Transcription

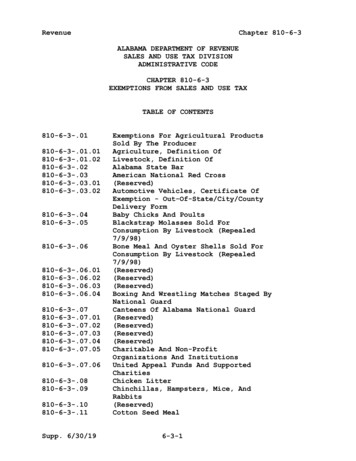

RevenueChapter 810-6-3ALABAMA DEPARTMENT OF REVENUESALES AND USE TAX DIVISIONADMINISTRATIVE CODECHAPTER 810-6-3EXEMPTIONS FROM SALES AND USE TAXTABLE OF .09810-6-3-.10810-6-3-.11Supp. 6/30/19Exemptions For Agricultural ProductsSold By The ProducerAgriculture, Definition OfLivestock, Definition OfAlabama State BarAmerican National Red Cross(Reserved)Automotive Vehicles, Certificate OfExemption - Out-Of-State/City/CountyDelivery FormBaby Chicks And PoultsBlackstrap Molasses Sold ForConsumption By Livestock (Repealed7/9/98)Bone Meal And Oyster Shells Sold ForConsumption By Livestock ng And Wrestling Matches Staged ByNational GuardCanteens Of Alabama National table And Non-ProfitOrganizations And InstitutionsUnited Appeal Funds And SupportedCharitiesChicken LitterChinchillas, Hampsters, Mice, AndRabbits(Reserved)Cotton Seed Meal6-3-1

Chapter 35.01810-6-3-.35.02810-6-3-.36Supp. 6/30/19RevenueCotton Seed Meal Exchanged For CottonSeed(Reserved)Credit Unions, Federal And StateChartered, Sales ByDefense Plant CorporationDepartment Of Pensions And SecurityFederal Charge Card Program, ExemptionCertificationFederal And State Chartered CreditUnionsFederal Production Credit AssociationsFederal Savings And Loan AssociationsFeed For Livestock And PoultryFertilizerExemption Certification FormRespecting Fertilizers, Insecticides,Fungicides, And Seedlings (Form ST:EXC-1)Fish And Minnow Sales By ProducersFlorists, Sales Of Nursery Stock AndFloral Products ByFluid, MilkFood BanksSales to Foreign Governments,Diplomatic and Consular OfficialsForeign Diplomatic And ConsularOfficials (Repealed 8/5/15)Fuel Oil Used In Firing KilnsGas DistrictsGases: Acetylene, Oxygen, Hydrogen(Repealed 12/10/97)Gasoline, Motor Fuels, And LubricantsGrass SodGrease Protective, When Exempt FromSales And Use Tax (Repealed 7/30/98)HerbicidesHistorical Preservation AuthoritiesIndustrial Development BoardInsecticides And FungicidesInterstate Shipments Subject To SalesTaxInterstate CommerceInterstate Commerce, Sales InLiquefied Petroleum Gas, LiquefiedNatural Gas and Compressed Natural Gas6-3-2

46.02810-6-3-.47810-6-3-.47.01810-6-3-.47.02Supp. 6/30/19Chapter 810-6-3Liquefied Petroleum Gas, Exempt FromSales TaxLivestock. All Sales Of Livestock AreExempted From Sales TaxMeals Furnished Along With Rooms BySchools And CollegesExemption From Lodgings Tax For FilmProduction Companies Approved By TheAlabama Film Office (Repealed 2/10/12)Exemption For Certain Items FurnishedTo Medicaid RecipientsMedical Clinic Boards(Reserved)(Reserved)Motor Freight Lines, Sales ToMunicipal Housing AuthorityExemption For Municipal Special HealthCare FacilitiesExemption For Certain Health CareAuthoritiesExemption For Improvement DistrictsNational Farm Loan Associations(Reserved)Nonresidents, Sales ToSales Of Certain Automotive VehiclesTo Nonresidents For First Use AndRegistration Or Titling OutsideAlabamaNurserymen - Sales Of Plants,Seedlings, Nursery Stock And ved)Paper Manufacturers - Items Used NotSubject To Tax Or Exempt (Repealed11/3/98)Parakeets, Parrots, CanariesPeat MossAir And Water Pollution ControlExemptionPost Office, Sales To ThePoultry ProductsPrescription DrugsPrivate Schools, Sales To6-3-3

Chapter -3-.67.04Supp. 6/30/19RevenueProperty To State, City, Or County ForUse By Public Schools, Sales OfPublic Schools, Sales ToPublic Schools - Athletic Equipment,Sales ToPublic Schools, Public SchoolPrincipals Or Teachers, Etc., Sales ToRepairs To Equipment, When Not SubjectTo on For Certain Purchases ByFilm Production Companies Approved ByThe Alabama Film Office (Repealed2/10/12)(Reserved)(Reserved)Municipal Sales And Use Taxes AndGross Receipts Taxes (Repealed 9/5/13)State Sales, Use, And Lodgings TaxExemption For Qualified Reserved)(Reserved)(Reserved)(Reserved)Sales Tax Holiday For “Back-To-School”Sales Tax Holiday For Severe WeatherPreparednessSheriff's Purchases(Reserved)Ships, Sales OfShips, Sales ToCertificate Of Exemption - Fuel And/OrSupplies Purchased For Use OrConsumption Aboard Vessels Engaged In6-3-4

6-3-.75810-6-3-.76810-6-3-.77810-6-3-.78Appendix ASupp. 6/30/19Chapter 810-6-3Foreign Or International Commerce OrIn Interstate CommerceShips, Vessels And Barges - Fifty TonsBurden Definition And Method OfDetermination (Repealed)Load Displacement Of Vessels, Barges,Ships, Other Watercraft, AndCommercial Fishing VesselsStale Bread And Table Waste Sold ForConsumption For Livestock (Repealed7/9/98)(Reserved)Exemption For United States, State,County, City, And Other ExemptEntities From The Payment Of SalesTax, And Purchases Made Through TheUse Of Purchasing Agents(Reserved)Ties And Timbers - When Not Subject ToTax (Repealed 10/20/98)Tung Meal(Reserved)United States, Sales To(Reserved)(Reserved)Vitamins, Minerals, And DietarySupplementsWarranty Parts - Manufacturer'sWarrantyWrapping Paper, Poultry Processors(Repealed 7/30/98)Septic TanksProperty Purchased For Export AndSales Tax Refunds On Certain PurchasesOf Tangible Personal Property InAlabama For Export To And Use In AForeign CountryExemption For Certain Purchases ByContractors And Subcontractors InConjunction With ConstructionContracts With Certain GovernmentalEntitiesSales Of Aircraft Manufactured, Soldand Delivered In AlabamaAttachments6-3-5

Chapter 810-6-3810-6-3-.01Producer.RevenueExemptions For Agricultural Products Sold By The(1)There are two exemptions in the sales and usetax statutes relative to agricultural products sold by theproducer. One is found in §§40-23-4(a)(5) and 40-23-62(8), Codeof Ala. 1975, and the other in §40-23-4(a)(44)(45), Code of Ala.1975. A sale of agricultural products that does not qualify forone of these exemptions may still qualify for the other.(2)§§40-23-4(a)(5) and 40-23-62(8), Code of Ala.1975, exempt sales of products of the farm, dairy, grove, orgarden from sales and use tax when the products (i) are sold bythe producer, by members of the producer’s immediate family, orby persons employed by the producer to assist in the productionof the products and (ii) have not been processed, except to theextent that the products are customarily processed by operatorsof farms, dairies, groves or gardens in preparing products formarket.(a)This exemption does not apply to agriculturalproducts sold by the producer through a store which the produceroperates. (Curry v. Reeves, 195 So. 428 (Ala. 1940)).(b)Unlike the exemption outlined in paragraph (3)below, this exemption is not limited to products that areplanted, cultivated, and harvested by the producer. Examples ofproducts that may qualify for this exemption but not theexemption in paragraph (3) include but are not limited to milk,eggs, catfish, minnows, bees, honey, rabbits, and hamstersproduced on farms.(3)Section 40-23-4(a)(44), (45) exempts fruit orother agricultural products from sales and use tax when sold bythe person or corporation that planted or cultivated, andharvested the products on land owned or leased by them. Unlikethe exemption outlined in paragraph (2) above, this exemption isnot lost to the producer who sells qualifying agriculturalproducts through a store operated by the producer.(4)Sales of agricultural products which otherwisequalify for one or both of the exemptions outlined in paragraphs(2) and (3) above, do not lose their exempt status if theproducts, retain their raw, unprocessed form when prepared bythe producer for marketing or merchandising. An agriculturalproduct is no longer in its raw, unprocessed form if it isSupp. 6/30/196-3-6

RevenueChapter 810-6-3cooked, boiled, roasted, or mixed or compounded with ingredientsother than additional exempt agricultural products.(a)Examples of prepared agricultural products whichdo not lose their exempt status when they otherwise qualify foreither or both exemptions outlined in paragraphs (2) and (3)are:1.raw pecans when cracked or shelled2.raw shelled peanuts3.raw shelled peas, beans, or butterbeans4.raw shucked corn5.raw washed fruits or vegetables(b)Examples of processed agricultural productswhich do not qualify for the exemptions outlined in paragraphs(2) and (3) above are:1.apple cider2.boiled or roasted peanuts3.candy4.cane or sorghum syrup5.fruit pies6.ice cream7.jellies and jams8.peanut butter9.pickled peaches10.pickles11.roasted pecansAuthors: Michelle Mayberry, Dan DeVaughnStatutory Authority: Code of Ala. 1975, §§40-2A-7(a)(5),40-23-4(a)(44), (45), 40-23-31, 40-23-83.Supp. 6/30/196-3-7

Chapter 810-6-3RevenueHistory: Filed September 28, 1982. Filed January 15, 1993,certification filed April 15, 1993, effective May 20, 1993.Amended: Filed June 25, 1998; effective July 30, 1998.Amended: Filed June 25, 1998; effective July 30, 1998.Amended: October 17, 2018; effective December 1, 2018.810-6-3-.01.01Agriculture, Definition Of.(1)For purposes of interpreting references in thesales and use tax statutes to agriculture and agriculturalpurposes, the term "agriculture" is defined to be the art orscience of cultivating the ground, or raising and harvestingcrops on land owned or leased by the person who planted orcultivated and harvested the agricultural crops, including alsofeeding, breeding, and management of livestock and poultry;tillage; husbandry, farming.(2)The following items or areas fall within thedefinition of agriculture:(a)tree farming(b)raising horticultural products in commercialgreenhouses and nurseries(c)orchards)fruit and nut trees (whether or not in groves or(d)vegetable gardens (whether or not on farms)(e)livestock farming(f)dairy farming(g)commercial fish ponds(h)commercial sod farms(i)poultry and egg farming(3)The following items or areas do not fall withinthe definition of agriculture:(a)lawns, shrubbery, and flower beds aroundresidential and business propertySupp. 6/30/196-3-8

RevenueChapter 810-6-3(b)golf courses, baseball or football fields(c)highway, railroad, or utility right-of-way(d)shade trees (other than fruit or nut trees)(e)house plants(f)commercial pest control servicesAuthor: Dan DeVaughnStatutory Authority: Code of Ala. 1975, §§40-23-31, 40-23-83.History: Filed January 15, 1993, certification filedApril 15, 1993, effective May 20, 1993. Amended: FiledJanuary 11, 2019; effective February 25, 2019.810-6-3-.01.02Livestock, Definition Of.(1)In accordance with the guidelines forinterpretation outlined in Brundidge Milling Co. v. State, 45Ala. App. 208, 228 So. 2d 475 (1969); the term "livestock" asused in Title 40, Chapter 23 of Code of Ala. 1975, and in thesales and use tax regulations shall mean cattle, swine, sheep,goats, and members of the equidae family of mammals such ashorses, mules, and donkeys.(2)Animals other than those enumerated above do notfall within the term "livestock."Author: Dan DeVaughnStatutory Authority: Code of Ala. 1975, §§40-23-31, 40-23-83.History: Filed with LRS March 9, 1994. New Rule: FiledJune 15, 1994; effective July 20, 1994.810-6-3-.02Alabama State Bar. The Alabama State Bar is aninstrumentality of the state (§34-3-105, Code of Ala. 1975) andis not subject to sales or use taxes on the property purchasedfor use in carrying on any activity they are authorized toengage in by law.Author: Dan DeVaughnStatutory Authority: Code of Ala. 1975, §§40-23-4(11),40-23-31, 40-23-83.History: Filed September 28, 1982.Supp. 6/30/196-3-9

Chapter 810-6-3Revenue810-6-3-.03American National Red Cross. The AmericanNational Red Cross is an agency of the United States; itspurchases are exempt from the sales and use tax.Author: Dan DeVaughnStatutory Authority: Code of Ala. 1975, §§40-23-4(17),40-23-31, 40-23-83.History: Filed September 28, ive Vehicles, Certificate OfExemption - Out-Of-State/City/County Delivery Form.(1)Whenever a dealer in automotive vehicles, trucktrailers, semitrailers, or house trailers sells an automotivevehicle, truck trailer, semitrailer, or house trailer anddelivers it outside Alabama, or outside the city and/or countyin which the dealer is located, any claim of exemption fromsales tax on the sale because of delivery outside Alabama or thecity or county in which the sale was made, shall be supported byan affidavit of the dealer and the buyer and by an affidavit ofthe person making delivery of the vehicle, trailer, semitrailer,or house trailer using a form furnished by the Department ofRevenue. This form shall be entitled “Certificate ofExemption- -Out-of-State/City/County Delivery” and shall requirethe following information:(a)The date of the sale(b)The invoice number(c)The dealer’s sales tax registration number,name, and address(d)The purchaser’s name and address(e)A description of the automobile vehicle, trucktrailer, semitrailer, or house trailer to include the make,model, year, vehicle identification number (VIN), an indicationas to whether the vehicle is new or used, the total sales priceSupp. 6/30/196-3-10

RevenueChapter 810-6-3of the vehicle, the trade-in allowance, and the net amount paidfor the vehicle.(f)An indication as to the state in which thevehicle will be titled or registered.(g)A certification by the undersigned seller andbuyer, or their representatives, that the vehicle described onthe form has been sold and will be delivered outside Alabama,the city and/or county in which the dealer is located, and thatthe information provided on the form is true and correct.(h)The state, county, and city if applicable, wherethe vehicle, trailer, semitrailer, or house trailer wasdelivered.(i)The name of the person making the out-of-stateor out-of-city/county delivery and an indication as to whetherthat person is the seller or an employee of the seller.(j)The name of the person to whom the out-of-stateor out-of-city/county delivery was made and the date and placeof delivery.(k)A certificate by the person making the deliveryof the vehicle, trailer, semitrailer, or house trailer that heor she has personally delivered the vehicle, trailer,semitrailer, or house trailer described in (e) to the person andplace indicated in (j).(2)No sale of any automotive vehicle, trucktrailer, semitrailer, or house trailer will be recognized ashaving been delivered outside Alabama or outside the city and/orcounty in which the dealer is located unless there has beenspecific compliance with this rule.(3)This rule shall not apply to a sale of anautomobile, motorcycle, truck, truck trailer, or semitrailer toa person who takes delivery of the vehicle, trailer, orsemitrailer inside Alabama and removes it from Alabama within 72hours for first use and registration or titling outside Alabama.See Rule 810-6-3-.42.03 entitled Sales of Certain AutomotiveVehicles to Nonresidents for First Use and Registration orTitling Outside Alabama for the requirements necessary todocument a sale which qualifies for the 72-hour drive-outexclusion contained in Section 40-23-2(4), Code of Ala. 1975.Author: Ginger BuchananSupp. 6/30/196-3-11

Chapter 810-6-3RevenueStatutory Authority: Code of Ala. 1975, §§40-2A-7(a)(5),40-23-2(4), 40-23-4(17), 40-23-31.History: Amended: August 16, 1974; November 3, 1980. FiledSeptember 28, 1982. Amended: Filed April 28, 1988. Amended:Filed June 25, 1998; effective July 30, 1998. Amended: FiledJune 2, 2006; effective July 7, 2006.810-6-3-.04Baby Chicks And Poults. Sales of baby chicksand poults are specifically exempted from sales tax.Author: Dan DeVaughnStatutory Authority: Code of Ala. 1975, §§40-23-4(3), 40-23-31.History: Filed September 28, 1982.810-6-3-.05Blackstrap Molasses Sold For Consumption.(Repealed)Author: Patricia A. EstesStatutory Authority: Code of Ala. 1975, §§40-23-4(3), 40-23-31.History: Filed September 28, 1982. Repealed: FiledJune 4, 1998; effective July 9, 1998.810-6-3-.06Bone Meal And Oyster Shells Sold For ConsumptionBy Livestock. (Repealed)Author: Patricia A. EstesStatutory Authority: Code of Ala. 1975, §§40-23-4(4), 40-23-31.History: Filed September 28, 1982. Repealed: FiledJune 4, 1998; effective July 9, ed)810-6-3-.06.03(Reserved)810-6-3-.06.04Boxing And Wrestling Matches Staged By NationalGuard. Boxing and wrestling matches staged by the NationalSupp. 6/30/196-3-12

RevenueChapter 810-6-3Guard in National Guard Armories or on property adjacent theretocontrolled by the National Guard are exempted from sales taxwhere such matches are held in accordance with the provisions ofSection 31-2-56, Code of Ala. 1975, as Amended.Author: Horace HittStatutory Authority: Code of Ala. 1975, §40-23-31.History: Adopted October 8, 1985.810-6-3-.07Canteens Of Alabama National Guard.(1)Canteens and exchanges of the Alabama NationalGuard and the Alabama Naval Militia are not required to collector pay sales tax where:(a)Established and operated in accordance withrules and regulations issued by the Adjutant General andapproved by the Governor, and where,(b)Owned, operated, and run exclusively by NationalGuard or Naval Militia units for the convenience and benefit ofthe active and retired members of the National Guard and NavalMilitia, and pursuant to Act #2006-195, all other active andretired members of the United States Armed Forces (Section31-2-81), and where,(c)Profits of such canteens or exchanges go to theunits and not to the persons operating them.(2)The canteens and exchanges established andoperated as described above are not subject to sales tax onpurchases for use in such operations. (Section 40-23-4(a)(11))Author: Donna JoynerStatutory Authority: Code of Ala. 1975, §§31-2-81,40-2A-7(a)(5), 40-23-4(11), 40-23-31.History: Filed September 28, 1982. Amended: FiledOctober 4, 2006; effective November 8, ed)Supp. 6/30/196-3-13

Chapter 04(Reserved)810-6-3-.07.05Institutions.Charitable And Non-Profit Organizations And(1)Unless specifically exempted by statute,charitable and nonprofit organizations and institutions aresubject to the sales and use tax levied under Title 40, Chapter23, Code of Ala. 1975, and related collection, remittance, andreporting requirements.(a)Entities, other than governmental entities asdefined i

ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX DIVISION ADMINISTRATIVE CODE . 810-6-3-.07.05 Charitable And Non-Profit Organizations And Institutions . Registration Or Titling Outside Alabama 810-6-3-.43 Nurserym