Transcription

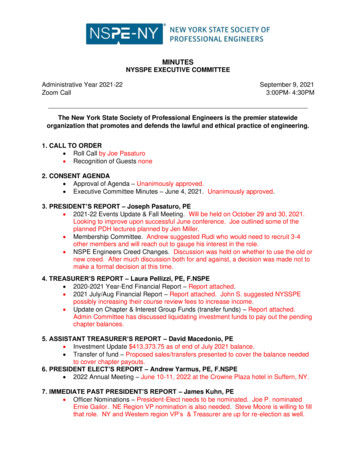

MINUTESNYSSPE EXECUTIVE COMMITTEEAdministrative Year 2021-22Zoom CallSeptember 9, 20213:00PM- 4:30PMThe New York State Society of Professional Engineers is the premier statewideorganization that promotes and defends the lawful and ethical practice of engineering.1. CALL TO ORDER Roll Call by Joe Pasaturo Recognition of Guests none2. CONSENT AGENDA Approval of Agenda – Unanimously approved. Executive Committee Minutes – June 4, 2021. Unanimously approved.3. PRESIDENT’S REPORT – Joseph Pasaturo, PE 2021-22 Events Update & Fall Meeting. Will be held on October 29 and 30, 2021.Looking to improve upon successful June conference. Joe outlined some of theplanned PDH lectures planned by Jen Miller. Membership Committee. Andrew suggested Rudi who would need to recruit 3-4other members and will reach out to gauge his interest in the role. NSPE Engineers Creed Changes. Discussion was held on whether to use the old ornew creed. After much discussion both for and against, a decision was made not tomake a formal decision at this time.4. TREASURER’S REPORT – Laura Pellizzi, PE, F.NSPE 2020-2021 Year-End Financial Report – Report attached. 2021 July/Aug Financial Report – Report attached. John S. suggested NYSSPEpossibly increasing their course review fees to increase income. Update on Chapter & Interest Group Funds (transfer funds) – Report attached.Admin Committee has discussed liquidating investment funds to pay out the pendingchapter balances.5. ASSISTANT TREASURER’S REPORT – David Macedonio, PE Investment Update 413,373.75 as of end of July 2021 balance. Transfer of fund – Proposed sales/transfers presented to cover the balance neededto cover chapter payouts.6. PRESIDENT ELECT’S REPORT – Andrew Yarmus, PE, F.NSPE 2022 Annual Meeting – June 10-11, 2022 at the Crowne Plaza hotel in Suffern, NY.7. IMMEDIATE PAST PRESIDENT’S REPORT – James Kuhn, PE Officer Nominations – President-Elect needs to be nominated. Joe P. nominatedErnie Gailor. NE Region VP nomination is also needed. Steve Moore is willing to fillthat role. NY and Western region VP’s & Treasurer are up for re-election as well.

8. VICE PRESIDENTSAction Items only – written reports covered under consent agenda8.1 Mid-Hudson Region VP – Steven Robbins, PE, LEED AP – Rockland Chapter isholding a Golf Outing this fall for their Scholarship Fund. Zoom lectures are expected tocontinue. Westchester-Putnam has had some leadership turnover and will be puttingtogether a program of lectures for the coming year. Rockland suggested NYSSPEconsider providing sample press release verbiage.8.2 Northeast Region VP - Ernest Gailor, PE – Plan to participate in Future Cities andMathCounts and have a Golf Outing planned as well.8.3 New York Region VP– Rick Lefever, PE – Slate of presentations, mostly online,has been established after an August planning session. Working to resuscitate dormantchapters of NYC outside of Manhattan. Discussion was held on how to reach KingsChapter as NYSSPE has not had success reaching Elliot Shapiro.8.4 Long Island Region VP– John Sucharski, PE – Chapter is in good healthfinancially. Continuing to provide PDH opportunities. Awarded 2 scholarships tostudents pursuing CE degrees. Also offering scholarships for engineering licensureexams.8.5 Central New York Region VP– Peter Lautensack, PE – Deciding whether or not tohold an Engineering Exposition this fall. Continuing education is continuing in theBinghamton area. Ed Szpala. offered to lend assistance from experience that ErieNiagara had in offering a virtual Expo.8.6 Western Region VP– David Roberts, PE – Had left the meeting. No report.8.7 INTEREST GROUP VP – Larry O’Connor, PE, LS, F.NSPE & Ed Szpala, PE –Nothing to report. Andrew Y. advised that PEC has put together an update for theProject of the Year award application.9. LEGISLATIVE ITEMS – Mark Kriss, Esq. Jane Blair has asked for a suggestedreplacement for Bob Stelianou who will no longer be serving on the state board as the InteriorDesign representative. Also discussed NYC expediters improperly using design professionalcredentials for logging into City portals. Discussed NYS lack of liability exposure protection fordesign professionals. Bachelors bill will be going to Governor’s office for signature later thisyear. Working with AIA and ACEC on indemnification bill position.10. NEW BUSINESS – There will not be an Admin Committee meeting on this coming Tuesdayafter this ExComm meeting. Next call will be September 28 th.11. ADJOURNMENT

Sept. 9, 2021 – MeetingAttendanceNameErnie Gailor, PEByPhoneDid Not AttendXJim Kuhn, PEPeter Lautensack, PEBy ZoomXXRick Lefever, PEXDavid Macedonio, PEXLarry O’Connor, PE, LS, F.NSPEXJoe Pasaturo, PEXLaura Pellizzi, PE, F. NSPEXSteven Robbins, PE, LEED APXDavid Roberts, PEXJohn Sucharski, PEXEd Szpala, PEXAndrew Yarmus, PE, F. NSPEXGuestsMark Kriss, Esq.XRachel PieniazekJennifer MillerKathryn ViggianiXXX

The New York State Society of Professional EngineeBalance SheetAs of June 30, 2021TotalASSETSCurrent AssetsBank Accounts1000 Cash0.001015 KeyBank Checking x101514,261.001025 Key Bank MM x5390125,986.881030 PayPal2,000.00 Approx.1040 Petty Cash - General378.281050 KeyBank Checking x 137250.001060 Key Bank MM x 8052Total 1000 CashTotal Bank Accounts45,594.82 188,270.98 188,270.98Accounts Receivable1100 Accounts ReceivableTotal Accounts Receivable0.00 0.00Other Current Assets1400 Other Current Assets1420 Prepaid Expenses0.001430 Prepaid Expense - Inventory0.001440 Security DepositsTotal 1400 Other Current Assets0.00 1499 Undeposited Funds1500 Investments0.001510 Charles Schwab InvestmentTotal 1500 Investments413,070.00 413,070.00 413,070.00 601,340.98Uncategorized AssetTotal Other Current AssetsTotal Current Assets0.000.000.00Fixed Assets1600 Fixed Operating Assets1610 Furniture, Fixtures, & EquipmentTotal 1600 Fixed Operating Assets4,630.00 4,630.001700 Accumulated Depreciation - Fixed Operating AssetsTotal Fixed AssetsTOTAL ASSETS 4,630.00 605,970.98LIABILITIES AND EQUITYLiabilitiesCurrent LiabilitiesAccounts Payable2000 Accounts PayableTotal Accounts Payable0.00 0.00Credit Cards2100 Credit Cards2120 Southwest Rapid Rewards x4457Total 2100 Credit CardsTotal Credit Cards6,775.00 6,775.00 6,775.00 Month to Month balanceOther Current Liabilities2190 Line of Credit2191 Key Bank Line of Credit x5130Total 2190 Line of Credit0.00 0.002200 Accrued Liabilities2210 Accrued Payroll3,431.912220 Accrued Paid Leave1,835.86

2240 Accrued Expenses - Other0.002260 Accrued Sales TaxTotal 2200 Accrued Liabilities0.00 2300 Chapter Dues Payable5,267.77 Biweekly payout0.0001 Capital District Chapter6,334.0002 Bronx Chapter272.0003 Broome Chapter475.0004 Central New York12,776.3505 Champlain Valley0.0006 Chautauqua/Cattarugus Chapter0.0008 Dutchess/Ulster Chapter0.0009 Erie/Niagara Chapter3,279.0011 Jefferson/Lewis Chapter0.0012 Kings County Chapter3,464.0013 Monroe Chapter1,407.0014 Nassau Chapter0.0015 New York Chapter3,331.4017 Oneida/Mohawk Chapter0.0018 Orange/Sullivan Chapter7,472.2519 Queens Chapter1,679.0021 Richmond Chapter11,424.7022 Rockland Chapter1,429.0023 St. Lawrence/Franklin Chapter0.0025 Steuben Chapter0.0026 Suffolk Chapter5,743.0029 Westchester Chapter3,639.0030 Uncategorized ChapterTotal 2300 Chapter Dues Payable0.00 2500 Due To/Due From0.002510 FEE - Scholarship2,275.002515 PIE0.002520 NYPE - PACTotal 2500 Due To/Due From62,725.70151.00 2600 Inactive Chapters2,426.000.00Accrued SIMPLE3,800.00 Yearly ContributionPayroll LiabilitiesFederal Taxes (941/944)1,955.77Federal Unemployment (940)0.00NY PFL34.73NYS Employment Taxes46.69NYS Income TaxTotal Payroll Liabilities827.89 211 PEC2,865.08 Biweekly payout40,231.54213 PEG5,158.03214 PEI10,150.98215 PEPP31,095.82230 VLF EscrowTOTAL LIABILITIES9,845.66 Wednesday, Sep 08, 2021 05:41:31 AM GMT-7 - Accrual Basis180,341.58

Actual vs. Proposed Budget FY 20‐21Prepared 9/9/21ProposedFY 20‐21ActualFY 20‐21ProposedFY 21‐22Budget(as of 6/30/21)BudgetDescriptionIncome4000 Revenue from Direct Contributions4010 Individual ContributionsEnd 4000 Revenue from Direct Contributions5100 Revenue from Program-Related Sales & Fees5110 Member Dues5115 Chapter Dues5120 Sustaining Member Dues5130 Voluntary Member Dues5140 Registration Fees5150 Sponsor Income5170 Exhibitor Revenue5185 CE Evaluation5195 Sale of Goods/ProductsEnd 5100 Revenue from Program-Related Sales & Fees5300 Revenue from Investments5310 Interest - Savings/Short-Term Investments5320 Dividends & Interest - Securities5330 Unrealized Gain or LossEnd 5300 Revenue from Investments5400 Revenue from Other Sources5410 FEE/PIE Shared ServicesReimbursement from FEE Payment to cover J.Miller/Eweek5420 Advertising5450 Royalties5490 Misc Revenue5495 PPP LoanEnd 5400 Revenue from Other 500500001000 Direct Contributions/Donations from members (Through NSPE PAC, VLF, FEE)Sustaining members (payments come in June)- Need Rachel to check on FY 19/20- None shown in QBVoluntary Dues Donations from Life MembersAll Conference and Event Registration FeesSponsor RevenueExhibitor RevenueChapter CE Evaluation (Fees paid by Chapters to State for Program Evaluation)Branded sales of shirts, lapel pins, etc.PIE and FEE Shared Services Agreement 90,000 (PIE) and 12,500(FEE) - Rebate to PIE due to PPP loanEweek to cover J. MillerBoxwood online job postingsRedvector - Online SeminarsSold Furniture & Filing Cabinets during renovations & Tax ReturnsPPP loan - May not need to be paid backUncategorized IncomeTotal IncomeExpenses7000 Grants, Contracts, & Direct Assistance7020 Grants to other organizations7200 Salaries & Related Expenses7210 Quickbooks payroll service7220 Employee Salaries7224 Payment to J. Miller for Eweek7230 Simple IRA Payments7240 Employee Benefits - Not Retirement7250 Payroll Taxes, Etc.7260 Payroll Service FeesEnd 7200 Salaries & Related ExpensesDescription2158954100190001700075000 1000 to STEM in 01150Partial year in acutalBase Salaries Includes a portion of Line items 7250 and 7260 - Changes from Paychex to QB reports differentlyExpense to match income above2% of prior years salaryCDPHP ( 1732/month), NYSIF- Workers Comp & DisabilityPayroll taxPaychex- Payroll service and W2 processing7500 Contract Service Expenses7520 Accounting Fees7530 Legal Fees7540 Speaker/Presenter Fee7550 Legislation/Lobbyist7595 Administrative Expenses7596 Quickbook FeesEnd 7500 Contract Service Expenses8100 Nonpersonnel Expenses8110 Supplies8130 Telephone & Telecommunications5250500035000490000Wojeski (CPA)Kriss Legal FeesFees paid to Seminar SpeakersKriss Legislative/Lobby/Ex.Director DutiesQuickBooks Fee ( 713441084173863334000400036111033000 2747.22/month. Rent Includes Phones and IT space in server 01500015004003500026525023650024090 25/member portion of membership dues paid to Chapters 011892410250036508001200120900002500Total Expenses516840537620508836Net Income20451471534048140 Postage & Shipping, Printing8160 IT Expenses8161 Computer Software8170 Printing & Copying8180 Subscriptions8190 Internet, Web, Hosting FeesEnd 8100 Nonpersonnel Expenses8200 Facility & Equipment Expenses8210 Rent, Parking, Other Occupancy8260 Equipment Purchase, Rental Maintenance8300 Travel & Meetings Expenses8310 Executive Committee8330 Travel President's8340 Travel President-Elect8350 Travel Executive Director's8360 Travel NSPE Delegate8370 Travel Other8380 Conferences, Conventions, Seminars, MeetingsEnd 8300 Travel & Meetings Expenses8400 Client Specific Expenses8410 CE Evaluations8420 Chapter Membership DuesEnd 8400 Client Specific Expenses8500 Other Expenses8505 Refunds8510 Interest Expense - General8520 Insurance - non-employee related8530 Membership Dues - Organization8540 Staff Development and Training8550 Bank Fees8560 Processing Fees8570 Advertising/Marketing Expenses8580 Taxes, Registration, Licensing Fees8590 Other ExpensesEnd 8500 Other Expenses800 Office Supplies720 J. Miller Phone Reimbursement ( 60/month)Postage Machine (we can get rid of and purchase stamps), Shipping for Seminar Supplies ( 500/year) , Printer/Scanner500 Fees ( 819/year)3625 Computer Visions - Hours are purchased in hour blocks of 25 hrs at 145/hour1815 Office 365 ( 972/year), Firewall ( 534/year), Adobe ( 16.19/month)01500 Icontact-newsletter ( 64/month), Dropbox ( 120/year), SW Annual Fee ( 99/year),500 Survey MonkeyBoard breakfast at Annual conferences, Excom dinners at Annual conferencesPresident's travel to chapters and to NSPE conference (NSPE provides 400 stipend)President-Elects travel to chapters and to NSPE conference (NSPE provides 400 stipend)NSPE Delegate's travel is split between NSPE/NYSSPEStaff TravelAll workshop and conference expenses (room fees, food, etc.) Check with Jen for what to do for futureExhibitor RefundsInterest on LOC, credit cardsNationwide Insurance - Office content insurance ( 1950/year) & Rose & Kiernan Directors & Officers Liability ( 1660/year) Office contents policyICC Sponsor org membership, ( 500), NYSSPE's PIE Membership ( 300)Staff Training, if desiredKeyBank KBBO online banking fees ( 15- 25/month), Late Fees, Stop Payment Charges,First Bank- merchant service / Cvent Fees for CC's & reg., paypal fees etc. (extropolated out per month)Misc advertising for events such as Albany Union times, LIBN etc., Cvent appE-filing of taxes

The New York State Society of Professional EngineeProfit and LossJuly 1, 2020 - June 30, 2021TotalIncome5100 Revenue from Program-Related Sales & Fees5110 Member Dues (Does not include chapter dues)1747952860182706105023603637715130 Voluntary Member Dues5140 Registration Fees5170 Exhibitor Revenue5185 CE EvaluationTotal 5100 Revenue from Program-Related Sales & Fees5300 Revenue from Investments5310 Interest - Checking/Money Market119119Total 5300 Revenue from Investments5400 Revenue from Other Sources5410 FEE/PIE Shared Services94513805756781181083660From FEE to cover J.Miller payment for Eweek5420 Advertising5490 Misc RevenueTotal 5400 Revenue from Other SourcesUncategorized IncomeTotal Income 472,256.00Gross Profit 472,256.00Expenses7200 Salaries & Related Expenses7030 Salaries & Wages2227001764636880573791236927050 Payroll Taxes, Etc.7100 Quickbooks Payroll7224 J.Miller EWeek Checks7230 Retirement Contributions7240 Employee Benefits - Not RetirementTotal 7200 Salaries & Related Expenses 276,254.007500 Contract Service Expenses7520 Accounting Fees66006000852214900010737530 Legal Fees7540 Speaker/Presenter Fee7550 Legislation/Lobbyist7596 QuickBook FeesTotal 7500 Contract Service Expenses 147,894.008100 Nonpersonnel Expenses8110 Supplies8140 Postage, Shipping & Printing8160 IT Expenses8161 Computer Software27038041271344

8170 Printing & Copying108417386338180 Subscriptions8190 Internet, Web, Hosting FeesTotal 8100 Nonpersonnel Expenses 9,576.00 36,111.008200 Facility & Equipment Expenses8210 Rent, Parking, Other OccupancyTotal 8200 Facility & Equipment Expenses361118300 Travel & Meetings Expenses8380 Conferences, Conventions, Seminars, MeetingsTotal 8300 Travel & Meetings Expenses28065 28,065.008500 Other Expenses8505 Registration Refunds8520 Insurance - non-employee related8530 Membership Dues - Organization8550 Bank FeesPayPal Fees8560 Processing Fees8580 Taxes, Registration, Licensing FeesTotal 8500 Other Expenses57538018501162.629241250 14,835.62Total Expenses 512,735.62Net Operating Income- 40,479.62Net Income- 40,479.62Notes: Items not shownPPP Loan - One time loan 45,594.07Tuesday, Jun 01, 2021 01:22:54 PM GMT-7 - Accrual Basis

PRESIDENT'S REPORT . Payroll Liabilities Federal Taxes (941/944) Federal Unemployment (940) 0.00 NY PFL 34.73 . 7210 Quickbooks payroll service 368 1380 Partial year in acutal 7220 Employee Salaries 215895 222,700 227,682 Base Salaries Includes a portion of Line items 7250 and 7260 - Changes from Paychex to QB reports differently .