Transcription

CORPORATE GOVERNANCE CHARTER OFTHE VANDEMOORTELE GROUPNovember 2020 update 7

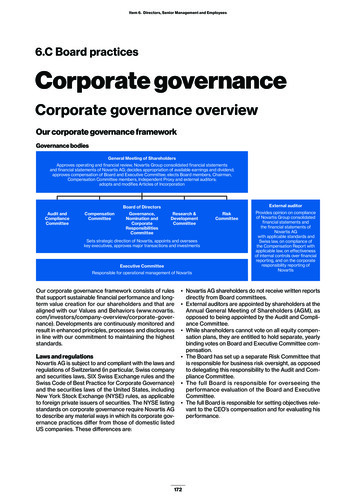

CONTENTLetter from the Chairman of the Board of Directors and from the ChiefLETTER FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS AND FROMTHE CHIEF EXECUTIVE OFFICER . 4I - STRUCTURE AND ORGANISATION. 61. LEGAL STRUCTURE . 62. OPERATIONAL STRUCTURE AND ORGANISATION . 6II - VANDEMOORTELE SHAREHOLDERS AND BONDHOLDERS . 81. CAPITAL AND SHARES . 82. GENERAL MEETINGS OF SHAREHOLDERS AND BONDHOLDERS . 83. DIVIDEND POLICY . 9III - VANDEMOORTELE BOARD OF DIRECTORS . 101. ROLE, RESPONSIBILITIES, POWERS AND DECISION-MAKING. 102. COMPOSITION, INDUCTION AND EVALUATION OF THE BOARD OF DIRECTORS . 113. CHAIRMANSHIP OF THE BOARD OF DIRECTORS . 144. STRUCTURE, ORGANISATION, AND RULES OF CONDUCT OF THE BOARD OF DIRECTORS 15PART IV - SPECIALISED COMMITTEES OF THE BOARD OF DIRECTORS . 171. GENERAL PROVISIONS APPLICABLE TO THE SPECIALISED COMMITTEES . 172. THE COMPENSATION & NOMINATION COMMITTEE .183. THE AUDIT COMMITTEE . 20PART V - THE CHIEF EXECUTIVE OFFICER. 241. ROLE, RESPONSIBILITIES AND POWERS. 24PART VI - THE EXECUTIVE COMMITTEE . 251. ROLE, RESPONSIBILITIES AND POWERS . 252. COMPOSITION AND OPERATION .263. RULES OF CONDUCT.26-2-

PART VII - VANDEMOORTELE REMUNERATION POLICY . 271. REMUNERATION POLICY FOR THE BOARD OF DIRECTORS AND THE SPECIALISEDCOMMITTEES – D&O INSURANCE . 272. REMUNERATION POLICY FOR THE CEO AND THE EXECUTIVE COMMITTEE . 27-3-

LETTER FROM THE CHAIRMAN OF THE BOARD OF DIRECTORSAND FROM THE CHIEF EXECUTIVE OFFICERThe Vandemoortele Group is a family owned group of companies that was founded in 1899. The companyVandemoortele NV, a Belgian public limited liability company, has made public offerings of securitieswithin the meaning of article 1:12, 2 of the Belgian Code of Companies & Associations (“CCA”)(“Wetboek van Vennootschappen en Verenigingen” “Code des Sociétés et Associations”) since the issuanceof its 75 million retail bond on December 13, 2012.Adequate corporate governance is one of Vandemoortele’s essential tools to ensure its sustainablegrowth and profitability, now and in the future, to the benefit of its stakeholders.The Vandemoortele Corporate Governance Charter must be read as a supplement to the Articles ofAssociation of the Company, the CCA and other applicable legislation. The Charter is also based onseveral principles laid down in the 2020 Belgian Code of Corporate Governance. However, consideringthe specific characteristics of the Vandemoortele Group and, in particular, the fact that the shares arenot listed, some principles of the Code, such as the “comply or explain principle “have not been appliedsystematically.Vandemoortele expects its associates to contribute to its endeavours towards sound businessmanagement practices by giving the Vandemoortele Group’s interest priority over personal interest,searching for the best business practices and acting ethically in all their undertakings. In this way,Vandemoortele aims to strike a healthy balance between profitable growth, risk management andcontrol.Ghent, November 2020Jean VandemoorteleChairman of the BoardYvon GuérinChief Executive Officer-4-

INTRODUCTIONThe Vandemoortele Group uses its best efforts to apply the following governance best practices:-adopt a clear governance structure;-have an effective and efficient Board of Directors that takes decisions in the corporateinterest;-have a rigorous and transparent procedure for the appointment and evaluation of theboard and its members who shall demonstrate integrity, gravitas and commitment;-set up specialised committees;-define a clear executive management structure;-remunerate the directors and executive managers fairly and responsibly;-treat all shareholders equally with respect of their rights;-ensure adequate disclosure of its corporate governance;-guarantee compliance by each associate, director, supplier, customer and any otherbusiness partner with the commitment to ethical behaviour in all matters as per its Codesof Conduct, Policies and other applicable Charters.The Vandemoortele Board of Directors approved the first version of this VandemoorteleCorporate Governance Charter on April 6, 2006 and this latest updated version on October 29,2020. The Charter is published on Vandemoortele’s website (https://vandemoortele.com/en)******-5-

I - STRUCTURE AND ORGANISATION1. LEGAL STRUCTUREThe Vandemoortele Group is understood to mean the operational holding company NV Vandemoortele, as wellas the companies which are consolidated in the IFRS consolidated annual accounts of NV Vandemoortele(hereinafter referred to as “the Vandemoortele Group“ or “Vandemoortele”).Vandemoortele NV is a public limited liability company under Belgian law whose shares are not listed on the stockexchange. The Company’s registered head office is located at Ottergemsesteenweg-Zuid 816, 9000 Ghent, withKBO (Central Register of Enterprises) number 0429.977.343 (hereinafter referred to as “the Company”).The Company has various direct and indirect subsidiaries in Belgium and abroad as reflected in the simplifiedlegal organisational chart which is attached to this Charter as Appendix 1.2. OPERATIONAL STRUCTURE AND ORGANISATIONVandemoortele focuses on two business segments: (i) Bakery Products (hereinafter referred to as “BP”) and (ii)Margarines, Culinary Oils and Fats (hereinafter referred to as “MCOF”).These business segments are managed and developed by two separate business lines, the Bakery Productsbusiness line and the MCOF business line (margarines, culinary oils and fats). Both business lines are mainlyB2B oriented and are European leaders in their respective markets.With its bakery products, the BP business line targets professional users who appreciate the quality andconvenience of the Vandemoortele frozen pastry, bread, sweet treats (including patisserie) and savouryproducts. These products are further crafted, baked off or simply defrosted by the users and sold fresh to theconsumer as a final product or as part of a meal or snack. The business line aims at fulfilling consumer’sexpectations for taste, quality, convenience and value for money.With regard to the MCOF business line, Vandemoortele owns retail brands in the Benelux and Germany. AtEuropean level, however, Vandemoortele targets professional users of margarines and fats and retailers forwhom it develops and produces private labels.Each business line has its own production plants and supply chain but the commercial activities are performedby a Belgian company operating through European branches.Through its 100% subsidiaries Metro NV and Panalog SA, Vandemoortele is also active in transport andtransport management for the benefit of both the Vandemoortele Group and third parties.Finally, the Vandemoortele Group has several group services that support both business lines:-Group Finance & Administration (including controlling, treasury, corporate finance, tax & ICT);Group Human Resources (including communication & sustainability);Legal and Risk (compliance, risk management & insurance as well as internal audit);Group Marketing (corporate identity, branding, product category development);-6-

-General Procurement & key raw materials;The QA group service (quality assurance) and HSE group service;R&D and Engineering.The end responsibility for the operational management of the Vandemoortele Group lies with the ChiefExecutive Officer (hereinafter “the CEO”). The CEO leads an Executive Committee that is composed of the CEO,the Managing Directors of the two business lines, the Chief Financial Officer, the Chief Human ResourcesOfficer, the Group Marketing Director , the Chief Transformation Officer and the Chief Legal & Risk Officer.-7-

II - VANDEMOORTELE SHAREHOLDERS AND BONDHOLDERS1. CAPITAL AND SHARESVandemoortele NV has a capital of 14.862.354,00 EUR represented by 547.208 registered shares; the names ofthe shareholders are entered in the share register which is kept at the Company’s registered office.The shareholding of the Company is as follows:-544.893 shares held by Safinco NV ( 99%), a company controlled by the family shareholders;-2.315 shares held by the Company itself (Treasury shares).On December 13, 2012 Vandemoortele NV has issued a 75 mio EUR retail bond with a duration of five (5) years.A second retail bond with a seven-year (7) duration and for an amount of 100 mio EUR was issued byVandemoortele NV on June 10,2015; its prospectus is published on the Vandemoortele Group website underthe item “Investors”.2. GENERAL MEETINGS OF SHAREHOLDERS AND BONDHOLDERS2.1.ANNUAL MEETING OF SHAREHOLDERSThe annual general meeting of Vandemoortele NV is held at the Company’s registered office each year onthe second Tuesday of the month of May; the nominative shareholders as well as the bondholders areinvited to attend the annual general meeting in accordance with the provisions of the CCA and articles ofassociation of the Company. The bondholders may attend the meetings only in an advisory capacity.2.2.GENERAL MEETINGS OF SHAREHOLDERS OTHER THAN THE ANNUAL MEETINGGeneral meetings of shareholders other than the annual meeting can be convened by the Board ofDirectors, the auditors or at the request of the shareholders representing at least 1/10th of the share capitaland follow the requirements of quorum and majority of the CCA.2.3.GENERAL MEETINGS OF BONDHOLDERSGeneral meetings of bondholders can be called by the Board of Directors, the auditors or at the initiativeof bondholders in accordance with the relevant provisions of the CCA.-8-

3. DIVIDEND POLICYVandemoortele’s dividend policy is based on a well-balanced consideration of return for the shareholdersand availability of free cash flow to the Vandemoortele Group to finance its growth.-9-

III - VANDEMOORTELE BOARD OF DIRECTORS1. ROLE, RESPONSIBILITIES, POWERS AND DECISION-MAKING1.1. ROLE AND RESPONSIBILITIESThe Board of Directors is the highest decision-making body of the Vandemoortele Group, except formatters which are reserved to the shareholders.The primary objective of the Board of Directors is to sustain and develop further a successful group in thefood industry by creating sustainable value in line with the vision of the family shareholders, i.e. makinggreat food for a more enjoyable and healthier life through a truly people-driven organization.The key responsibilities of the Board of Directors are:-strategy - to set Vandemoortele’s strategic course based on proposals from the CEO and the ExecutiveCommittee and to approve the operational plans and main policies developed by the CEO and theExecutive Committee to implement the strategy;-leadership - to appoint the Vandemoortele Group’s CEO and members of the Executive Committee, todefine the general remuneration policy for the Group and the renumeration of the non-executivemembers of the Board of Directors, of the CEO and of the members of the Executive Committee and toreview their performance;-supervision & monitoring - to supervise the business evolution and the Vandemoortele Group’sperformance in general; to approve the framework of internal control processes and risk managementproposed by the CEO and the Executive Committee and to monitor the implementation andeffectiveness thereof.The Board of Directors supports and challenges the CEO and the Executive Committee in the performanceof their duties and questions it when appropriate.1.2. POWERSWithin the general frame defined by the family shareholders, the board has discretionary and exclusivepower to perform all acts that are necessary or useful to realize Vandemoortele NV’s corporate object,save for those acts for which only the shareholders’ meeting holds the required powers in accordance withapplicable laws. In that context, the board will:-monitor Vandemoortele’s operational management and the condition of every company within theVandemoortele Group;-10-

-appoint and dismiss the Chairman and members of the specialised committees;appoint and dismiss the CEO;assess its own operation;The board has exclusive power, upon adequate proposals from the CEO and the Executive Committee, to:---define the strategy and approve the strategic business plan;approve the annual budget;approve the investment and disinvestment programmes, the individual commitments in respect ofcapital expenditure which, on a project by project basis, exceed 2,5 million as well as any overspendingon investments exceeding 10%;determine the financial structure of the balance sheet as well as the structure and general terms andconditions of the financial debt;establish, close or relocate corporate seats, branches or sales offices;incorporate or liquidate subsidiaries as well as acquire or transfer shares of other companies, merge withor in any other way restructure the Vandemoortele Group or pledge the Company’s assets orshareholdings or any of its subsidiaries shareholdings;define the external communication policy of the Vandemoortele Group;approve the Vandemoortele Group’s Code of Conduct and Charters and ensure compliance therewith byits associates, directors, suppliers, customers and any other business partner;appoint and dismiss the members of the Executive Committee;appoint the persons who are authorised to represent the Company as directors in subsidiaries of theVandemoortele Group as well as the persons authorised to represent the Vandemoortele Group in externalorganisations.2. COMPOSITION, INDUCTION AND EVALUATION OF THE BOARD OF DIRECTORS2.1. COMPOSITIONThe Company has opted for a one-tier governance structure as referred to in articles 7:85 et seq. of the CCA.The board ensures that it is composed of an adequate number of directors with diverse, yet complementaryprofessional backgrounds, knowledge and experience. The composition of the board must allow for changes in itscomposition without disrupting its operation. At least one third of the board members are of an opposite genderthan the other board members.The board consists of twelve (12) directors as follows:-six (6) family directors who are non-executive directors;five (5) non-family directors who are non-executive directors;the CEO of the Vandemoortele Group also being the Managing Director gué”) of the Company.-11-

2.2.APPOINTMENTS AND RE-APPOINTMENTSThe board submits its proposals relating to (re-)appointments of directors to the shareholders on therecommendation of the Compensation & Nomination Committee (as defined hereinafter in Part IV).The board will consider candidates for (re-)appointment, as non-family director, based on certain criteria. Ideally,every candidate must:-have specific skills, knowledge and experience to complement those already present on the Board ofDirectors; in preparation of this, the Board of Directors draws up a profile description of thenon-familydirector sought;-demonstrate probity, integrity and professionalism and be sufficiently available to fulfil his/her obligationsas a non-family director in an adequate manner;-be sufficiently independent i.e. he or she must be free of any commercial relationships, close family ties, orother connections with the Company, the controlling shareholders or the management of theVandemoortele Group which might give rise to conflicts of interests and/or which could affect theindependent and sound judgement of this director.The family shareholders freely determine the criteria that the family directors must fulfil.2.3. TERM OF APPOINTMENTDirectors are appointed for a period of 3 years, renewable once or more.The mandates of the non-family directors can, in principle, only be renewed twice.2.4. AGE LIMITThe mandates of the directors expire at the Annual General Meeting immediately following the date onwhich they reach the age of seventy (70).2.5. HONORARY MEMBERSThe board can confer to the retiring Chairman of the Board of Directors or to the retiring directors the titleof Honorary Chairman or Honorary Director in recognition of their services to Vandemoortele. There is noremuneration associated with these honorary titles and these honorary titles do not confer any voting,attendance or information rights.-12-

2.6. OBSERVERSBoard succession planning of family members will be ensured through fostering family involvement, sharinginformation and providing family training; through granting a status of observer in the board, the Company ispreparing family members to become responsible owners for the next generations.The board can have up to three (3) observers. The observers are family members entitled to attend the meetingsof the Board of Directors to prepare them for their future onboarding and governance responsibilities.The following principles will apply:-an observer’s term is two (2) years which can only be exercised once to allow also other family members tobenefit from this development opportunity;-observers are expected to read and examine the materials presented to the Board of Directors; they do notparticipate in the board discussions and do not have voting rights;-observers will receive an attendance fee.2.7. INDUCTION OF DIRECTORSNewly appointed directors and observers are offered a suitable induction program, the objectives of which are:-to help new directors and observers gain insight into the fundamental characteristics of Vandemoortele,including its strategy, management, main lines of policy and financial and corporate challenges;-to advise new directors and observers on their rights and obligations as director and observer.If a newly appointed director is also appointed as member of a specialised committee, the induction program willalso include an introduction to the operation and objectives of that specialised committee, including an outline ofthe specific role, assignments and pending matters of that committee.2.8. EVALUATION2.8.1. THE BOARD AS A COLLEGIAL BODYThe board examines and evaluates on a regular basis its own operation and performance as a collegial body,including the number of specialised committees and their respective responsibilities, tasks and operations.To this end, the Chairman of the board conducts every year an internal board evaluation based on individualdiscussions with each board member. Additionally, and every three years, an evaluation is made by externalexperts. These evaluations pursue the following four (4) objectives:to review the operation of the board;-13-

-to ascertain whether or not the key issues are thoroughly prepared and discussed;-to assess the existing composition of the board in the lig

These business segments are managed and developed by two separate business lines, the Bakery Products business line and the MCOF business line (margarines, culinary oils and fats). Both business lines are mainly B2B orien