Transcription

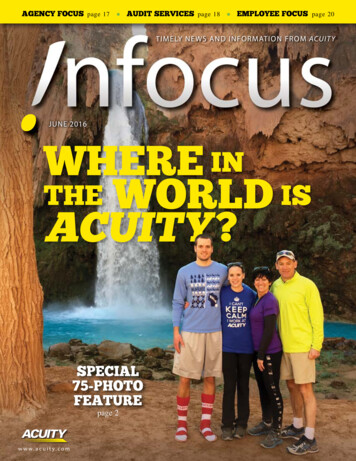

AGENCY FOCUS page 17 AUDIT SERVICES page 18 EMPLOYEE FOCUS page 20TIMELY NEWS AND INFORMATION FROM ACUIT YJUNE 2016WHERE INTHE WORLD ISACUITY ?SPECIAL75-PHOTOFEATUREpage 2w w w.acuity.com

AGENTS AND EMPLOYEES TAKEACUITY ACROSSTHE GL BEENNIWIThe response over the past few years to our “Where in the World IsACUITY?” contest has been overwhelming, with agents and staff sending in far morepictures than we will ever have room to print! Last summer, we published a special50-picture feature; this year, we expand it to an incredible 75 photos. Keep theEWEHWEORRIN THpictures coming!LD ISACUITY?SPECIAL75-PHOTO FEATUREWhat makes for a winning picture? The best shots: Clearly show ACUITY gear and the people wearing or using it Are in an interesting or iconic location Show people having fun—be creative!Cover: Sean Lewandowski and fiancée Abby Clark,Commercial Underwriter, with Mary and Bill Clark ofKlinner Insurance, at Havasu Falls in ArizonaMark Ekeroth, Senior LossControl Representative, at theColiseum in RomeRick Hoffmann, SeniorRegulatory Analyst, atCopper Mountain in Colorado

nfocusBonnie Hammes of Fleis Insurance Agency, Inc.,visited Niagara FallsRob Deming of First West Inc.at the Coliseum in RomeAngela Schneider,Insurance ServiceCenter, sailed inSaint LuciaMichelle Molkenthine,Senior Staff Accountant, atMayan ruins in MexicoSarah Bublitz, CommercialProcessor, at Fiesta AmericanaResort in CancunJ U N E2 0 1 6PAG E 3

ENNIWIDamir Hadrovic,Regulatory Analyst,in QuebecWHEREIN THE WORLD ISACUITY?Shelly Waddell of F.A. Peabody Co.at the Grand CanyonJason Tschudy,CommercialUnderwriter, at theBuddy Holly Museumin Lubbock, TexasBuilding Maintenance/Inventory SpecialistPaul Bimmel and familyin Orlando, FloridaMilan Patel of Donaghy Kempton Insurorsand his wife, Purva, at Karakoram MountainRange in Kerala, India

nfocusClint and Sarah Kueffer, Integrity Midwest Insurance,and family at the Grand CanyonJennifer Finstad, SF Insurance Group, in Punta Cana,Dominican RepublicMarissa Murphy, Business Analyst, at Universal Studios, OrlandoCathy Herr, Senior Programmer Analyst,in HollywoodApril Stoker of USI Insurance Services visited Tulum, MexicoCarol Gau of Marsh & McLennan Agency at the Great Wall of ChinaJ U N E2 0 1 6PAG E 5

ENNIWIWHEREIN THE WORLD ISACUITY?Regulatory Analyst Christian Wolf and girlfriend Kelsey atopFlagstaff Mountain in ColoradoElizabeth Dies,Commercial Underwriter,and sister Sarah at PeaceHill in St. John, U.S.Virgin IslandsZach Berg, Business Analyst, in MexicoKaren Cartier,Assured Partners/AJ Lupas InsuranceAgency, in BelizeEmily Dixon of Howey and AssociatesInsurance at the Great Barrier Reef

nfocusHeather McCormick of MBAH Insurance in CancunAlan Anderson, Leavitt Insurance &Central Bond Services, visited SeattleJohn D. Yoder ofHutchison InsuranceAgency, Inc., visitedGrassington, YorkshireDales, EnglandMarie Schuette, Senior Personal LinesProcessor, at Mount RushmoreChris Fontaine, Systems Engineer, in the PhilippinesJ U N E2 0 1 6PAG E 7

ENNIWIWHEREIN THE WORLD ISACUITY?Dana Repetowski of Big RiversInsurance visited Peoria, ArizonaDaughter Jessica and nieceTuesday of Danielle Belisle,Insurance For Arizona,traveled to New OrleansJohanna Robinson,Leavitt Insurance &Central Bond Services,at Half Moon Bay inCaliforniaAngela MartinezMoore of FreemanInsurance West inKauai, HawaiiClaims Representative Brad Wagner at theRocky statue in Philadelphia

nfocusAdrianne Goodrich ofSafeguard Insurance LLCin Port Canaveral, FloridaCommercial Underwriter Anthony Simanovskiand his wife, Kayla, on Bradenton Beach, FloridaCarol Williams, Bowers Group, and husband Frank in ArubaKaren Wallace of General InsuranceServices at Tracy Arm Fjord, AlaskaAmber Saunders, CommercialProcessor, visited Accident, MarylandSpecial Investigator Steve Starkey at AlcatrazJ U N E2 0 1 6PAG E 9

ENNIWIWHEREIN THE WORLD ISACUITY?Shaun Armstrong, PropertyClaims Specialist, and SusieGibadlo, Senior ClaimsRepresentative, in the GrandTeton National ForestBarb Schiermeyer, TRICOR, Inc., in South AfricaTammie Peterson, TRICOR Insurance, in IrelandJessica Kooienga, Pioneer Business InsuranceAgency, in Phuket, ThailandSusan Matzat, Systems Architect, on theUSS Ronald Reagan

nfocusBrian Dandoy, Ansay and Associates, at Happy Bay Beach in St. MartinSystems Architect HeidiHughes and daughter Leahat Laurel Falls, TennesseeColleen Sheahan, WojtaHansen-Braun InsuranceTom Heckman, The Metz Agency, in Punta Cana,Dominican RepublicKathy Leader, Marshfield Insurance AgencyJ U N E2 0 1 6PAG E 1 1

ENNIWIWHEREIN THE WORLD ISACUITY?Laurie Stanley, StassenInsurance Agency, inScottsdale, ArizonaAlec Bernander, Commercial Underwriter, inKey West, FloridaWorkers’ Compensation Claims RepresentativeWhitney Christopherson and her husband, Chris,at the Gulf of Papagayo in Costa RicaBarbara Brian, Western States Insurance Group,at Lapakahi State Historical Site, HawaiiSue Porupcan, Senior Personal Lines Underwriter,in Oahu, Hawaii

nfocusDave Van Essen,Prins Insurance, Inc.,in BelizeSpencer Monk, The Hartwell Corporation,at the Art District in Xi’an, ChinaHaley Lindstrom,Human ResourcesSpecialist, in Cabo,MexicoSarah Burroughs, Town &Country Insurance, and friendBrett Dunnick in Fajardo,Puerto RicoNatalie Clemens,Commercial Underwriter,in Kauai, HawaiiJ U N E2 0 1 6PAG E 1 3

ENNIWIWHEREIN THE WORLD ISACUITY?Donna Foster, First WesternInsurance Agency, Inc., andhusband Rick in PuertoVallarta, MexicoSenior Commercial FieldUnderwriter Neil Machenin Times SquareMary Jo Kaatz,Schwarz Insurance, inSan Tan Valley, ArizonaManufacturing Specialist MikeSchlagenhaufer and his wife, PeggyStuart Lee, Bassler & Co. Insurance, atSong Mountain in New York

nfocusRacael Gonzales,Dell’s InsuranceAgency, at SportsAuthority Field atMile Highin DenverBarbara Shrimp,Davis InsuranceAgency, at the LittleLeague World Seriesin South Williamsport,PennsylvaniaPatty Pairitz and Michelle Nelson, InsuranceBrokers of MN, at TCF Bank StadiumKalli, daughter of Tony Reynolds,Dimond Bros Insurance, LLC, at PanamaCity Beach in FloridaAl Meyer, General Manager - Sales, Melissa Meyer, Manager - CommercialUnderwriting, and Lorie Scharenbroch, Document Composition Technician,along with Lilly and Blake at Dutch Wonderland in PennsylvaniaJ U N E2 0 1 6PAG E 1 5

ENNIWIProgrammer Analyst Kristen Buschke inSt. Thomas, U.S. Virgin IslandsWHEREIN THE WORLD ISACUITY?Rogene Wheeldon of Agri-City Insurance,in Belmont, WisconsinSenior Strategic Information Analysts MichelleR Miller and Nikki Kraemer in Las VegasKimberli Koeppen, Commercial Processor, in Costa RicaDeborah DeRue, Biglow & Company, Inc.,at Rosemary Beach, Florida

nfocusKANSAS AGENC Y IS FOCUSED ONPROVIDING SOLUTIONSKansas-based Tozier Parkway Housh Jones(TPHJ) believes in providing solutions, not products.“We do not see our role as an agency as a company thatsells insurance—never have, never will,” says Vance Logan,agency Principal. “We focus on delivering information tocustomers that they can use to solve problems and make thebest decisions around protecting their assets.”Extending from that philosophy is TPHJ’s focus on thecustomer. “We prospect people, not accounts,” Logan says.“Some agencies focus on writing a particular type of policyor in a particular market, but we don’t. We design solutionsaround each customer’s needs and do whatever it takes to betheir agent.”Deep RootsIn 1985, four independent insurance agencies merged toform Tozier Parkway Housh Jones, bringing together firms thathave as much as 120 years of experience in the Kansas Citymarketplace. The merger was driven by both opportunity andcompetitive necessity.“Each agency was successful and growing, but we realizedwe needed to get bigger or we wouldn’t survive because of thechanging dynamics of the insurance marketplace,” Logan says.Over the past 30-plus years, TPHJ has not only survived;it has thrived. Today the agency has offices in Overland Park,Kansas; Perry, Kansas; and Kansas City, Missouri; and servescustomers in 30 states. TPHS’s leadership team consists ofDavid Tozier, Vance Logan, Dan Liston, Nick Biby, andCary Jones III.The agency writes a broad mix of commercial and personallines business along with life insurance and surety bonds. Thedirection the agency’s business takes is largely driven by theinterest and passion of TPHJ’sproducer staff, all of whom havea strong motivation to succeed.“We always look to hire people who have a competitivedrive,” Logan says. “We often recruit peoplewho were athletes in high school or collegebecause they understand the need for thatdrive, know how to work as a team,and don’t like to lose.”nfocusThe agency’s staff is alsoknown for its extensive knowledgeOF THEof insurance and for experience inlocal markets.“There aren’t many exposureswe haven’t seen,” Logan says. “Also,being ‘native sons’ of the area, weknow what’s important to families andbusiness owners. Something as simpleas knowing the price of concrete or thegoing rate for different types of construction can make a hugedifference in designing the best risk management programfor customers.”AGENCYMONTHPerpetuation PlansWith several of the agency’s current management teamnearing retirement, TPHJ is working to ensure its perpetuation.Plans include current agents taking the helm in coming years,including producers Biby and Liston.“We are proud of what we’ve built,” Logan says. “We arealso confident that we have the people in place to continue ourfocus on providing solutions, to build on our momentum, andto grow the business even more in the years ahead.” David Tozier (left) and Vance LoganJ U N E2 0 1 6PAG E 1 7

AREA inSIGHTA C U I T Y E X PA N D S P R E M I U MAUDIT SERVICESIt has always been ACUITY’sLawrence has over 12 years ofphilosophy to have as many audits as possibleexperience. They have alsoconducted by our own personnel. Currently,both conducted fieldACUITY field premium auditors complete 85audits in the pastpercent of all physical audits. All businesses,and bring a vastincluding small companies, are growing more andknowledge base tomore complex, so having our own, experiencedACUITY. Vickieauditors working with insureds helps eliminateand Roxanne areproblems and answer questions regarding the audithandling audits in allprocess.25 states in which weWith the active and expansive growth ofwrite and have been aACUITY into new states over the past several years,welcome addition towe have greatly increased our number of auditablethe ACUITY Premiumpolicies, and we’ve increased our overall fieldAudit team.auditor staff as a result.Recently, ACUITY developed a telephoneBY JOSH DAVIDSON,MANAGER - PREMIUM AUDITMaking sure that we are well-staffed in the fieldand creating a telephone audit team helps reduce theaudit team to expand our services to insuredsnumber of audits we have completed by an outsidewho complete audits by mail. Our new telephonefee company, keeping as many as possible in house.audit team includes two seasoned veterans ofIn turn, that helps ensure that we provide the bestthe insurance industry. Vickie Cady has over 10service to insureds during the audit process. years of premium audit experience, and RoxanneRoxanne Lawrence (left) andVickie Cady

nfocusACUITY NAMED MINNESOTACOMPANY OF THE YEARACUITY is named Minnesota Independent Insurance Agents Company of the Year by Minnesota IndependentInsurance Agents and Brokers Association (MIIAB). Receiving ACUITY’s award are Al Meyer, General Manager - Sales,Wally Waldhart, Vice President - Sales and Communications, Melissa Ceman, Territory Director, Chris Holm, CommercialField Underwriter, and Neil Machen, Senior Commercial Field Underwriter. ACUITY EXPERTS PRESENT ATRECENT INDUSTRY CONFERENCESAt the annual conference of theInternational Association of Arson Investigators,Michael Rindt, Manager - Special Investigations,presented on “The Team Approach: Should Public &Private Investigators Work Together?”Lea Kapral, Manager - Field Claims, spokeat the Claims and Litigation Management AllianceAnnual Conference on “Litigation Management Excess Carrier: Friend or Foe?” J U N E2 0 1 6PAG E 1 9

RYAN BIRENBAUMRYAN BIRENBAUM PAYS IT FORWARD FORWhile he was workingatNorthwestern Mutual, Ryan Birenbaum was involved inthe insurer’s support program for Alex’s Lemonade StandFoundation, a national initiative dedicated to fightingchildhood cancer. When he joined ACUITY as an InsideClaims Representative in 2014, Ryan sought out new waysto build on his passion for making a difference in the livesof children.“I was looking for a way to help support kids in thelocal community,” Ryan says. He found it in the AnnualDinner Auction to benefit Children’s Hospital of Wisconsin.Sponsored by 5 Pillars Restaurant & Banquet Hall in hishometown of Random Lake, the dinner auction was createdseven years ago by the Eischen family, the restaurantowners.Pitching InRyan rolled up his sleeves and put his education incommunication and marketing from Marian University towork to help with mailings, the group’s Facebook page,and other marketing materials. He helps secure donors andserves at the annual event.In addition to the fundraising dinner, the event featuresa live and silent auction with nearly 200 itemsup for bids. Thanks to donations of thebanquet hall, food, and auction items,100 percent of proceeds collectedgoes directly to Children’sHospital of Wisconsin.“People like knowing thatevery dollar that comes in goesto help children receivecare,” Ryan says. In2015, the dinnerauctionserved 300 people and raised over 20,000. The event alsofeatures an arts and crafts activity where families can makecards and gifts to send to children who are hospitalized forlong periods of time.“Hearing how children and families are impacted byvisits from people and from cards and gifts is rewardingand lets us know how important the community’s supportis,” Ryan says.Vital CareChildren’s Hospital of Wisconsin is the region’s onlyindependent health care system dedicated solely to thehealth and well-being of children. It provides kids and theirfamilies throughout the state with a wide range of careand support, including everything from routine care to lifesaving advances and treatment options. Together with theMedical College of Wisconsin, Children’s Hospital worksto ensure that every child and family served receives thebest care.The 2016 dinner auction will be held in October. Formore information, search for Annual Dinner Auction forChildren’s Hospital on Facebook, or follow the link atfivepillarssupperclub.com.“You never know when youor someone you know willneed to use Children’sHospital,” Ryan says.“I am passionate aboutwhat I do and believeit’s important to be anactive member of thecommunity,” he adds.“We all benefit by payingit forward.”

nfocusSAYING “THANKS” ISEASY WITH ACUITYAgents, are you looking for an extra way to say “thanks” to customers? As part of your customer service efforts,ACUITY is pleased to offer thank-you cards that can be used to make a personal connection with your customers.These cards can be ordered in sets of 10 at www.acuity.com/thankyou, or under Agency Supplies via the Agent Centerat www.acuity.com.Additionally, many other informational and promotional materials for agents are available to order at the Agent Center,including: Commercial lines overview brochures Corporate brochure folders Workers’ compensation new business kits Workers’ compensation loss reporting businesscards and magnets Workers’ compensation education kits Workers’ compensation 24/7 M.A.S.H. nursehotline materials Annual reports Auto fleet accident kits InGear transportation newsletters Inter-office memo pads Personal auto information kits Truckers’ accident kits Corporate headquarters flyers Payment envelopes J U N E2 0 1 6PAG E 2 1

START-TO-FINISH CL AIMS HANDLINGMAKES A DIFFERENCEIN CUSTOMER SERVICEACUITY’s property-casualty claims department includes fieldclaims representatives who, as the title implies, work outside the homeoffice, and inside claims representatives who work within our CentralClaims department. Typically, inside adjusters handle high-frequency,low-severity claims, while field adjusters are assigned claims where“boots on the ground” are needed.Although the types of claims handled by each type of adjuster aredifferent, both inside and field claims have an important characteristicin common: each and every one is fully dedicated to providing the bestcustomer service in the industry.Also, all our claims representatives are true multi-line adjusters,which really separates our claims service from the competition.Having multi-line adjusters means not only that adjusters handleboth commercial and personal lines claims, but also that every claim,whether handled by a field or inside adjuster, is handled start to finishby the same person. We do not pass off claims to an auto, subrogation,or litigation department. Our experience has shown this is not onlymore efficient, but also helps us deliver the best customer service byproviding insureds, claimants, and agents with a single point of contactthroughout the life of a claim.Here are some interesting facts about Central Claims: We are an extremely busy department! Central Claims handlesover 30,000 claims each year, including all equipment breakdownand cyber liability claims. Central Claims is the first to receive after-hours and weekendemergency pages for all ACUITY claims. Inside claimsrepresentatives are on call 24/7 to ensure our customersare taken care of whenever and wherever it is needed In 2015, we answered over 6,400 general claims questions forinsureds, claimants, and agents. Central Claims houses our auto physical damage specialists,including damage appraisers and heavy equipment appraisers.In 2015, they managed over 13,000 roadside and glass claims,worked with 1,200 preferred auto repair shops, reviewed nearly2,000 non-electronic claims, and managed over 6,200 estimatesthat were electronically “scrubbed” by our expert system, for atotal of over 8,200 estimates. We are the team that will reach out to policyholders proactivelywhen catastrophes strike. Using business intelligence tools, wetrack storms and identify policyholders who may be impacted.We call our policyholders to make surethey are safe and identifyif they have damage,helping us get a jumpstarton handling claimsand enabling our fieldrepresentatives to beon site well before othercompanies.ACUITY’s Central Claimsdepartment is a large and diversestaff that handles a wide variety oflosses, as does our field claimsstaff. What is important isthat, whether an agent orpolicyholder is dealing withan inside or field claimsadjuster, they can be assured ofconsistency and obtain the best, most efficient customer service becauseof ACUITY’s start-to-finish philosophy.BY SARA LARSON,GENERAL MANAGER CENTRAL CLAIMS

nfocusASK THE SPECIALISTAsk CathyImagine how many more products or services a business wouldneed to sell or provide to make up the fines that could be imposed!How can you prevent this from happening at your business?What does the increase in OSHA fines mean to my business? Develop a written safety program highlighting how yourOn November 2, 2015, President Obama signed a new budget intolaw that included plans to raise OSHA citation fines up to 80 percent business will comply with the OSHA regulations (osha.gov). Conduct compliance training as required by OSHA with youreffective August 1, 2016. Below is a chart of current and proposedemployees and document the training with employee sign-inmaximum penalty levels that OSHA plans to levy on employers:sheets (osha.gov/Publications/osha2254.pdf). Walk around your business on a daily basis and search forCitationCurrent MaximumNew MaximumLevelPenaltyPenaltyhazards and fix them before employees are injured. Get employees involved in your safety program. They do theOther Than Serious 7,000 12,600Serious Violatio

Colleen Sheahan, Wojta-Hansen-Braun Insurance Systems Architect Heidi Hughes and daughter Leah at Laurel Falls, Tennessee. Laurie Stanley, Stassen Insurance Agency, in Scottsdale, Arizona Alec