Transcription

Office ofThe Morris County SurrogateA Citizen’s GuidetoWills, Trusts, and EstatesSurrogate Heather J. Darling, Esq.Release 1.0 - January 2020Websitewww.morrissurrogate.com1Copyright, 2020 by the Office of the Surrogate, Countyof Morris, State of New Jersey. All rights reserved. No partof this book may be reproduced or transmitted in any formor by any means; electronic, mechanical, photocopying,recording, any information storage and retrieval system notknown or to be invented, or otherwise; without priorwritten permission of the Office of the Surrogate, MorrisCounty, New Jersey, USAThis is intended as a handbook to help you understand theservices available to you from the Office of the Surrogate,how to make use of them, and what benefits you may gainfrom this public facility. While the authors and editors havemade every effort to make this handbook correct andcurrent, it is comprised of general guidelines to assist youin understanding and using the services of this office. It isnot a legal document and does not address particularcircumstances or specific cases. This handbook is not asubstitute for information the office would furnish relatedto specific circumstances and individuals, nor is it a substitute for professional personal legal and financial advicethat your circumstances may require. Before you takespecific action or make specific decisions that relate to theresponsibilities and services of the Office of the Surrogateof Morris County, you are advised to use the resources ofthis office and your own sources of legal and financialadvice. Neither this Office nor any author or editor of thishandbook shall have any liability to any person or entitywith respect to any liability, loss or damage caused oralleged to be caused directly or indirectly by the information contained in this document nor the activities andpractices described herein.Printed in the United States of America, 1st Printing, January2020The Office of the Morris County SurrogateAdministration and Records Building, Fifth FloorMorristown, New Jersey, 07963-0900USAsurrogate@co.morris.nj.us 2020, Office of the Morris County Surrogate2

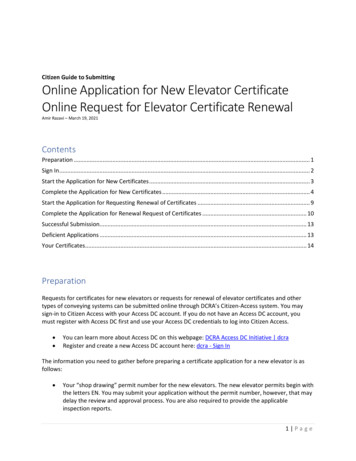

Office ofThe Morris County SurrogateA Citizen’s GuidetoWills, Trusts, and EstatesCO NTENTSTHE OFFICE OF THE MORRIS COUNTYSURROGATE5WILLS AND ESTATES6WILLSStandard WillSelf Proving Will66Holographic Will7Items to Remember When Having a WillDrafted7Changing Wills and Codicils9Intestate succession96Challenges to ExecutorPrepared and Distributed byHeather J. Darling, Esq., SurrogateChristopher Luongo, Esq., Deputy SurrogateAdministration and Records BuildingFifth FloorMorristown, New Jersey 07963-0900973-285-6500Fax 973-829-8599Surrogate@co.morris.nj.us311Probating a WillTAXESState Inheritance TaxFederal Estate Tax12TRUSTS14POWER OF SARYHELPFUL LINKS FOR FIDUCIARIESCHECKLISTTELEPHONE NUMBERSYOUR COMMENTS17131414419202123242526

THE OFFICE OF THE MORRIS COUNTYSURROGATE’S COURTThe function of the Morris County Surrogate’s Courtincludes administrating Wills, Trusts and Estates forMorris County Residents. The Surrogate is elected fora five year term under the New Jersey State Constitutions and is a Chancery Division Clerk of the NewJersey Superior Court.The Surrogate serves as Judge of the Surrogate’s Courtfor uncontested Wills, Trusts and Estates presiding overthe filing of Wills that appoint executors, in order totransfer a decedent’s real and personal property. TheCounty Surrogate appoints an administrator to an estatewhere there is no Will.The Surrogate serves as Deputy Clerk of the SuperiorCourt, maintaining the files of contested probate mattersand adoptions. The Surrogate’s Court also oversees theAdministration of Guardianships of incapacitatedadults.The Morris County Surrogate’s office is open from 8:30A.M. to 4:30 P.M. Monday through Friday and from4:30 P.M. to 6:30 P.M. on Tuesday, all by appointmentonly. All inquir ies will be gladly addr essed by theSurrogate and her staff at 973-285-6500.You may wish to keep this Guide with your Will andother important documents to assist your Executor inhandling your estate.55WILLS AND ESTATESWillsA Will is a legal document that designates the distribution of an individual’s estate upon death. An individual must be at least 18 years of age in order to execute a Will. A Will specifies how property is to be divided, to whom it shall be distributed and who is incharge. If an individual does not have a Will, an Administrator, which is appointed by the Surrogate’sCourt, distributes the estate according to the laws ofthe State of New Jersey. It is therefore very importantfor individuals over the age of 18 to have a Will, inorder to protect thei r specific interests and intentions concerning the distribution of their property.Types of Wills include the following:Standard WillA standard Will is one that is written, signed by the Testator, and witnessed by two individuals. A standard Will alsocontains an attestation clause that declares it as being thatlast Will of the Testator.Self-proving WillA self-proving Will is a standard Will whose two witnessessign at the time the Will is notarized. This Will includes anAcknowledgement and Affidavit Relating to Execution ofthe Will that is attached to the original Will. Having a self-proving Will eliminates the need for witnesses to appearbefore the Surrogate in order to have the Will admitted toprobate, and the need to appear before the Superior Courtif the witnesses cannot be located or have died.66

Holographic WillA Holographic Will is one in the handwriting of the Decedent and bears no witnesses. A Holographic Will canbe admitted to probate only in Superior Court, and in themanner prescribed by the Rules Governing the Courts ofNew Jersey. This type of Will is more vulnerable to challenge.Whatever type of Will is executed, it should be kept ina safe place that is accessible in case of an emergencyor upon the Testator’s death. Executors, family members, or those close to the Testator should be awarethat the Will exists and where it is kept.Items to Remember When Having a Will DraftedA Will is a legal document that is not effective unlessproperly prepared. Individuals should not undertake toexecute a Will unless they are knowledgeable about therequirements of a legally enforceable Will, or have hadan opportunity to obtain legal advice. The process ofexecuting a Will can be simple, but certain items shouldbe kept in mind while going through this process.1. All beneficiaries should be specifically namedand specific amounts, or percentages, of bequestsshould be listed in the Will.2. Alternate beneficiaries should be specificallynamed in the event a designated beneficiary diesbefore the Testator. If money or assets remain inthe Testator’s estate, an individual should benamed to receive the remainder in specific dollaramounts or percentages.73. All Wills must designate an executor. Th atindividual is responsible for carrying out theintent of the testator with respect to property distribution.4. An alternate Executor, preferably substantiallyyounger than the Testator, as well as capableand trustworthy, should be designated in theevent the first named executor dies before theTestator or is incapable of serving.5. Provide that an Executor and Guardian(s) willserve without bond. This will prevent the needto set aside money from the estate for thatpurpose.6. If the Testator has children under the age of18, name a Guardian for those children. Thedesignation of a Guardian should be discussedin advance of executing the Will. One or twoindividuals may be so designated. These individuals are responsible for the day to day careof the Testator’s children as well as for anyproperty the children may own or inherit.7. All Wills and codicils (see next page) must besigned in the presence of two witnesses whoare at least 18 years of age. The State of NewJersey requires that the Will be signed and witnessed before a notary public. It becomes aself-proving Will, provided it is properly worded and signed by the Testator, two witness anda notary public. (see page 6)8

Changing Wills and CodicilsA codicil is an addition or supplement to the original Will that adds to or replaces part of the original Will. A codicil is offered to probate in addition to the original Will and must make referenceto the original Will. A codicil is often used when atestator undergoes some change in his or her lifesuch as a marriage, divorce, birth or death of achild, a witness or Executor, purchase or sale of real property, or a change in financial status. Changes in the federal estate or state inheritance taxlaws may also warrant a codicil. An executed Willshould be reviewed upon the occurrence of any ofthe above events to evaluate the need for a codicilor a new Will. In order to prevent confusion, itmay be beneficial to create a new Will.Intestate succession as of February 27, 2005If an individual dies without a Will, the laws ofthe State of New Jersey provide for the distributionof property to the heirs by intestate succession.1. If an individual dies leaving a spouse andchildren, who are also the children of the surviving spouse, the spouse receives the entireestate.2. If an individual dies leaving a spouse and children who are not also the children of thatspouse, the spouse receives the first 25% (notless than the first 50,000 nor more than 200,000) plus ½ of the balance. The rest goesto the children.93. If an individual dies leaving children but nospouse, the children receive the entireestate divided equally among them. If there aregrandchildren, they take their deceased parent’sshare by representation. If all the children aredeceased, then the grandchildren share equallyin the estate.4. If an individual dies leaving a spouse, motherand father, but no children, the spouse receivesthe first 25% (not less than the first 50,000nor more than 200,000) plus 3/4 of the balance. The rest goes to the parents.5. If an individual dies leaving no spouse and nochildren and that individual’s parents survive,the parents inherit the entire estate. If no parent survives, brothers and sisters receive equalamounts of the entire estate.6. If the estate does not exceed 50,000 and thereis a surviving spouse, an Affidavit of SurvivingSpouse may be issued by the Surrogate. An affidavit allows a husband or wife to dispose ofthe property. If there is no surviving spouseand the property does not exceed 20,000, aclose relative can be issued an affidavit tohandle the disposition.10

Probating a Will7. If the estate exceeds 50,000/ 20,000, an Administrator will be appointed by the Surrogate.Before an administrator can be appointed, allother next of kin of the decedent must renounce their right to be the administrator. Asurety bond is also required. The Surrogatewill issue a “Letter of Administration” givingthe administrator the necessary authority totransfer property, withdraw money from thebank accounts, pay outstanding bills and handlethe other affairs of the estate.Challenges to Executor or AdministratorTo challenge the appointment of an Executor or Administrator, a caveat must be filed prior to their appointment, with the Surrogate to temporarily prevent the probation of a Will or granting of administration. After an Executor or Administrator is appointed, if you allege impropriety, delay or negligence ontheir part, you must make an application to the Court toseek their removal.The appointment of an Administrator often takestime, especially if there are challenges to theappointment which must be addressed before acourt, or if a search for distant relatives must beperformed. During that period, final pay checkscan be withheld and bank accounts that were notjointly held can be frozen.Probating a Will refers to the legal process throughwhich the authenticity of a Will is established. Onceprobated, a Will becomes a permanent part of thecounty records.Upon the death of a loved one, there are certainsteps to be taken to ensure the smooth probation ofa Will.1. Locate the decedent’s original Will.2. Present an original death certificate with raisedseal. Also provide the names and addresses ofpersons named in the Will and all next of kin tothe Surrogate’s office. If the Will is self-proving,it can be probated within a v e r y s h o r t t i m e .I f t h e W i l l i s n o t s e l f - proving, one of thewitnesses to the Will must come to the Surrogate’s office or present proof of their signature.3. Within 60 days of the Will’s probation, the Executor shall notify all the heirs and beneficiariesnamed in the Will, with proof sent to the Surrogate’s Court.4.T h e S o c i a l S e c u r i t y O f f i c e , V e t e r a n ’ s Administration and employer of the decedent shouldalso be contacted to ascertain any benefits duethe decedent.Finally, if there are no next of kin, the property willescheat to the State of New Jersey.1112

TAXESState Inheritance TaxThe revised New Jersey Transfer Inheritance TaxAct of 1985 provides for four classifications ofbeneficiaries.1 Class A– Spouses, children, step-children,grandchildren, parents, and grandparents are notsubject to state inheritance tax.2. Class B- This class was eliminated in a 1963revision of the inheritance tax law.3. Class C- Brothers, sisters, daughters-in-law andsons-in-law are exempt from inheritance tax forthe first 25,000. They are subject to 11% tax forbequests in excess of 25,000 and up to 1,100,000; 13% tax for bequests in excess of 1,100,00 and up to 1,400,000; 14% tax for bequests in excess of 1,400,000 and up to 1,700,000; and 16% tax for bequests in excessof 1,700,000.4. Class D- All other individuals that do not fall intoClass A or C are exempt from tax if the totalamount of the bequest does not exceed 499.These individuals are subject to 15% tax on allbequests over 499 and up to 700,000, and 16%tax on bequests in excess of 700,000.5. Class E- Charitable or non-profit entities areexempt from inheritance tax.13Further information concerning state inheritance taxmay be obtained by contacting the New JerseyTransfer Inheritance and Estate Tax Division.NJ Estate TaxCurrent law states there is no NJ Estate Tax on orafter 2018. Please consult an attorney or a tax professional for current regulations.Federal Estate Tax:For transfers from spouse to spouse there is no federal estate tax. For all others the estate tax exemption is approximately 11.58 million for 2020 andadjusted for inflation. Please consult an attorney or atax professional for current regulations.TRUSTSA Trust is an agreement which allows a third partyto administer another’s property or bequest. A Trustcan be created through or independent of a Will.Such an agreement can be established for minorchildren or others who are incapable of managingtheir affairs or bequests. The party appointed to administer this property or bequest is called a Trustee.When a Trustee is named in a Will, that individualmust file a written declaration under oath of his orher acceptance of the trusteeship and a Power of Attorney. This declaration contains the name and14

CREDITORSaddress of the Trustee and all persons who have aninterest in the Trust. It also identifies the interest ofthe Trust. Upon filing of an Acceptance and Power ofAttorney, appropriate certificates and Letters ofTrusteeship are issued by the Surrogate’s Court.POWER OF ATTORNEYA Power of Attorney is a written document in whichan individual authorizes another to act on his or herbehalf concerning real property, bank accounts orother legal matters. A Power of Attorney is oftenused when an individual is unable to carry out his orher own affairs, due to incapacity or absence fromthe vicinity for an extended term. It can be of a limited power, giving the individual authority to act fora specific purpose or event, such as the purchase of ahome. It can also be of a general power, giving anindividual power to act on all legal matters.“Durable” Power can be effective immediately uponsigning and “Springing” Power is effective upon certain occurrences. A Power of Attorney ends withdeath of the grantor.Under N.J.S.A.3:22-4 creditors of the decedent needto present their claims to the Executor in a sworn writing within nine months from the date of the decedent’sdeath. The Executor cannot distribute assets to beneficiaries until all claims are satisfied, or the Executormay be personally liable to the creditor for the debt.If a claim is not presented to the Executor within thenine months from the date of the death, the Executor isnot liable to the creditor with respect to any assetswhich the Executor distributed or paid on other claimsbefore the presentation of the claim.All Executors are required to obtain a Release and Refunding Bond from the Beneficiaries listed in the Will.Claims presented to the Executor need not be acceptedand the Executor can dispute claims. In the case of adispute, the claimant must commence an action on theclaim within one month after receiving the notice ofdispute. If the creditor does not commence an actionwithin that time, the Executor may not be liable to thecreditor with respect to assests delivered or paid before the commencement of any action. Creditors mayalso be willing to negotiate with the Executor for payment of a lesser amount.Creditor ComplaintsIf there are no next of kin, any creditor who is owed adebt from the estate has the right to apply for administration as a creditor of the estate after 40 days fromthe date of death of the Decedent. This is of particularimportance if there is a person who paid for the decedent’s funeral and is seeking reimbursement or a landlord is owed rent on the decedent’s residence.1516

Priority of ClaimsUnder New Jersey Law, there is a specific order inwhich debts should be paid. The Executor should firstpay the bill for reasonable funeral expenses. Anycosts or fees associated with administering the estateshould be paid next, followed by debts and taxes.Medical expenses from the decedent’s last illness arepaid next, then, judgments or liens. Any other out standing debts are paid last.Non Probate AccountsCertain accounts are not subject to probate and are notaccessible by creditors. For example, insurance policies with named beneficiaries, payable-on-deathaccounts and 401(k) are all non-probate accounts andcannot be used to pay creditors. These accounts passimmediately to a beneficiary upon death.ADOPTIONAdoption is the legal process through which a parentchild relationship is established between the adoptingparent and adopted child. The Surrogate reviews andfiles the Complaint for Adoption, Order Fixing Datefor Hearing and Final Judgment for Adoption. Depending on the type of adoption, there are other documents that must be filed. The complaint cannot befiled until a child has been in the adoptive home a prescribed length of time, depending on the type of adoption.Types of AdoptionAdult Adoption– The adult seeking to be adoptedmust be at least 10 years younger than the adoptingparent. No waiting period.*17Relative Adoption– The child was not received froman agency. The adoptive parents are a brother, sister,grandparent, aunt or uncle. Hearing scheduled in 2-3months.*Agency Adoption– The child is in the custody andcontrol of an approved agency. Hearing shall bescheduled within 10-30 days.*Step-Parent Adoption– The child is the natural childof the plaintiff’s spouse. Hearing scheduled in 2-3months.*Foreign Adoption– The child is in the custody andcontrol of an approved agency.Foreign Re-Adoption– The foreign child was adoptedin a foreign country before a judge or notary and isbeing re-adopted in New Jersey in order to create avalid paper trail for the child to New Jersey.Private Adoption– The child has been received froma birth mother. A preliminary hearing scheduled in 60to 90 days and a final hearing between 6 and 9months.**All waiting periods are as of the time of this publication. Check with your attorney or agency for exactwaiting periods at the time you are seeking to adopt.County of Venue– Adoption papers shall be filed withthe Surrogate in one of the following:1. The County in which the adopting parents reside;2. The County where the child resided immediatelybefore the adoption placement;3. The County in which the child was born if thechild is less than 3 months of age.18

4. If the child is being adopted through an approvedagency, the action may be brought in the SuperiorCourt, Chancery Division, Family Part of anyCounty in which the approved agency maintainsan office.GUARDIANSHIPSGuardianA Guardian is one who has been appointed by thecourt to conduct the general care and control ofanother. When a Guardian is needed for a minor(under the age of 18), the Guardian is appointedby the Surrogate’s Court. When a Guardian isneeded for someone 18 years of age or older, theGuardian is appointed by the Superior Court.Adult GuardianshipsWhen a person, by reason of medical necessity, is unable to govern themselves and manage their affairs,after the proper paperwork is filed, the Court will appoint a Legal Guardian. Court appointed LegalGuardians make decisions for incapacitated peopleabout personal and medical care, meals, transportation, and even where a person lives. Guardians control assets, manage budgets, pay debts and make allfinancial and investment decisions for the people theyassist. Guardianships have certain procedural requirements, including but not limited to, proof from twomedical or psychological exams within 30 days offiling a complaint in the Surrogate’s Court. A courthearing is required and an attorney will be appointedfor the alleged incapacitated person.19In order to minimize the opportunity for abuse of powerby guardians, the judiciary has a Guardianship Monitoring Program. Guardians are required to file annual reports on the well being of those in their care. This includes parents, children, brothers, sisters and friendswho are caregivers to those who are most vulnerable. Ifthere is no next of kin or friend to become the guardian ,the court may require that the Office of the PublicGuardian become involved.Guardianship of a MinorWhen a minor is expected to receive assets over 5,000.00, a guardian for the minor must be appointed.Guardians for minors are appointed by the Surrogate’sCourt. In the event of the death of a parent, the otherparent is typically the guardian of the child. However,in the case of the permanent absence of both parentsfrom the child’s life, the Surrogate or the Superior Courtmay appoint a guardian for the person, estate or both.FEESThe duties of the Morris County Surrogate and heroffice are established by the acts of the New JerseyState Legislature, as are the fees to be charged forthose services.Payment can be made by either cash or checkmade pa yable to the Morris Count y Surrogate’sCourt. The office does not accept credit cards.20

GLOSSARYAdministrator/Administratrix—Person appointed bythe courts to take charge of the estate of a decedentwho dies without a Will.Beneficiary—Person designated to receive money,property or benefits under a Will.Bequest—A gift of personal property by a Will.Bequeath—To dispose of personal property through aWill.Codicil—An addition or supplement to an originalWill that adds to or deletes only part of a Will.Decedent—A deceased person.Heir—Person who inherits property from a deceased person.Intestate—When a person dies without a Will.Legatee—Person who receives a gift under a Will.Personal property—Intangible property, such asstock, bonds or bank accounts, and tangible propertysuch as jewelry, furniture or an automobile.Probate—Official proof of the authenticity orvalidity of a Will.Real Property—Land or building.Devise—A gift of real estate through a Will.Surrogate—Elected county official who overseesprobate in the State of New Jersey.Escheat—Property reverting to the state for want ofany legal heir.Testator/testatrix—Person who makes a Will.Estate—Property and possessions owned by anindividual.Executor/Executrix—Person named in a Will to carryout the wishes and intentions of the Will.Guardian—Person entrusted by the law with the personal and/or fiduciary care of another.Trust—Property owned or managed by a person foranother.Trustee—Person holding property in trust for another.Will—A legal declaration of the manner in which aperson wishes his or her estate to be distributedafter death.Witness—Person who observes the signing of adocument and attests to the signatures.2122

CHECKLISTHelpful Links for Fiduciaries:Agents Under Powers of Attorneyhttp://files.consumerfinance.govf/201310 cfpb lay fiduciaryguides agents.pdfThis is a list of documents and important papersthat may help settle your estate and resolve issuesfor your survivors should you die. Keeping themin a single known location or seeing that someoneresponsible has a list of the location of all thesedocuments can save time and trouble later.Court Appointed Guardianshttp://files.consumerfinance.govf/201310 cfpb lay fiduciaryguides guardians.pdfWill and other finalinstructions documentsReal Estate deeds,related recordsDeath certificateIncome tax recordsNJ Courts.govChecking/savings/CDacct. numbers and banksVehicle titles and otherpaperworkTrusteesSafe deposit key,number, name of holderInstallment loansStocks, bonds, mutualfunds, other securitiesBirth/baptismal cert.,adoption papers, etc.Pension and annuityrecordsSocial security numbersInsurance policiesMarriage, divorce,prenuptial documentsUnion/company healthand other benefitsMilitary and civil servicedocumentationSelf-Help 310 cfpb lay fiduciary guides trustees.pdfGovernment BenefitsFiduciaries (Social Security Representative Payees and VA 1310 cfpb lay fiduciaryguides representative.pdfOther important information to have available is thename, addresses and phone numbers of the Attorney,Accountant or Financial Advisor and Physician.2324

TELEPHONE NUMBERSYOUR COMMENTSMorris County Bar Association and LawyerReduced Fee Referral Program973-267-6089Lawyer referrals973-267-5882Morris County Surrogate’s OfficeFAX973-285-6500973-829-8599NJ Inheritance Tax Office609-292-5033NJ Motor Vehicle Information609-292-6500Please let us know how future issues of ACitizen’s Guide to Wills, and Estates ca nbe improved or corrected to serve you andothers in Morris County better: (Continueon reverse and attach additional paper ifLegal Aid Society of Morris County 973-285-6911Social Security Administration800-772-1213US Tax Information800-829-1040Your name, address, and telephone number(optional):nametelephonestreet address, apt.Department of Veterans neyFinancial AdvisorPhysician25city/town, state, ZIP codeCLIP AND MAIL TO:“Citizen’s Comments”Surrogate Heather J. DarlingThe Office of the Morris County SurrogatePO Box 900Administration and Records BuildingFifth FloorMorristown, New Jersey, 07963-0900To arrange for the Surrogate to speak to yourclub or organization, contact:Hdarling@co.morris.nj.us26

The Office of the Morris County SurrogateHeather J. Darling, Esq., SurrogateChristopher Luongo, Esq., Deputy SurrogateAdministration and Records BuildingFifth FloorMorristown, New Jersey, 07963-0900973-285-6500FAX 973-829-8599Surrogate@co.morris.nj.us2728

WILLS AND ESTATES Wills A Will is a legal document that designates the distri-bution of an individual's estate upon death. An indi-vidual must be at least 18 years of age in order to exe-cute a Will. A Will specifies how property is to be di-vided, to whom it shall be distributed and who is in charge. If an individual does not have a Will, an Ad-