Transcription

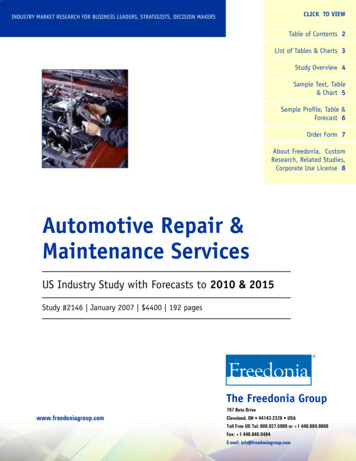

CLICK TO VIEWINDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERSTable of Contents 2List of Tables & Charts 3Study Overview 4Sample Text, Table& Chart 5Sample Profile, Table &Forecast 6Order Form 7About Freedonia, CustomResearch, Related Studies,Corporate Use License 8Automotive Repair &Maintenance ServicesUS Industry Study with Forecasts to 2010 & 2015Study #2146 January 2007 4400 192 pagesThe Freedonia Group767 Beta Drivewww.freedoniagroup.comCleveland, OH 44143-2326 USAToll Free US Tel: 800.927.5900 or 1 440.684.9600Fax: 1 440.646.0484E-mail: info@freedoniagroup.com

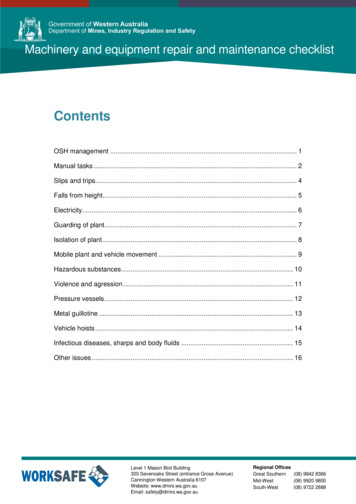

Study #2146January 2007 4400192 PagesAutomotive Repair &Maintenance ServicesUS Industry Study with Forecasts to 2010 & 2015Table of ContentsExecutive SummaryMarket EnvironmenTGeneral.4Macroeconomic Environment.5Population.8Personal ConsumptionExpenditures.11Light Vehicle Overview.12Charging Equipment.84Other ment Systems.92Controls, Modules & Sensors.94REPAIR & MAINTENANCESERVICE PROVIDERSGeneral. 97REPAIR & MAINTENANCESERVICE TRENDSNew Light Vehicle Dealerships.99General Repair & ServiceStations. 102Body Shops. 105Specialists. 106Tire Stores & Repair Chains. 109Quick Lubes. 111Other. 113REPAIR & MAINTENANCESERVICESSERVICES BY PROVIDERGeneral.15Vehicle Quality Improvement.18Labor Pricing Trends.22Technician Capabilities.23Technology & Materials Trends.25Global Supply & Demand 0Drivetrain.43Steering & Suspension.45Cooling System.49Brakes.53Exhaust/Emission System.57Air Conditioning System.64Fuel System.65Exterior & Structural.68Body Repair.69Windows & Glass.71Tires & Wheels.73Electrical.75Ignition Systems.76Batteries.80Lighting Equipment.82General. 115Revenues by Service Provider. 117Collision Repair Service. 119Ignition & Engine SystemService. 121Routine Maintenance Service. 123Drivetrain System Service. 125Temperature Control Service. 127Brake System Service. 128Glass, Mirror & Lamp Service. 130Steering & SuspensionService. 131Exhaust System Service. 133Electrical System Service. 134Computer & Emissions SystemService. 135Other Service. 137INDUSTRY STRUCTUREGeneral. 139Industry Composition. 140Click here to purchase onlinePage Market Share. 142Mergers, Acquisitions &Industry Restructuring. 145Product Development &Manufacturing. 148Marketing. 150Distribution. 151Company ProfilesAAMCO Transmissions. 156Asbury Automotive Group . 157Ashland Incorporated. 158AutoNation Incorporated. 159Bridgestone Corporation. 161CarMax Incorporated. 162CARSTAR Incorporated. 163Diamond Glass Companies. 164Discount Tire. 165Driven Brands. 166Exxon Mobil. 167Goodyear Tire & Rubber. 168Group 1 Automotive Group. 169Hendrick Automotive Group. 170Lithia Motors. 171MAACO Enterprises. 172Marathon Oil. 173Midas Incorporated . 174Monro Muffler Brake. 175Penske Corporation. 177Pep Boys - Manny, Moe & Jack. 178Royal Dutch Shell plc. 180Safelite Group. 181Scheib (Earl) Incorporated. 182Schwab (Les) Tire Centers. 183Sears Holdings. 184Somerset Tire Service. 185Sonic Automotive. 186Sumitomo Corporation. 187TCG International. 189Tuffy Associates. 190United Auto Group. 191Wal-Mart Stores. 192Order now, click here!

Study #2146January 2007 4400192 PagesAutomotive Repair &Maintenance ServicesUS Industry Study with Forecasts to 2010 & 2015List of Tables & ChartsEXECUTIVE SUMMARY1 Summary Table.3Market EnvironmenT1 Macroeconomic Environment.82 Population.103 Personal ConsumptionExpenditures.124 Light Vehicle Overview.14REPAIR & MAINTENANCESERVICE TRENDSCht US Light Vehicle Productionby Company, 2005.17Cht Quality Impact on MajorAftermarket Parts &Components Segments .19Cht Vehicle DurabilityComparison.21Cht Aftermarket Value ofIncreased Durability.221 World Light Vehicle Serviceby Region.30REPAIR & MAINTENANCESERVICES1 Automotive Service Revenuesby System.332 Mechanical Service Revenues.343 Filter Service Revenues.364 Engine Service Revenues.435 Drivetrain Service Revenues.446 Steering & SuspensionService Revenues.477 Cooling System ServiceRevenues.508 Brake Service Revenues.579 Exhaust/Emission SystemService Revenues.5910 Air Conditioning SystemService Revenues.6511 Fuel System Service Revenues. 6712 Exterior & StructuralService Revenues .6913 Body Repair Service Revenues 7114 Automotive Windows &Glass Service Revenues.7315 Tire & Wheel ServiceRevenues.7516 Electrical System ServiceRevenues.7617 Ignition System ServiceRevenues.7818 Battery Service Revenues . .8219 Automotive Lighting EquipmentService Revenues.8420 Charging EquipmentService Revenues.8621 Other Automotive ElectricalSystem Service Revenues.8722 Electronics Service Revenues.8923 Electronic Diagnostic ServiceRevenues.9224 Entertainment SystemService Revenues.9425 Electronic Controls, Modules &Sensors Service Revenues.96REPAIR & MAINTENANCESERVICE PROVIDERS1 Automotive ServiceRevenues by Provider.992 New Light Vehicle DealerService Revenues. 1023 General Repair & ServiceStation Service Revenues. 1044 Body Shop Service Revenues 1065 Specialist Service Revenues. 1086 Tire Store & Repair ChainService Revenues. 1107 Quick Lube Service Revenues 1128 Other Service ProviderRevenues. 114Click here to purchase onlinePage SERVICES BY PROVIDER1 Automotive ServiceRevenues by Job Type. 1192 Collision Repair ServiceRevenues by Provider. 1213 Ignition & Engine SystemService Revenuesby Provider. 1234 Routine Maintenance ServiceRevenues by Provider. 1255 Drivetrain System ServiceRevenues by Provider. 1266 Temperature Control ServiceRevenues by Provider. 1287 Brake System ServiceRevenues by Provider. 1298 Glass, Mirror & Lamp ServiceRevenues by Provider. 1319 Steering & SuspensionService Revenuesby Provider. 13210 Exhaust System ServiceRevenues by Provider. 13411 Electrical System ServiceRevenues by Provider. 13512 Computer & Emission SystemService Revenuesby Provider. 13713 Other Automotive ServiceRevenues by Provider. 138INDUSTRY STRUCTURE1 Revenues for SelectedAutomotive ServiceProviders, 2005. 142Cht Automotive ServiceMarket Share by Company,2005. 1452 Selected Acquisitions &Divestitures. 147Order now, click here!

Study #2146January 2007 4400192 PagesAutomotive Repair &Maintenance ServicesUS Industry Study with Forecasts to 2010 & 2015Despite improvements in new light vehicle quality, reliability and durability, opportunities to provide service for these vehicles are expected to arise as more of them reach prime aftermarket service age.US demand to grow 4%annually through 2010Repair and maintenance service revenue for light vehicles in the US isprojected to increase at an annual rateof 4.0 percent, reaching 105 billion by2010. The industry’s current moderaterevenue growth results from improvements in new vehicle quality, reliabilityand durability. However, opportunities toprovide service are expected to arise asmore vehicles reach prime aftermarketservice age.New vehicle dealersto increase market shareNew light vehicle dealers held the largestshare of the automotive service marketin 2005, due to their typically large sizeand industry-high labor rates. Dealersoffer a unique combination of specialtools, training and equipment needed toperform many key service operations,and benefit from direct access to thediagnostic data used to troubleshootvehicle systems. Dealers consider partsand service work highly valuable dueto its outsized impact on their bottomline results. Additional reasons for theexpected growth of the new light vehicledealer’s share of the service marketinclude the extended vehicle and powertrain warranties offered on many newervehicles. Since warranty work, which ispaid for by the OEM, is typically performed at a fraction of the rate dealerscharge retail customers, the impact willbe moderated yet remain substantial.New LightVehicle Dealers26%US Autmotive Service Revenues( 105 billion, 2010)General Repair& ServiceStations21%Body Shops20%Specialists9%Other Providers23%Quick lubes, tire stores,repair chains to lead gainsGeneral repair garages and service stations are expected to experience belowaverage growth as an increasing numberof these providers install conveniencestores in the place of service bays.Independent garages are also hamperedby the inability to access OEM diagnosticand service data at cost-effective rates,and often have difficulty attracting andretaining skilled technicians.Quick lubes will continue to experiencestrong growth as they expand beyond oilchanges and increasingly offer servicesthat are possible while the vehicle is inposition for an oil change. These caninclude radiator flush and refill, transmission oil and filter change, diagnosticsystem scans, cabin air filter changes,tire rotation and vehicle inspections.Body shops will continue to perform themajority of vehicle body repair work,although dealers are attempting tocapture more of this business. Specialists will experience moderate growth asa group, caused by the improved qualityof stainless steel exhaust systems andextended OEM powertrain warranties.Tire stores and repair chains will experience strong growth as they expandinto more service categories, and to anextent replace general repair garages aslocal service providers.Copyright 2007 The Freedonia Group, Inc.Click here to purchase onlinePage Order now, click here!

Study #2146January 2007 4400192 PagesAutomotive Repair &Maintenance ServicesUS Industry Study with Forecasts to 2010 & 2015Sample Text,Table & ChartTABLE VI-2COLLISION REPAIR SERVICE REVENUES BY PROVIDER(million dollars)Item1995 2000 2005 2010 2015Auto Repair & Maintenance Service 60000 70900 86200105000129000% collision repair 25.8 26.0 26.8 27.0 27.1repair & maintenance service providersCollision Repair Service Revenues 15500 18400 23100 28400 34900Body Shops 8900 10545 13300 16200 20000Body ShopsNew Light Vehicle Dealers 3690 4500 5800 7500 9300Demand at body shops for automotive repair and maintenance serGeneral Repair & Service Stations 1630 1890 2300 2720 3320vice is forecast to rise at a 4.6 percent annual rate through 2010, to 21.5Specialists 540 600 695 790 860billion. Growth will be driven by both standard crash repair work andTire Stores & Repair Chains 470 550 650 780 940the burgeoning customization industry, which allows car owners to cusQuick Lubes80 105 115 140 170tomize their vehicles to stand out. Body shops represent a highly fragOther 190 210 240 270 310mented segment, comprised mainly of “mom and pop” shops. Amongthe few body shop chains, MAACO Enterprises has national coverage.The few major chains in existence today provide evidence that attemptsto consolidate the industry in the late 1990s have not been as successfulas envisioned.sampletablesampletextMAACO Enterprises is a privately held company specializing inautomotive refinishing and body work. The company conducts businessthrough franchise operations in the US, Canada and Mexico. MAACO’sservices include cosmetic and collision repairs, including rust, scratch,ding and dent repair. MAACO Enterprises operates through franchisedstores that typically occupy between 8,000 and 10,000 square feet. As of2006, the company operated approximately 500 MAACO franchises inthe US.Earl Scheib is one of the largest automotive painting and bodyrepair service companies, pa

Auto Repair & Maintenance Service 60000 70900 86200105000129000 % collision repair 25.8 26.0 26.8 27.0 27.1 Collision Repair Service Revenues 15500 18400 23100 28400 34900 Body Shops 8900 10545 13300 16200 20000 New Light Vehicle Dealers 3690 4500 5800 7500 9300 General Repair & Service Stations 1630 1890 2300 2720 3320