Transcription

Epicor EnterpriseResource PlanningFinancial Management

Epicor ERP Diagramss Intelligence and AnalyticsBusinek, and Compliarnance, RisnceGoveHuman CapitalManagementService and AssetManagementFinancialManagementriness A chitectureBusCustomer RelationshipManagementERPProduction ManagementSales ManagementProductManagementSupply ChainManagementPlanningand SchedulingProjectManagementtGlobal Business Managemen2

Financial ManagementFinancial ManagementXX General LedgerXX Advanced AllocationsXX Financial PlanningXX Accounts ReceivableEpicor Financial Management offers a refreshing new approach to business. Asuite of accounting applications built for insight, automation, and compliancein an increasingly global business world, it is built around a series of “globalengines” that support effective financial management and control anywhere.XX Credit Card ProcessingXX Credit and CollectionsXX Accounts PayableXX Bank Electronic PaymentsXX RebatesOur goal is to help every business go beyond sound financial management andcontrol to efficiently deliver real value. Epicor Financial Management gives youaccess to real–time fiscal information and provides the modern platform youneed to support business around the world.XX Tax Connect and Tax Connect GlobalXX Cash ManagementXX Asset ManagementXX Advanced Financial Reporting3

Financial ManagementGlobal Engines(for example, US GAAP and non- GAAP,200 characters available, Epicor gives youEpicor Financial Management is built aroundetc.), and comprehensive consolidations.the flexibility to manage your financiala series of unique global engines, which inEpicor Financial Management provides theoperations exactly as you need.turn support the global nature of businesstools to seamlessly handle the accountingtoday, enabling effective operations inrepresentations from your variousBalance Controlsexisting and new markets—as necessary.subsidiaries while at the same time givingEpicor Financial Management allows usersAt the heart of the Epicor solution, Epicoryou a consolidated view of the one versionto define the frequency at which balancesglobal engines are designed to addof the financial truth for your organization.on accounts are captured and stored. Oftenused to facilitate the calculation of Averageaccounting agility and flexibility to yourbusiness while simultaneously allowingKey highlights and benefits of using MultipleDaily Balances, this flexibility enablesyou to meet the local financial and legalBooks within your company:the user to update account balances asfrequently as required by the organization:compliance requirements of individualmarkets. Complete functionality includes:Chart of Accounts: Create different chartby hour, by day, by week, or by month.of accounts by book, post transactions toXX Rules-based posting enginedifferent accounts within different booksConsolidations and EliminationsXX Configurable tax enginesimultaneously using the posting engine.Epicor Financial Management meets theXX Legal numbering engineneeds of businesses today through integralXX Multicurrency engineReporting Currency: Have a differentfinancial consolidation at either a summaryXX Rounding enginereporting currency tied to each book andor detailed transaction level, providingeven, if ever needed, assign a differentthe flexibility to consolidate from differentGeneral Ledgerperiod calendar to each book. This flexibilitybooks and/or companies within aEpicor General Ledger (GL) is the heart ofallows users with a single journal to processdefined relationship.Epicor Financial Management, processingboth the management accounts and theand posting all accounting transactionsstatutory accounts at the same time withoutcreated throughout Epicor applications,the need for multiple transaction entry.XX Merge balances (and underlyingtransactions) from one or more booksinto a single consolidated view ofas well as entries made directly within theledger. The information and controls whichMultiple Closing Calendars: As businessesfinancial information, from whichflow from the General Ledger system enableacquire new businesses there is often a needfinancial reports may be prepared, whilean organization to operate efficiently,to maintain different calendars for “stub“at the same time creating the supportingcomply with fiscal regulations, underpinperiods or for example up to 18 months toelimination journal entries as a result ofstrong corporate governance, and drivebring the acquired company in line with theenterprise performance. This powerful GLfiscal calendar of the acquiring business. Eachapplication provides the accounting controlsestablished book can operate a completelyfinancial results based on the differencesand system security necessary to help ensureindependent fiscal calendar as applicable.in the consolidated currencies usingdiffering rates types (e.g., spotthe integrity of your company’s financialdata. Complete functionality includes:the process.XX Re-measure accounting transactions andCalendar Adjustment Period: Generalfixed, etc.).Ledger has built-in support for an additionalMultiple Booksyear-end period to be defined as a part ofAt the core of the General Ledger, Epicoryour calendar that will be used for year-endAdvanced AllocationsFinancial Management provides flexibleadjusting entries.Automation and control of repetitiveprocesses is one of the major benefitsfinancial accounting representations throughmultiple book functionality, which flowsChart of Accountsof using a Financial Management Suite.all the way through to financial reportsEpicor Financial Management allows upManual processes such as monthly allocationand statements. “Multiple Books“ allowsto 20 user-definable segments within theand accrual entries slow down closing cyclesthe establishment of unlimited financialchart of accounts (COA). These can be usedand introduce multiple points of inaccuracybooks to support a wide variety of financialfor accounting and reference purposesor error. Epicor Advanced Allocationsrequirements, such as budgeting andproviding the ability to record, store, allocateautomatically computes cost and revenueforecasting, statutory and governmentand report on important financial dataallocations and the resultingaccounting versus management accountingat a highly granular level. With a total of4

Financial Managementjournal calculations, streamlining processes,analysis. EFP features a web interface withreceiving process, and will then have theirincreasing relevance and improving accuracy.a clear design that is available from multiplevalue applied as part of the settlementThis results in shorter close cycles and moremobile devices, while the Microsoft Excelprocess. The Debit Notes may be related toaccurate financial statements. Advancedadd-in helps with a more sophisticatedspecific invoices or remain unassigned.Allocations allows for sophisticateddata entry using the functions, conditionalallocation of cost and revenue to multipleformatting or even charting for representingThe new Debit Note will remain as anprojects or departments or locations—data. All the models, budget plans, scenariosopen receivable until matched to a creditultimately to any entity represented in yourand the data extracted from the ERP systemmemo or subsequently paid. In addition,corporate financial accounting structure.are stored on highly reliable cloud servers.Debit Notes sent by customers can beGL Allocations helps your finance staff toBy being connected to the data in yourrecorded independently of the cash receiptcreate, execute, retain, and reuse allocationsERP system, EFP has the ability to pull inprocess - for example, electronically receivedto greatly simplify what can be an otherwiseinformation—such as previous actuals—inpayments. They can then either be appliedtime-consuming and error-prone task.order to carry out comparisons and utilizesor produce an unapplied cash value.them in the spreading function. This makesAn Allocation History Tracker keeps ait incredibly simple and intuitive for plannersInterest Invoicesdetailed history of allocation runs whichtasked with carrying out budgeting tasks,Create and apply interest invoices toprovides a comprehensive view of eachfreeing them to concentrate on value addedmanually charge an interest amount toAllocation run and all GL transactionstasks. Optional packages extend EFP withan overdue or late-paid invoice. Select acreated grouped by batches and tiers. Thecash flow analysis, capital expenditurecustomer and choose the single or multipleapplication allows for allocation reversal(CAPEX), profitability analysis, consolidation,invoice lines against which to generate thedirectly from the Allocation History Tracker.sales budgeting and more.interest invoice. Additionally, finance chargeson invoices can be generated against aAdvanced Allocations allows you to:XX Allocate an amount in a single accountto one or more accounts.XX Allocate balances or transactions usingstatic or dynamic calculations.XX Pool accounts for allocation using adirect update or offset account.XX Make allocations based on statistical dataXX Base allocations on Business ActivityXX Microsoft Excel toolsetcustomer’s overdue invoice balance. UsersXX Integrated budget approval workflowhave the ability to include or exclude theXX Pre-built templatesimpact of credit memos when calculatingXX In-built securityfinance charges.XX Real time collaborationXX Live forecastMultiple Payment InstrumentsXX Financial and operational modelsTrack the different types of creditXX Drill down and drill throughinstruments such as Promissory Notes andAccounts Receivablepost-dated checks and their correspondingstatus, from initial generation or receiptQuery (BAQ)- derived dynamic data suchAccounts Receivable (AR) provides athrough to clearance/ settlement. Track theas monthly revenue, help desk servicecomprehensive set of tools to managemovements of the payment instrumentscalls per month, etc.your invoicing, credit, cash management,and generate status change updates withinand customer management needs. Withthe Accounts Payable and ReceivableAccounts Receivable, you know who isapplications, these changes can be reflectedbuying what and who is paying their billsin the General Ledger to properly record toon time.the financial status of the asset or liability.XX Structure hierarchical or tiered allocationsto run sequentially.XX Create and post allocation journals orsimply use the output of the calculationselsewhere within the system.XX Maintain allocation history for reuse,review, and analysis.XX Reverse allocations where required byYou can track how your customer credit isInvoice Entrymaintained through the life of the paymentEnter multiple shipments for an orderinstrument reflecting the available crediton a single invoice, and write unlimitedbased on the status and final settlementsimply selecting the original allocationcomments. Invoice entry supports advance/of the payment instrument. By using thisand flagging it for reversal with a user-progress billing deposits, credit memos, andfunctionality, you can be assured thatdefined apply date.standard invoices.complex, settlement-related taxes arecorrectly handled when payment is made viaFinancial PlanningDebit Notespayment instruments.Ability to record Debit Notes (Chargebacks)Epicor Financial Planner (EFP) is a fully cloudsent from the customer. Debit Notes maybased solution for financial planning andnow be entered as part of the AR cash5

Financial ManagementInvoice Logging and Numberinginvoices for posting instead of selecting allThe potential discount is then included inLogging allows the recording of invoiceavailable items at once.the tax values calculated for VAT.invoice is in the process of of review andCredit Manager WorkbenchTerms and Conditionsapproval. This allows you to reclaim theEasily view all credit-related informationEpicor supports all of the most commoninput tax in a timely fashion, where suchsurrounding a customer. The credit managerbusiness practice terms and conditionspractices are allowed. When an invoice isworkbench provides a single point fromwithin Accounts Payable and Receivable.created, users have the flexibility to allowwhich to manage credit status, order creditThis feature also affords great flexibilitythe system to automatically generate invoicestatus and account management, withfor the definition of creative receipt andnumbers or you can manually enter numericdrilldown to all associated information.payments terms within countries where thisdetails with applicable input tax while thefunctionality is not necessarily demandedor alphanumeric invoice numbering schemesat the invoice type level.National Accounts (HQ Accounts)but may offer a competitive advantage.The National Accounts (HQ Accounts)Terms and Conditions are user defined, butAging Information andCustomer Reminderfeature provides the ability to createtypically include; End of month plus n days,customer relationships, either hierarchical orEnd of following month, Specific due datesView aging information on the screen orthe more traditional parent/child type, withinin a month, 2% 10 days and Net 20 days.print it in one of several formats. AccountsAccounts Receivable. This functionalityReceivable offers Customer Reminderallows customers within a National Accountfeatures that allow companies to track thegroup to accept invoice payments fromElectronic Report Formatsand Transmissionhistory of their customers’ AR balancesany customer within the relationship. TheSubmit various legal reports electronically,together with the option to issue them user-functionality also permits extensive creditwhich are based on existing reports such asdefined reminder letters.checking across the National Account groupthe EU Sales List, Intrastat and Tax Reporting.with credit available to be split across levelsYou can then reformat generic reports towith or without variable pooling.meet your local requirements.generated against a customer’s overdueFlexible Tax EngineComplete functionality includes:invoice balance. These finance chargesEpicor Financial Management contains aare automatically calculated based onfeature-rich flexible Tax Engine which allowsXX Cash receiptsrules defined within the Finance Chargebusinesses to configure Epicor applicationsXX Interest invoicesMaintenance program. The charges can alsofor local and international financial reportingXX Invoice GL account definitionbe reviewed before they are posted.standards, as well as unique local taxXX AR transaction adjustmentsjurisdictions. Tax tables within the Tax EngineXX Deferred revenueBill-To Customerinclude the ability to define or override rateXX Consolidated invoicingProvides the ability for a customer toeffective dates. The Sales Tax Register listsXX Automatic credit holdsmaintain a list of allowed Alternate Bill-toinvoice totals and tax amounts by customerXX Invoice/statement forms(Alt-BT) customers, optionally with onefor codes on file.XX Invoice-based sales commission paymentAutomatic Finance ChargesFinance charge invoices can nowXX Multi-format sales analysisset as a default. This will default ontothe Quote/Order/Direct Invoice and canSettlement Currenciesbe changed by the user to a differentYou can record currency gains and lossesauthorized bill-to customer prior to postingat the time of settlement. Through thisXX Settlement currenciesthe invoice. If no alternates have been setfunctionality, you post amounts correctlyXX Settlement discountsup then the Alt-BT customer is the sold-towhen you invoice in one currency but areXX User-friendly invoice and customer trackercustomer (but using the ‘Bill-to address’ onpaid by the customer in another currency.XX General Ledger interfaceXX Credit card management andauthorizationXX Cash management interfacethat customer).Settlement DiscountsXX Reconciliation reportManual Selection of InvoicesThe application contains two methods forA manual selection option to get Invoiceshandling early settlement discounts on salesand Recurring Invoices is available withinand tax values. The settlement amount isCredit Card ProcessingInvoice Entry. This allows the selection oftaken by the customer on the AR invoice.The Epicor ERP Credit Card Processingmodule gives access to several componentsparticular or multiple invoices or recurringthat cover credit card processing6

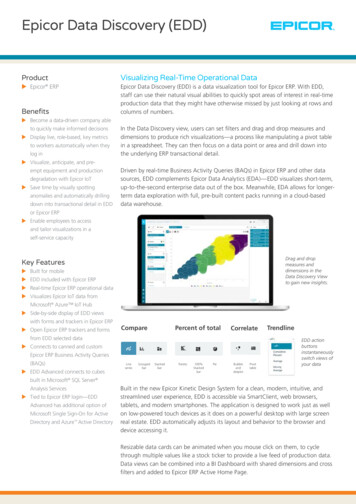

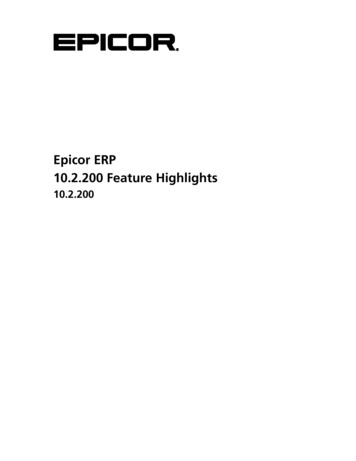

Financial Managementneeds–available directly with Epicor ERP.These components are:XX Cloud Retail Environment (CRE)XX Epicor Payment GatewayXX Epicor Payment Exchange (EPX)Cloud Retail Environment (CRE) is a newpayment application. It provides a servicethat receives the transaction informationfrom Epicor and then sends the request tothe Epicor Payment Gateway.The Epicor Payment Gateway serviceconnects Epicor ERP to the credit cardprocessing network in the cloud andtransmits the requests of a credit cardpayment transaction to the gateway.Figure 10.1 Credit and Collections—Improve cash flow and reduce receivables balances.Epicor Payment Exchange (EPX) connectsto full merchant services and creditprocessing businesses to perform credit cardFor processing transactions in Canada,sales outstanding (DSO) through automatedauthorization, settlement and reporting,Australia, and New Zealand, the EpicorAR management. Completeas well as credit, debit and PIN debitPayment Gateway connects with PayFlowfunctionality includes:operations. American Express and DiscoverPro (PayPal). The EPX service is only availablecards are supported and it is PCI Compliant.to U.S. customers.XX Collection managementEPX is fully integrated with Epicor ERP and(See figure 10)XX Centralized activitiesXX Collection templatesoffers higher security, easier compliance,daily batch reconciliation, and streamlinedprocesses.(See figure 10.1)Credit and CollectionsAccounts Receivable is one of the largestCRE combined with the Epicor Paymentassets of any company, and it’s typically oneAccounts PayableGateway stores all of the credit card dataof its most fluid. Most businesses, however,Accounts Payable (AP) allows you to enterencrypted securely in the cloud, thereforehave to write-off four percent of this assetsupplier invoices for purchases that youthe Payment Card Industry Data Securityevery year. This is a substantial cost to themake, and then create payments for theStandard (PCI DSS) scope for Epicor ERPbusiness that can be greatly reduced withinvoices you want to pay. The system canusers is reduced.better management. Take control of yourgenerate payments for all invoices due,outstanding receivables and reduce daysthose for a particular supplier, or only forspecific invoices. If a supplier calls you todiscuss an invoice, you will have completeERP 10 ClientCC Entry onToken/ExpirationEPX RequestERP 10 ServerTransactionCREPayFlow Requestinformation at your fingertips, and thatEpicor PayGateToken HostedPage Servicehistory can be kept indefinitely.EpicorPaymentExchangeAP allows you to update both purchaseorders in Purchase Management as well asEpicorPayGate AuthServicesOtherProcessorsactual job costs. Adjustments are createdif the purchase price does not match theinvoiced price. With AP, you will know howPayFlowProFigure 10 ERP 10 Credit Card Process Flow.7much you owe and when it is due.

Financial ManagementInvoices, Debit Memos, PaymentsRecord and post all payables instrumentseasily, including supplier or vendor vouchersand invoices, debit memos, automatedcheck runs, and manual payments.Payment InstrumentsTrack the different types of creditinstruments such as Promissory Notes andpost-dated checks and their correspondingstatus, from initial generation or receiptthrough to clearance/ settlement. Track themovements of the payment instrumentsand generate status change updates withinFigure 10.1 Cash Management—Manage, report, and distribute financial information securely.the Accounts Payable and Receivableapplications, these changes can be reflectedallowing to further reduce costs by using

General Ledger . Epicor General Ledger (GL) is the heart of . Epicor Financial Management, processing and posting all accounting transactions created throughout Epicor applications, as well as entries made directly within the ledger. The information and controls which flow from the General Led