Transcription

Financial Planningexplained1

“ ur job is to offer you, as a client orOpotential client, a service of the highestpossible standard delivered by highcalibre people with expertise andintegrity. It is as simple as that ”Jonathan Wragg, CEO

WelcomeWe believe Financial Planning can add context to your investment decisions.The aim of this brochure is to explain what we do, how we do it and who wefeel would benefit from our services. We want you to be able to make a fullyinformed decision on what is right for you and your family.“Financial Planning explained” also includes the cost of our FinancialPlanning service as well as relevant background information on ourindependence for you.We hope you find it useful and look forward to meeting you.Chris AitkenHead of Financial Planningchris.aitken@investecwin.co.uk3

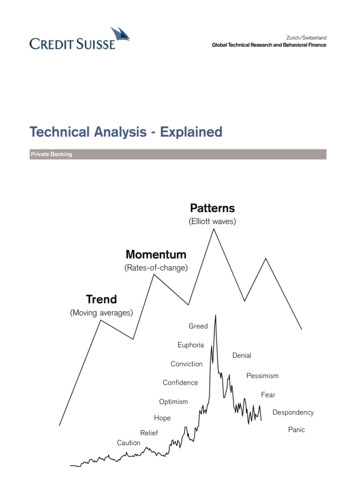

Introduction“ lanning is bringingPthe future into thepresent so that youcan do somethingabout it now ”Alan LakeinAt the core, Financial Planning is about you engagingwith your money. The process of planning can be as muchabout having matters clear in your mind, as it is abouthaving things clear on paper.Let’s start with what Financial Planning is not – it isn’t aboutbuying products like pensions, ISAs and bonds. Productsmay be the pieces in the jigsaw but, as important as theycan be, they are not the whole picture.Financial Planning is an ongoing process to help you makesensible decisions about money, and it starts with helpingyou articulate the things that are important to you. Thesecan sometimes be aspirations or material things, but oftenthey are about you achieving peace of mind.For you, Financial Planning might involve puttingappropriate wills in place, thinking about how your familywould manage without your income should you fall ill or dieprematurely, managing your expenditure, providing for yourown future or passing on wealth to your family.Financial Planning brings all of these elements togetherin one coherent, ongoing strategy. You can build a planon your own, but where your needs are more complexor where you work better with others as part of a team,you should take advice from a Financial Planner.4

What are the benefitsof Financial Planning?Financial Planning provides direction and meaning to yourfinancial decisions. It allows you to understand how eachdecision you make affects other areas of your finances. Forexample, buying a particular product might help pay yourmortgage faster, but conversely, might delay yourretirement or reduce funds available to pass on to yourchildren now.Estate PlanningWill the right people recieve the right amounts, and at theright time? Are they ready to receive potentially large sums?Will you simply be passing on a tax bill? Estate Planning ismore than just money and tax – it is about making sure thepeople who are left are financially supported, that yourassets are protected and that the tax paid is fair.By viewing each financial decision as part of a widerstrategy, you can consider the short and longer-termeffects on your goals. By implementing a suitable financialplan to meet these goals, you will gain control and peaceof mind, knowing that you are on track for the future youwant for yourself and your family.Investment PlanningDo you self-manage your portfolio or outsource to aprofessional firm? Do you hold the investments directly orthrough a particular wrapper? Can you tolerate the truelevel of risk within your portfolio or could you achieve thesame return for less risk? Investment Planning is aboutchoosing the most appropriate investment solutions,understanding the risks, making best use of tax allowancesand achieving a true level of diversification.Lastly, if your experience of Financial Planning so far hasleft you feeling more confused than when you started,you haven’t met the right team yet.The main areas to be consideredRetirement PlanningWill you have enough? How much is enough? RetirementPlanning is about taking responsibility now by focusing onthe future. It is about ensuring you can meet yourretirement income expectations and, if you are alreadyretired, whether you are using your capital in the most taxefficient and appropriate way. We can also help determinewhether your current income is sustainable if it is comingfrom savings or pensions.Protecting your wealthWhat is your most valuable asset? Is it your home?Or, is it your future income and your abilityto continue earning it? Protecting your wealth is afundamental part of financial planning, yet most of usdon’t spend the time or money on it that is oftennecessary. When someone dies, money can’t everreplace them, but it can make life a little easier forthose we love who are left behind.5

What makes us Independent?Investec Wealth & Investment Financial Planning offersindependent advice.We begin the advice journey by assessing the whole of themarket, for and on behalf of our clients. This ensures yourobjectives are met by choosing from the widest range ofproducts or service providers.The Investec Wealth & Investment Financial PlanningResearch Committee is responsible for the analysis anddue diligence of the market in which we operate. We usean independent 3rd party research software andmanagement tool to help us do this.We are proud of the quality of our research. The disciplinedand robust scrutiny in the areas of risk, cost and complexityunderpins the integrity of the advice we provide to you.We are able to recommend pensions including stakeholder,personal pensions, annuities and Self Invested PersonalPensions (SIPP). In addition we advise on onshore andoffshore investment bonds, Enterprise InvestmentSchemes (EIS), Venture Capital Trusts (VCT), business reliefschemes, collective investments, ISAs, Investment Trusts,structured products and structured deposits.We are also able to advise on life assurance and healthinsurance including whole of life and other life products,some of which are premium driven. We should point outthat Investec Wealth & Investment Financial Planning isunable to advise on individual shares or mortgages.When assessing the range of personal pensionsavailable to you we may recommend the InvestecWealth & Investment SIPP if we believe it is the most suitablefor you. We may also advise you to utilise the investmentmanagement services of Investec Wealth & Investment,including the Inheritance Tax Planner for your estateplanning. Any and all recommendations are subject to ourresearch process and would only be made following areview of the relevant market.We are not tied to any provider’s products and we areunbiased in our selection process in that we assess thebreadth of the market and we do not receive inducementsfrom any product provider when recommending productsand services.7

The Financial Planning processWe will use our expertise to help you understand your ownsituation, because only then can you start to talk aboutwhat you want and need in order to form your goals. Whenwe know these, we can identify what is already helping youachieve those goals, and what needs to change. We willthen help you prioritise goals and any associated changesnecessary, outline the challenges ahead, and talk openlyabout the costs. The final stage is then to deliver our fullyconsidered recommendations in the form of a writtenreport, which will form the basis of your own plan.1. Client Engagement6. Review2. Discovery5. Implementation3. Analysis & Research4. Presentation “If you can’t explain it simply, you don’tunderstand it well enough ”8Albert Einstein

How does it work?1. Client EngagementThe process of finding out what you really want andneed, your hopes, goals and fears. It is about you, notyour money.2. DiscoveryThe fact finding process including establishing yourcurrent financial position, attitude to risk, we will alsotake into account your assets and liabilities, incomeand expenditure and any existing financial productsyou own.3. Analysis & ResearchWhere we fully evaluate the information gathered andanalyse this in the context of what we have discussedat stage 1. Does what you already have work? Can it bemade to work or do you need to do something different? Our Research Committee, which consists ofprofessionals from across the financial planningspectrum within Investec Wealth & Investment, ensuresour service to you always reflects the latest technical,legislative and regulatory developments.4. Presentation This is where we present our recommendations to youin the form of a detailed written report and give reasonsfor the selected recommendations including risks, costsand complexity. Once we have agreed how best toproceed, we will move onto the next stage.5. ImplementationWhere we take responsibility for putting all the agreedchanges into place.6. ReviewOne of the most important parts of the wholeprocess – revisiting the financial plan with you, at leastannually, to make adjustments as required. Life changes,as do rules and regulations, so being able to make‘course corrections’ is absolutely vital. Remember, thisis your plan and your story. Building a financial plan isthe first time many people address why they areinvesting, rather than simply investing for investing’ssake. Done properly, it can be a thought-provoking andstructured process, which can help you achieve theoutcomes you desire.9

Want to know whatmost people ask first?I s Financial Planningexpensive?I ’m already retired– do I still need advice?The real question here is perhaps, “How muchis expensive?”We are living longer and so it is very likely that what youhave today will need to last for many years – in fact, manyof us underestimate the impact this can have on oursavings. What matters most is what our money can buy ordo for us, not what its value is on paper. This is the impactof inflation, and it can be a significant threat.The aim of Financial Planning is to provide you witha robust strategy to make the best use of your money.Very often our recommendations can save you significantamounts of tax over the years; or they can enhance yourinvestment returns.Costs typically include an upfront advice fee for providing acritical analysis of your personal situation and makingbespoke recommendations. The combination of time,detailed research, expertise, regulation and ensuring thatInvestec Wealth & Investment remains a secure and stablebusiness to support you for the longer term all playa part in costs.Should you decide to retain us as your Financial Plannerwe also charge an ongoing fee to ensure that your planremains on track and appropriate, and that legislative ortaxation changes do not lead to any derailments.If we feel our Financial Planning services would not giveyou real value for money, perhaps because your situationdoesn’t require a detailed plan, we will tell you.We will normally cover the cost of the initial meeting, so youshould feel confident to talk openly about your situationwithout fear of an unexpected bill.Page 17 of “Financial Planning explained” outlines in detailhow we charge should you wish to engage with us.10Living for a long time also brings the issue of possible careneeds in later life. People at this stage in life are alsotypically more conscious of Estate Planning and in makingplans for their families future. So we believe FinancialPlanning in retirement is every bit as important as FinancialPlanning for retirement.

o I need anDongoing relationship?Can’t you just tell mewhich products orservices I need?Do I needprofessional advice?You can undertake some basic Financial Planning of yourown, but there are many benefits to receiving advice froma professional Financial Planner.Option A: going it aloneWe believe it is important to have a thoroughunderstanding of your personal situation before we makeany recommendations. Only then can we help you to buildyour own individual plan. Remember that products orservices may be the jigsaw pieces, but they are not thewhole picture.Whether your plan is simple or complex, an ongoingrelationship can be vital.Think about Financial Planning as a journey – you cantravel solo to a place you have never been, once someonehas booked you on the right plane, but wouldn’t it be betterto have a guide once you land?If you are looking for free general information andguidance on money topics such as “What is an annuity?”or finding the best cash rates available, there is plenty ofreliable information online. Try sites such as the MoneyAdvice Service (MAS), moneyadviceservice.org.uk orthe Pensions Advisory Service (TPAS),pensionsadvisoryservice.org.ukOption B: seeking professional adviceYou can be confident that a personalised plan will bedeveloped for your circumstances. This tailored approachwill be flexible and adaptable, and will be as a result of adetailed analysis by a professional planner, drawing on theirknowledge and experience. This will help cut throughjargon and marketing speak and tell you what is right foryou. As circumstances change, whether in your own life ordue to regulations and tax, the pieces in the jigsaw can bechanged to ensure you remain on track.11

How can InvestecWealth & Investment help me?We believe that starting each relationship with ablank piece of paper and no products to sell is thebest way to deliver professional and comprehensiveFinancial Planning.Once we have implemented your personal financialplan, we will continue to develop our relationship with you.So much of Financial Planning is about mutual trust andrespect, whether in the context of helping you invest forthe future, protecting your family or reducing taxes. Weunderstand that the topics we discuss can be sensitive,and the questions we ask can be probing, but themotivation is to make sure we look after you.We believe in working in collaboration, but also appreciatethat this sometimes takes time. Being part of your existingteam, or building one around you where you also needlegal or complex tax advice, is important to us.Our Financial Planners are highly qualified with manyhaving

For you, Financial Planning might involve putting appropriate wills in place, thinking about how your family would manage without your income should you fall ill or die prematurely, managing your expenditure, providing for your own future or passing on wealth to your family. Financial Planning brings all of these elements together