in the workplace for the jobrole matched to the level of the professional qualification.The simulation will require learners to demonstratethat they have acquired the knowledge, skills andmindset of the CIMA finance professional along withan appreciation of the impact of the features of thesimulation (the context, organisational structures andenvironment and ecosystem within which theorganisation operates).The examination uses a simulated Case Study toprovide a rich, immersive scenario to prepare and toprovide a context for the tasks in the examination.The scenarios are developed around today’s modernbusiness environment and the challenges thatcandidates will face — allowing them to demonstratethe core activities that have been identified byemployers as critical.Examination tasks will be practical and applied, nottheoretical or academic. To be successful, candidateswill have to perform the core activities in the same wayand to the same standards that would be valid andvalued in the workplace.Management level examination blueprint 14

Simulating the role of thefinance functionThe finance function has a mandate to go beyond its corehistorical accounting role. This changing mandate doesn’tdiscard core accounting; it’s still an essential foundationof the finance function. However, enabled by newtechnologies, the function is now capable of assessinga broader range of information and is becoming amore influential player within an organisation.At the heart of the finance function are basic activities— the function’s DNA. Whether you are assessingfinance risk, reconciling accounts or compilingmanagement information reports, the processactivities remain constant.Figure 1: Basic finance activities from information to ce worksin isolationMore automatable activitiesAt all levels of the CIMA qualification, learners areexpected to create information, insight, influence andimpact. However, the scope, reach and the nature of thisactivity varies by level and is defined in the role simulationand by the core activities defined for that role.15ApplyInfluenceImpactAcumenFinance workswith othersLess automatable activities

Finance manager — simulating the roleThe role simulated is that of a finance manager.As a manager withresponsibility for monitoringand implementing of strategythe job focus is on the mediumterm. This involves translatingthe long-term strategy that hasbeen decided at the seniormanagement/board level intomedium-term, tactical goals,making full use of technologiesto derive information that canbe of value in evaluatingbusiness opportunities,including the implementationof cyber technologies in orderto evaluate businessprocesses and to create andenhance value for thecompanyThe manager has to collaborate with colleagues from finance and other disciplinesto make decisions concerning investment projects, product development andproduct pricing and relies on the output of junior colleagues on matters suchas cost drivers to formulate optimal recommendations. The responsibilitiesrequire a sound understanding of the business environment, including theopportunities arising in the digital ecosystem, and the manager is required tomeasure and report on the performance of individuals and divisions. There isalso an expectation to evaluate business risksBeing involved in the accountingdecisions that affect thepreparation and content of theconsolidated financialstatements prepared by thecompany, the manager’s dutiesrequire the exercise ofprofessional judgement, asrecommendations and decisionscan have a significant impact onthe actions of both internal andexternal decision-makers. Themanager’s successfulperformance requires strongcommunication skills. The needto inform key decisions may raisesignificant ethical dilemmas thatmust be resolved in a justifiableand professional mannerManagement level examination blueprint 16

Finance manager — simulating thejob tasksFinance manager — mindset of theCIMA finance professionalWithin each Management Case Study Examination,five core activities will be assessed. These coreactivities represent the tasks that are most frequent,critical and important to the role of a finance manager.The Case Study Examination allows the opportunity todemonstrate technical knowledge applied to a scenario.But in order to respond fully to the given scenario andproblems to add value to the simulated organisation,candidates will need to ensure that they have theattitude and mindset to affect and influence their owndecisions, actions and behaviours and those of otherswithin the organisation. They must also have anawareness of the environment in which theorganisation is operating and the increasingly digitalecosystem.The five core activities are:A. Evaluate opportunities to add value.B. Implement senior management decisions.C. Manage performance and costs to aid value creation.D. Measure performance.E. Manage internal and external stakeholders.The core activities are linked to associated assessmentoutcomes expressed in terms of ‘I Can’ statements.These statements reflect the skills and competenciesthat drive the employability of successful candidates.17Enabling qualities and competencies

level imparts the knowledge and business acumen that's expected from a finance professional working at an entry level, managerial level or at a senior leadership level. At the end of each level, learners have to take a Case Study Examination — a business simulation of real-life job tasks that someone at that level is expected to perform.