Transcription

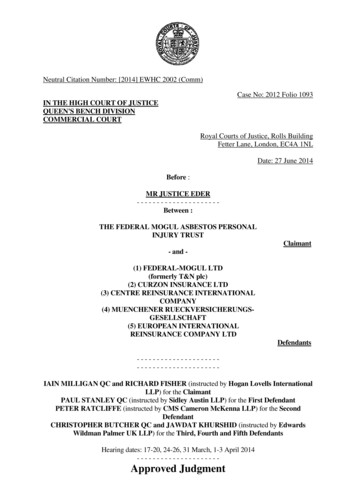

Neutral Citation Number: [2014] EWHC 2002 (Comm)Case No: 2012 Folio 1093IN THE HIGH COURT OF JUSTICEQUEEN'S BENCH DIVISIONCOMMERCIAL COURTRoyal Courts of Justice, Rolls BuildingFetter Lane, London, EC4A 1NLDate: 27 June 2014Before :MR JUSTICE EDER--------------------Between :THE FEDERAL MOGUL ASBESTOS PERSONALINJURY TRUSTClaimant- and (1) FEDERAL-MOGUL LTD(formerly T&N plc)(2) CURZON INSURANCE LTD(3) CENTRE REINSURANCE INTERNATIONALCOMPANY(4) MUENCHENER RUECKVERSICHERUNGSGESELLSCHAFT(5) EUROPEAN INTERNATIONALREINSURANCE COMPANY ---IAIN MILLIGAN QC and RICHARD FISHER (instructed by Hogan Lovells InternationalLLP) for the ClaimantPAUL STANLEY QC (instructed by Sidley Austin LLP) for the First DefendantPETER RATCLIFFE (instructed by CMS Cameron McKenna LLP) for the SecondDefendantCHRISTOPHER BUTCHER QC and JAWDAT KHURSHID (instructed by EdwardsWildman Palmer UK LLP) for the Third, Fourth and Fifth DefendantsHearing dates: 17-20, 24-26, 31 March, 1-3 April 2014---------------------Approved Judgment

I direct that pursuant to CPR PD 39A para 6.1 no official shorthand note shall be taken of thisJudgment and that copies of this version as handed down may be treated as authentic.MR JUSTICE EDER

MR JUSTICE EDERApproved JudgmentFederal Mogul Trust v Federal Mogul & othersMr Justice Eder:I. Introduction1.The claimant in these proceedings is a Trust (the “Trust”) established incircumstances described more fully below by an order of the US Bankruptcy Court on8 November 2007 and in accordance with the terms of a Joint Plan of Re-Organisation(specifically the Fourth Joint Plan of Re-organization for Debtors and Debtors inPossession (as Modified)) (the “Plan”) and a Trust Agreement.2.Pursuant to the Plan, the Trust is, in effect, authorised to bring claims on behalf of avery large number of individuals in the US who have allegedly suffered injury as aresult of exposure to asbestos and asbestos related products supplied and/ordistributed over a lengthy period by the first defendant (“T&N”) and its subsidiaries(the “Asbestos Claims”). For convenience and unless otherwise stated, references toT&N in this Judgment include T&N’s subsidiaries.3.The second defendant (“Curzon”) was and is T&N’s captive insurer under the termsof an Asbestos Liability Policy (“ALP”). In summary, the ALP provided cover of 500 million in excess of 690 million with effect from 1 July 1996 against T&N’sliabilities for personal injury claims caused by asbestos anywhere in the world arisingfrom their activities prior to the policy inception date. In its turn, Curzon ceded itsliabilities under the ALP in equal shares to the 3rd, 4th and 5th Defendants (respectively“Centre Re”, an Irish subsidiary of Zurich Re, “Munich Re” and “EIRC”, a Barbadiansubsidiary of Swiss Re – collectively referred to as the “Reinsurers”) under aReinsurance Agreement (the “Reinsurance”) although, as referred to below, EIRC’sshare was subsequently reduced by virtue of a settlement made in the context ofseparate Court proceedings. The ALP and the Reinsurance are often referred to as the“Hercules Programme”.4.In very broad terms, the main issues concern the ability of the Trust to obtain certaindeclarations with regard to the obligations of the Reinsurers relating to the handlingand settlement of any Asbestos Claims which the Trust wishes to advance againstT&N. In essence, the Trust says that pursuant to the Plan, it has itself established anappropriate mechanism for valuing individual Asbestos Claims in accordance withwhat are called Trust Distribution Procedures (“TDPs”); that the TDP value ascribedto individual Asbestos Claims is considerably lower than the likely settlement oraward value for such claims if litigated in the US tort system, certainly if the costs ofdefending the claims are taken into account; that putting on one side any question oftime-bar, handling claims in such manner is an economic “no-brainer”; and that theonly businesslike approach is for the Reinsurers to settle them in accordance with anadministrative process reflected in the TDP standard i.e. without resort to the USlitigation process. On this basis, the Trust now seeks various declarations as set outbelow.5.On the main issues, both T&N (represented by Mr Stanley QC and his team) andCurzon (represented by Mr Ratcliffe and his team) are broadly neutral. The mainbattle lies between the Trust (represented by Mr Milligan QC and his team) and theReinsurers (represented by Mr Butcher QC and his team). In essence, on the mainissues, it is the Reinsurers’ case that the Trust has no standing to seek any declaratory

MR JUSTICE EDERApproved JudgmentFederal Mogul Trust v Federal Mogul & othersrelief; alternatively that such relief should be refused on various grounds. Inparticular, the Reinsurers say that there is no obligation on them to handle or to settlethe Asbestos Claims by reference simply to the value ascribed to them by the TDPs;that the Reinsurers will consider any such claims as may be presented by the Trust ingood faith; and that unless otherwise settled by agreement, any Asbestos Claimsshould, if necessary, be pursued by the Trust in the US tort system in the usual way.In response, the Trust says that although such an approach might, in the long run, leadto certain claims being defeated, it will do so at a price that will exceed the cost ofsettling such cases at TDP value.6.In addition, there are other ancillary issues in relation to which one or more of theparties seek declaratory relief as referred to below.II. Background7.T&N is an English company formerly known as T&N plc and originally Turner &Newall Ltd. For much of the 20th century, it was a major producer and distributor ofasbestos and products containing asbestos. In particular, together with two of itssubsidiaries, Gasket Holdings Inc (“Flexitallic”) and Ferodo America Inc (“Ferodo”),it used to distribute products containing asbestos in the United States. As is now wellknown, asbestos is (at least in certain forms) a serious potential danger to the health ofanyone who is exposed to it. In particular, exposure to asbestos can cause four maindiseases:i)Mesothelioma (predominantly a cancer of the lining of the lungs (pleuralmesothelioma); it is always fatal and is almost exclusively caused by exposureto asbestos. It is scientifically recognized as a signature asbestos disease);ii)Asbestos-related lung cancer (which is almost always fatal);iii)Asbestosis (a scarring of the lungs which is not always fatal but can be a verydebilitating disease, greatly affecting quality of life); andiv)Diffuse pleural thickening (a thickening of the membrane surrounding thelungs which can restrict lung expansion leading to breathlessness).8.Several factors can contribute to determine how asbestos exposure affects anindividual, including (i) dose (how much asbestos an individual was exposed to); (ii)duration (how long an individual was exposed); (iii) size, shape, and chemicalmakeup of the asbestos fibres; (iv) source of the exposure; and (v) individual riskfactors, such as smoking and pre-existing lung disease. In many cases, the symptomsonly appear many years after the original exposure.9.Asbestos litigation in the US began in the 1960s and thereafter exploded. Accordingto the American Academy of Actuaries, the management of this litigation by bothlitigants and courts in the US became an almost insoluble problem. Many companieswhich had manufactured, sold or distributed asbestos were faced with a large numberof claims which eventually resulted in them filing for bankruptcy. Over the last 40years or so, various possible solutions and part-solutions have been canvassed andimplemented (including the Wellington Agreement as considered, for example, inHiscox v Outhwaite (No 3) [1991] 2 Lloyd’s Rep 524); but these have generally

MR JUSTICE EDERApproved JudgmentFederal Mogul Trust v Federal Mogul & othersfoundered or been only partly successful for one reason or another. The result is thatthere remains a very large number of claimants who have allegedly suffered personalinjury as a result of exposure to asbestos many years ago and whose claims have evennow still not been resolved.10.By the mid-1990s, T&N’s principal business had moved away from asbestos and hadfocussed instead on engineering. However, it remained exposed to its legacy ofasbestos related claims. The nature and basis of such claims was explained in adetailed written statement of Paul J Hanly Jr who is a qualified US attorney andpartner in Hanly Conroy Bierstein Sheridan Fisher & Hayes LLP and (apart from abrief hiatus) acted as defence Counsel for T&N, Flexitallic and Ferodo from 1981until 2001. This statement was put in evidence by the Trust. By agreement, Mr Hanlydid not give oral evidence because none of the other parties wished to cross-examinehim. Based on Mr Hanly’s statement, the following would appear to beuncontroversial.11.During the 20th century, T&N ultimately became, and was for many decades, thelargest vertically-integrated asbestos company in the world being involved in everyaspect of asbestos, from the mining and milling of the mineral (at its mines and millsin southern Africa and Canada), through the manufacturing processes (at its factoriesin England, India, Africa, North America and Western Europe), to the sale,distribution and installation of its asbestos-containing products (through its sales,distribution and installation companies throughout the world). Every one of the T&Ncompanies, both in the U.K. and abroad, manufactured products using all of theasbestos fibre types - including crocidolite (blue asbestos), amosite (brown asbestos),and chrysotile (white asbestos).12.In the event, T&N found itself as a defendant in asbestos cases in both the US andother countries. The basic elements of the causes of action against T&N and itssubsidiaries were (i) failure to warn based on strict products liability and (ii)negligence. T&N was first named as a defendant in a US asbestos personal injury casein 1977. Thereafter, it was faced with a deluge of claims in the US arising principallyout of three areas of its historical business.13.First, the manufacture of a sprayed product known as “Limpet” (i.e. a cement andasbestos mixture sprayed directly onto surfaces for fireproofing, thermal insulation,acoustical insulation and correction, condensation control and decorative finishes).Limpet had the highest concentration of asbestos of any product produced anddistributed in the US, and contained amosite or crocidolite (the worst type ofasbestos). Claims were generally brought by persons involved in the team applyingthe Limpet, bystanders to the spraying process (such as painters or electricians) orpersons who were exposed to the clothes of someone involved in the process (i.e.family members or neighbours). Limpet was used extensively throughout the US on,for example, ships, submarines, in the manufacture of railway cars and locomotives,for thermal insulation and fireproofing in various industrial plants, and forfireproofing on public and private buildings.14.Second, ownership from 1934-1962 of a company called Keasbey & Mattison Co.(and, to a lesser extent, its ownership in other years of two Canadian subsidiaries).Keasbey was the head Limpet licensee in the US from 1934 to August 1962. LikeT&N, it was a vertically-integrated manufacturer and seller of asbestos-containing

MR JUSTICE EDERApproved JudgmentFederal Mogul Trust v Federal Mogul & othersproducts and, by the 1950s, had ten plants located in various US States. It was afrequent correspondent with its parent, T&N, regarding the hazards associated withasbestos. Keasbey sold a wide variety of asbestos-containing materials throughout theUS between 1934 and 1962, at which time its assets were sold to unrelated USCompanies. It was dissolved in 1967. Although there were certain legal precedents incertain states to the effect that T&N was not Keasbey’s alter ego, claims were pursuedagainst T&N on the basis of legal theories such as agency, conspiracy, concert ofaction, joint venture and subsequently on the basis that T&N supplied raw fibre toKeasbey. Once it became apparent to the plaintiffs’ bar in 1988/1989 that T&N wasthe near exclusive supplier of fibres to Keasbey, it was no longer necessary forplaintiffs to establish the “alter ego” theory.15.Third, the supply of raw asbestos fibre that was used in a myriad of asbestos productsmanufactured and distributed in the United States. Such fibres were not only used byT&N for its own products but were provided to other unrelated asbestosmanufacturing companies. This gave rise to claims from those exposed in the courseof their work at other manufacturing plants owned by third parties, as well as thoseexposed during the course of distribution.16.T&N meticulously maintained virtually every piece of paper it ever created or indeedreceived from third-parties concerning asbestos, including literally thousands ofdocuments demonstrating probably the earliest knowledge in the world of thepotential health hazards of working with or around asbestos; indeed, there was reallyno development of any significance in the history of knowledge about the hazards ofasbestos in which T&N was not involved, either directly or through one of itssubsidiaries. Additionally, T&N’s historical records contained numerous documentsevidencing that the company regarded all types of asbestos – amosite, chrysotile andcrocidolite – as capable of causing disease, and debunking the notion that there was orcould be proved to be a safe form of asbestos or safe level of asbestos exposure.According to Mr Hanly, the existence of these records became of “profoundimportance” with regard to the litigation against T&N.17.Ferodo was a manufacturer of asbestos-containing automotive friction products suchas brake linings and disc pads. Ferodo was first named in an asbestos personal injuryclaim in the United States in November 1979. Almost all Ferodo cases withdemonstrated product identification involved former brake mechanics who claimed tohave contracted asbestos-related disease from exposure to Ferodo products during theinstallation and replacement of asbestos-containing brake systems.18.Flexitallic was manufacturer of a type of gasket known as the “spiral wound gasket”which was used in industrial environments especially in plants where extremely hot oracidic liquids were transported through the plant via pipe. Flexitallic was first namedin an asbestos personal injury claim in the United States in January 1976. This gasketcontained asbestos and plaintiffs alleged that they were exposed to asbestos when theyor co-workers removed the gasket from pipe flanges.1976-2001: T&N’s core strategy19.As explained by Mr Hanly, T&N’s core strategy remained constant throughout theperiod from 1976 to October 2001 (when T&N sought the protection of formalinsolvency proceedings) viz to settle as many cases as it could; as cheaply as possible;

MR JUSTICE EDERApproved JudgmentFederal Mogul Trust v Federal Mogul & othersconsistent with the cash flow needs of the company; and to avoid trials. In particular,if and to the extent that T&N considered that there was evidence of exposure to aT&N defendant’s product sufficient to survive a motion for summary judgment by theT&N defendant, and evidence of an asbestos-related disease or condition, T&Nviewed the claim as being, in practice, indefensible and therefore a claim that ought tobe settled as quickly and cheaply as possible. Settlement was viewed by T&N asinvariably leading to a lower cost resolution of the claim as compared to litigation.This was because evidence of exposure to a T&N product and evidence of illnesscaused by asbestos exposure was very likely to lead to jury verdicts against T&N andvery considerable awards for damages. The dangers posed by jury awards at trial, andpotentially crippling effects of not settling asbestos claims early, are well-illustratedby the examples given by Mr Hanly viz a US 10 million award (including US 7million in punitive damages) against T&N for a mesothelioma case tried in Missouriin 2001; a US 4.2 million mesothelioma verdict against Flexitallic in 2001 from ajury in California and a jury verdict of US 35 million against Flexitallic and a codefendant in Texas in 2001 in respect of claims brought on a consolidated basis by 22non-malignant plant workers.20.As a consequence, during the 20 years in respect of which Mr Hanly was US defencecounsel for T&N and its subsidiaries, between 200,000 and 300,000 asbestos personalinjury claims involving T&N alone were settled (in excess of 100,000 for Flexitallicand Ferodo), with trials occurring during the same period in only circa 100-200 cases.According to Mr Hanly, trying even 1% of the pending case load (say 200 cases ayear) was calculated by T&N to have amounted to financial suicide. The lack ofpunitive damages awards reflects the fact that T&N did its best to avoid allowingcases to get to verdict.The Center for Claims Resolution21.As explained by Mr Hanly, T&N were initially (i.e. from 1976 to 1985) what hedescribes as “stand-alone” defendants. Thereafter, T&N became members of two jointdefence/claims handling entities viz from 1985 to 1988, the “Asbestos ClaimsFacility” (“ACF”); and later from 1988 to late 2000/early 2001, the “Center forClaims Resolution” (“CCR”). The CCR was, in effect, a joint claims-handling anddefence organisation consisting of approximately 21 members who were mainlyasbestos product manufacturers. The essence of the arrangement was that if you werea member of the CCR and a plaintiff provided evidence of exposure to one of theCCR members’ products, the other members who had been named in the plaintiff'scomplaint had to contribute to that settlement notwithstanding that the plaintiff hadnot proffered any evidence of exposure to the products of those other defendants.Although this meant that the T&N defendants could be potentially contributing tosettlements where there was no evidence of exposure to those defendants’ asbestoscontaining products, it was, according to Mr Hanly, their judgment, and the judgmentof the members of his team, that the cost savings and the protection that the CCRoffered were far greater than was available if the T&N defendants became “standalone” defendants in the tort system, without the benefit of cost sharing arrangementsfor indemnity and legal expense.22.The role played by the CCR and its methodology in handling and settling claims isexplained by Mr Hanly in paragraphs 62-79 of his statement. Given the importance

MR JUSTICE EDERApproved JudgmentFederal Mogul Trust v Federal Mogul & othersattached to such matters by Mr Milligan, it is convenient to set out in full the materialpart of this section of Mr Hanly’s statement:“62. The CCR actively sought to settle claims whenever itcould. Often these settlements were made between the CCR andplaintiffs’ attorneys in respect of a large group or inventory ofclaims. The settlement would cover a variety of asbestosrelated diseases, including malignancies and nonmalignancies. Thousands of cases were routinely settled before,or even without, the actual filing in a court; this saved allparties substantial sums and generally resulted in lower percase average settlement costs as compared to costs associatedwith filed cases.63. The attached CCR Settlement Agreement is an example of atypical settlement agreement entered into during the time T&Nwas a member of the CCR [pages 279 to 310 of PJH-1].64. The settlement was entered into by the CCR, on behalf of 16members, and Plaintiff Counsel, as agent for 6,379 “PresentPlaintiffs”. The Present Plaintiffs are plaintiffs or claimantsrepresented by Plaintiff Counsel who “presently have lawsuitspending in the Courts of Maryland, or who are or wereresidents of the State of Maryland and/or whose substantialoccupational

subsidiaries, Gasket Holdings Inc (“Flexitallic”) and Ferodo America Inc (“Ferodo”), it used to distribute products containing asbestos in the United States. As is now well known, asbestos is (at least in certain forms) a serious poten