Transcription

European Journal of Accounting, Auditing and Finance ResearchVol.5 No.3, pp.68-75, March 2017Published by European Centre for Research Training and Development UK (www.eajournals.org)THE IMPACT OF WORKING CAPITAL MANAGEMENT ON CORPORATEPERFORMANCE: EVIDENCE FROM LISTED NON-FINANCIAL FIRMS INGHANAYakubu, Ibrahim Nandom (Corresponding Author)Graduate Student, University of Liverpool, UKEmail: kassiibrahim@gmail.comAlhassan, Mohammed MubarikController and Accountant General’s DepartmentTamale, Northern Region-GhanaFuseini, Abdul-AzizEnergy Bank LimitedTamale Branch, GhanaABSTRACT: Working Capital Management (WCM) plays a significant role in the successfuloperation of businesses due to its significant effect on corporate profitability and liquidity. Thisstudy empirically examines the impact of working capital management on the performance ofnon-financial firms in Ghana. Using secondary data of five listed non-financial firms for theperiod 2010-2015, the Random effect model was employed to establish the relationship thatexists between the various components of working capital management and firm performanceand whether these WCM components impact significantly on firm performance. The resultsshow that average payment period and current ratio have a positive relationship with firmperformance. Average collection period, inventory turnover, cash conversion cycle, and firmsize on the other hand have a negative relationship with firm performance. However, onlyaverage collection period, average payment period, cash conversion cycle, and current ratioare found to have a significant impact on firm performance. The study recommends thatmanagers of non-financial firms in Ghana should formulate sound working capitalmanagement policies that will enable firms to deal with liquidity challenges and enhance theirperformance.KEYWORDS: Working Capital Management, Performance, Non-financial firmsINTRODUCTIONWorking Capital Management (WCM) is one of the crucial components of financialmanagement which impacts directly on corporate performance (Pouragha andEmamgholipourarchi, 2012). Working capital management involves the ability of a companyto manage its current assets and current liabilities in a more efficient manner that providesmaximum return on assets (Jagongo and Makori, 2013). Sound working capital managementpolicies improve firms’ profitability and market value, and the negligence of working capitalmanagement may lead to operational challenges (Christopher and Kamalavalli, 2009). The goalof working capital management is to ensure that firms are able to manage their operationalexpenses and also meet their short term debt obligations by maintaining adequate cash flows.Therefore it is crucial for finance managers to adopt suitable approaches to working capital68ISSN 2053-4086(Print), ISSN 2053-4094(Online)

European Journal of Accounting, Auditing and Finance ResearchVol.5 No.3, pp.68-75, March 2017Published by European Centre for Research Training and Development UK (www.eajournals.org)management in order to increase firms’ profitability and also create value for their investors.Though profitability is a major goal of firms, insolvency problems may occur when firmsconcentrate too much on profitability at the expense of liquidity. Working capital managementtherefore seeks to maintain a balance between each of the components of working capital(Gitmen, 2009). The lack of understanding about the impact of working capital on profitabilityand the inability of management to plan and control its components may lead to insolvency andbankruptcy (Gill, 2011).Considering the large amount of current assets and current liabilities among firms, the issue ofworking capital management is crucial which has received much attention in the financialmanagement literature. Several studies (for example; Akoto, Awunyo-Vitor and Angmor,2013; Sharma and Kumar, 2011; Oladipupo and Okafor, 2013; Gill, Biger and Mathur, 2010)have been conducted on working capital management especially its relationship with firms’profitability. However, only few studies exist in Ghana on the impact of working capitalmanagement on firms performance, with most of the studies been focused on financial services.This study adds to the limited literature on working capital management in Ghana by assessingthe relationship between working capital management and the performance of non-financialcompanies listed on the Ghana Stock Exchange.LITERATURE REVIEWSeveral studies have been carried out in different countries and industries on the impact ofworking capital management on corporate profitability. The results from these studies havebeen quite different.For instance, Tauringana and Afrifa (2013) examined the significance of working capitalmanagement on firm profitability in the UK using 133 SMEs for the period 2005-2009.Applying a panel data regression analysis, their findings showed that SMEs profitability wassignificantly influenced by average days receivable (ADR) and average days payable (ADP).However, there was insignificant relationship between cash conversion cycle (CCC) andprofitability. Similarly, Stephenand Elvis (2011) studied the relationship between workingcapital and profitability of 232 SMEs in Kenya. Using a panel data, the results established thatCCC, ADR, and ADI significantly determine the profitability of SMEs in Kenya.Almazari (2013) investigated the impact of working capital management on profitability ofcement manufacturing firms listed in the Saudi Stock Exchange. Using the Pearson Bivariatecorrelation and regression analysis, the study reported current ratio (CR) as the significantfactor influencing the profitability of cement manufacturing firms in Saudi.Gakure, Cheluget, Onyango, and Keraro (2012) conducted a study on working capitalmanagement and profitability of manufacturing firms listed at the Nairobi stock exchange. Thestudy found the existence of negative correlation between net operating profit and the firm’saverage collection period, inventory holding period, accounts payment period and the cashconversion cycle.Akoto, Awunyo-Vitor and Angmor (2013) in examining the relationship between workingcapital management and profitability of manufacturing companies in Ghana for the period2005-2009, used the OLS econometric model on a panel data. The findings presented Account69ISSN 2053-4086(Print), ISSN 2053-4094(Online)

European Journal of Accounting, Auditing and Finance ResearchVol.5 No.3, pp.68-75, March 2017Published by European Centre for Research Training and Development UK (www.eajournals.org)Receivable Day (ARD), Cash Conversion Cycle (CCC), Current Asset Ratio (CAR), andCurrent Assets Turnover (CAT) as the working capital management components impactingsignificantly on profitability of manufacturing companies in Ghana. Napompech (2012) usinga regression analysis based on a panel sample of 255 companies listed on the Stock Exchangeof Thailand from 2007 through 2009 revealed a negative relationship between the grossoperating profits and inventory conversion period and the receivables collection period. Thestudy suggested that managers can increase the profitability of their firms by shortening thecash conversion cycle, inventory conversion period, and receivables collection period.However, they cannot increase profitability by lengthening the payables deferral period.Showing how working capital management affects profitability, liquidity and firm value,Usama (2012) examined the effect of different variables of working capital management on theKarachi Stock Exchange using average collection period, average payment period, inventoryturnover in days, cash conversion cycle, debt ratio, financial asset to total asset ratio, currentratio and net operating profitability. The study used pooled least square regression and commoneffect model and found that there is significant positive effect of working capital managementon profitability and liquidity of the firms.Ahmed (2012) investigated the impact of working capital management on the performance offirms using a sample of 253 non-financial listed companies of the Karachi Stock Exchange(KSE), Pakistan. The study used secondary data taken from Balance Sheet Analysis of StockListed Companies on KSE published by State Bank of Pakistan. Results were analysed by usingthe Logistic Regression, OLS Regression and Pearson Correlation techniques. The resultsuggests that out of the five selected components of working capital management only currentasset over total sales showed significant negative relationship with both the proxies ofperformance i.e. return on equity and return on assets. While current asset over total asset(CATA), inventory turnover, debtor’s turnover and current ratio showed significant positiverelationship with performance. The logistic regression results suggested that probability of firmbeing in profit is highly determined by CATA, CATS and CR.Nazir and Afza (2009) investigated the relationship between the aggressive/conservativeworking capital asset management and financing policies and its impact on profitability of 204Pakistani firms divided into 16 industrial groups by KSE for the period 1998-2005. Using paneldata regression models between working capital policies and profitability, the study found anegative relationship between the profitability measures of firms and degree of aggressivenessof working capital investment and financing policies.METHODOLOGYSample Size and DataFive non-financial firms were selected for this study. The selected firms were Fan Milk,Unilever Ghana, Aluworks, Benso Oil Palm Plantation, and Ghana Oil Company. These firmswere selected based on data availability. The study primarily used secondary data obtainedfrom the Ghana Stock Exchange (GSE) annual financial statements of the selected firms from2010-2015.70ISSN 2053-4086(Print), ISSN 2053-4094(Online)

European Journal of Accounting, Auditing and Finance ResearchVol.5 No.3, pp.68-75, March 2017Published by European Centre for Research Training and Development UK (www.eajournals.org)Description of VariablesDependent VariableThe empirical literature on working capital management (for example; Azam and Haider(2011); Nazir and Afza (2009)) used Return on Assets (ROA) and Return on Equity (ROE) asthe most common measures of firm performance. In this study, firm performance is measuredby ROA which is computed as the ratio of Net Income to Total Asset.Independent VariablesAverage Collection Period (ACP): ACP explains how long it takes a firm to retrieve or collectcash from its customers. It is computed as account receivable divided by net sales multipliedby 365 days.Average Payment Period (APP): APP refers to how long it takes a firm to settle its suppliersor creditors. It is calculated as accounts payable divided by purchases multiplied by 365 days.Inventory Turnover (IN): This refers to how fast a firm is able to convert its inventory heldinto sales. It is computed as inventory divided by cost of goods sold multiplied by 365 days.Cash Conversion Cycle (CCC): This expresses the length of time a firm takes to convert itsresources into cash flows. CCC is calculated by summing accounts receivable days andinventory days less accounts payable days.Current Ratio (CR): CR measures the liquidity level of a firm which is calculated as the ratioof current assets to current liabilities.In addition to the selected independent variables, the study introduced firm size (measured bylog of sales) as a control variable.Model Specification and Analytical ApproachThe econometric model employed in this study is a linear model which is specified as follows:ROAit a0 β1ACPit β2APPit β3INTit β4CCCit β5CRit β6Fsizeit From the model, the subscript i represents individual firms, t denotes the sample period from2010-2015, and the symbol a refers to the intercept. ROA is the dependent variable whichrepresents firm performance. Average collection period, average payment period, inventoryturnover, cash conversion cycle, current ratio, and firm size are represented by ACP, APP, INT,CCC, CR, and Fsize respectively. refers to the error term, and β1 to β6 represent the modelcoefficients.The study employed the Pooled Ordinary Least Square (OLS), Random effect, and Fixed effectestimation techniques in the data analysis.ANALYSIS AND RESULTSDescriptive StatisticsTable 1 presents a summary of the descriptive statistics which shows the total observation,mean, standard deviation, maximum, and minimum values of each variable used in this study.71ISSN 2053-4086(Print), ISSN 2053-4094(Online)

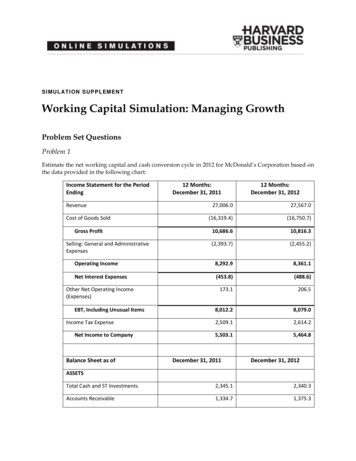

European Journal of Accounting, Auditing and Finance ResearchVol.5 No.3, pp.68-75, March 2017Published by European Centre for Research Training and Development UK (www.eajournals.org)The results show that return on assets (ROA) has an average of 15.46% with a standarddeviation of 11.18%. The mean value for average collection period (ACP) is 29.6 days meaningthat listed non-financial firms in Ghana do not advance credit beyond 29.6 days to theircustomers. Also, the firms take an average of 47.5 days, maximum of 150.2 days and minimumof 52.7 days to settle their customers. In addition, on average, it takes 110 days for the firms toconvert their held inventory into sales. Furthermore, the selected firms use an average of 68.9days to convert their resources into cash, with some of the firms taking a maximum of 198.8days and a minimum of 15.7 days. The mean value of current ratio (CR) of the firms consideredis 2.26 with a maximum of 7.68 and minimum of 0.008. The mean value indicates that onaverage, listed non-financial firms in Ghana maintain adequate current assets in meeting theircurrent liabilities.Table 1: Descriptive 972.2605.133Stand 50.23975.69198.827.686.19Correlati

Sound working capital management policies improve firms’ profitability and market value, and the negligence of working capital management may lead to operational challenges (Christopher and Kamalavalli, 2009). The goal of working capital management is to ensure that firms are able to manage their operational expenses and also meet their short term debt obligations by maintaining adequate .