Transcription

Board Meeting Minutes - 6-22-2018Monthly Financial Report - 6-30-2018Census - June 2018Admissions - JulyRisk Management and APT Meeting - June 28, 2018Statistical Data - 2016Board & Administrator Newsletter - JulyClick on the links above to navigate to the specified pages.

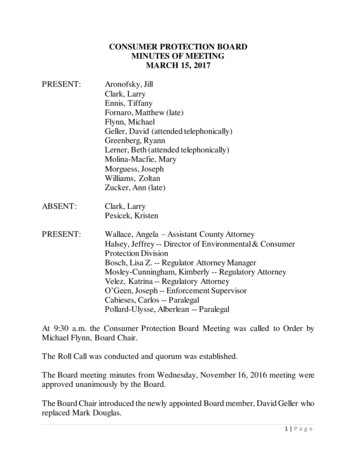

-Swiss Village Inc.Berne, IN 46711BOARD OF DIRECTORS MEETINGJune 22, 2018Present: Kent Liechty, Chair, Nancy Subler, Paul Zuercher, Greg Meyer, Scott Bixler, Matt Lehman, MarkLeFever, Larry Zurcher, and Bertie LehmanStaff Present: Rod Mason, Alma Ahmetovic, Roger Young, Cris Morreale, Taylor Lehman, and Jessica ReinhardScott led the meeting in prayer. The Commitment to Compliance and Ethics and Conflicts of Interestforms were distributed to the Board Members for them to sign. The current Board Members were given theopportunity to introduce themselves to the two new Board Members, Bertie Lehman and Larry Zurcher.Approval of Minutes:The Board reviewed the minutes of the April 27, 2018 Board of Directors Meeting. Kent asked for amotion to approve the minutes. Greg moved, and Matt seconded approval of the minutes. Motion carried.Financial Review:Roger distributed the Financial Dashboard packet and explained that due to the accelerated year-end close,there may be adjustments to the statements being presented. There were two goals for this presentation; to paint apicture of where the organization is financially at the end of May and to provide an idea of what the pressurepoints are and where we have challenges and opportunities as an organization. The bottom line of the financialstatement is not the focus for Swiss Village; doing what is best for the residents is our driving force.The Operating Ratio is 97.92%, which is higher than it has been the past couple of years but is anindication we are accumulating cash. The Total Excess Margin Ratio of 4.09%, is down from prior years but isstill solid compared to the benchmarks. The Days Sales in Accounts Receivable is 26 days. This is higher thanpast years because of entrance fees that were booked right at the end of May, caused a portion of the increase.The second contributing factor relates to credit adjustments on residents’ accounts. Those credits weresignificantly higher at 5/31/2017 which caused the balance to be lower than normal. So, the year over yearincrease looked higher than what it actually was. The reality is that there are also several accounts that havegrown in the past year that we are working on collecting. The Days Cash on Hand stands at 300. This is downfrom last year, but was expected due to the use of cash in our building projects.On the balance Sheet, total assets of 40,034,764.11, is an increase of 2,700,001.33 compared to lastyear. Cash & cash equivalents total 1,104,084.45 which decreased this year due to our investment in property,plant, and equipment. Total Accounts Receivable shows an increase of 969,207 compared to last year. Theincreases are in (1) private pay, (2) receivable from Woodlawn Hospital, and the receivable due to Swiss Villagefrom our IGT partners. The allowance for doubtful accounts increased 69,396.00 due to the aging of accountsreceivable. Assets Limited as to Use totals 10,902,594.81, which is an increase over last year as the result ofmarket appreciation and receiving 300k in bequests. Pledges Receivable of 561,167.66 is designated for thehealthcare campaign for excellence. The Property & Equipment amount of 22,230,999.28 is the net book valueof fixed assets, which is an increase of 1,006,105.23. Buildings increased by 2,119,415.74, which includesLower Langfeld and the first three duplex buildings. Construction in Progress of 694,399.56, is for the currenttwo duplex buildings that are being completed. Total Liabilities of 14,693,573.25 is up 851,032.26 from lastyear. Total Net Assets of 25,341,190.86 is an increase of 1,801,701 compared to last year. 898,300.00 istemporarily restricted for the healthcare project.Revenue is driven by census. For the past year, private pay has exceeded the target, and we have not seenthe shift to Medicaid that we had anticipated. Medicare census has stayed pretty consistent. Total healthcarecensus averaged 118.6 this year, vs. 117.3 last year. Assisted Residential average census per day is identical tolast year. Residential census was down because of Lower Langfeld being empty during the construction.1 of 4

Congregate Independent Living was basically the same as last year and just under the budget. We exceeded thebudget for the Duplexes because of the new buildings.Healthcare net operating revenue totals 10,654,389.87. Private pay exceeded budget and prior year.Medicaid and Medicare were both below budget but exceeded last year. Residential Care revenue of 844,220.34was short of budget and slightly exceeded last year. Assisted residential care revenue of 1,285,934, is right atbudget and exceeded last year. Independent-living revenue of 724,141.50 is short of budget but exceeded lastyear. Daycare revenue of 365,608 exceeded both budget and last year. The Wellness Center revenue of 275,222 slightly missed budget and was slightly over last year. Facility fee revenue totaling 791,668 is belowbudget and slightly above last year. Other Operating Revenue of 550,021, is below budget and last year. SupplyRevenue has been decreasing over the past couple years. When the skilled census is short, the supplies followsuite. Transportation is down a little bit as well. We do not charge for the Phone/DSL service anymore, justinstallation, so this amount is lower as well. Meals show a slight increase from last year. Total operating revenueof 15,491,205 is 448,671.93 below budget and 435,675 above last year.Salaries & wages plus employee benefits account for 62.5% of our operating expenses. Salaries andwages totaling 8,239,060 are 68,098 below budget and 296,718. higher than a year ago. This includes 91,329of temporary staffing to help cover the shortage of certified nursing assistants. Employee Benefits totaling 2,197,922 is 60,817 higher than budget and 433,921 above last year. Group Insurance is the driving factor inthis increase. The 403b match benefit was increased this year and as a result, expense exceeded both budget andlast year. Most of the medical ancillary supplies and services were below budget and last year. However, therapywas higher than both budget and last year. Pharmacy received a refund going back to October of 2016 because ofrepricing pharmaceuticals. Swiss Village has saved a substantial amount because of the new price structure. Foodand Kitchen Supplies is above budget and last year because of transitions of personnel and emergencypreparedness items. Maintenance and Repairs is above budget and last year because of maintaining an agedfacility. Utilities is 43,195.62 higher than last year but staying close to the budget. Advertising is 54,910.31higher than a year ago, but still on budget. Around 31k of this went towards the 50th Anniversary Celebration.Special Projects was over budget and higher than last year because of contributions made to assist with HurricaneRelief. Fees and Services is above budget and above last year, which was impacted by a contracted dietitian andthe companion lifeline monitoring service added in independent living. Bad Debts was above budget and lastyear. Total Operating Expenses of 16,681,106 is 195,98 higher than budget and 1,057,197 higher than lastyear.We have a net operating loss of 1,189,901 before the IGT is taken into consideration. The IGT programcontributed 794,165 of income. The net operating loss after IGT is 395,736 which is 597,575 worse thanbudgeted and 549,040 worse than last year. Contributions for the fiscal year total 1,353,016. Additionally, wehave investment income totaling 792,443. The bottom line shows a net surplus of 1,848,969.07, which is 394,410 higher than last year.Swiss Village has participated in the IGT program since January 1, 2013. Over that time period, we haveadded 2,263,604 to the Swiss Village checking account. On average, 35,930 a month. Bertie asked if the IGTprogram is going to go away. Matt explained that it is a federal program that Indiana is taking full advantage of.It is like the government form of the Samaritan program. In the future we could see changes of partnerships orcuts to the program. Rod stated that we have a goal to meet budgets without the IGT program so that when it goesaway, we are prepared. Greg made the point that Swiss Village has added quite a bit of assets this year, and wewere able to do that without going outside to finance it. He went on to say that operationally we did not have agood year, but we did a lot to the facility this year that was taken out of operating funds.Kent asked for a motion to approve the Financial Report. Nancy moved, and Mark seconded approval ofthe Financial Report. Motion carried.Committee Assignments:Kent briefly went over the Committee Assignments. Kent entertained a motion to approve the CommitteeAssignments. Matt moved, and Nancy seconded approval of the Committee Assignments. Motion carried.2 of 4

Reports from Rod/Cris/Alma:Project Update: Duplexes – 9 of 10 units sold. Rod stated that there is some interest in the last unit. The units that arebeing turned over, are quickly being sold. Langfeld – 4 of 10 units sold. Rod stated that this is dragging more than we would like. We have had afew residents that were interested in moving to Langfeld, but they would like to stay where they are fornow. Only 8 of the 10 units are marketable. One of the units is being used as a guest room and the oneacross from it may be used as a staffing area if we decide to go that route. Healthcare Renovation/Capital Campaign – 984k we thought this was at 1.03 million but one of theundesignated contributions was moved to the endowment fund.Census Review:Cris reviewed the May Census Dashboard. Assisted residential is above budget. We are aware of aResidential move that will take place in August. In Congregate Independent we had a couple vacate, but theymoved to Assisted Residential. The Duplexes are a little bit below, but we still have one available. Theremaining Duplexes are due to be complete in late July or early August.Anniversary Celebration:Rod stated how pleased we were with the 50th Anniversary Celebration. He said that there were a couplethousand people that attended throughout the day. He stated that we have received good feedback on the event.Review of Resident Discharge:Rod stated that we had to give an involuntary discharge because we were unable to manage one of ourresidents. The resident was aggressive with staff and other residents. We issued a 30-day notice. This is the firsttime we have ever had to do this at Swiss Village. The family was not in agreement with this decision, so ahearing was held. Alma stated that we had admitted the resident in February of this year. The family had told usit would be a short stay, so we were willing to help. The resident was unable to adjust to Swiss Village. Almastated that we even tried to change medications. The resident was hitting, kicking, and behaviors were gettingworse. Swiss Village had to report 10-12 reportables to the state, in addition to hundreds of other incidents thatdid not arise to the level needing reported (namely involving staff and visitors). We almost got to the point wherewe needed to provide one on one care for this resident. Alma stated that it was hard to get the family on boardwith medication changes and programs to help the resident. A two-hour hearing was held with a judge, but hecould not honor the discharge because we did go through all of the correct steps. We started the process overagain, but the family pulled the resident before everything was final. Rod and Alma wanted to apprise the Boardas word has gotten out to the community in a variety of ways about this discharge. Rod stated that we triedcontacting nearly two dozen facilities to take the resident, but only two were willing to take the resident.Approval of Facility Assessment:Alma reviewed the Facility Assessment. She stated that this will be updated every year. The governmentwants us to ensure that we are providing the care that our residents require, and that staff is following through.One of the areas that we needed to work on, was getting agreements in place with all vendors that provideanything to us. This was the first year that we had all of our staff going through the Skills Check Off program tomake sure that we our competent in all areas to provide care. Alma stated that we have to make sure we have staffmembers that can adjust to different types of resident needs. The third part of the assessment was checking allequipment that we use, to make sure it suitable. We also were required to create an Emergency Preparedness plan,which Cris has been working on.The Board Members thoroughly reviewed the Facility Risk Management program. Rod stated that we arerequired to involve the board in these types of programs. Rod represents the Board, but the Board receives thereports for their approval.3 of 4

Kent entertained a motion to approve the Facility Assessment. Greg moved, and Scott seconded approvalof the Facility Assessment. Motion carried.Compliance Review:The Board reviewed the Compliance Committee meeting minutes.Kent entertained a motion to approve the Compliance Committee Minutes. Matt moved, and Paulseconded approval of the Compliance Committee Minutes. Motion carried.Executive Session:An Executive Session was not held.Future Meetings:Finance / Audit Committee Meeting – August 7, 2018 at 7:00 a.m.Board Meeting – August 31, 2018 at 7:00 a.m.Board Meeting – October 26, 2018 at 7:00 a.m.Board Meeting – December 28, 2018 at 7:00 a.m.Board Meeting – February 22, 2019 at 7:00 a.m.Respectfully Submitted,Jessica ReinhardRecording SecretaryNancy SublerBoard Secretary4 of 4

SWISS VILLAGE, INC.MONTHLY FINANCIAL REPORT(Unaudited)June 30, 2018The accompanying balance sheets of Swiss Village, Inc. as of June 30, 2018 and 2017, and the relatedstatements of income for the one month then ended, have been prepared by management who isresponsible for their integrity and objectivity. These statements have not been compiled, reviewed, oraudited by external accountants.To the best of management’s knowledge and belief, the statements and related information wereprepared in conformity with Generally Accepted Accounting Principles, and are based on recordedtransactions and management’s best estimates and judgments.Roger D. Young, CPAVice President of Finance

TABLE OF CONTENTSFinancial Statement Review1–3Dashboard4– 5Balance Sheet6Income Statement7Schedule of Net Operating Revenue8Schedule of Operating Expenses9

Swiss Village, Inc.Financial Statement ReviewOne Month ending 6/30/18Balance SheetTotal Assets of 39,606,679 is a decrease of 428,085 from 5/31/18 Cash & cash equivalents decrease of 31,444 Accounts receivable decrease of 418,867. Largely due to receipt of thesupplemental nursing home payment for the first quarter of 2018 and paymentsreceived from our IGT partners totaling 208,559. Assets limited as to use decrease of 52,581 – Unrealized loss on investments Property and equipment increased 40,573Total Liabilities of 14,413,914 is a decrease of 279,659 from 5/31/18 Accounts payable increase of 21,416 Accrued liabilities increased 43,138. Deferred revenue from entrance fees decrease of 109,555. This was due to therefund of an entrance fee due to vacating a duplex. This resident had chosen aguaranteed refundable entrance fee back in 2008. Net Assets of 25,192,765 is a decrease of 148,426 from 5/31/18 Temporarily restricted net assets of 894,338 is the total contributions received thatare designated for the Healthcare Campaign for Excellence. Contributions for thisproject will be shown as “temporarily restricted” until funds are used for therenovation project. Woodlawn’s portion of net assets totals 1,724,963. This is the total amount of thesupplemental nursing home payments retained by the hospital.RevenueSchedule of Net Operating RevenueOperating revenue for the first month of the fiscal year totals 1,211,528 which is 161,280below budget and 20,852 below June last year. Please note that rate increases were noteffective until 7/1/18. The new budget is spread through the new year based on the number ofdays in each month. Consequently, we will be playing catch up to the budget all year.Following are several observations: Healthcare revenue of 820,386 is 102,874 below budget and 35,151 below June lastyear. Private pay is 88,633 below budget and 71,038 below last year. Medicaid is 25,470 above budget and 44,166 above last year. Medicare is 39,711 below budgetand 8,279 below last June. Residential care revenue of 78,280 is 23,206 below budget and 10,881 above lastJune. Assisted Residential revenue of 102,138 is 16,927 below budget and 10,084 belowlast June. Independent Living revenue of 59,903 is 9,973 below budget and 3,755 above Junelast year.1

Child Daycare revenue of 34,659 is 3,586 better than budget and 503 below Junelast year.Wellness revenue of 23,198 is 421 above budget and 7,160 above June last year.Facility Fee revenue of 49,289 is 10,756 below budget and 6,808 above June lastyear.Other Operating Revenue of 43,675 is 1,551 below budget and 3,717 below June lastyear.ExpensesSchedule of Operating ExpensesOperating expenses for the first month of the fiscal year totals 1,407,450 which is 7,160below budget and 96,224 (7.3%) above June last year. Following are several observations: Salaries and wages of 699,054 are 16,330 below budget and 60,127 (9.4%) abovelast year. Employee wage increases become effective with the first full pay in July. Thisneeds to be taken into consideration with comparing salaries and wages to the budget.Included in salaries and wages is 9,355 of temporary staffing expense.Employee benefits of 190,673 is 264 above budget and 15,431 above June last year.Group insurance by itself is 6,274 over budget and 15,053 above last year.Food costs totaling 63,418 is 3,545 above budget and 2,268 above June last year.Furniture & equipment of 4,652 is 3,479 below budget and 2,346 below June lastyear.Therapy of 38,453 is 8,589 below budget and 1,614 below June last year.Advertising of 23,359 is 13,537 above budget and 18,524 above June last year. Thisincludes 9,134 of expense related to the anniversary celebration held early in June.The budget for this event was in last fiscal year and was not entirely used.Utilities of 61,199 is 120 below budget and 8,569 above last year. Water is 4,186above June last year and electric is 5,494 above last June. Gas is 1,735 below June lastyear.Bad Debts of 6,358 is 3,481 above budget and 16,337 below June last year.Charitable services include funds used from the Endowment Fund to assist residentswho are unable to pay their full cost of care. In June 2018 we used 10,157 which is 1,938 above budget and 11,960 higher than June last year. (Note: in June 2017 werecovered a portion of what had been used in a prior month. That is why the varianceto last year is higher than the amount spent this year.)Results from Operations before IGTFor June 2018, we show an operating loss before IGT of 195,922 which is 154,120 worsethan our budget, and is 117,076 worse than June last year.Inter-Governmental TransferThe Inter-governmental transfer (IGT) section shows income of 54,853, which amounts tothe Supplemental Nursing Home Payment.2

Results from OperationsFor June 201818 we have a net operating loss of 141,069 which is 151,489 worse than ourbudget and 118,050 worse than the same period last year.Other Income (Expense)Statement of Income and ExpenseOther Income (Expense) nets to expense of 7,357 and creates a deficit of 148,426.Note the following observations: Contributions total 3,775 Designations are as follows:o Kinder Haus 20o Special Purpose 8o Maintenance Facility 400o Operating Fund 500o Endowment Board Memorial Fund 20o Endowment Fund 2,827 Investment income totals - 19,716 (including 67,140 of unrealized loss oninvestments) There is an unrealized gain of 8,584 due to the change in the market valuation of theinterest rate SWAP.3

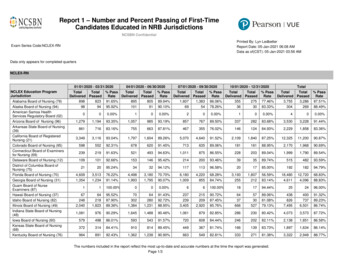

Swiss VillageFinancial DashboardOne Month ended June 30, 2018Operating 90.00%102.15%98.63%97.92%95.59%95.19%YTD F/Y 2019 YTD F/Y 2018 YTD F/Y 2017 YTD F/Y 20162016 CARFMedianThe operating ratio measures whether current year cash operating revenues aresufficient to cover current year cash operating expenses. An operating ratio of lessthan 100% is desired.Total Excess Margin .00%5.84%4.09%2.42%0.85%-6.85%F/Y 2019F/Y 2018F/Y 2017F/Y 20162016 CARFMedianThe total excess margin ratio presents a picture of financial performance. A valuegreater than zero is necessary to achieve positive net assets, maintain a favorablebalance sheet, and provide adequate contingency funds for unforseen financial needs.4

Swiss VillageFinancial DashboardOne Month ended June 30, 2018Days Sales in Accounts Receivable3025202526222019151050F/Y 2019F/Y 2018F/Y 2017F/Y 20162016 CARFMedianThe days sales in accounts receivable ratio measures the average number of daysaccounts receivable remain outstanding. A key component of accounts receivablemanagement is understanding how receivables will change depending on the payertype.Days Cash on Hand400350300250200150100500291300319F/Y 2019F/Y 2018F/Y 2017351289F/Y 20162016 CARFMedianThe days cash on hand ratio measures the number of days of cash operatingexpenses a provider could cover with its unrestricted cash, cash equivalents,and marketable securities on hand.5

Swiss Village-WoodlawnBalance SheetJune 30, 20186/30/2018SwissAssetsCash & cash DquivalentsAccounts receivablePrivate payMedicaidMedicareOther third partiesSupplemental nursing home (IGT)HospitalIGT PartnersSwiss VillageMiscellaneousAllowance for doubtful accountsInventoriesPrepaid expensesAssets limited as to useSamaritan's endowmentAnnuity assetsWellness 79.0640,034,764.11(428,085.05)LiabilitiesAccounts payableAccrued LiabilitiesReserve for capital improvementsReserve for subordinated management feesInsurance reservesNotes payableBonds payableDeferred revenue from entrance feesDue to Swiss VillageDue to WoodlawnAnnuity LiabilitiesFair value of interest rate swapTotal )Net AssetsUnrestrictedTemporarily restrictedTotal Net ,764.11(428,085.05)Pledges receivableEntrance Fees FinancedPeace Church Equity ParticipationUnamortized EDC Bond Issue CostsOther assetsProperty & equipmentLandLand ImprovementsBuildings / Leasehold ImprovementsEquipment and furnishingsDeferred capital reserveConstruction in progressTotal CostAccumulated DepreciationTotal AssetsTotal liabilities and net assets6

Swiss Village, Inc. - Berne, IndianaStatement of Income and ExpenseOne Month ended June 30, 2018 & 2017Swiss VillageActual2018-2019Swiss VillageBudget2018-2019IGT PartnersActual2018-2019IGT inedBudget2018-2019TOTAL OPERATING 41,211,528.211,372,808.55TOTAL OPERATING 71,407,449.871,414,610.30NET OPERATING INCOME (LOSS) BEFORE IGTIGT INCOME (EXPENSE) IN OPERATIONSManagement Fee IncomeManagement Fee ExpenseLeased Employee IncomeLeased Employee ExpenseFacility Lease IncomeFacility Lease ExpenseGain on Fixed Assets - IGT TermLoss on Fixed Assets - IGT TermSupplemental NH PaymentsNET OPERATING INCOME (LOSS)OTHER INCOME (EXPENSE):ContributionsInvestment incomeAnnuity paymentsRealized gain (loss) on sale of investmentsUnrealized gain (loss) on investmentsChange in value of interest rate swapNET INCOME OR (LOSS)CombinedVariance to BudgetBetter / Combined ActualVariance to Pr YearBetter / .15)7

Swiss Village, Inc. - Berne, IndianaSchedule of Net Operating RevenueOne Month ended June 30, 2018 & 2017Net Service RevenueHealthcarePrivate PayMedicaidMedicareResidential careAssisted residential careIndependent-livingChild DaycareWellness CenterNet Service RevenueFacility Fee IncomeOther Operating RevenueSuppliesSpecial ServicesBuilding UseTransportationTelephone / DSLMealsApplicationsMerchandiseMiscellaneousGain (loss) on sale of propertyTotal Operating RevenueSwiss VillageActual2018-2019Swiss VillageBudget2018-2019IGT PartnersActual2018-2019IGT inedBudget2018-2019CombinedVariance to BudgetBetter / (Worse)CombinedActual2017-2018Combined ActualVariance to Pr YearBetter / 567.94

The IGT program contributed 794,165 of income. The net operating loss after IGT is 395,736 which is 597,575 worse than budgeted and 549,040 worse than last year. Contributions for the fiscal year total 1,353,016. Additionally, we 394,410 higher than last year. Swiss Village has participated in the IGT program since January 1, 2013.