Transcription

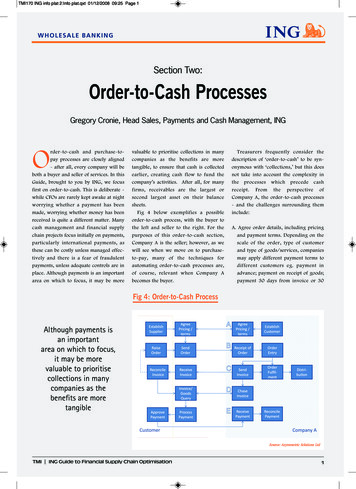

TMI170 ING info plat 2:Info plat.qxt 01/12/2008 09:25 Page 1Section Two:Order-to-Cash ProcessesGregory Cronie, Head Sales, Payments and Cash Management, INGOrder-to-cash and purchase-topay processes are closely aligned- after all, every company will beboth a buyer and seller of services. In thisGuide, brought to you by ING, we focusfirst on order-to-cash. This is deliberate while CFOs are rarely kept awake at nightworrying whether a payment has beenmade, worrying whether money has beenreceived is quite a different matter. Manycash management and financial supplychain projects focus initially on payments,particularly international payments, asthese can be costly unless managed effectively and there is a fear of fraudulentpayments, unless adequate controls are inplace. Although payments is an importantarea on which to focus, it may be morevaluable to prioritise collections in manycompanies as the benefits are moretangible, to ensure that cash is collectedearlier, creating cash flow to fund thecompany’s activities. After all, for manyfirms, receivables are the largest orsecond largest asset on their balancesheets.Fig 4 below exemplifies a possibleorder-to-cash process, with the buyer tothe left and seller to the right. For thepurposes of this order-to-cash section,Company A is the seller; however, as wewill see when we move on to purchaseto-pay, many of the techniques forautomating order-to-cash processes are,of course, relevant when Company Abecomes the buyer.Treasurers frequently consider thedescription of ‘order-to-cash’ to be synonymous with ‘collections,’ but this doesnot take into account the complexity inthe processes which precede cashreceipt. From the perspective ofCompany A, the order-to-cash processes- and the challenges surrounding theminclude:A. Agree order details, including pricingand payment terms. Depending on thescale of the order, type of customerand type of goods/services, companiesmay apply different payment terms todifferent customers eg. payment inadvance; payment on receipt of goods;payment 30 days from invoice or 30Fig 4: Order-to-Cash ProcessAlthough payments isan importantarea on which to focus,it may be morevaluable to prioritisecollections in manycompanies as thebenefits are moretangibleSource: Asymmetric Solutions LtdTMI ING Guide to Financial Supply Chain Optimisation1

TMI170 ING info plat 2:Info plat.qxt 01/12/2008 09:25 Page 2Order-to-Cash MetricsAlthough companies will apply metrics at different stages of the order-to-cashprocess (eg. the number of days after order date/fulfillment that the invoice israised, proportion of invoices resulting in a query, speed of query resolution) themost significant metric from a liquidity and working capital perspective is DaysSales Outstanding or DSO.Accounts Receivable x Number of Days (i.e. 360/365)Total Credit SalesOr:Accounts Receivable/Total Credit SalesNumber of DaysDSO is the average number of days between point of sale and collection. Therefore,the lower the number of DSO, the fewer days it takes a company to collect revenue.DSO is calculated as:lAccounts Receivable Amount of Cash Owing to Company(i.e. invoiced and not received)l Total Credit Sales Annual sales where amounts are payable after order/orderfulfillmentl Number of Days Number of Days in the year - i.e. 365For example, assuming Total Credit Sales 1,000,000 and Accounts Receivable is 100,000 1,000,000 / 365 2,739.70DSO 100,000 / 2,739.70 7.51 daysDSO can vary from month to month, and over the course of a year with a company’sseasonal business cycle. If using DSO, it is important to analyse trends. For example,increasing DSO may be an indication of customer dissatisfaction or that extendedpayment terms are being offered (perhaps for competitive reasons or sales targetpressures). It could also reflect inefficiencies in credit or collection processes.However, DSO is not the most accurate indication of the efficiency of the collections process. Changes in sales volume influence the outcome of the DSO calculation. For example, even if the overdue balance stays the same, an increase of salescan result in a lower DSO. A better way to measure collections effectiveness is tolook at the total overdue balance in proportion of the total accounts receivablebalance (total AR Current Overdue), which is sometimes calculated using theDays Delinquent Sales Outstanding (DDSO) formula.Metrics are available for “best in class” DSO for different industries by companiessuch as The Hackett Group.2TMI days from receipt of goods. Applyingdifferent payment terms helps thecompany to manage risk but can alsomake it more difficult to monitor andfollow up on receipts.B. Orders can be received in a variety ofways depending on the industry andtype of goods etc. but a frequentproblem is transferring details of theorder into the company’s systems to bepassed on through finance forinvoicing and production/services fororder fulfillment. Manual input ofpurchase orders can result in errorsand a great deal of resource.C. When receiving invoices, manycustomers will require their originalpurchase order number so they canreconcile the invoice with the originalorder details. As well as details of theorder, payment terms etc. this information therefore needs to be held onthe company’s system to be passedthrough to the customer. Without this,a customer’s reconciliation process,and therefore payment, can bedelayed.Invoices are frequently sent bypost, which is expensive and, can losea few days, which can result in latepayment. On the other hand, oftencustomers will not accept invoicesreceived unless in hard copy.D. With payment terms often extendingto 30, 60 days or beyond, andpayments frequently received on adate other than the due date,depending on customers’ payment runetc. unpredictability of collectiontiming is a significant problem forcompanies, making it difficult toforecast accurately.Furthermore,chasinglatepayment is frequently a timeconsuming but vital activity, mademore difficult when different peopleare involved in collections, or theprocess is dispersed across differentparts of the organisation. For example,the sales team (often distributedacross many locations) in manyING Guide to Financial Supply Chain Optimisation

nTMI170 ING info plat 2:Info plat.qxt 01/12/2008 09:25 Page 3Fig 5: Example Challenges & Remedies in the Order-to-Cash ProcessPayment Term sChallengeRem edyEnsuring payment terms are appropriate tothe risk profile.Customer management system (CMS) and creditprocess to apply appropriate payment terms.Monitoring collections when different ordershave different payment termsTraining of sales staff and processes to ensurethat payment terms reflect credit risk whilst beingattractive to customers. Supply chain financesolutions, such as receivables financing (pleasesee Part Two of this Guide).Automated collections solution which includesthis capability.Purchase OrderRecording order details accurately incompany’s systems with limited resourcesElectronic order processes such as orderscanning and automated data dissemination.Remote order input by customers directly tocompany’s order management/ERP system eg:data originating from customers’ systems.Invoicin gPostage can be expensive and delay payment.Invoices need to include customers’ purchaseorder reference.CollectionLate payment is damaging to suppliers partlydue to the unpredictability of cashflow.Chasing payments is not always systematicwhen conducted on a distributed basis and/orby individuals with other responsibilities, socash may be received later than necessary.Electronic invoicing (eInvoicing) including collaborative approach with customers. For example,eInvoices able to be imported directly intocustomers’ systems.Modification of ERP or order managementsystem to record this information and allow it tobe reproduced on invoices.Early payment discounting encourages timely orearly payment and increases predictability of collection.Centralised collections process, either throughshared service centre or dedicated collectionsfactory.Reconciliation & Working CapitalDifficulties in identifying when cash has beenreceived into different accounts etc.Impact on customer relationships andliquidity/ working capitalPayment under ExportLetter of CreditErrors in trade documentation delay receipt ofcash.companies is responsible for chasingcollections but sales professionals aregenerally incentivized to generaterevenue, so these other priorities frequently prevent collections from beingmanaged systematically.E. Receiving payments in differentbanks, accounts, locations and viadifferent payment methods means thatfinance managers do not always knowwhen payment has been received,TMI Work with banking partners to ensure that invoicenumber is shown on bank statement for reconciliation.Cash centralisation to allow greater visibility ofcollections and control over liquidity.Review and tighten internal processes, includingseeking advice from trade banking partners.particularly if reconciliation is adecentralised activity. This can causeproblems with customer relationships- for example, a company appearsunprofessional if chasing invoices,which have already been paid, orincorrectly stops future orders.Furthermore, unidentified or unpredictablecollectionsrestrictacompany’s efforts to manage liquidityand working capital.ING Guide to Financial Supply Chain OptimisationIn theory, the timing of cash receivedunder the terms of an export letter ofcredit should be more predictable.However, with a large proportion oftrade documentation being submitted tothe bank with errors, often repeatedly,which need to be remedied beforepayment can be made, companies areoften unnecessarily delaying inflows ofcash which could be essential forliquidity management purposes.3

TMI170 ING info plat 2:Info plat.qxt 01/12/2008 09:25 Page 4Remedies to Order-to-CashChallengesAddressing the challenges above can beachieved in various ways, including acombination of internal initiatives, potentially with solution vendors and/or banks,and external projects working withbanking partners. While every company’sorder-to-cash process will differ, some ofthe most important solutions include:Purchase order servicesPurchase order services are closely alliedwith eInvoicing. By connecting theseprocesses, buyers and sellers can share acommon view of data with data importedand exported electronically from/to therespective companies’ systems. Typically,systems supporting purchase orderdelivery allow copies to be printed and/orthe relevant data imported into the seller’ssystems in the appropriate format. Thisavoids the need to manually input datafrom the purchase order and both buyerand seller record the same referenceinformation. Some systems provideautomatic notification to buyers ofpurchase order receipt.leInvoicingPurchase order services can be (althoughis not always) linked to eInvoicing byautomatically creating the invoice basedon the purchase order information. Datafrom the original purchase order is supplemented with additional informationfrom the seller’s systems, such aspayment terms, and transmitted back tothe buyer. Like purchase orders, thesecan then be printed by the buyer, orimported in the relevant format into itsinternal systems.eInvoicing is used as quite a genericexpression to include different types ofelectronic invoicing. For example, EIPP(electronic invoice presentment andpayment) and EBPP (electronic bill presentment and payment) are both acronymsfrequently used to describe different typesof eInvoicing solutions. EIPP is typicallyReducing the quantity and value ofoverdue collections should be a priorityfor every CFO, now more than ever.TMIlllllReduce Days Sales Outstanding(DSO)Leverage technology andpersonnel more effectivelyMore strategic global customerrelationships/support salesfunctionIncrease Predictability of CashflowInfluence Timing of CashflowPotential source of financingused to describe business-to-business(B2B) invoicing, whereas EBPP is used torefer to business-to-consumer (B2C)billing such as utility and telecoms bills.Although more relevant to purchase-topay, some eInvoicing solutions alsoinclude automated purchase order andinvoice reconciliation, as well as invoiceapproval.One trend, which has emerged inrecent years, is a purchase order/invoiceexchange, such as OB10, which effectivelyprovidesanintermediarymechanism for distributing, receiving,matching and converting purchase orderand invoice data.Centralised Collections“eInvoicing techniques are developing momentum and manycompanies are seeing the benefits of both B2C and B2BeInvoicing. The cost benefits in terms of reduction in paper,printing and postage is clear, but eInvoicing brings majorbenefits to both suppliers and their customers by enablingstraight-through-processing as invoices can be processedautomatically without the need for data reinput. eInvoicingis an example of a collaborative approach to financial supplychain optimisation in which both buyers and suppliers benefit, strengthening relationships and making it easier to do business”Ad van der Poel, Head of E-Business, Payments & Cash Management, ING4Fig 6: Advantages ofCentralising Collections Reducing the quantity and value ofoverdue collections should be a priorityfor every CFO, now more than ever.Clearly, the earlier payment is received,the sooner that cash flow is available tothe business. Furthermore, duringdifficult economic conditions, manyfirms are scrutinizing their credit riskin more detail, resulting in shorterpayment terms, lower credit limits andmore stringent limitations on re-orderin the event of outstanding collections.In many companies, the accountsreceivable function is distributed geographically and by business line, oftenaligned with the sales organization. Assales departments are primarily focusedING Guide to Financial Supply Chain Optimisation

nTMI170 ING info plat 2:Info plat.qxt 01/12/2008 09:25 Page 5on signing new orders, monitoring col

TMI ING Guide to Financial Supply Chain Optimisation 1 Section Two: Order-to-Cash Processes Gregory Cronie, Head Sales, Payments and Cash Management, ING O rder-to-cash and purchase-to-pay processes are closely aligned