Transcription

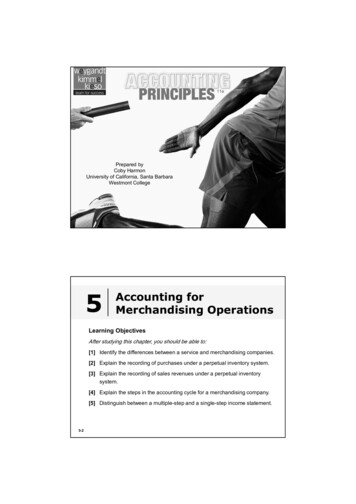

Prepared byCoby HarmonUniversity of California, Santa BarbaraWestmont College5-15Accounting forMerchandising OperationsLearning ObjectivesAfter studying this chapter, you should be able to:[1] Identify the differences between a service and merchandising companies.[2] Explain the recording of purchases under a perpetual inventory system.[3] Explain the recording of sales revenues under a perpetual inventorysystem.[4] Explain the steps in the accounting cycle for a merchandising company.[5] Distinguish between a multiple-step and a single-step income statement.5-2

Preview of Chapter 5Accounting PrinciplesEleventh EditionWeygandt Kimmel Kieso5-3Merchandising OperationsMerchandising CompaniesBuy and Sell GoodsRetailerWholesalerConsumerThe primary source of revenues is referred to assales revenue or sales.5-4LO 1 Identify the differences between service and merchandising companies.

Merchandising OperationsIncome MeasurementSalesRevenueLessCost ofGoods SoldNot used in aService business.EqualsGrossProfitCost of goods sold is the totalcost of merchandise sold duringthe period.5-5Illustration 5-1Income measurement process for amerchandising O 1 Identify the differences between service and merchandising companies.Merchandising OperationsOperatingCyclesIllustration 5-2The operatingcycle of amerchandisingcompanyordinarily is longerthan that of aservicecompany.Illustration 5-35-6LO 1 Identify the differences between service and merchandising companies.

Merchandising OperationsFlow of CostsIllustration 5-4Companies use either a perpetual inventory system or a periodic inventorysystem to account for inventory.LO 1 Identify the differences between service and merchandising companies.5-7Merchandising OperationsFlow of CostsPerpetual System Maintain detailed records of the cost of each inventorypurchase and sale. Records continuously show inventory that should be onhand for every item. Company determines cost of goods sold each time asale occurs.5-8LO 1 Identify the differences between service and merchandising companies.

Merchandising OperationsFlow of CostsPeriodic System Do not keep detailed records of the goods on hand. Cost of goods sold determined by count at the end ofthe accounting period. Calculation of Cost of Goods Sold:Beginning inventoryAdd: Purchases, netGoods available for saleLess: Ending inventoryCost of goods sold 100,000800,000900,000125,000 775,000LO 15-9Merchandising OperationsFlow of CostsAdvantages of the Perpetual System5-10 Traditionally used for merchandise with high unit values. Shows the quantity and cost of the inventory that shouldbe on hand at any time. Provides better control over inventories than a periodicsystem.LO 1 Identify the differences between service and merchandising companies.

5-11Recording Purchases of Merchandise Made using cash or credit (on account).Illustration 5-6 Normally record whengoods are received from theseller. Purchase invoice shouldsupport each creditpurchase.5-12LO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of MerchandiseIllustration 5-6Illustration: Sauk Stereo (thebuyer) uses as a purchaseinvoice the sales invoiceprepared by PW Audio Supply,Inc. (the seller). Prepare thejournal entry for Sauk Stereo forthe invoice from PW AudioSupply.May 4Inventory3,800Accounts Payable5-133,800LO 2 Explain the recording of purchases under a perpetual inventory system.Recording Purchases of MerchandiseFreight Costs – Terms of SaleIllustration 5-7Shipping termsOwnership of the goodspasses to the buyer when thepublic carrier accepts thegoods from the seller.Ownership of the goodsremains with the seller untilthe goods reach the buyer.5-14Freight costs incurred by the seller are an operating expense.LO 2

Recording Purchases of MerchandiseIllustration: Assume upon delivery of the goods on May 6,Sauk Stereo pays Public Freight Company 150 for freightcharges, the entry on Sauk Stereo’s books is:May 6Inventory150Cash150Assume the freight terms on the invoice in Illustration 5-6 hadrequired PW Audio Supply to pay the freight charges, theentry by PW Audio Supply would have been:May 4Freight-Out150Cash5-15150LO 2 Explain the recording of purchases under a perpetual inventory system.Recording Purchases of MerchandisePurchase Returns and AllowancesPurchaser may be dissatisfied because goods are damagedor defective, of inferior quality, or do not meet specifications.5-16Purchase ReturnPurchase AllowanceReturn goods for credit if thesale was made on credit, orfor a cash refund if thepurchase was for cash.May choose to keep themerchandise if the seller willgrant a reduction of thepurchase price.LO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of MerchandiseIllustration: Assume Sauk Stereo returned goods costing 300 to PW Audio Supply on May 8.May 8Accounts PayableInventory5-17300300LO 2 Explain the recording of purchases under a perpetual inventory system.Recording Purchases of MerchandiseReview QuestionIn a perpetual inventory system, a return of defectivemerchandise by a purchaser is recorded by crediting:a. Purchasesb. Purchase Returnsc. Purchase Allowanced. Inventory5-18LO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of MerchandisePurchase DiscountsCredit terms may permit buyer to claim a cash discountfor prompt payment.Example: Credit termsmay read 2/10, n/30.Advantages:5-19 Purchaser saves money. Seller shortens the operating cycle by converting theaccounts receivable into cash earlier.LO 2 Explain the recording of purchases under a perpetual inventory system.Recording Purchases of MerchandisePurchase Discounts - Terms5-202/10, n/301/10 EOMn/10 EOM2% discount ifpaid within 10days, otherwisenet amount duewithin 30 days.1% discount ifpaid within first 10days of nextmonth.Net amount duewithin the first 10days of the nextmonth.LO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of MerchandiseIllustration: Assume Sauk Stereo pays the balance due of 3,500 (gross invoice price of 3,800 less purchase returnsand allowances of 300) on May 14, the last day of thediscount period. Prepare the journal entry Sauk Stereomakes on May 14 to record the payment.May 14Accounts Payable3,500Inventory70Cash3,430(Discount 3,500 x 2% 70)LO 2 Explain the recording of purchases under a perpetual inventory system.5-21Recording Purchases of MerchandiseIllustration: If Sauk Stereo failed to take the discount, andinstead made full payment of 3,500 on June 3, the journalentry would be:June 3Accounts PayableCash5-223,5003,500LO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Purchases of MerchandisePurchase DiscountsShould discounts be taken when offered?Example: 2% for 20 days Annual rate of 36.5% 3,500 x 36.5% x 20 365 705-23LO 2 Explain the recording of purchases under a perpetual inventory system.Recording Purchases of MerchandiseSummary of Purchasing Transactions4th - Purchase6th – Freight-in3,800150Balance3,5805-24300708th - Return14th - DiscountLO 2 Explain the recording of purchases under a perpetual inventory system.

Recording Sales of Merchandise Made using cash or credit (on account). Sales revenue, like servicerevenue, is recorded whenthe performance obligationis satisfied. Performance obligation issatisfied when the goodsare transferred from theseller to the buyer. Sales invoice shouldsupport each credit sale.Illustration 5-6LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.5-25Recording Sales of MerchandiseJournal Entries to Record a Sale#1Cash or Accounts receivableXXXSales revenue#2Cost of goods soldInventory5-26XXXXXXSellingPriceCostXXXLO 3 Explain the recording of sales revenuesunder a perpetual inventory system.

Recording Sales of MerchandiseIllustration: PW Audio Supply records the sale of 3,800on May 4 to Sauk Stereo on account (Illustration 5-6) asfollows (assume the merchandise cost PW Audio Supply 2,400).May 4Accounts Receivable3,800Sales Revenue43,800Cost of Goods Sold2,400Inventory5-275-282,400LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.Advance slide in presentation mode to reveal answer.

Recording Sales of MerchandiseSales Returns and Allowances “Flip side” of purchase returns and allowances. Contra-revenue account to Sales Revenue (debit). Sales not reduced (debited) because: Would obscure importance of sales returns andallowances as a percentage of sales. Could distort comparisons.LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.5-29Recording Sales of MerchandiseIllustration: Prepare the entry PW Audio Supply would maketo record the credit for returned goods that had a 300 sellingprice (assume a 140 cost). Assume the goods were notdefective.May 8Sales Returns and Allowances300Accounts Receivable8Inventory140Cost of Goods Sold5-30300140LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.

Recording Sales of MerchandiseIllustration: Assume the returned goods were defectiveand had a scrap value of 50, PW Audio would make thefollowing entries:May 8Sales Returns and Allowances300Accounts Receivable8Inventory30050Cost of Goods Sold50LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.5-31Recording Sales of MerchandiseReview QuestionThe cost of goods sold is determined and recorded eachtime a sale occurs in:a. periodic inventory system only.b. a perpetual inventory system only.c. both a periodic and perpetual inventory system.d. neither a periodic nor perpetual inventory system.5-32LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.

5-33Recording Sales of MerchandiseSales Discount5-34 Offered to customers to promote prompt payment of thebalance due. Contra-revenue account (debit) to Sales Revenue.LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.

Recording Sales of MerchandiseIllustration: Assume Sauk Stereo pays the balance due of 3,500 (gross invoice price of 3,800 less purchase returnsand allowances of 300) on May 14, the last day of thediscount period. Prepare the journal entry PW Audio Supplymakes to record the receipt on May 14.May 14Cash3,430Sales Discounts70 *Accounts Receivable3,500* [( 3,800 – 300) X 2%]LO 3 Explain the recording of sales revenuesunder a perpetual inventory system.5-35Completing the Accounting CycleAdjusting Entries5-36 Generally the same as a service company. One additional adjustment to make the records agree withthe actual inventory on hand. Involves adjusting Inventory and Cost of Goods Sold.LO 4 Explain the steps in the accounting cycle for a merchandising company.

Completing the Accounting CycleIllustration: Suppose that PW Audio Supply has an unadjustedbalance of 40,500 in Merchandise Inventory. Through a physicalcount, PW Audio determines that its actual merchandise inventoryat year-end is 40,000. The company would make an adjustingentry as follows.Cost of Goods Sold500Inventory5-37500LO 4 Explain the steps in the accounting cycle for a merchandising company.Completing the Accounting CycleClosingEntries5-38LO 4 Explain the steps in the accounting cycle for a merchandising company.

Completing the Accounting CycleClosing EntriesLO 4 Explain the steps in the accounting cycle for a merchandising company.5-39Forms of Financial StatementsMultiple-Step Income Statement5-40 Shows several steps in determining net income. Two steps relate to principal operating activities. Distinguishes between operating and non-operatingactivities.LO 5 Distinguish between a multiple-step and a single-step income statement.

Illustration 5-14MultipleStepKey Items: Net salesIllustration 5-145-41LO 5Illustration 5-14MultipleStepKey Items: Net sales Gross profitIllustration 5-145-42LO 5

Illustration 5-14MultipleStepKey Items: Net sales Gross profit OperatingexpensesIllustration 5-145-43LO 5MultipleStepKey Items: Net sales Gross profit Operatingexpenses NonoperatingactivitiesIllustration 5-145-44LO 5

MultipleStepKey Items: Net sales Gross profit Operatingexpenses NonoperatingactivitiesIllustration 5-145-45LO 5MultipleStepKey Items: Net sales Gross profit Operatingexpenses Nonoperatingactivities Net incomeIllustration 5-145-46LO 5

Forms of Financial StatementsReview QuestionThe multiple-step income statement for a merchandisershows each of the following features except:a. gross profit.b. cost of goods sold.c. a sales revenue section.d. investing activities section.5-475-48LO 5 Distinguish between a multiple-step and a single-step income statement.

Forms of Financial StatementsSingle-Step Income Statement Subtract total expenses from total revenues Two reasons for using the single-step format:1. Company does not realize any profit until totalrevenues exceed total expenses.2. Format is simpler and easier to read.5-49LO 5 Distinguish between a multiple-step and a single-step income statement.Forms of Financial StatementsSingle-Step Income StatementIllustration 5-155-50LO 5 Distinguish between a multiple-step and a single-step income statement.

Forms of Financial StatementsClassified Balance SheetIllustration 5-165-51LO 5 Distinguish between a multiple-step and a single-step income statement.APPENDIX 5AWorksheet for a Merchandising CompanyPerpetualInventoryIllustration 5A-15-52LO 6 Prepare a worksheet for a merchandising company.

APPENDIX 5BPeriodic Inventory SystemDetermining Cost of Goods Sold Under aPeriodic System No running account of changes in inventory. Ending inventory determined by physical count. Cost of goods sold not determined until the end of theperiod.LO 7 Explain the recording of purchases and sales ofinventory under a periodic inventory system.5-53APPENDIX 5BPeriodic Inventory SystemDeter

under a perpetual inventory system. Illustration 5-6 Recording Sales of Merchandise 5-26 Journal Entries to Record a Sale Cash or Accounts receivable XXX Sales revenue XXX LO 3 Explain the recording of sales revenues under a perpetual inventory system. #1 Cost of goods sold XXX Inventory XXX #2 Selling Price Cost Recording Sales of Merchandise