Transcription

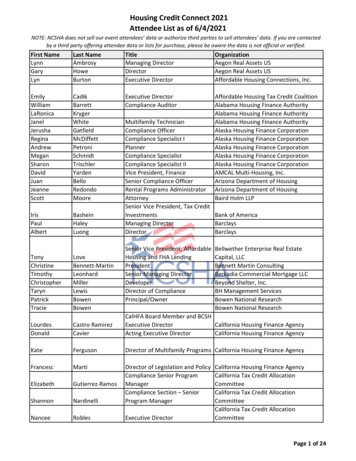

Jackee KnightCorporate Training Director2021 STC, Inc.

is a retirement plan administrator only and does not providelegal, tax, or investment advice. is not a registered investment advisor and does notrepresent or sell securities or investments of any kind. does not represent or endorse any investment opportunitiesthat may be shared in this presentation.We recommend you consult with your legal, tax and investmentadvisors prior to making any investments.2021 STC, Inc.

Self-directed Retirement Accounts Investment Options Guidelines Retirement account LLC Structure STC Services Q&A2021 STC, Inc.

What is a Self-directed Retirement Plan? You may choose any allowable type of asset Includes non-traditional assets like real estate You manage your retirement plan’s investments You have control2021 STC, Inc.

Traditional IRARoth IRASEPSIMPLE401 k – former employer403 b – former employerTSA – former employerTSP – former employerSolo 401(k)2021 STC, Inc.

Real Estate Single/Multi-family homesVacation investment propertyTax LiensRaw Land/Building LotsCommercial BuildingsReal Estate SyndicationsMortgages/LoansPrivate Business InvestmentsCertain Precious MetalsForeign Currency/Options/FuturesStocks/Bonds/Mutual Funds2021 STC, Inc.

Prohibited assets: Life Insurance ContractsCollectibles i.e. rugs, works of art, stamps, coinsProhibited transactions: Transactions not for the exclusive benefit of the planCan’t borrow from the retirement planCan’t pledge plan assets to secure a personal loanCan’t utilize credit or guarantee to obtain loan for the planCan’t benefit any disqualified person2021 STC, Inc.

Disqualified persons: “You” Certain family members AscendantsDescendantsLateral family members are not disqualified Company if you are a majority shareholder Company if you are officer, director, HCE2021 STC, Inc.

Offers maximum flexibility Provides additional asset protection ‘Checkbook control’ over retirement funds Immediate response to investment opportunities Simplifies asset titling Ease of pooling2021 STC, Inc.

Retirement Plan LLC StructureCurrentCustodianTransfer #2Co-investors at inception ofpurchase transactionInvestor#3PersonalFunds2021 STC, Inc.

Retirement Account LLC structure setupProtected ‘checkbook control’CPAs & attorneys to answer technical questionsGuidance on transaction complianceHandle all the ‘back office’ supportMaintain LLC financial statementsSupervise regulatory reportingOversee annual valuation2021 STC, Inc.

2021 STC, Inc.

Do you want to open a self-directed account now? have clients or colleagues who would be interested inself-direction? need more information?2021 STC, Inc.

Website: www.stcira.com Corporate Office: 866-682-3683 Jackee Knight: jknight@stcira.com2021 STC, Inc.

Traditional IRA . Retirement Account LLC structure setup . Guidance on transaction compliance Handle all the ‘back office’ s