Transcription

White PaperMultimedia Communication Services:What enterprise decision-makerswant and are willing to pay for!

IntroductionTo make prudent decisions regardingVoice over IP (VoIP) services rollout,service providers have asked for quantitative information regarding the value ofmultimedia communication services to themarketplace. Up to now, market researchof this type has been very limited. For thisreason, Nortel Networks commissionedPollara, Inc., a leading market researchfirm, to execute a research exercise focusedon understanding the value of these services to enterprise decision-makers. Theresults of this research initiative—whichestimates relative services values, pricing,and expected market penetrations—provide the valuable insight to the VoIPservices market that our carrier customershave been looking for.This white paper will provide a high leveloverview of the study and highlight someof the most interesting findings. For moredetails on any of the information includedin this white paper, please contact yourNortel Networks representative.Multimedia CommunicationServices enterprise researchinitiativeIn order to most accurately answer thequestion, “What services do enterprisedecision-makers value and how much arethey willing to pay for these services?” wedesigned a comprehensive research process.The first step of this process was to obtainqualitative information that could be usedto design quantitative surveys includingconjoint analysis to determine relativefeature values. The qualitative researchincluded telephone interviews of CIOs oflarge enterprises, as well as focus groupsof small and medium enterprise decisionmakers. The results of qualitative researchwere leveraged to create a more detailedsurvey which received responses frommore that 600 U.S. enterprise decisionmakers. The results of this survey arestatistically representativeof the U.S. enterprisepopulation.Companies currently considering moving to VoIP67% Not at this timeThe survey wassegmented betweensmall, medium, and largeenterprises. The segmentation was based onnumber of telephoneextensions within theenterprise—small (4 to40 lines), medium (41to 200 lines) and large(201 lines or above). The results wereweighted according to the current U.S.business distribution. In addition, thedecision was made to focus the study onthe high VoIP opportunity sectors, including health care, education, government,hospitality, finance/insurance/real estate,and business services.This research had four primary goals:determine the current enterprise timelinefor transition to VoIP communications,understand the purchasing criteria for VoIPcommunications services, identify thecurrent barriers to adoption, and determinethe value of new multimedia services inthe marketplace. For the latter question,the new multimedia services were assumed15% Not sure18% YesSource: Nortel NetworksPrimary Market Researchto be a subset of the services available todayfrom the Nortel Networks MultimediaCommunication Server 5200.The focus group participants wereprovided with an actual demonstration ofthe various services. The survey includedpictures of the MCS 5200 MultimediaPC Client and Personal Agent to giveparticipants a visual representation of theservices. These efforts provided researchparticipants with a high-level understanding of the services included in the researchand how they would be delivered and used.However, care was taken not to educate thesurvey participants or to provide additionalinformation about the services beyond thatwhich would be conveyed in typical serviceprovider promotional activities.Figure 2. VoIP purchase timeline—all U.S. enterprises0.512% 0.40.3Over 10% of allU.S. businesses arealready using VoIP0.20.10TechnologyenthusiastsFirst topurchaseSmall2Figure 1. U.S. enterprise Voice over IP transition kepticsPurchasesoon afterintroductionWait untilother companiespurchaseWait untilmost companieshave itOne of last topurchaseLargeSource: Nortel Networks Primary Market Research

The first question addressed by the researchwas, “What proportion of businesses arecurrently considering moving to VoIP?”Our research suggests that 18 percent of allbusinesses are currently considering movingto VoIP in at least one of their company’slocations, with a majority indicating theywill be purchasing before the end of thethird quarter of 2003.equipment. Figure 2 provides a currentview of the Voice over IP adoption timeline. The technology enthusiast segmentaccounts for a very small proportion ofthe small, medium, and large enterprisemarket—less than 5 percent in eachsegment. Meanwhile, the visionariesaccount for roughly 10 percent of themarket.The implication of this is significant—ourestimates suggest that one-tenth of the U.S.VoIP market will be decided this year.Considering that the visionaries and thetechnology enthusiast segments accountfor roughly 15 percent of the entire market,our research would suggest that we’re onthe cusp of mass market adoption of VoIPequipment.Our research further indicates that 10percent of the enterprise market hasalready begun adoption of Voice over IPFigure 3. VoIP purchasing decision25% Price21% Type of system10% Brand9% Type of physical phoneSource: Nortel NetworksPrimary Market ResearchFigure 4. Services rankingsCentrex userPBX userRemote access16Multi-party conference calling22Dynamic call handling35Video calling412Call screening and routing53Office hoteling69Secure instant messaging78Instant file transfer84Unified messaging97Plug-and-play phones101Video conferencing1110PC application sharing1211Communications managementMultimedia and collaborationWe included conjoint analysis in theresearch to determine the weighting of thedecision factors in the purchase of a VoIPoffering in an enterprise environment.The results of that analysis indicate thatenterprises are price sensitive, with priceaccounting for 25 percent of the decisionto purchase these types of systems. We alsodiscovered that enterprises are much morelikely to be driven to this technology forthe features, which accounts for 36percent of the decision to purchase.Interestingly, the type of system (definedas either a PBX-based system or a Centrexbased system) is also an important driverin the purchase of VoIP—accounting for21 percent of the decision to purchase.Comparatively, brand is a less importantconsideration, accounting for only 10percent of the decision to purchase.Finally, we included a number of differenttypes of physical phones that could beincluded with these services—defined aseither IP phones, soft clients that wouldrun on their PC, or architecture thatwould allow them to access many ofthese services using their existing phones.The type of phone accounts for only9 percent of the decision to purchase.36% FeaturesServiceThe Voice over IPadoption decisionValue of featuresSignificantvalue deltaBased on willingness to pay fromconjoint analysisresearchSource: Nortel NetworksPrimary Market ResearchWe tested the features on two types ofsystems: Centrex and PBX systems.What we found is a slightly differentimpact on demand depending on whichtype of system the features were added to.If these features were added to a PBXservice offering, the features that wouldhave the greatest impact on increasingdemand would be plug-and-play phones,call screening and routing, multi-partyconference calling, and instant file transfer.3

If the features were added to a Centrexoffering, the features that would have thegreatest impact on increasing demandwould be remote access, multi-partyconference calling, real time call handling,and desktop video calling. It is interestingthat remote access is the highest valuedfeature to Centrex targets. Remote accesswould allow end users to use their SIPenabled phone on their laptop while theywere out the office. Overall, the featuresthat have the greatest impact on demandrelate to the needs of managing communications among end users, rather thanadding new multimedia functionality.It’s interesting to note that users whocurrently have PBX or Centrex systemsplace different importance on certaintypes of features.Figure 6. Choice share impact Centrex IP vs. IP PBX80%Take rate for four market-leading IP PBXs togetherversus Centrex IPCentrex IP Increases the overall VoIPshare by 18% Lowers the IP PBX share by 6%70%60%50%Centrex plus additional services Increases overall VoIP shareby 28% Lowers the IP PBX share by 11%40%30%20%IP PBX choice10%0%Centrex IP choiceKeep existing systemNo Centrex IPWithCentrex IPRevenue andpenetration opportunityPlug-and-play phones are particularlyattractive to those with PBX installations,probably because it eliminates much ofthe cost and hassle associated with moves,adds, and changes. Meanwhile, the relatively low impact that desktop video callinghas on PBX users may relate to the needfor their in-house staff to support theseapplications.What is the value of these services interms of dollars and demand? Figure 5shows the demand/revenue curve of aCentrex IP offering into the marketplace.This illustration shows that next-generation services do add significant value toa Centrex IP offering. Since this serviceis usually priced on a monthly basis, anyshift upward in the demand/revenue curvecan represent a substantial revenue increaseover time.Figure 5. Next-generation services add quantifiable value to Centrex IP Increases penetration Increases average revenue per user50%Multimedia and collaboration services Call management services Centrex IP0% 15 60Price customers are willing to pay forCentrex IP in a market that also offersleading IP PBXs4WithCentrex IPand MM servicesSource: Nortel NetworksPrimary Market ResearchSource: Nortel NetworksPrimary Market ResearchCentrex IP vs. IP PBXFigure 6 shows the impact of the introduction of a Centrex IP offering intothe marketplace. This illustration is basedon three scenerios:In the first scenerio, Centrex IP is notoffered into the marketplace, resulting insome penetration by IP PBX offerings. Inthe second scenerio, Centrex IP is offeredinto the marketplace. Finally, in the thirdscenerio, Centrex IP service—completewith interactive multimedia services—isoffered into the marketplace.The research indicates that introducing aCentrex IP offering into the VoIP marketplace does impact the IP PBX penetration,but also increases the overall VoIP penetration—and in the case of a full-featuredCentrex IP offering, overall VoIP penetration is increased by 28 percent. The bottomline is that introducing a Centrex IP offering into the marketplace with interactivemultimedia services almost doubles thepenetration rate of the Centrex IP offering.

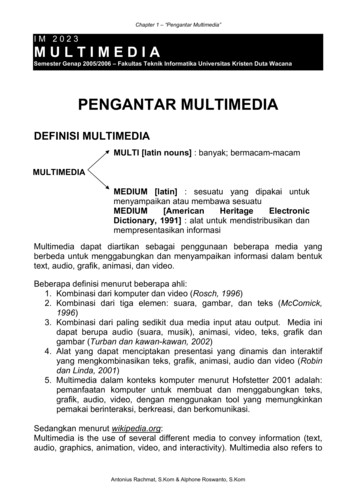

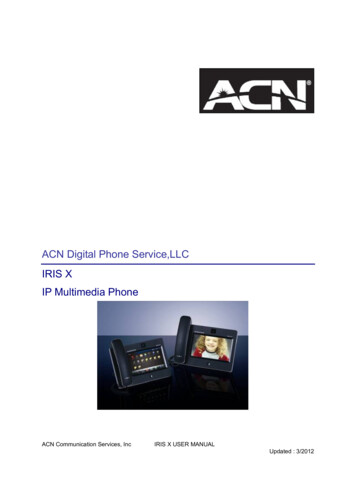

The MultimediaCommunication Server 5200The evidence is in. Multimedia Communication services greatly increase the potentialfor Centrex IP adoption. How can youtake advantage of this opportunity? Theservices included in this research are available to be deployed into your broadbandservices delivery infrastructure today!The services were based on the MultimediaCommunication Server 5200. The MCS5200 is Nortel Networks multimedia services engine, and will work in conjunctionwith the Succession* CommunicationServer 2000 as an integrated multimediafeature server to deliver these services alongwith existing Centrex services to yourcustomers—today!Summary of findingsThe research shows that there is a largemarket opportunity for next-generationmultimedia services in the enterprise—especially with small and mediumbusinesses.What’s the next step? Contact yourNortel Networks representative to engagethe Nortel Networks MarketForce team—they are ready to apply the results of thisresearch to your specific market opportunity today!In addition, now is the time for us to beworking with our enterprise customers tohelp them in their Voice over IP purchasedecision. As was stated earlier in this paper,the majority of businesses currentlyconsidering VoIP will purchase this year!From a Centrex perspective, we find astrong indication that these interactivemultimedia services also add quantifiablevalue to a Centrex IP offering. In fact thistype of combined offering not only takesmarket share away from IP PBX offerings,but it also increases the overall Voice overIP market penetration.Figure 7. Multimedia Communication Server 5200MultimediaCommunicationServer 5200CS 2000PVG orMG 4000CICM,MG 9000or IADPSTNPacketNetworkResidentialEnterpriseSOHO5

In the United States:Nortel Networks35 Davis DriveResearch Triangle Park, NC 27709USAIn Canada:Nortel Networks8200 Dixie Road,Suite 100Brampton, Ontario L6T 5P6CanadaIn Caribbean and Latin America:Nortel Networks1500 Concorde TerraceSunrise, FL 33323USAIn Europe:Nortel NetworksMaidenhead Office ParkWestacott WayMaidenhead Berkshire SL6 3QHUKIn Asia:Nortel Networks Asia6/F Cityplaza 4,Taikooshing,12 Taikoo Wan Road,Hong KongNortel Networks is an industry leader and innovator focused on transforming how the worldcommunicates and exchanges information. The company is supplying its service provider andenterprise customers with communications technology and infrastructure to enable value-addedIP data, voice and multimedia services spanning Wireline, Wireless Networks, Enterprise Networks,and Optical Networks. As a global company, Nortel Networks does business in more than 150 countries.More information about Nortel Networks can be found on the Web at:www.nortelnetworks.comFor more information, contact your Nortel Networks representative, orcall 1-800-4 NORTEL or 1-800-466-7835 from anywhere in North America.*Nortel Networks, the Nortel Networks logo, the globemark design, and Succession are trademarks of Nortel Networks.All other trademarks are the property of their ownersCopyright 2003 Nortel Networks. All rights reserved. Information in this document is subject to change without notice.Nortel Networks assumes no responsibility for any errors that may appear in this document.NN104044-090803

Centrex IP vs. IP PBX Figure 6shows the impact of the intro-duction of a Centrex IP offering into the marketplace. This illustration is based on three scenerios: In the first scenerio, Centrex IP is not offered into the marketplace, resulting in some penetration by IP PBX offerings. In the second scenerio, Centrex IP is offered into the marketplace. Finally, in the third