Transcription

Fed ral·E e dituresby State forFiscal Year 1989U.S. Department of CommerceBUREAU OF THE CENSUS

ACKNOWLEDGMENTSThis report was prepared in the Governments Division underthe supervision of David Kellerman, Chief of the Federal FinanceStaff. R. Ross Saberin and SuZanne Peck compiled andreviewed the tables, and were assisted by William Goldsworth,Sue Jones, Rita Loftus and James Millet.Computer processing operations were performed by PamButler, Michael Freeman, and Steve Poyta, Chief of the Computer Utilization Branch.Corrine W. Davis supervised preparation of publication copy,assisted by Esther Fogwell and Ruth Samuels.The staff of the Administrative and Publications ServicesDivision, Walter C. Odom, Chief, performed publication planning, design, composition, editorial review, and printing planningand procurement. Joan I. Kinikin provided publication coordination and editing.Guidance and supervision for this report were provided by theBudget Review Division, and the Planning and CommunicationsManagement Division, of the Office of Management andBudget.Grateful acknowledgement is made of the cooperation ofvarious Federal Government departments and agencies for providing information needed for this report.For information regarding data in this report, contact DavidKellerman, Governments Division, Bureau of the Census, Washington, DC 20233 [(301) 763-5276].

FederalExpendituresby State forFiscal Year 1989Issued March 1990U.S. Department of CommerceRobert A. Mosbacher, SecretaryThomas J. Murrin, Deputy SecretaryMichael R. Darby, Under Secretaryfor Economic AffairsBUREAU OF THE CENSUSBarbara Everitt Bryant, Director

BUREAU OF THE CENSUSBarbara Everitt Bryant, DirectorC.L. Kincannon, Deputy DirectorCharles A. Waite, Associate Directorfor Economic ProgramsGovernments DivisionWilliam C. Fanning, Acting ChiefFor sale by the Superintendent of Documents, U.S. GovernmentPrinting Office, Washington, DC 20402

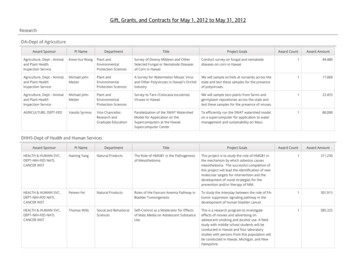

CONTENTS[Page numbers listed here omit the prefix thatappears as part of the number of each page]IntroductionPagevTable1.2.3.4.5.6.7.Summary Distribution of Federal Funds, by State and Territory: Fiscal Year 1989Federal Government Grants to State and Local Governments by Agency and for Selected Programs by,State and Territory: Fiscal Year 1989Federal Government Expenditure for Salaries and Wages, by State and Territory: Fiscal Year 1989Federal Government Direct Payments for Individuals by Program, State, and Territory: Fiscal Year 1989Federal Government Procurement Contracts-Value of Awards, by State and Territory: Fiscal Year 1989Federal Government Expenditure for Other Programs, by State and Territory: Fiscal Year 1989Federal Government Loan and Insurance Programs-Volume of Assistance Provided, by State andTerritory: Fiscal Year 1989216172021248.9.10.Per Capita Amounts of Federal Expenditure, by State and Territory: Fiscal Year 1989Percent Distribution of Federal Expenditure, by State and Territory: Fiscal Year 1989Federal Expenditure for Defense Department and All Other Agencies, by State and Territory: Fiscal Year1989 .---------------------3711.Historical Summary of Federal Government Expenditures, by State and Territory: Fiscal Years 1981 to1989State Rankings for Per Capita Distribution of Federal Expenditures: Fiscal Year 1989384412.2732AppendixA.Amtrak Subsidy: Estimated Allocation of Federal Government Subsidy for National Railroad PassengerCorporation (Amtrak), by State: Fiscal Year 19898.Program Coverage:Table 8-1. Listing of Programs Tabulated in Table 2 for "Other" Columns: Fiscal Year 1989Table 8-2. Listing of Programs Tabulated in Tables 4, 6, and 7 for Columns in Which Multiple Programsare Included: Fiscal Year 1989A-18-18-3

INTRODUCTIONThis report was prepared in accordance with the Consolidated Federal Funds Report Amendments of 1986(P.L. 99-547), which requires "The Director of the Office ofManagement and Budget to prepare an annual reportconsolidating the available data on the geographic distribution of Federal funds . " The report reflects FederalGovernment expenditures by State and Territory.Coverage includes Federal Government expendituresfor grants to State and local governments, salaries andwages, procurement, direct payments for individuals, andother programs for which data were available by State andterritory. For fiscal year 1989, the statistics compiledamount to 931.9 billion.The data presented in this report on grants, salaries andwages, direct payments for individuals, procurement, andother direct Federal expenditures are shown by program orFederal agency whenever possible.Federal Government expenditure amounts not includedin this report reflect data that could not be distributed byState and territory, or that were not available. Such amountsinclude net interest on the Federal Government debt,international payments and foreign aid, current operationalexpenses not included under salaries or procurement(tables 3 and 5), expenditures for selected agencies (suchas the Central Intelligence Agency and National SecurityAgency), and foreign outlays within each of the categoriesin tables 2 through 6.Another significant difference between this report andthe CFFR publications 'is the level of geographic detail forwhich data are shown. This report distributes data only ona State-by State basis, while the CFFR publications contain county area and subcounty area information.The CFFR Volume I publication covers Federal expenditures for all object categories (grants, salaries and wages,direct payments for individuals, procurement, and otherdirect payments) shown in this publication. The CFFRVolume II publication covers only Federal expenditures forgrants and procurement contract awards. Users shouldconsult the introductory texts in the CFFR publications fordetailed explanations of the data reported.SOURCES AND LIMITATIONS OF DATAAll data in this report were obtained from FederalGovernment departments and agencies, as outlined in theTechnical Notes. Data were reviewed for accuracy andconsistency, and compared to actual outlays in the FederalBudget to assure reasonableness and proper coverage.No attempts have been. made to account for all FederalGovernment expenditures as reported in the Federal Budget, or as presented in the Census Bureau annual reportGovernment Finances.Users are urged to read carefully the Technical Notes,particularly as to the conceptual coverage represented byeach table.CONSOLIDATED FEDERAL FUNDS REPORTSERIESTECHNICAL NOTESThis publication is part of the Consolidated FederalFunds Report (CFFR) series, which consists of threereports: Federal Expenditures by State for Fiscal Year 1989 Consolidated Federal Funds Report, Fiscal Year 1989,Volume I, County AreasoConsolidated Federal Funds Report, Fiscal Year 1989,Volume II, Subcounty AreasThis report presents data similar to the data in VolumesI and II of the CFFR publications. In this report, however,grants to State and local governments represent actualexpenditures of the Federal Government. In the two CFFRpublications, Federal grants generally represent obligations, and include payments to State and local governments as well as grants to nongovernmental recipients.Statistics for this report were gathered from a variety ofsources within the Federal Government. Consequently,amounts in each table may represent different accountingor timing concepts. Below is a table-by-table description ofthe sources and coverage of the statistics.Statistics representing actual expenditures of the Federal Government during the fiscal year were used whenever possible in this report. The primary exception, asnoted below, was for Federal Government procurementstatistics provided by the Federal Procurement Data Center. The procurement data represent the value of obligations for contracts awarded during the fiscal year.Table 1All amounts in table 1 were carried forward from succeeding tables. Data were rounded to millions of dollars.v

Table 2All amounts of Federal Government grants to State andlocal governments represent actual cash outlays or payments made during the fiscal year. Each Federal Government executive department and agency provides annualdata on grants to governmental units pursuant to OMBCircular A-11, and the Consolidated Federal Funds Report.The data are collected from Federal agencies by theCensus Bureau.Prior to 1983, such data were incorporated into thereport Federal Aid to States, published by the Departmentof the Treasury. The Treasury Department collection andpublication of Federal grants was done in accordance withthe former Treasury Circular 1014 and the annual TreasuryFinancial Manual. Both of these contained definitions andreporting guidelines that were consistent with OMB Circular A-11 and the current Census Bureau reporting guidelines. Hence this publication (Federal Expenditures byState) and the previous Treasury publication Federal Aid toStates provide users with historically consistent statisticson Federal agency grants to State and local governments.Federal Government aid to State and local governments includes the following:1. Direct cash grants to State or local governmentunits.2. Payments for grants-in-kind, such as purchases ofcommodities distributed to State or local government institutions (e.g., school programs).3. Payments to nongovernment entities when suchpayments result in cash or in-kind services passedon to State or local governments.4. Payments to regional commissions and organizations that are redistributed at the State or locallevel.5. Federal Government payments to State and localgovernments for research and development that isan integral part of the provision of public services.6. Shared revenues.It should be noted that the concept of grants covered intable 2 excludes Federal Government payments to individuals, profit or nonprofit institutions not covered above, andpayments for services rendered. Grants to individuals andprofit or nonprofit institutions are covered in table 6 of thisreport. Payments for services rendered are largely coveredin table 5 of this report.The examination and edit process used by the CensusBureau included comparison of reported data to thatsubmitted for the prior year, and to budget amountssupplied by the Office of Management and Budget. Allgrants data were reconciled by budget account and tobudget figures that each Federal agency is required tosubmit annually to OMB, in accordance with OMB CircularA-ii. Discrepancies were brought to the attention of theVIsubmitting agencies and, where warranted, revisions weremade. The Office of Management and Budget also provided assistance in the classification of grants and inensuring compliance with the reporting requirements.Table'3Amounts reported for Federal Government salaries andwages were taken from statistics provided by the Department of Defense, Department of Transportation (UnitedStates Coast Guard), Federal Bureau of Investigation,Office of Personnel Management, and United States PostalService. All amounts represent outlays during the FederalGovernment fiscal year indicated.Department of Defense military payroll statistics wereprovided by the Directorate for Information, Operationsand Reports, Washington Headquarters Services, Department of Defense, Amounts represent estimates by State,and include gross compensation, except retired militarypay which is reported in table 4. Other features of theDepartment of Defense salaries and wages data include:1. Amounts for military personnel stationed overseasare excluded from totals.2. Salaries and wages for inactive personnel refer tomilitary reserve and National Guard payroll.3. Amounts reported reflect the State and territory ofemployment (duty station) rather than home resi, dence.Payroll statistics provided by the United States PostalService represent actual outlays during the fiscal year, butwith the national total distributed among the States on anestimated basis. State-by-State estimates were derived bycalculating the "per employee" payroll cost, applying thiscost to each postal facility based upon the number ofemployees, then aggregating to the State level for reporting purposes. Estimates were based on place of employment rather than place of residence.Salaries and wages for employees of the Federal Bureauof Investigation were obtained separately from that agency.Prior to 1986, these amounts were included in data forcivilian agencies provided by the Office of PersonnelManagement.Salaries and wages for uniformed employees of the U.S.Coast Guard were provided by that agency. Geographicallocation were based upon place of employment.Statistics on salaries and wages (including premium payand lump sum payments) for all other civilian FederalGovernment personnel working in the States and territories were obtained from the Office of Personnel Management (OPM). The OPM statistics reflect actual outlaysduring the fiscal year for civilian salaries, but with thenational aggregate distributed among the States on anestimated basis. Assumptions of the salaries and wagesdata compilation from OPM were:

1. The basis for the geographic distribution was placeof employment. Data on salary and employmentdistribution from the Office of Personnel Management's (OPM) Central Personnel Data File (CPDF)as of March 31 st of the fiscal year were used togeographically pro-rate to total fiscal year payrolland payment data from the SF 113-A, "MonthlyReport of Federal Civilian Employment.2. Estimated payroll data were produced at the State,county, and territory levels only.3. DOD and Non-DOD State, county, and territorypayroll data were partially estimated, predicated onthe assumption that premium pay and lump sumpayments as well as parttime and intermittent paywere proportional to the salaries of full-time Federalcivilian employees (defense and non- defense) inthe counties and territories.4. Judicial pay was estimated based on the aboveassumption with the exception of the SupremeCourt whose SF 113-A pay was added to theDistrict of Columbia's non-defense payroll.The methodology used to estimate the geographicbreakdown involved the following steps:1. Actual expenditures for salaries and wages wereobtained from the SF 113- A. Salary and wage dataon the SF 113-A were total expenditures (includingbasic, premium, and lump sum payments) for allFederal civilian employees. These data were notreported by State and county on the SF 113-A.2. From OPM's CPDF and agency survey data (Tennessee Valley Authority) aggregate basic salariesfor full-time employees only were computed foreach U.S. county, each U.S. Territory, total U.S.,and total U.S. Territories. Based on these aggregate basic salaries, DOD and non-DOD percentages were computed. These percentages determined each county's and territory's proportion ofthe total (U.S. and U.S. Territories) full- time salaries.3. The percentage referenced above for DOD andnon-DOD were applied to SF 113- A DOD andnon-DOD payroll data for the U.S. and U.S. Territories to estimate actual expenditures in U.S. countiesand U.S. Territories. State and U.S. Territory totalswere obtained by aggregating estimated actualexpenditures in U.S. counties and U.S. Territories,respectively.4. The District of Columbia's estimated actual expenditures were computed by the above methodology.However, a supplement was then added to thisestimate for agencies not reporting to the CentralPersonnel Data File. The supplement consisted ofagency payroll data for the following agencies: U.8.Congress, Congressional Budget Reserve Board,Architect of the Capitol, U.S. Botanic Gardens,Library of Congress, Copyright Royalty Tribunal,U.S. Tax Court, Office of Technology Assessment,and the Supreme Court. Since employment in theseagencies is primarily, and most cases totally, in theDistrict, payroll data were added to the District'sestimate.The Office of Person'nel Management, Workforce Analysis and Statistics Division, can be contacted for additionalinformation.Table 4Except where indicated, data in table 4 were compiledfrom amounts reported by the Federal Agencies for theFederal Assistance Award Data System. 1 Amounts reportedrepresent obligations of Federal funds.Data on Social Security, Medicare, and SupplementalSecurity Income (S81) payments were obtained from reportssubmitted by the Department of Health and Human Services for the Federal Assistance Award Data System. Allamounts reflect obligations during the fiscal year, with theState-by-State distribution estimated. All amounts are reportedby recipient location. Excluded from the amounts reportedare payments to recipients in foreign countries. The amountsshown under the SSI program exclude any State government shares administered by the Federal Government.Retirement and disability payments for Federal civilianand military personnel represent actual expenditures during the fiscal year. Data on military retirement were obtainedalong with Department of Defense salaries data (seeTechnical Notes for table 3 above).Data on retired civilian payments were received fromthe Office of Personnel Management, Compensation Group.Figures include expenditures for all periodic annuity, survivor annuity, lump sum death claims, and withdrawals.Annual expenditures reflect actual payments, with theState-by-State distribution based on the Zip code of therecipient's place of residence. Included in the amountsshown for civilian retirement benefits is 354.9 million inbenefits for retired uniformed Coast Guard personnel, forwhich data were obtained from the Department of Transportation. Also included in the total is 70.5 million inbenefit payments for retired Public Health Service Commissioned Corps employees, obtained from that agency.Also included are benefits and lump sum withdrawals forthree smaller Federal employee programs: Foreign Services Officers ( 283.6 million); the National Oceanic and1The Federal Assistance Award Data System (FAADS) is a quarterlyreport of financial assistance awards made by each Federal agency.Coverage includes grants, direct payments to individuals, insurance, andloans. Data submitted by Federal agencies for this survey serve as thesource, as indicated, for many of the statistics in this publication. TheOffice of Management and Budget selected the Census Bureau asexecutive agent, responsible for operating FADDS.VII

Atmospheric Administration (NOAA) Corps ( 5.3 million);and Tennessee Valley Authority (TVA) ( 240.6 million).Data were obtained from the State Department, NOAA,and TVA respectively.Amounts reported for the various veterans programs intable 4 were obtained from data supplied by Department ofVeterans Affairs (VA) for the Federal Assistance AwardData System (FAADS). Information from each quarterlyFAADS report covering fiscal year 1989 was tallied toarrive at the fiscal year totals. Amounts reported by the VAfor veterans benefit programs represent actual outlaysduring the year. Foreign payments are excluded from thedata.Food Stamp program information was obtained fromdata supplied by the Department of Agriculture for theFederal Assistance Award Data System. Amounts reflectthe actual value of coupons issued, by State, during thefiscal year. Figures may differ slightly from amounts representing the value of coupons redeemed or processedthrough the Federal Reserve System.Social insurance payments for railroad workers reflectbenefits paid under the Railroad Retirement and RailroadUnemployment Insurance Acts. Amounts represent actualoutlays during the fiscal year, reported by residence ofrecipient. Data were reported by the Railroad RetirementBoard, for the Federal Assistance Award Data System.Amounts for the Housing Assistance payments wereprovided by the Department of Housing and Urban Development in a special submission for the Federal AssistanceAward Data System. Data represent outlays. Data on thePell grant program represent actual outlays during thefiscal year. The State-by-State distribution was based onthe location of the recipient school to which the paymentwas made.The National Guaranteed Student Loan program amountsrepresent interest subsidies paid to lending institutionsduring the fiscal year. Total Federal expenditures reflectactual payments. Information on this program was suppliedby the Department of Education in a special submission forthe Federal Assistance Award Data System.Earned income tax credits represent Federal Government refunds during calendar year 1989. Information wasobtained from the Department of Treasury, Internal Revenue Service, Statistics of Income Division. Amounts reflectonly the excess earned income tax credit portion-thatamount actually refunded.Federal Employee Workers Compensation paymentswere obtained from reports submitted by the Departmentof Labor, Employment Standards Administration, Office ofWorkers' Compensation Programs, for the Federal Assistance Award Data System. Amounts for fiscal year 1989reflect actual payments, with the State-by-State distribution based on the ZIP code of the recipient's place ofresidence.Federal Government expenditures for Black Lung benefits are reflected in two programs. Coal Mine Workerscompensation payments refer to the program administeredVIIIby the Labor Department, Employment Standards Administration. The program is number 17.307 in the Catalog ofFederal Domestic Assistance (CFDA). Amounts reportedfor this program represent actual outlays during fiscal year1989. Amounts reported for this program represent actualoutlays during fiscal year 1989. Amounts for Special Benefits for Dis'abled Coal Miners reflect CFDA program13.806, of the Department of Health and Human Services(HHS). Amounts reflect obligations for the fiscal year,distributed on the basis of residence of the recipient.Statistics on Federal expenditures for unemploymentcompensation were compiled from information obtainedfrom the Department of Labor. Amounts reported includeall benefit payments made from the Unemployment Compensation Trust Fund, regardless of the source of fundingfor the payments. Thus, amounts reported include regularand extended benefits to unemployed workers, and benefits to exFederal and military employees. This is a significant change in coverage in this publication. Prior to 1989,only benefit payments financed by the Federal governmentwere included in this report.Of the amount shown in the "other" direct paymentscolumn, two data items were obtained from sources otherthan FAADS. These were payments under the PensionPlan Termination Insurance program of the Pension Benefit Guaranty Corporation and the Safety Officers Benefitprogram of the Justice Department.Table 5Statistics in table 5, covering Federal Government procurement contracts, were obtained from the United StatesPostal Service (USPS) and the Federal Procurement DataCenter (FPOG).Amounts provided by the USPS represent actual outlaysfor contractual commitments, while amounts provided bythe FPDC represent the value of obligations for contractactions, and do not reflect actual Federal Governmentexpenditures. In general, only current year contract actionsare reported for data provided by the FPDC; however,multiple-year obligations may be reflected for contractactions of less than 3 years duration.The FPDC collects procurement statistics from mostFederal Government departments and agencies, and provides these data according to the place of performancerather than the location of the prime contractor. Excludedfrom the procurement totals reported are amounts for thejudicial and legislative branches of government and mostintergovernmental transfers of funds. Also excluded fromthe totals are amounts for procurement in foreign countries. As indicated in the footnotes to table 5, foreignprocurement awards were 7.4 billion in fiscal year 1989,with 6.7 billion for the Defense Department and 698million for all other Federal Government agencies otherthan the USPS.Most contract actions provided by the FPDC with valuesunder 25,000 were not distributed by State and territory.These amounts, as indicated in the footnotes to table 5,were reported as "undistributed."

Procurement data provided by the USPS include alloutlays made under formal contractual agreements. TheFPDC data include contractual actions for construction,purchase of equipment, and other purchases of tangibleitems by the Federal Government. Also included with theFPDC data are contractual actions for services often notgenerally associated with procurement, such as the purchase of utilities, building leases, and other servicesentered into via contractual agreement.Table 6Grant amounts shown in table 6 were obtained from theFederal Assistance Award Data System. It should be notedthat these grant programs represent awards to nongovernmental recipients during the fiscal year. The amounts donot duplicate data on grant expenditures reported in table2. Appendix B contains a list of the specific grant programsincluded in table 6.Table 6 grant amounts generally represent obligationsof the Federal Government, based upon awards of financial assistance during the fiscal year. Estimates of thedifferences between these amounts and actual expenditures are not available, but are believed to be small andbased upon timing considerations.Amounts shown for "direct payments-other than forindividuals" were obtained from the Federal AssistanceAward Data System, with exceptions for those programslisted below. These amounts generally represent obligations incurred during the fiscal year.The Agriculture Department was the source for data onclaims and adjustor expenses under the Federal CropInsurance program. Data reflect actual expenditures duringthe fiscal year.Amounts shown for the Federal employee life andhealth insurance programs were obtained from the Officeof Personnel Management. For both the life insurance andhealth insurance programs, the amounts reported represent only employer (Federal Government) share of thepremiums. The life insurance portion of premiums ( 340.1million) was allocated by State according to the percentage of the total of all death and dismemberment claimspaid to each State or territory. The employer share forhealth insurance premiums ( 6,743.3 million) was allocated based upon calendar year 1989 claims filed at thelocal carriers headquarters offices in each State area.The Federal Emergency Management Agency provideddata on claims paid under the National Flood InsuranceProgram. Amounts for other Postal Service expendituresand expenditures of the Legal Services Corporation wereobtained from these two agencies, respectively. The LegalServices Corporation payments represent annualized grantsand contracts, by State, made by this agency from thesubsidy it receives from the Federal Government.Table 7Amounts in table 7 do not represent actual expendituresof the Federal Government, but instead reflect the volumeof loan or insurance activities. These amounts representeither direct loans made to certain categories of borrowers, or the Federal Government contingent liability forloans guaranteed and direct insurance against loss. Allamounts reflect the dollar value of loans or insurancecoverage provided during the fiscal year, and not thecumulative totals of such activity over the life of theprograms.Data were obtained from reports submitted to theBureau of the Census for the Federal Assistance AwardData System by the departments and agencies whichadminister the programs shown.Table 8Per capita amounts in table 8 were computed using1989 population estimates for the 50 States and theDistrict of Columbia, and 1987 population estimates for theterritories. All computations were based on dollar amountsin thousands.Table 9Percentage distributions were computed based on dollar amounts in thousands.Table 10All amounts in table 10 were computed from data intables 2 through 6. Figures for Department of Defensegrants to State and local governments (table 2), salariesand wages (table 3), retired military pay (table 4), procurement (table 5), and research grants (table 6) were tallied toarrive at a total for Department of Defense expenditures.This total was then netted from the grand total ofFederal Government expenditure, and the residual categorized as nondefense expenditures. This procedure wasfollowed for each State and territory.Per capita and percent distribution amounts were computed using the derived defense/nondefense totals, asdescribed above for tables 8 and 9.Data in the column on Energy Department defenserelated activities were obtained from the Department ofEnergy, Office of the Assistant Secretary for Defenseprograms. These data represent atomic energy defenseactivities, and are presented on an exhibit basis only.Dollar amounts represented are included under othercategories (such as procurement or salaries and wages) intables 2-6.Table 11Federal Expenditures by State has been publishedannually since fiscal year 1"981. The data in table 11represent summary totals, by State and object category. ofcovered Federal expenditures from fiscal years 1981 to1989. Amounts shown include revisions to originally published figures, where applicable. These revisions weremade where errors existed in the original data, or whereFederal programs have been reclassified to another objectcategory of expenditure.IX

Users should be aware of the several factors that affectthe historical consistency of the data:. Data on Federal Government share of Federal employeelife and health insurance programs were not includedprior to fiscal year 1983.ItPrior to the 1986 fiscal year, data for two functions werenot included in the publications: Salaries and wages foruniformed employees of the United States Coast Guard;Retirement benefit payments for the Public Health Service Commissioned Corps retirement system. Data on expenditures for Unemployment Compensationbenefits have been modified, effective with fiscal year1989. Data now i

and include gross compensation, except retired military pay which is reported in table 4. Other features of the Department of Defense salaries and wages data include: 1. Amounts for military personnel stationed overseas are excluded from totals. 2. Salaries and wages for inactive personnel refer to