Transcription

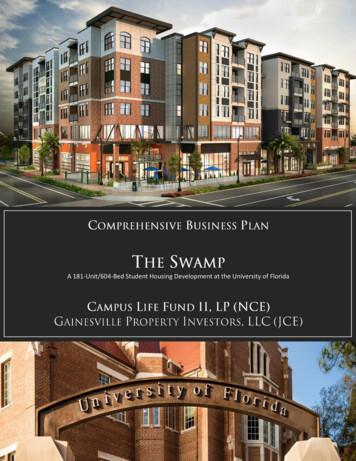

A 181-Unit/604-Bed Student Housing Development at the University of Florida

Table of ContentsProject Overview .1University of Florida (UF). 2Project Location .4The Project’s Land and Site Plan .4Architectural Renderings .6Project Amenities .7Property Amenities. 7Student Apartment Unit Amenities/Finishes . 7Unit Floorplans .8Development/Project Team . 11Developer . 11General Contractor . 12Property Manager . 12Architect . 12Engineer . 13Project Costs . 14The Project’s Organizational Structure . 15Capital Structure / Sources & Uses of Capital . 16Construction Loan . 16The Project’s Equity . 16Investment Structure. 17Distributions from JCE to NCE Investment Vehicle . 17Distributions from NCE Investment Vehicle to NCE . 18Project Timeline . 18Market Analysis . 18Student Enrollment at UF . 19Market Occupancy and Rent Trends . 19Demand Analysis . 20Competitive Analysis . 21Purpose-Built Properties and Conventional Multifamily Apartments . 21New Product Pipeline . 22On-Campus Residence Halls and Dormitories . 22Unit Mix and Rental Rates . 24Marketing Strategy . 24Permits & Licenses . 25

Executed & Draft Contracts . 26Job Creation. 26Project Strengths & Weaknesses . 27Strengths. 27Prime Location. 27Student Specific Amenities. 27Strong Enrollment Growth . 27Constrained Supply and Minimal Development Pipeline. 27Seasoned and Experienced Developer, General Contractor, and Architect . 28Excess Job Creation for the Project’s EB-5 Investors . 28Weaknesses . 28Dependence on School Enrollment . 28Existing & New Competition . 28Financial Analysis . 28Revenue and Expense Assumptions . 29Financial Projections. 30Appendix A - Market Analysis Information. 31Appendix B - Licenses & Permits . 48Appendix C - Executed & Draft Contracts . 132

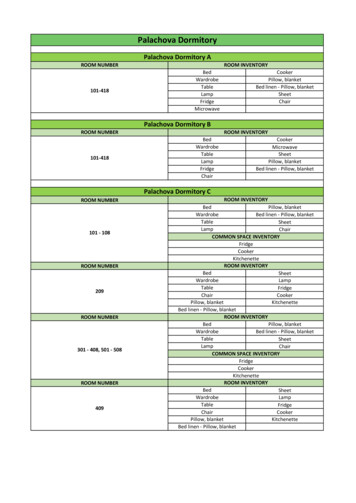

PROJECT OVERVIEWCampus Life Fund II, LP (“CLF II” or the “NCE”) is a Delaware limited partnership that wasorganized on August 1, 2019. Per its private placement offering memorandum and limitedpartnership agreement (included in this I-526 petition), the NCE will offer up to 100 limitedpartnership units to qualified, non-U.S. citizens seeking permanent resident status in the UnitedStates through the EB-5 Immigrant Investor Program. Per its private placement memorandum,CLF II will invest its EB-5 capital in a portfolio of job creating, EB-5 qualified projects (all portfolioprojects will be located in geographies and industries already approved for their respectiveRegional Center and will meet the qualifications of the EB-5 Program).Gainesville Property Investors, LLC, a Delaware limited liability company formed on July 1, 2020(the “JCE”), will develop, own and operate The Swamp, a purpose-built student housingproperty in Gainesville, Florida (the “Project”). The Project will cater to students attending theUniversity of Florida (“UF”), which had an enrollment of 56,567 in 2019, with 35,491 at its maincampus in Gainesville. The Project will consist of 181 one-, two-, three-, four- and five-bedroomunits with 604 total bedrooms and 410 garage-parking spaces. All units will offer bedroom-tobathroom parity (each bedroom has its own private bathroom), include individual leases (leasedby the bedroom versus the overall apartment unit), come fully furnished (beds, desks, living roomcouches, Smart TVs, coffee table, and appliances: oven/range, microwave, refrigerator,dishwasher and washer/dryer) and walk-in closets.The Project’s amenities will include a study lounge with group study rooms, computer center/labwith printing capabilities, high-speed internet throughout the property, resident lounge with TVsand gaming area, bicycle and scooter storage, gourmet coffee bar, and dog walk area. Theproperty will feature a rooftop amenity deck with swimming pool, hot tub, Jumbotron, resortstyle cabanas, modern indoor/outdoor professional fitness center and outdoor grilling area. Inaddition, the Project will offer approximately 18,828 square feet of ground floor retail/restaurantspace, fronting the highly trafficked W University Avenue.Construction of the Project began in August 2020 and is anticipated to take 24 months, lastingthrough July 2022, with an anticipated opening for the start of UF’s Fall 2022 school year. TheProject’s total development budget is 97,977,390. Please refer to Project Costs on page 14 andCapital Structure / Sources & Uses of Capital on page 16 for additional information.Each of the JCE’s financing sources has been secured. On July 28, 2020, the JCE closed on asyndicated construction loan with First Merchants Bank, Old National Bank, and First FinancialBank of 65,000,000 (please see the executed loan agreement and promissory notes included inthe I-526 petition). The Developer invested 10,977,390, and CLF II will contribute up to 13,500,000 of equity capital from up to 15 EB-5 investors. It should be noted that CLF II’sinvestment is being bridged within an investment vehicle/entity until the EB-5 capital is raised.For a detailed discussion of the investments to be made by CLF II and the other parties involved,please refer to Organizational Structure on page 15.

University of Florida (UF)Founded in 1853, the University of Florida isa public land-grant, sea-grant, and spacegrant research university located inGainesville, Florida. It is a senior member ofthe State University System of Florida and is the only member of the Association of AmericanUniversities in the state. It has operated continuously on its Gainesville campus since September1906. It is the third largest Florida university by student population, and is the eighth largestsingle-campus university in the United States with 56,567 students enrolled for the Fall 2019semester. The university has experienced an 11.9% enrollment growth since 2014 and in 2019 hadan acceptance rate of 37.9%. The freshman retention rate was 97% and the university overall hasa 90% graduation rate.The University of Florida is home to 16 academic colleges and more than 150 research centers andinstitutes. It offers multiple graduate professional programs—including business administration,engineering, law, dentistry, medicine, pharmacy and veterinary medicine—on one contiguouscampus, and administers 123 master's degree programs and 76 doctoral degree programs in 87schools and departments.In 2020, U.S. News & World Report ranked UF as tied for the 7th -best public university in the UnitedStates, and tied for 34th overall among all national public and private universities. Many of UF’sgraduate schools have received top-50 national rankings from U.S. News & World Report with theschool of education at 25th, Florida's Hough School of Business at 25th, Florida's Medical School(research) tied for 43rd, the Engineering School tied for 45th, the Levin College of Law tied for 31st,and the Nursing School tied for 24th in the 2020 rankings.UF is one of the nation's largest research universities. According to a 2019 study by theUniversity's Institute of Food and Agricultural Sciences, the university contributed 16.9 billionto Florida's economy and was responsible for over 130,000 jobs in the 2017–18 fiscal year. Over50 biotechnology companies have resulted from faculty research programs. Florida consistentlyranks among the top 10 universities in licensing. Royalty and licensing income includes theglaucoma drug Trusopt, the sports drink Gatorade, and the Sentricon termite elimination system.The Institute of Food and Agricultural Sciences is ranked No. 1 by the NSF in Research andDevelopment.The University of Florida was awarded 837.6 million in annual research expenditures insponsored research in 2018. Research includes diverse areas such as health-care and citrusproduction (the world's largest citrus research center). In 2002, Florida began leading six other

universities under a 15 million NASA grant to work on space-related research during a five-yearperiod. The university's partnership with Spain helped to create the world's largest singleaperture optical telescope in the Canary Islands (the cost was 93 million).UF’s intercollegiate sports teams, commony known by their “Gators”nickname, compete in National Collegiate Athletic Association(“NCAA”) Division I and the SEC Conference and are consistentlyranked among the top college sports programs in the United States.UF currently fields teams in nine men's sports and twelve women'ssports. All Florida Gators sports teams have on-campus facilities,and most are located on or near Stadium Road on the north side of campus (within walkingdistance from the Project), including Steve Spurrier-Florida Field at Ben Hill Griffin Stadium forfootball and the Exactech Arena at the Stephen C. O'Connell Center for basketball.Beginning in the early 1990s, the Florida Gators have been recognized as oneof the premier athletic programs in the Southeastern Conference (“SEC”) andone of the best in the nation. The SEC has awarded an All-Sports Trophy tothe best overall sports program in the conference since 1984, and Florida haswon the award 27 times as of 2017. Florida is the only school in the SEC andone of four schools nationally to have won a national championship infootball, men's basketball, and baseball (including being the only school in NCAA history to wina national championship in both footbal and basketball in the same school year).

PROJECT LOCATIONThe Swamp will be located on 2.85 acres at the northeast corner of intersection of W UniversityAvenue and NW 17th Street (with an approximate address of 1642 W University Avenue) inGainesville, Florida. The Project site is directly across the street from the edge of the mostpopulous corner of UF’s campus, and just 0.2 miles from the Ben Hill Griffin Stadium. The site isalso in the center of the main entertainment area for students, called “Midtown.”Under the EB-5 Program, the required investment amount for each foreign investor is currently 900,000 if the investment is made into a geographic area that qualifies as a Targeted EmploymentArea (“TEA”). Based on an analysis performed by Vermillion Consulting, The Swamp’s locationqualifies as a TEA. The TEA analysis letter is included in this I-526 petition.THE PROJECT’S LAND AND SITE PLANOn July 28, 2020, at the time of closing on its construction loan, the JCE closed on the purchase ofthe land for required for the Project’s development. This included 11 separate parcels making up2.85 acres. As such, all land required for the development of the Project is owned by the JCE. Thefollowing outlines The Swamp’s proposed site plan, which will include two adjacent mid-rise

residential buildings each wrapped around a structured parking garage, 604 total beds, and 410garage parking spaces.

ARCHITECTURAL RENDERINGSIntersection of W University Avenue and NW 17th StreetView looking down NW 1st Avenue

PROJECT AMENITIESThe Swamp will feature student-focused amenities and will offer unit finishes designedspecifically for students, including:Property Amenities Study lounge and group study rooms Computer lab with printing capabilities High-speed internet access throughout the property Controlled access On-site management and maintenance Walkable to campus 24-hour indoor/outdoor fitness center Two-story clubhouse with resort-style swimming pool and hot tub Outdoor grilling stations Tanning beds Fire pits Dog park Roommate matchingStudent Apartment Unit Amenities/Finishes Spacious one-, two-, three-, four- and five-bedroom units Private bedrooms with locks from the unit’s common area Private bathroom in each bedroom Fully furnished units (beds, dressers, dining table/chairs, living room table and couch) Fully equipped kitchens with oven/range, microwave, refrigerator and dishwasher Smart HDTVs and Smart technology in every unit, including thermostats and locks Full size washer & dryer in every unit Individual leases on a per-bed basis to avoid a single master lease (i.e. minimal liabilityto parents) Walk-in closets Balconies

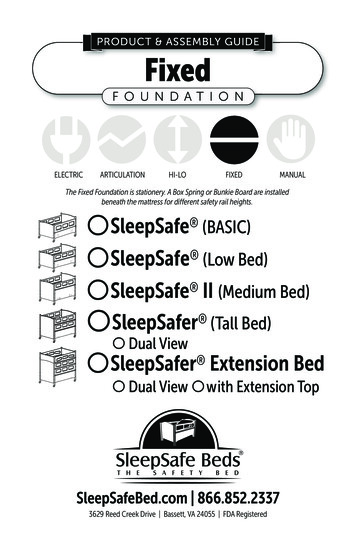

UNIT FLOORPLANSThe following depicts the unit floorplans designed for The Swamp.1-Bedroom / 1-Bathroom Unit2-Bedroom / 2-Bathroom Unit

3-Bedroom / 3-Bathroom Unit4-Bedroom / 4-Bathroom Unit

5-Bedroom / 5-Bathroom Unit

DEVELOPMENT/PROJECT TEAMThe Swamp’s development/project team is comprised of parties experienced in the development,construction and leasing/management of student housing properties.DeveloperThe Project is being developed and sponsored by 908 Group and Scannell Properties (togetherthe “Developer”), which have co-developed numerous student housing properties in the pastseveral years.908 Group is a Tampa, Florida based real estate developmentcompany specializing in purpose-built student housinglocated within walking distance to campus, namelythroughout the Power 5 Conferences, as well as urban infill,multifamily and affordable housing. 908 Group’s focus is tocreate highly unique properties and innovatively functional living spaces through the utilizationof cutting-edge architecture, design, and technology. One of the company’s primary points ofemphasis is for each distinctive project to achieve a balance between form and function. As asocially responsible development firm, 908 Group develops real estate with a triple-bottom lineinvestment approach aiming to simultaneously yield financial, social and environmental returnsfor all partners and stakeholders involved with its developments. www.908group.comRepresentative Projects (908 Group)

Scannell Properties is a privately held companyfounded in 1990 that has established itself as one of thecountry’s premier developers.The company’sheadquarters is in Indianapolis, Indiana with additionaloffices in Alexandria, Virginia, Minneapolis, Minnesota, Denver, Colorado, Kansas City, Missouriand Oakland, California. Scannell has 40 full time employees and in recent years its averageannual development volume has exceeded 300 million. www.scannelproperties.comThe JCE has entered into development agreements with 908 Group Advisor, LLC (an affiliate of908 Group) and SP Gainesville Holdings, LLC (an affiliate of Scannell Properties), outlining eachparties’ responsibilities and compensation (the “Development Agreements”). Executed copies ofthe Development Agreements are included in Appendix C – Executed & Draft Contracts.General ContractorThe Project will be constructed by ARCO/Murray Construction Company (“ARCO” or the“General Contractor”), a Tampa, Florida based construction firm with a national presence. Thecompany was founded in 1992 and since then has grown to become a leader in the design/buildindustry with offices in 19 major markets and 800 associates nationwide. The General Contractorhas experience across numerous asset classes, including manufacturing, distribution facilities,seniors living, entertainment, healthcare, office, multifamily and student housing. They havecompleted two student housing projects in the UF market in recent years, including the Nine @Gainesville, which is another property jointly developed by 908 Group and Scannell Properties.This demonstrates not just local knowledge in the area, but also shows a positive workingrelationship with the Developer. www.arcomurraycc.comThe JCE has entered into a guaranteed maximum price contract with ARCO/MurrayConstruction Company, outlining the General Contractor’s responsibilities and compensation(the “GMP Construction Contract”). An executed copy of the GMP Construction Contract isincluded in Appendix C – Executed & Draft Contracts.Property ManagerThe Project will be managed by Asset Campus USA, LLC (“Asset Campus” or the “PropertyManager”), the third largest student housing property manager in the country, as well as anextensive manager of conventional multifamily properties. They have 35 years of experiencewith 320 total properties under management, with 140,000 student beds across 120 campuses in40 states, including several properties in the UF market. www.assetliving.comThe JCE will enter into a property management agreement with Asset Campus USA, LLC,outlining the Property Manager’s responsibilities and compensation (the “Property ManagementAgreement”). A draft of the Property Management Agreement is included in Appendix C –Executed & Draft Contracts.ArchitectThe Project’s architect is Humphreys & Partners Architects/Florida, LLC (“HPA” or the“Architect”). HPA has been providing high quality, innovative planning, and design services forthe past 27 years. They are an award-winning firm specializing in multifamily, mixed-use,

hospitality/resort design, student, senior, tax credit, affordable, moderate and luxurycommunities. They are headquartered in Dallas, Texas with regional offices all over the world.In total, they have designed 61 student housing properties in 38 different states, including twoprojects in the UF market. www.humphreys.comThe JCE has entered into an architectural services agreement with Humphreys & PartnersArchitects/Florida, LLC, outlining the Architect’s responsibilities and compensation (the“Architectural Services Agreement”). An executed copy of the Architectural Services Agreementis included in Appendix C – Executed & Draft Contracts.EngineerThe Project’s engineer is Causseaux, Hewett & Walpole, Inc. (“CHW” or the “Engineer”). CHWis a full-service engineering firm based in Gainesville, Florida that provides civil engineering,zoning, surveying, mapping, planning, permitting, landscape architecture, and constructionservices. They are a local firm with extensive expertise in the market and have received numerousawards from both the City of Gainesville and UF, most notably on the recent upgrade to theJ. Wayne Reitz Union Student Center Expansion. www.chw-inc.comThe JCE has entered into an engineering services agreement with Causseaux, Hewett & Walpole,Inc. that outlines the Engineer’s responsibilities and compensation (the “Engineering ServicesAgreement”). An executed copy of the Engineering Services Agreement is included in AppendixC – Executed & Draft Contracts.

PROJECT COSTSThe following table is a line item breakdown of The Swamp’s project/development budget, or“uses of capital.” This table has been prepared through extensive collaboration among theProject’s Developer, General Contractor, Architect and Engineer.AmountLand & RelatedLand CostExtension FeesBrokerage FeesTotal Land & Related 27,300,000380,000159,00027,839,000Per BedPSF (net) % of Total 45,199 Hard Construction CostsConstruction Contract GMPDirect Construction Work by OwnerConstruction ContingencyTotal Hard Construction .0%Furniture, Fixtures & EquipmentFurniture, Fixtures & EquipmentTotal Furniture, Fixtures & %3.1%Soft CostsArchitectureEngineering & InspectionInterior DesignSurveyingEnvironmental ReportsAccountingLegal FeesPartnership Overhead CostsInsuranceProperty TaxesMunicipal FeesMarketing & Initial Operating CostsDevelopment FeeDevelopment Cost ContingencyTotal Soft .0%0.3%0.1%0.6%0.5%1.4%0.9%2.6%0.5%9.1%Financing CostsConstruction InterestDebt FinancingOther Closing CostsPreferred Return ReservesTotal Financing l Project/Development Budget

It should be noted that the Project’s Developer, General Contractor, Architect and Engineer havesignificant experience building multifamily and student housing apartments, providing a strongbasis of recent comparable projects from which to accurately forecast the Project’s developmentcosts. A more detailed breakout of the Project’s hard construction costs, as prepared by theGeneral Contractor, is included in the construction schedule of values (included in theeconometric job creation report).THE PROJECT’S ORGANIZATIONAL STRUCTURECampus Life Fund II, LP (the NCE) will invest in Gainesville Property Investors, LLC (the JCE)through an investment vehicle to accommodate the total equity required by the Project and theneed to bridge the EB-5 capital until it has been raised. The following organizational chart depictsthe organizational structure of the NCE and JCE.The NCE will invest up to 13,500,000 of EB-5 capital from up to 15 EB-5 investors into AtlanticAmerican Gainesville Investments, LLC (“NCE Investment Vehicle”). The current members ofNCE Investment Vehicle include Atlantic American Fortune Fund, LP, which has made a 13,500,000 investment and five individuals who have made a 1,500,000 combined investment.NCE Investment Vehicle will invest a total of 15,000,000 into the JCE.Atlantic American Fortune Fund, LP’s investment will serve as temporary bridge financing forNCE’s investment until the EB-5 capital has been raised and invested. As the NCE invests itsEB-5 capital, NCE Investment Vehicle will admit NCE as a member and return the bridge capitalto Atlantic American Fortune Fund, LP, as outlined in NCE Investment Vehicle’s executedoperating agreement (included in the I-526 petition).The JCE has three members: Atlantic American Gainesville Investments, LLC (the NCEInvestment Vehicle), Campus Opportunities Fund, LP and 908-Scannell (Gainesville), LLC (theDeveloper’s investment entity). An overview of the investments made by these members isprovided below.

Capital Structure / Sources & Uses of CapitalThe Project’s 97,977,390 total budget is being financed through a combination of debt and equity.The following table depicts the sources and uses of capital for the Project.AmountSourcesConstruction LoanClass A Member equity (NCE)Class B Member equity (Campus Opportunity Fund)Class C Member equity (Developer)% of Total .1%11.2%Total Sources97,977,390100.0%UsesLand & RelatedHard Construction CostsFurniture, Fixtures & EquipmentSoft CostsFinancing 0028.4%52.0%3.1%9.1%7.3%Total Uses97,977,390100.0%Construction LoanOn July 28, 2020, the JCE closed on a syndicated construction loan with First Merchants Bank,Old National Bank and First Financial Bank in the amount of 65,000,000. The loan agreementstates that the construction loan will bear an interest rate equal to the 30-day LIBOR rate plus3.00% and have a 36-month maturity, with the ability to extend the loan for one 24-month periodassuming certain conditions are met. The construction loan will require interest only paymentsfor the 36-month term, with the outstanding principal balance due at maturity. If extended,however, the loan will amortize over a 30-year period.A copy of the executed construction loan agreement and related promissory notes are includedin the I-526 package.The Project’s EquityAs mentioned above, the JCE includes three members: Atlantic American GainesvilleInvestments, LLC (the NCE Investment Vehicle) has committed 15,000,000 as Class A Memberequity; Campus Opportunities Fund, LP has committed 7,000,000 as Class B Member equity;and 908-Scannell (Gainesville), LLC (the Developer’s investment entity) has committed 10,977,390 as Class C Member equity. The Class A Member will have a priority return of capital(i.e. preferred position) ahead of the Class B Member and Class C Member. The Class B Memberwill have a priority return of capital ahead of the Class C Member.A copy of the executed operating agreement for the JCE is included in the I-526 package.

Investment StructureThe following outlines the profit distributions and return of capital of the NCE’s investment inthe JCE.Distributions from JCE to NCE Investment VehiclePer the JCE’s executed operating agreement, th

graduate schools have received top-50 national rankings from U.S. News & World Report with the school of education at 25th, Florida's Hough School of Business at 25th, Florida's Medical School (research) tied for 43rd, the Engineering School tied for 45th, the Levin College of Law tied for 31st,